6 minutes reading time

In times of uncertainty, it’s natural to feel anxious about investing. With steep interest rate rises, predictions of a recession, and news of bank failures, the sharemarket can feel like a treacherous place. However, there is a strategy that can help investors weather these storms: quality investing.

Quality investing seeks out companies with stable earnings, low debt, attractive cash flow, and high return on equity.

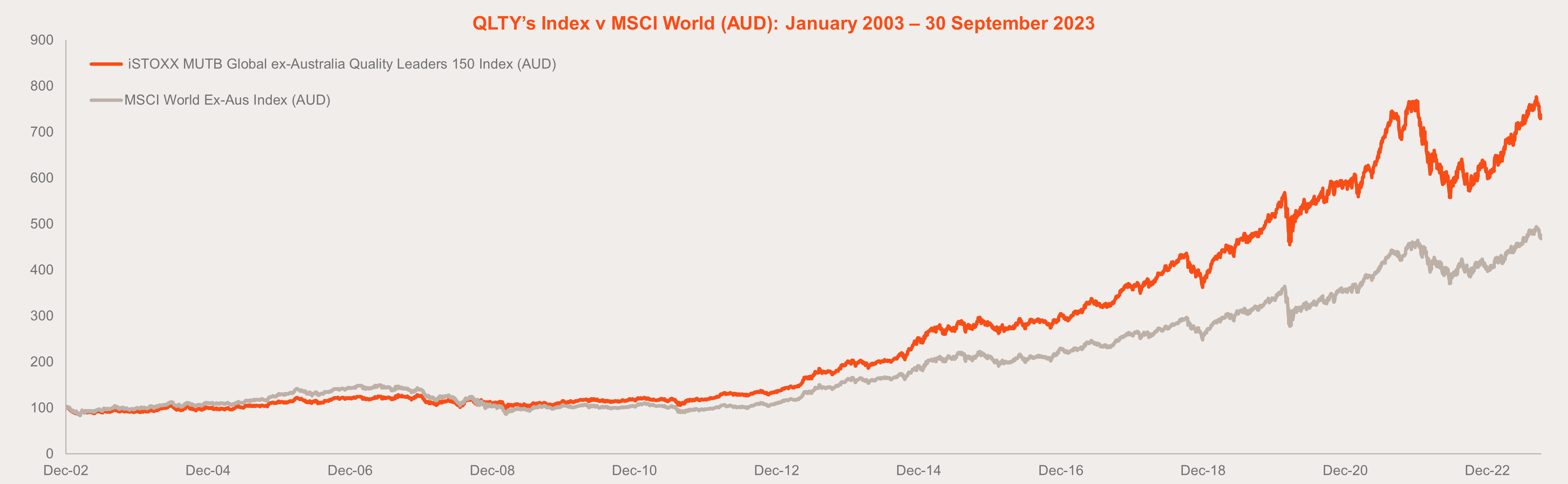

Evidence shows quality companies can produce attractive returns over time. As seen in the chart below, the index which Betashares Global Quality Leaders ETF (ASX: QLTY) aims to track (adjusted for QLTY’s fees) has delivered returns of 10.1% p.a. since inception on 27 December 2002, compared to 7.7% p.a. for the MSCI World ex-Australia Index (AUD).

QLTY’s index (minus fees) vs MSCI World Index ex-Australia (AUD)

Source: Bloomberg, Betashares. Chart shows performance of iSTOXX MUTB Global ex-Australia Quality Leaders Index (QLTY’s Index) vs MSCI World ex-Australia Index (AUD). QLTY’s index has been adjusted for QLTY’s 0.35% p.a. management costs. QLTY’s inception date was 05/11/2018. You cannot invest directly in an index. Past performance is not an indicator of future performance.

By adding exposure to ETFs that focus exclusively on quality companies, this approach can help investors improve overall resilience of their portfolios during economic storms while positioning themselves for potential growth over the long-term.

In this article, we will take a closer look at four quality-focused products: the Betashares Global Quality Leaders ETF and its currency-hedged variant, and ETFs that invest in quality companies in Australia and India.

1. QLTY Global Quality Leaders ETF

QLTY was created specifically for investors seeking exposure to a diversified portfolio of global companies outside Australia that boast quality characteristics, with the potential to deliver a sustainable and high return on equity over time.

The result? A portfolio of top-tier companies, many of which are household names such as Microsoft, Lululemon and Nintendo* (as at 20 October 2023).

The index which QLTY aims to track consists of the top 150 companies from a universe of 1800 stocks across global markets that pass rigorous quantitative screens covering return on equity, financial health, profitability, and business stability measures.

