5 minutes reading time

- Global shares

Momentum is a phenomenon that we experience in day-to-day life – a psychological, but very real effect where positive outcomes drive further success, or setbacks can compound.

Academic research and empirical data demonstrate that this behaviour can also be applied to investing. However, this requires a disciplined approach which seeks to avoid human bias.

What is momentum investing?

Momentum investing is a strategy that involves buying companies that have outperformed and selling or avoiding those that have recently underperformed.

Backed by academic research, momentum is a well-known ‘style factor’ (alongside the likes of value and quality).

Rather than aiming to profit from underlying company fundamentals, momentum investing instead is based on the theory that rising asset prices tend to continue rising, and falling prices tend to continue falling.

How momentum can add outperformance potential

A momentum-based investment strategy can add outperformance potential relative to broad equity index benchmarks over the long term. There is a considerable body of academic research and empirical data that demonstrates the benefits of momentum investing across different markets, regions and asset classes.

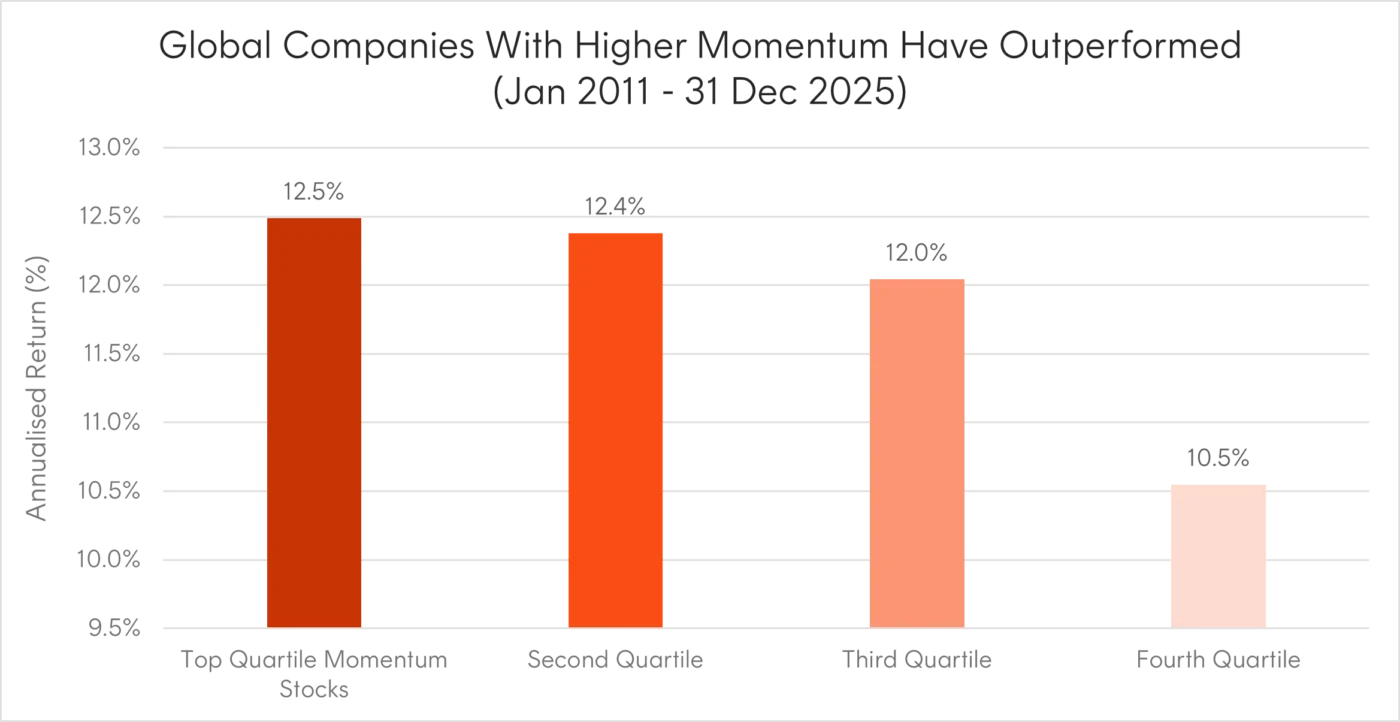

The below analysis illustrates the performance of the largest global ex-Australia companies1 grouped into quartiles by their momentum rankings measured by their risk-adjusted returns (12-month total return/12-month volatility), weighted equally and rebalanced semi-annually

