6 minutes reading time

If you prefer to listen to Off the Chain, you can listen to this audio readout here:

Bitcoin and the broader crypto market have been brutally sold off over the past seven days, with BTC tumbling to just over US$77,000 on 1 February 2026 – its weakest level since the Liberation Day selloff in April 2025.

Geopolitical shocks have caused a broader rout in risk assets, equities and cryptocurrencies alike. Even typically defensive plays like gold were crushed in a global risk-off stampede.

Bitcoin and Ethereum were down -11.82% and -17.82% respectively over the seven days to 1 February 2026. Bitcoin’s market capitalisation fell to US$1.56 trillion while the global crypto market dropped to US$2.65 trillion. Bitcoin’s market dominance rose to 59%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$78,221 |

$90,221 |

$77,143 |

-11.82% |

|

ETH (in US$) |

$2,415 |

$3,030 |

$2,371 |

-17.82% |

Source: CoinMarketCap. As at 1 February 2026. Past performance is not indicative of future performance. Performance is shown in US dollars and does not consider any USD/AUD currency movements.

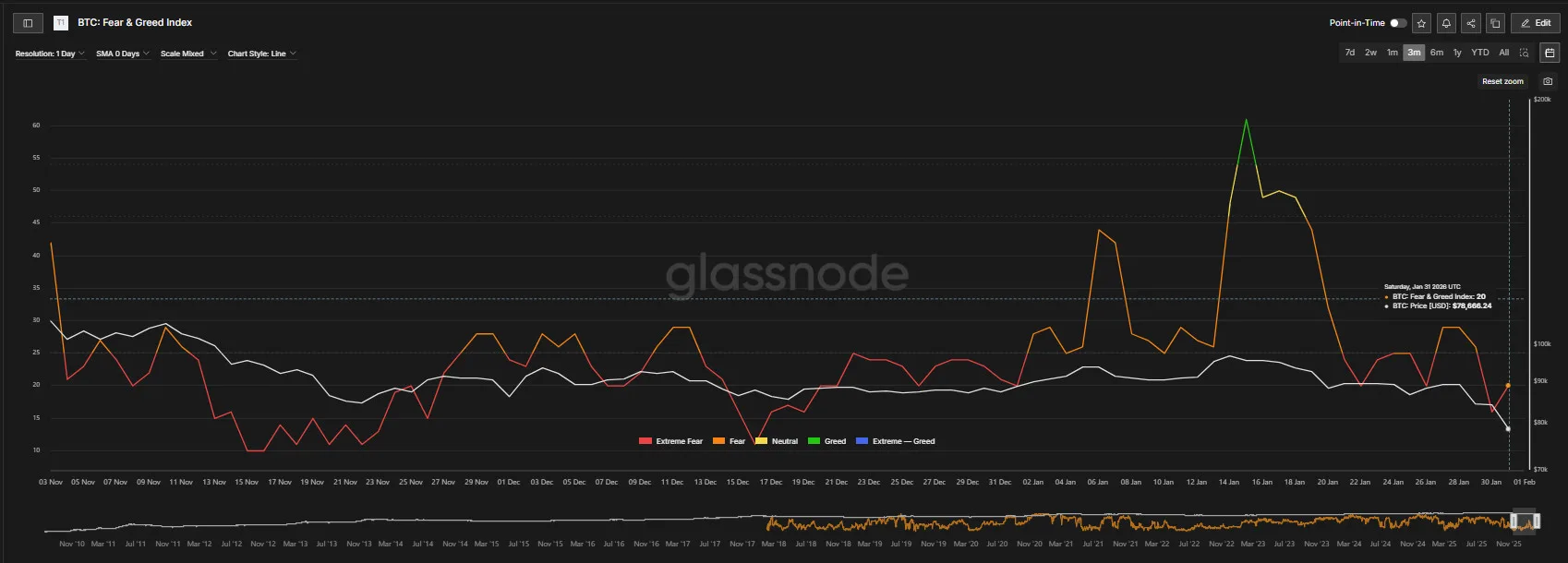

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Trump administration to meet with bank and crypto companies

The White House is set to meet with senior figures from the banking and crypto industries to try to break the deadlock around stalled stablecoin legislation. The talks, led by the administration’s crypto council, are expected to focus on one of the core fault lines in the bill: whether crypto firms should be allowed to pay interest or rewards on dollar-pegged stablecoins.

The meeting highlights both how entrenched the dispute has become and how determined the Trump administration is to push the legislation over the line, by forcing a compromise between two sectors that have been lobbying aggressively in opposite directions1.

Banking’s embrace of stablecoins

Capital One, one of the 10 largest banks in the US, has agreed to acquire fintech payments firm Brex in a US$5.15 billion cash-and-stock deal. The deal is expected to close in mid-2026 subject to regulatory approval. The transaction folds Brex’s corporate payments and spend-management platform, including its recently launched stablecoin settlement capability using USDC, into one of the largest US banking groups.

More than just a large fintech takeover, the deal reflects how traditional banks are beginning to engage with certain crypto-adjacent infrastructure, viewing it less as outright speculation and more as payments technology that could, in time, be integrated within regulated financial institutions2.

CRYP company spotlight

Iris pivots to AI

According to CoinWorld, IREN Energy (NASDAQ: IREN) is pivoting from Bitcoin mining toward AI cloud infrastructure, securing multi-year contracts and a notable partnership with Microsoft to monetise AI workloads.3

IREN is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.5

Crypto Fear and Greed index

The Crypto Fear & Greed Index is an indicator from Alternative.me that aims at capturing investor sentiment in a single number by incorporating data from multiple sources. The index ranges from 0 to 100, where 0 denotes ‘extreme fear’, and therefore times of exaggerated negative investor sentiment. On the other hand, 100 means ‘extreme greed’ and is an indication for maximum FOMO.

According to data from alternative.me, as of 31 January 2026, the index has turned to extreme fear with the reading sitting at 20.

Source: alternative.me courtesy of Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): Accumulation Trend Score

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating coins on-chain in terms of their BTC holdings. The scale of the Accumulation Trend Score represents both the size of the entities’ balance (their participation score) and the number of new coins they have acquired/sold over the last month (their balance change score).

An Accumulation Trend Score of closer to 1 indicates that on aggregate, larger entities (or a big part of the network) are accumulating while a value closer to 0 indicates they are distributing or not accumulating. This provides insight into the balance size of market participants, and their accumulation behaviour over the last month.

According to data from Glassnode, as of 31 January 2026, the score is sitting at 0.17 which indicates very little activity from larger entities.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Most top 20 altcoins were down sharply last week. However, impressive gains were made in Hyperliquid (HYPE). Over the last 7 days and 1-year to 1 February 2026, HYPE’s price increased by over 32% and 17% respectively. The move higher correlated to increased trading activity on Hyperliquid’s commodity-linked perpetuals6.

According to Coinnmarketcap, Hyperliquid (HYPE) is a decentralised perpetual futures exchange built on its own high-speed Layer 1 blockchain, combining DeFi transparency with centralised exchange performance.

Investing in crypto-assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

2. https://financefeeds.com/capital-one-strikes-5-15b-deal-to-acquire-brex-and-its-stablecoin-platform/

3. https://www.bitget.com/news/detail/12560605171902

4. As at 29 January 2026. No assurance is given that this company will remain in the portfolio or will be a profitable investment.5. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.6. https://cryptonews.com.au/news/hype-explodes-57-in-72-hours-as-hyperliquid-trading-surge-fuels-breakout-132692/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.