5 minutes reading time

Index tracking ETFs have been a great investment vehicle for Australians seeking tax effective exposure to global and Australian shares. They typically offer diversification, lower management fees than actively managed funds, and lower turnover, which reduces the capital gains tax obligations for end investors.

While the general advantages of ETFs are well understood, there are sometimes key structural differences between ETFs that can have significant implications for investors.

Please note that Betashares is not a tax adviser. This information should not be construed or relied on as tax advice and investors should obtain professional, independent tax advice before making an investment decision.

Dividend tax drag

One of those considerations is the domicile of the ETF that you are investing in, and how that impacts the taxes levied on dividends earned by the ETF.

Where an Australian-domiciled ETF invests directly in companies listed in a foreign country with which Australian has a Double Tax Agreement (which is most of the major economies), the investors in that ETF received an entitlement to a withholding tax (WHT) credit associated with foreign withholding tax paid on dividends from those companies.

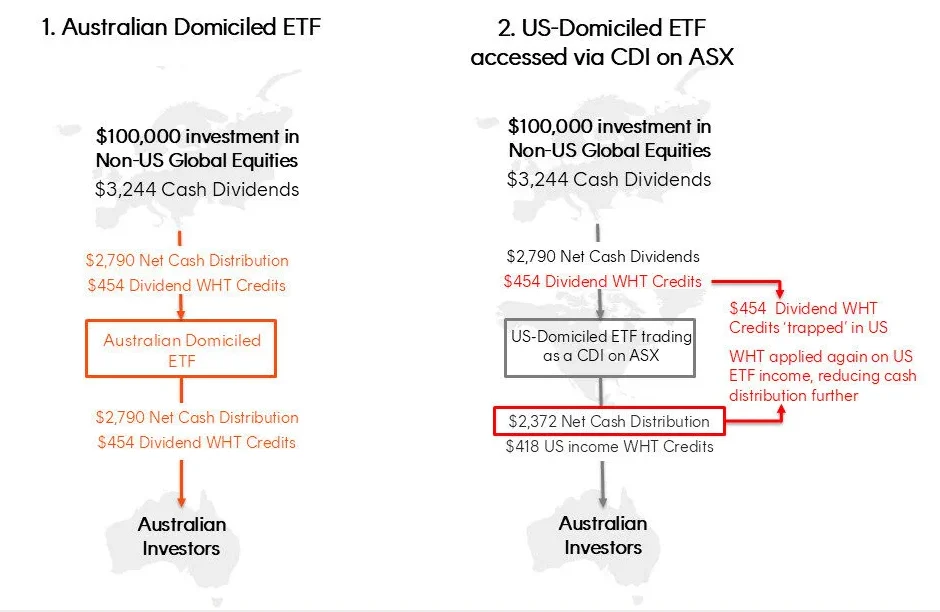

If instead you invest through an ETF domiciled offshore, and that ETF invests in companies listed in third party countries (so for example, a US-domiciled ETF investing in European companies), the dividend WHT credits are ‘trapped’ in the ETF’s country of domicile and are not passed through to the Australian investor. In addition, WHT is then applied a second time, on the foreign-domiciled ETF distributions.

The illustrative example below demonstrates how these two frictions could potentially impact the income generated from a $100,000 underlying investment in non-US global equities exposure accessed either through a US-domiciled ETF versus an Australian-domiciled ETF. Yield and tax assumptions used are set out in the below graphic.

Examples of the dividend and tax entitlements through different structures

Note: All figures are in Australian dollars, and based on a cash dividend yield of 3.244% for both the non-US Global Equities portfolio and the Australian domiciled ETF. A WHT rate of 14% is applied to non-US sourced income, and a WHT rate of 15% is applied to US sourced income. In the case of the US-domiciled ETF it is also assumed the investor has submitted a W8-BEN.

In comparison to investing through an Australian domiciled ETF that directly holds non-US global shares, based on our analysis the ‘tax drag’ faced by the Australian investor holding the US-domiciled ETF means that:

- The cash distributions were lower (only $2,372 versus $2,790), as WHT is applied twice

- investors will be unable to claim back the $454 in WHT paid on the underlying company dividends when they come to complete their tax return

To assess the cumulative impact we need to compare after tax returns and take into account the investor’s tax rate.

How material can this tax drag be?

The yield and WHT rate assumptions used in the example above are based on a popular global shares ETF available on the ASX, which is in fact a CHESS Depository Interest (CDI) in a US-domiciled ETF. The rates we used are based on the distributions paid between July 2024 and June 2025 for that ETF.

The table below shows the estimated cumulative after-tax impact for Australian taxpayers with $100,000 invested in that US domiciled ETF at different tax rates:

|

Investor Type |

Via US-domiciled ETF – After Tax Income |

Via Direct Investment – After Tax Income |

After Tax Impact ($) |

After Tax Impact (% invested) |

|

Pension Investor – 0% tax rate |

$2,372 |

$2,790 |

-$419 |

-0.42% |

|

SMSF Accumulation – 15% tax rate |

$2,372 |

$2,758 |

-$386 |

-0.39% |

|

32% tax rate – Individual/Trust |

$1,897 |

$2,206 |

-$309 |

-0.31% |

|

39% tax rate – Individual/Trust |

$1,702 |

$1,979 |

-$277 |

-0.28% |

|

47% tax rate – Individual/Trust |

$1,479 |

$1,719 |

-$241 |

-0.24% |

The after tax impact at any of these tax rates is greater than a typical low-cost index tracking ETF’s management fees.

The other issue for non-Australian domiciled global equity ETFs

Because these ETFs are not built for Australian investors, they may well include Australian shares, as part of a global shares portfolio. Australia is in fact the tenth largest country weight in the ETF referred to above, and CBA is the 16th largest holding.1 To top it all off, Australian investors in that ETF would not receive franking credits associated with CBA or the other Australian shares that they may not be seeking to hold in the first place.

In addition, investors in a US-domiciled ETF has the additional administrative burden of needing to periodically complete a W-8BEN or W-8BEN E. If they don’t, a US withholding tax at a rate of 30% will apply and further erode their after-tax outcome.

Tax matters, so do your homework

When ETFs were first launched in Australia, many were offered by foreign issuers via a CDI in an existing US-domiciled ETF. This allowed instant scale and cost efficiencies for that issuer. As the ETF ecosystem has grown in Australia many, but not all, have since been converted to Australian domiciled trusts.

Notwithstanding the dividend tax drag, there may be valid reasons for investing in an offshore domiciled ETFs, depending on the investment strategy and asset class. The tax implications of investing may be complex but can also be significant. It’s worth doing your homework and seeking professional tax advice. You can find information on where an ETF is domiciled, or whether if holds offshore domiciled ETFs, on the ETF provider’s webpage.

Footnote:

1. As at 31 September 2025. ↑