The chart below shows that, over the period 2011 to 2025, stocks with the highest momentum scores (top quartile) achieved 2% p.a. higher returns compared to stocks with the lowest momentum scores (bottom quartile).

Source: Solactive, Betashares, as at 31 December 2025. Past performance is not indicative of future returns.

A systematic approach to momentum

While the concept of momentum is straightforward, implementing it consistently is not.

An individual investor seeking to implement a momentum-based strategy on their own faces several hurdles, including the time commitment required, the difficulty of consistently identifying outperforming stocks, the challenge of maintaining an unbiased buying and selling discipline, and the impact of execution costs. This is where a systematic, rules-based approach can add value.

The Betashares Global Momentum ETF (ASX: GTUM) provides exposure to stocks with strong price momentum from global developed markets outside of Australia. GTUM’s Index ranks stocks within the eligible universe based on 6 and 12-month risk adjusted returns to target more sustainable positive momentum over sharp, highly volatile run-ups. Stocks displaying consistently strong positive momentum over recent history are rewarded with higher weights in the Index2.

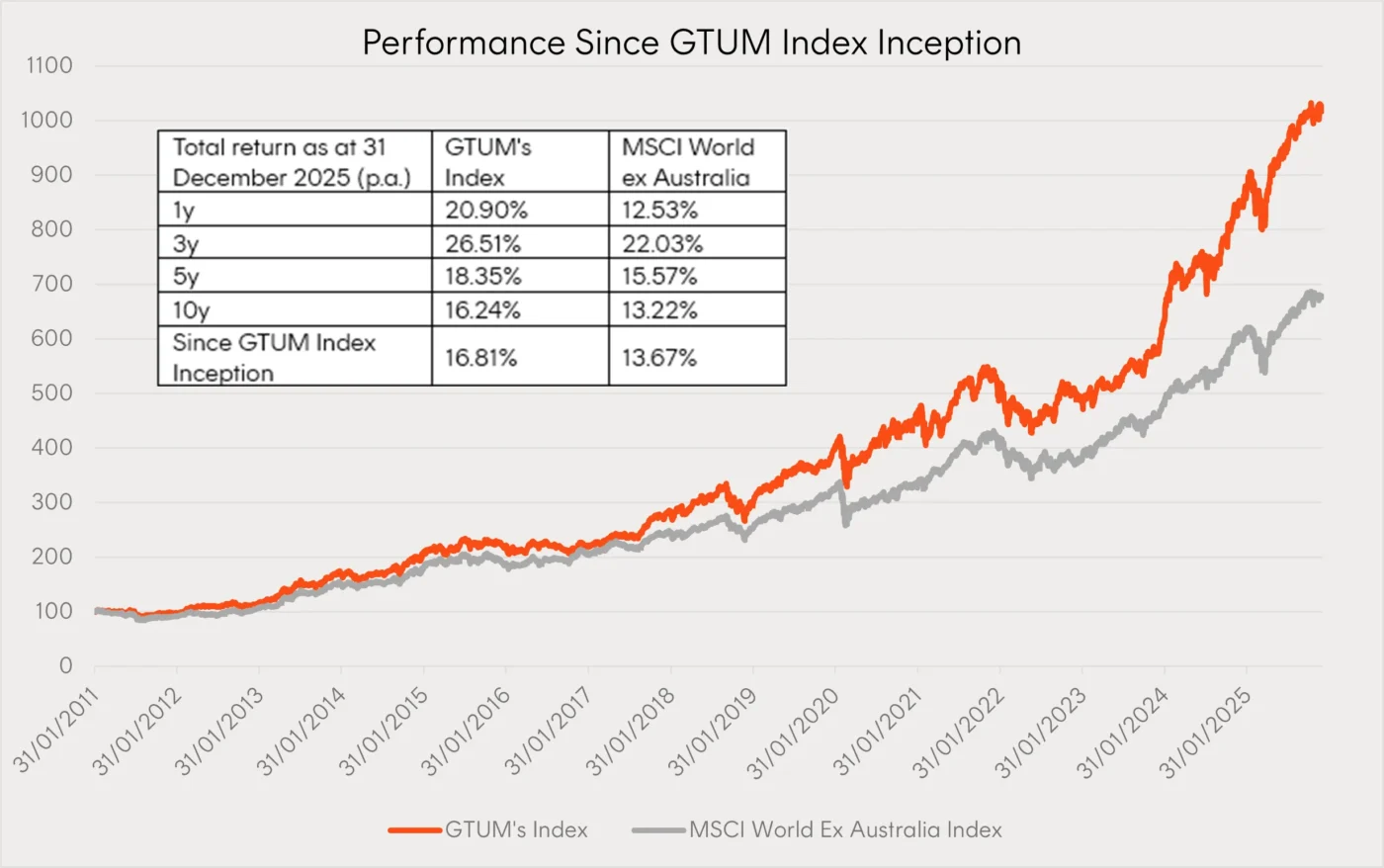

Since its inception in January 2011 to end December 2025, GTUM’s Index has outperformed the MSCI World Ex Australia Index by 3.14% p.a.

