7 minutes reading time

- Responsible investing

Private wealth is reshaping global capital markets, with family offices and the ultra-wealthy emerging as increasingly influential players. Once discreet vehicles for preserving intergenerational fortunes, family offices have evolved into sophisticated investment platforms spanning public markets, private equity, real estate and impact ventures. Their growing prominence reflects not only the sheer scale of wealth accumulation but also a deliberate shift towards greater control, flexibility, and alignment with ethical frameworks.

In Australia, the trend is accelerating as entrepreneurial success stories and intergenerational transfers give rise to a new wave of family-backed investment entities. Globally, the influence of these investors is being felt across asset classes, from venture capital in the United States to infrastructure and renewables in Asia. What is becoming clear is that the ultra-wealthy are no longer content to invest in traditional structures; they are increasingly shaping capital flows on their own terms, with a marked emphasis on sustainability, legacy, and long-term .

Private wealth surge drives family office boom

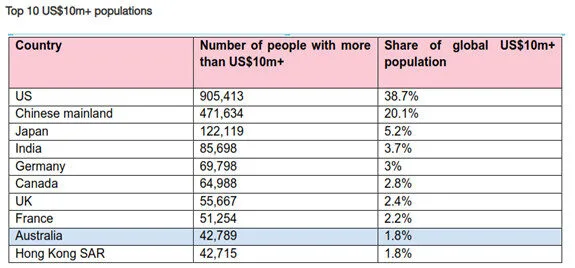

The global population of high-net-worth individuals (HNWIs), defined as those with assets of US$10m or more, grew by 4.4% in 2024 to more than 2.3m. Within this, the number of individuals or family offices worth over U$100m passed 100,000 for the first time.1

In 2024, Australia’s wealthy population was slightly ahead of Hong Kong SAR, which has 42,715 HNWIs, Italy (41,080), South Korea (39,210), Taiwan (28,391), Brazil (21,974) and Spain (21,275). The US is in first place, with almost 39% of the global US$10m+ population, nearly twice the level of China at 20.1%.2

Source: Knight Frank Wealth Report 2025

The wealth of HNWIs and families is being increasingly managed through family offices. UBS’ Global Family Office Report 2025 surveyed 317 single family offices across more than 30 markets, representing families with an average net worth of US$2.7b and managing roughly US$1.1b within each. Far from being focused on preservation, these offices have become sophisticated platforms allocating across public markets, private equity, real estate, private debt and increasingly, sustainable and impact-focused assets.3

The Asia-Pacific region has emerged as the fastest-growing hub for family offices. Many of these entities are relatively young, founded in the last 10 to 15 years by first-generation entrepreneurs institutionalising the management of their wealth. Rapid gains in technology, resources, and healthcare have created fortunes now being transitioned to more formal governance structures. Australia sits squarely in this trend, placing the country in one of the fastest-growing regions globally. Intergenerational wealth transfers, entrepreneurial success stories, and the maturation of local industries are all fuelling demand for family office structures in Australia.4

What sets family offices apart is not just the depth of capital, but the way it is deployed. Unlike traditional institutional investors, they can act with far greater flexibility, taking concentrated positions, moving quickly on opportunities, and backing higher-risk or values-driven strategies. This agility has made them influential players in venture capital, private credit, infrastructure, and emerging climate technologies. For many ultra-wealthy families, legacy now extends well beyond financial preservation, encompassing impact, stewardship, and a deliberate alignment with personal or generational values.

How the next gen is rewiring family offices

Private capital is moving from “values on the wall” to “values in the portfolio.” Family offices and HNWIs are tilting allocations toward responsible and thematic investing, often via private markets, where they see outsized opportunities in decarbonisation, electrification and health. Recent family-office surveys show long-term sector priorities include clean energy and AI, reinforcing a pragmatic, returns-led approach to sustainability rather than mere box-ticking.5

What’s driving the pivot? Succession is accelerating the shift. Next-generation principals care more about purpose, impact and technology, and they expect transparent reporting supported by advanced digital platforms. Wealth reports point to an immense intergenerational transfer and distinct next-gen investment priorities creating fertile ground for impact, climate, and mission-aligned mandates.6

Strong interest in sustainable investing, particularly among younger investors

Source: Morgan Stanley Sustainable Signals 2025

Responsible, transparent, and true-to-label – the case for index investing

For the next generation of wealth holders and family offices, investing is no longer just about compounding capital; it is also about aligning portfolios with deeply held values and delivering purpose alongside returns. Ethical index investing offers a particularly compelling way to achieve this alignment.