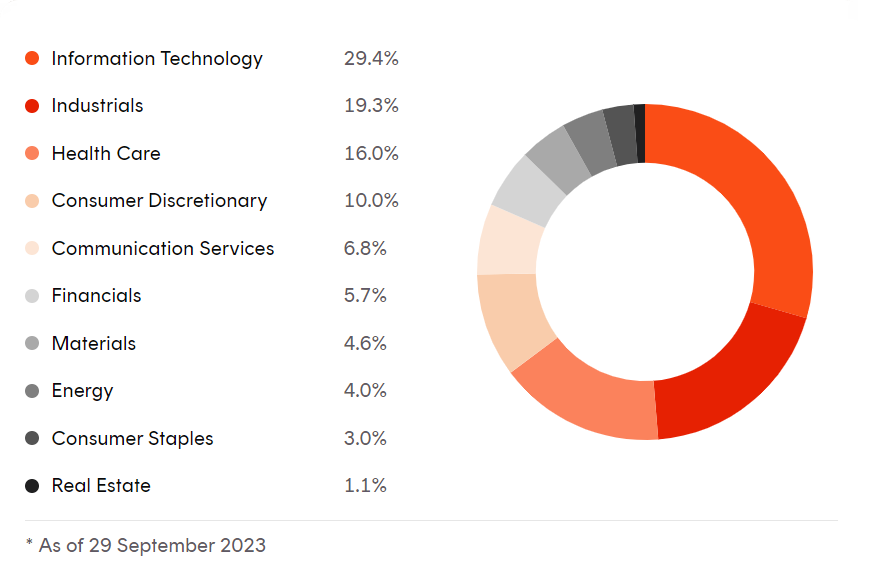

Additionally, with nearly 70% of quality companies being sourced from outside the IT sector, investors are not overly skewed towards any one sector of the market.

QLTY sector allocation

*No assurance is given that these companies will remain in the portfolio or will be profitable investments.

2. HQLT Global Quality Leaders Currency Hedged ETF

Investors who are looking to invest in global equities may want to consider the associated currency risk. Currency fluctuations can affect the value of the investment in their local currency.

HQLT, which tracks the same underlying index as QLTY, aims to address this by hedging the currency exposure back to Australian dollars. By doing so, HQLT provides investors with exposure to global quality companies while aiming to minimise the impact of currency fluctuations on their investment returns.

Investors looking to minimise the impact of currency fluctuations from the investment equation may find the currency-hedged version of the fund attractive. It may also be suitable for those who already hold unhedged global equities and want to reduce their currency exposure.

3. AQLT Australian Quality ETF

Investing in quality companies is as important in the Australian market as it is globally.

AQLT aims to track the Solactive Australia Quality Select Index (before fees and expenses), which targets Australian companies that meet specific quality criteria, including stable earnings, low leverage and high return on equity.

