7 minutes reading time

Financial adviser use only. Not for distribution to retail clients.

The S&P 500 is expensive, but historical analysis shows that valuations alone are not a good market timing tool. We believe this will be the catalyst investors have been waiting for to drive broader market returns and close the valuation gap.

Last week we analysed the latest earnings results of the US mega cap technology stocks, highlighting the increased scrutiny they have come under to meet the market’s lofty expectations.

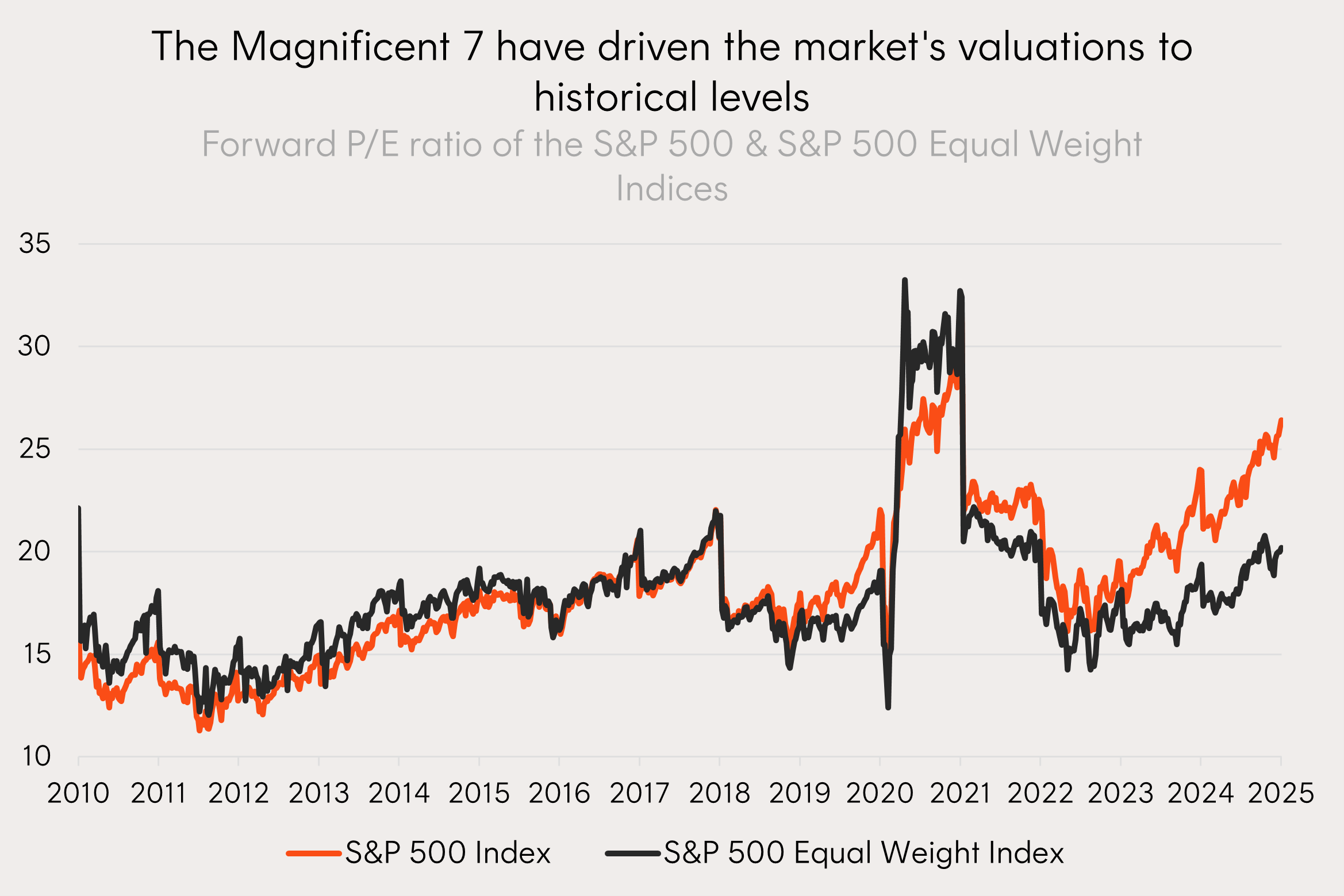

On nearly every fundamental metric you look at the S&P 500 index looks expensive, but it is also concentrated with a significant 34% allocation to the Magnificent 7.

The S&P 500 Equal Weight Index arguably provides a broader representation of the US equity market. As each stock is equally weighted in this index, the Magnificent 7 allocation instead makes up just ~1.4%. From a valuation perspective, the S&P 500 Equal Weight Index is around its long run average, and now 25% cheaper than its market cap weighted cousin.