Family offices have traditionally favoured active management when investing in public equities, reflecting their appetite for control, flexibility, and differentiated returns. Yet the shift towards passive investing that has already swept institutional markets is beginning to ripple through private wealth. UBS’ Global Family Office Report 2025 shows US family offices are leading the way, allocating the largest share of their equity portfolios to index strategies, a natural extension of the deep and efficient US markets and the cost advantages of passive products.7

The pattern is likely to mirror the broader evolution of asset management: what starts in the US tends to gain traction globally. As passive vehicles proliferate in Europe and Asia, family offices in those regions look set to follow suit, drawn by diversification, liquidity, and transparency. The move from active to passive is not about abandoning conviction, but about embedding efficiency and scalability into long-term portfolios.

Family office investments in public equities – US leading the charge on index investing

Source: UBS Global Family Office Report 2025

Sustainability-focused and ethically screened indices are rules-based, transparent, and “true-to-label.” Investors can see exactly which screens are applied—be it excluding fossil fuels, weapons, and tobacco, or overweighting companies driving the clean-energy transition. This clarity makes it easier for trustees, beneficiaries, and advisers to articulate how the investment process matches family values, while reducing reputational risk.

Index strategies are also, by their nature, diversified, cost-efficient, and scalable—critical for family offices that need both institutional-grade governance and the ability to manage multi-generational wealth over decades. Importantly, index funds have become a key channel through which investors can exercise stewardship, with managers voting proxies and engaging companies on climate, human rights, and governance. For values-driven families, this means their capital is not just invested cost effectively, but actively influencing corporate behaviour at scale.

Moreover, thematic index products allow families to target purpose-driven growth opportunities: renewable energy, gender equity, electric vehicles and sustainable transport, or healthcare innovation. Such exposures enable families to back long-term megatrends consistent with their legacy ambitions, while keeping costs predictable and liquidity high.

Australian family offices – the new architects of sustainable capital

Australian family offices, long regarded as conservative custodians of intergenerational wealth, are stepping forward as some of the most active backers of the sustainability transition. Deploying patient, mission-aligned capital, they are tilting portfolios towards climate tech, renewables, nature, and impact ventures, often filling funding gaps overlooked by traditional institutions.

Case Studies – Australian family offices committing capital to sustainable investments

Source: Startup Daily, Grok Ventures Portfolio, Tattarang, Wedgetail, Australian Financial Review, Wollemi Capital Group

Towards a sustainable future fuelled by next gen family offices

Responsible investing is no longer a fringe activity; it has become a defining pillar of modern wealth management. Australian family offices and HNWIs are demonstrating how concentrated pools of capital can be mobilised to accelerate the transition toward a low-carbon and socially inclusive economy. By backing climate technology, regenerative agriculture, and impact-focused ventures, these investors are shaping markets well beyond their balance sheets. Over the long-term, sustainability and responsible investing are set to define the very legacy of wealth stewardship, embedding purpose alongside profit and ensuring that generational capital is aligned with the sustainable transformation of economies and societies.

Betashares offers one of Australia’s broadest ranges of ethical and responsible investment ETFs, designed for investors who want rules-based, true-to-label and scalable solutions. The funds apply transparent and clearly articulated negative screens to avoid sectors such as fossil fuels, tobacco, gambling and weapons, while providing exposure to both global and Australian companies and issuers that are aligned with responsible investing practices. All ETFs are ASX-listed, liquid and transparent, making them easy to incorporate into larger portfolios. For family offices and high-net-worth investors, the range provides an efficient way to access diversified, values-aligned investments.

Sources:

1. https://content.knightfrank.com/resources/knightfrank.com/wealthreport/the-wealth-report-2025.pdf

2. https://content.knightfrank.com/resources/knightfrank.com/wealthreport/the-wealth-report-2025.pdf

3. https://www.ubs.com/content/dam/assets/wma/static/documents/ubs-gfo-report.pdf

4. https://financialnewswire.com.au/investment/australia-in-fastest-growing-region-for-family-offices/

5. https://impact-investor.com/family-offices-bullish-on-sustainable-investment-ubs-report/

6. https://www.pwc.com/gx/en/services/family-business/assets/global-family-office-deals-study-v4.pdf

7. https://www.ubs.com/content/dam/assets/wma/static/documents/ubs-gfo-report.pdf