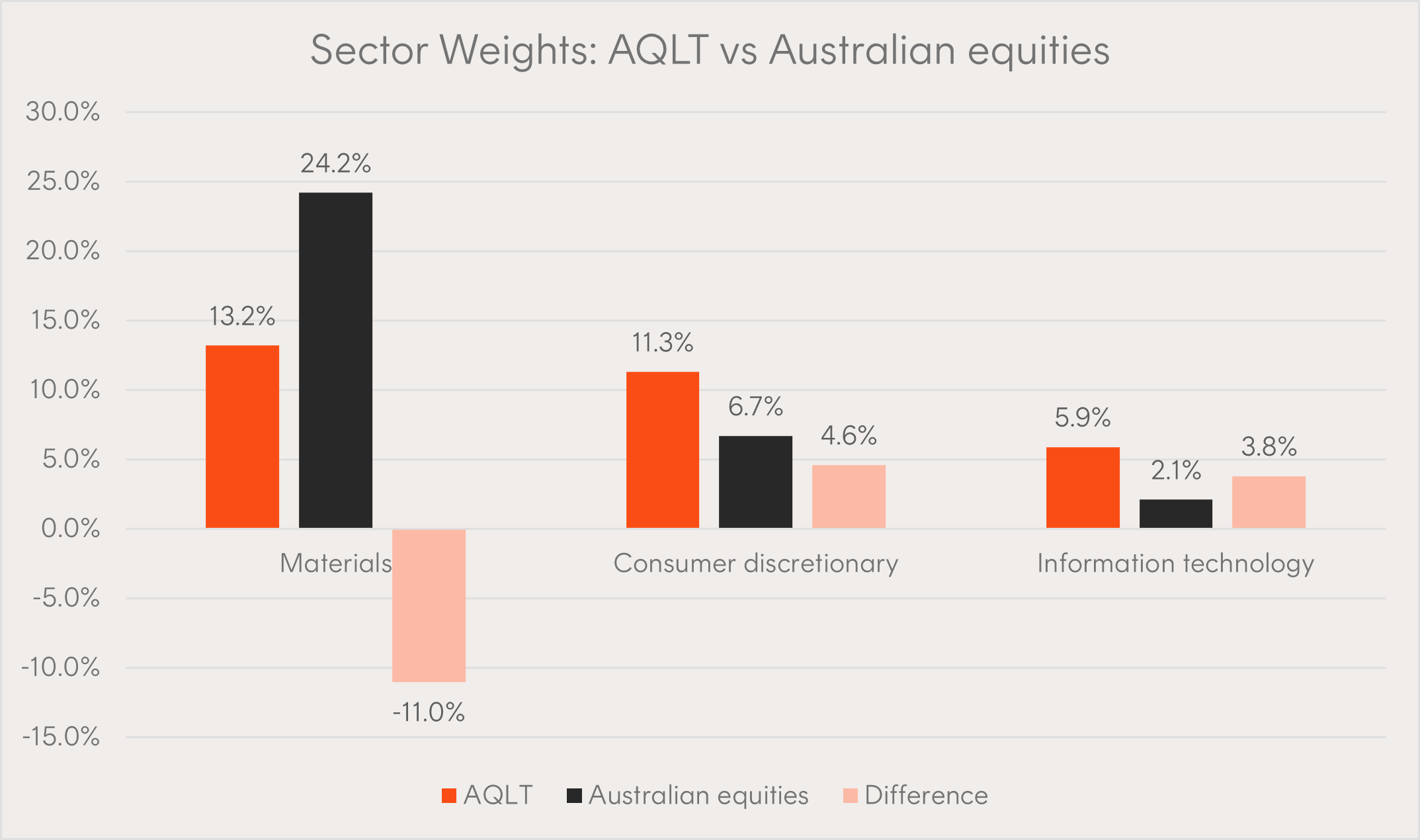

Given the Australian market is top-heavy with financial and mining stocks, AQLT’s Index also offers Australian investors potential diversification benefits as it has tended to have different sector weightings to benchmark Australian equities indices such as the S&P/ASX 200 Index (see below).

Source: Bloomberg, Betashares. As at 29 September 2023.

Currently, AQLT’s index holds 40 high-quality companies, including well-known names such as BHP, CSL, Wesfarmers, Macquarie, and Woolworths.

India’s growth potential is widely recognised, and for good reason. India recently surpassed China to become the most populous country in the world, with 1.43 billion people1 and rapidly closing in on China, India is projected to surpass Japan and Germany to become the third-largest economy by 2030, with an average annual growth rate of 6.3% through 20302.

Indian companies are in a favourable position to benefit from the increasing profitability driven by the growing middle class, expanding population, liberalising economy, and advanced digital infrastructure. However, the Indian market is highly competitive, and prioritising quality helps portfolios select companies with strong fundamental characteristics.

IIND’s quality-based approach seeks to take advantage of the inefficiencies in India’s sharemarket, compared to traditional market-cap weighted alternatives.

Additionally, Indian equities have exhibited a relatively low correlation with both Australian and global equities, which means they may perform differently than other markets during various market cycles, providing a valuable source of diversification.

A ballast during periods of volatility

Investing in quality stocks has appeal, particularly in turbulent markets. These types of companies are characterised by their strong and predictable cash flow, high returns on capital, and the ability to capitalise on attractive growth opportunities in diverse economic cycles.

QLTY, HQLT, AQLT, and IIND ETFs offer investors exposure to quality companies which may provide diversification benefits, thanks to their unique sector weightings compared to traditional market-cap weighted indices.

By including ETFs that focus on quality stocks, investors can potentially enhance the resilience of their share portfolios and seek to position themselves for possible long-term outperformance relative to traditional market-cap weighted indices.

Betashares Capital Limited (ABN 78 139 566 868 AFSL 341181) (Betashares) is the issuer of the Betashares Funds. This information does not take into account any person’s objectives, financial situation or needs. Investing involves risk. The value of an investment and income distributions can go down as well as up. Past performance is not indicator of future performance. Before making an investment decision, investors should consider the Product Disclosure Statement (PDS), available at www.betashares.com.au, and obtain financial advice. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for the BetaShares Fund and is available at www.betashares.com.au/target-market-determinations.

Any Betashares Fund that seeks to track the performance of a particular financial index is not sponsored, endorsed, issued, sold or promoted by the index provider. No index provider makes any representations in relation to the Betashares Funds or bears any liability in relation to the Betashares Funds.

Depending on the fund, risks include: market risk, security specific risk, , currency hedging risk, international investment risk, industry sector risk, currency risk, non-traditional index methodology risk, index tracking risk, and concentration risk.

Resources:

1. Source: World o Meter: Population clock

2. Source: CNBC: India may become the third largest economy by 2030, overtaking Japan and Germany