Put simply the broader US equity cohort is not expensive but the top end is.

Source: Bloomberg. February 2010 to February 2025.

Explaining the valuation gap

The divergence in the valuations of these two indices is a representation of the recent disconnect between the new and old economy.

From 2023-2024, the Magnificent 7 were insulated from macroeconomic headwinds as structural growth in cloud computing storage, AI hardware demand, and digital advertising efficiency drove strong underlying earnings growth.

Meanwhile, the old economy faced headwinds from the traditional impacts of higher inflation and interest rates. Utilities, Real Estate, and Consumer Staples faced margin compression and demand weakness, the Financials sector suffered from low deal volumes in a more uncertain market environment, and industrials earnings compressed due to slowing global manufacturing levels.

Source: Bloomberg intelligence. As at 11 January 2024. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Figures for Q4 2024 onwards are analyst consensus forecasts. Actual results may differ materially from forecasts.

The remarkable divergence in earnings growth through 2023-2024 makes it unsurprising that the market has valued the mega cap technology stocks so highly above the rest. However, unless you believe there has been a permanent re-rating higher in what investors are willing to pay for future earnings compared to history, we can expect these valuations to normalise.

Historical analysis shows that valuations alone are not a good market timing tool1. Just because big tech stocks are more expensive does not mean they are likely to stop being more expensive in the short term – markets require a catalyst.