Source: Bloomberg, Betashares. As at 31 December 2025. Chart shows index performance (not actual fund performance) to illustrate the longer-term historical performance of companies with high momentum, and does not take into account fund management fees and costs of 0.35% p.a. GTUM’s inception date was 30 January 2026. You cannot invest directly in an index. Past performance is not indicative of future performance.

Portfolio diversification

Momentum offers a unique return profile that differentiates it from other style factors such as quality and value, historically exhibiting low or even negative excess return correlation. As a result, it can be an appealing complement to many equity funds (both active and passive) which often exhibit style biases. Blending momentum with its distinct return profile may therefore provide meaningful diversification benefits within an existing equity portfolio.

|

Excess Return Correlation |

GTUM’s Index |

Value |

Quality |

|

GTUM’s Index |

1 |

||

|

Value |

-0.22 |

1 |

|

|

Quality |

0.27 |

-0.51 |

1 |

Correlation of monthly excess returns over MSCI World ex Australia Index, from Jan 2011 – Dec 2025. Value is represented by MSCI Value Index, Quality is represented by MSCI Quality Index. All returns in AUD. You cannot invest directly in an index. Past performance is not indicative of future performance.

While correlations change over time, we expect momentum as a factor to continue displaying a low to negative correlation with both quality and value given its differentiated exposure.