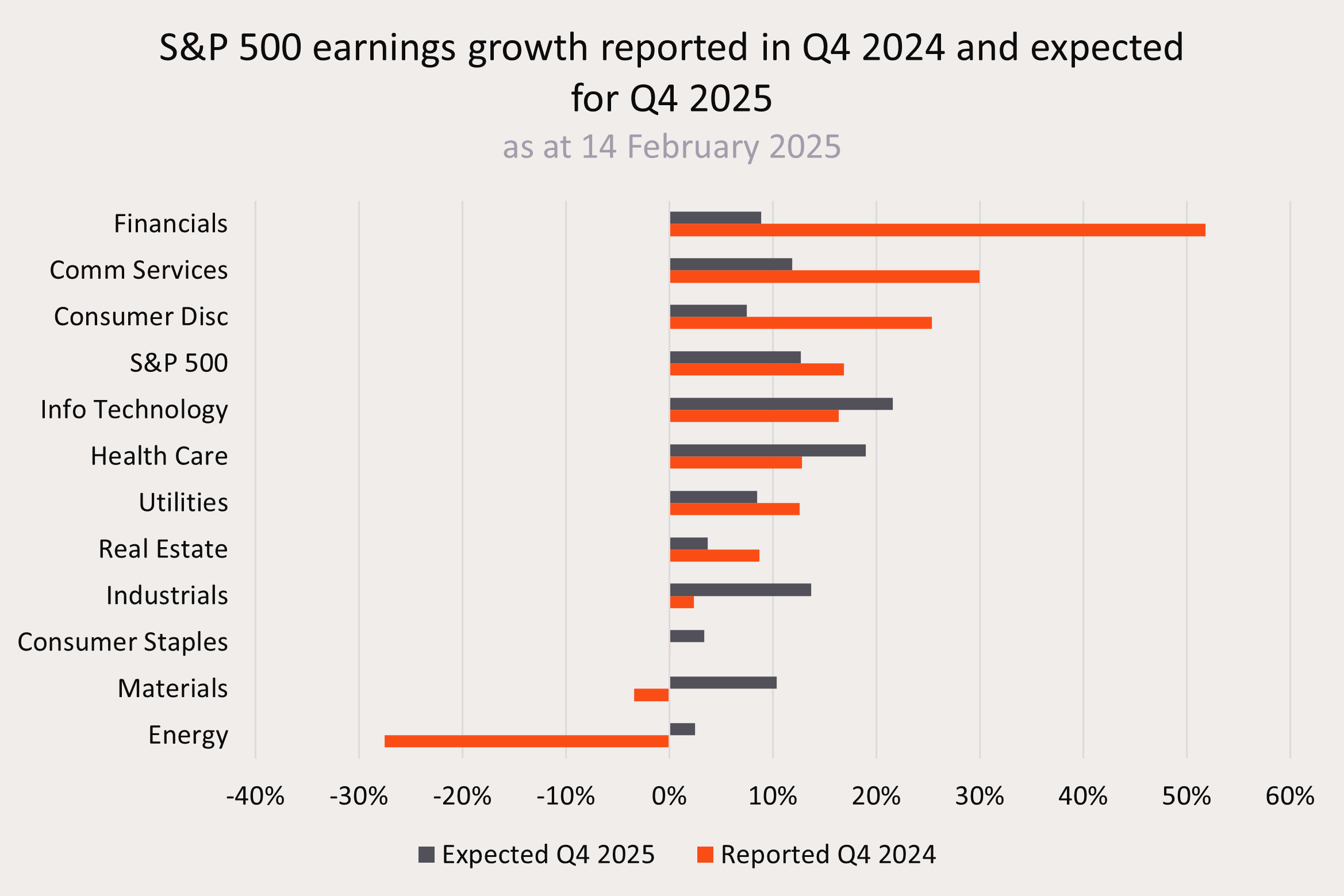

Every sector in the S&P 500 is expected to deliver positive earnings growth for 20252. This hasn’t happened since 2018.3 The rest of the S&P 500 is catching up to the Magnificent 7, and we believe this will be the catalyst investors have been waiting for to drive broader market returns and close the valuation gap.

Earnings to be the market’s catalyst

We have already spoken about the surge in bank profits. To date, Financials are reporting the highest year-over-year earnings growth of 52%4 with the bank industry being the biggest contributor to the sector.

Record banking profits for the year were attributed in part to interest rate moves benefiting trading and lending revenue, however the more exciting element for investors should be capital market and investment banking fees jumping – the latter seeing an aggregate 38% increase from 2023. Even after these results, both capital market and M&A activity remain well below 3-decade averages relative to nominal GDP giving confidence that there is a long runway of growth ahead.

Amongst US banks, JP Morgan led the way with a record $US58.5b profit, Citi recorded an increase of $US4.7b, while Goldman Sachs, Morgan Stanley and Bank of America all more than doubled their Q4 2024 profits compared to a year earlier. Investment banking fees were key contributors to each of these results.

Source: FactSet. As at 14 February 2025.

Industrials surprised with modest growth in Q4 despite expectations of an earnings decline for the sector. Industrial Services, the companies related to construction, transportation, and logistics, experienced stronger growth as rates started to fall. Any of Trump’s ‘America First’ policies that are enacted such as protectionism through tariffs and re-shoring of US manufacturing should only support this trend. The US January Manufacturing PMI, an economic indicator of manufacturing health, returned to an expansionary level this month.

Outside of Boeing, which is experiencing its own idiosyncratic problems, the Aerospace & Defence sector also showed strength within Industrials. Commercial airlines experienced accelerating demand throughout the year with Delta reporting its most profitable Q4 in company history5.

Meanwhile defence companies have been in the spotlight given evolving geopolitical tensions, and are experiencing strong growth as a result. For example, Palantir, which is becoming a poster child of Trump’s agenda, deepened its connection with the US Defence Department. Sales to the US government jumped 45% to $343 million and US commercial revenue gained 64% to $214 million6.

The Industrial sector is expected to continue to be a key beneficiary of these structural trends and grow earnings by 14% over 20257.

Outside of Industrials and Financials the Materials and Health Care sectors are also poised for double digit earnings growth in 2025.

These are all signs of broader strength growing within the S&P 500 that we believe will drive stronger performance amongst companies outside of big tech.

Investing in the market broadening theme in 2025

The QUS S&P 500 Equal Weight ETF offers a cost-effective exposure to 500 leading US companies using an equal weight approach. The S&P 500 Equal Weight Index arguably presents a cheaper entry point for US equities and is forecast to see strong earnings momentum in 2025.

BNKS Global Banks Currency Hedged ETF provides Australian investors exposure to the world’s largest banks outside of Australia, including Bank of America, JP Morgan, Citibank, Royal Bank of Canada, and HSBC with ~50% of the portfolio in North American banks. BNKS can be used in portfolios to take a tactical tilt to global banks which have been crowded out of broader indices by mega-cap technology stocks in recent years.

ARMR Global Defence ETF offers investors exposure to leading companies involved in the global defence sector. With strong momentum in underlying fundamentals and record levels of order books, the largest defence companies are well placed for future growth.

There are risks associated with an investment in each of the Funds. Investment value can go up and down. An investment in any Fund should only be made after considering your client’s particular circumstances, including their tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

References:

1. Asness, C. S., Ilmanen, A., & Maloney, T. (2017). Market timing: Sin a little—Resolving the valuation timing puzzle. AQR Capital Management. https://www.aqr.com/-/media/AQR/Documents/Insights/White-Papers/Market-Timing-Sin-a-Little.pdf ↑

2. Bloomberg consensus. 23 January 2025. ↑

3. JP Morgan, Building on Strength Outlook, November 2024. ↑

4. Factset Earnings Insight. 14 February 2025. ↑

5. Source: Delta Air Lines December Quarter and Full Year 2024 Financial Results ↑

6. Source: Palantir Q4 2024 Earnings Report ↑

7. Factset Earnings Insight. 14 February 2025. ↑