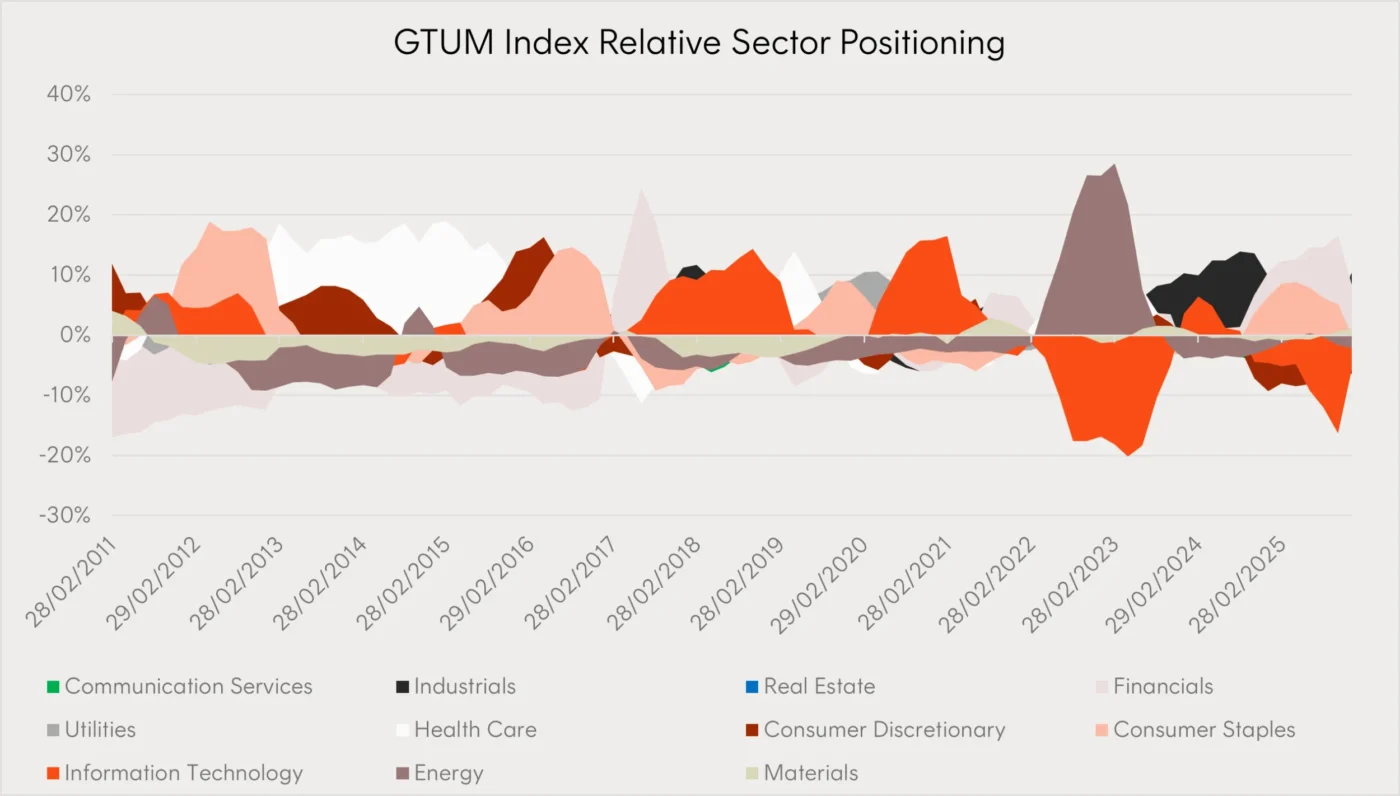

The historic sector profile of GTUM’s Index demonstrates the systematic strategy in action. The portfolio is dynamic, taking overweights (underweights) to strongly (poorly) performing sectors through the market cycle, irrespective of their quality or value credentials.

Source: Solactive, Betashares. Relative sector positions relative to the Solactive GBS Developed Markets ex Australia Large & Mid Cap Index, from Jan 2011 – Dec 2025. You cannot invest directly in an index.

Portfolio Implementation

In July 2024, the Betashares Australian Momentum ETF (ASX: MTUM) was launched and has outperformed the S&P/ASX 200 Index by 1.61% p.a. since inception to 31 December 2025 (past performance is not indicative of future performance).

For those looking for an equivalent global ETF, GTUM is designed to provide a convenient, transparent and cost-effective way for Australian investors to gain diversified exposure to global companies exhibiting strong price momentum.

Investors may consider GTUM:

- As an efficient way of accessing the performance potential of high momentum global stocks; and

- As a complement to other global equity strategies, including both passive and actively managed funds, given momentum’s unique return profile.

For more information on GTUM, please visit the fund page here.

Sources:

1. As per the Solactive GBS Developed Markets ex Australia Large & Mid Cap Index

2. For further information about the Fund’s index methodology, please refer to the PDS.