5 minutes reading time

If you prefer to listen to Bass Bites, you can click the player below:

Global week in review

Global equities moved higher again last week following the Fed’s widely expected rate cut and renewed hopes of a US-China trade deal.

The Fed cut rates by 0.25% as widely expected and the ‘dot plot’ of Fed member expectations suggested two further rate cuts this year and one more in 2026. That’s one extra rate cut by end-2026 compared to the Fed’s June dot plot expectation, although still two less than the market expects next year. All up, markets considered the Fed outcome as less dovish than hoped, pushing bond yields up and equities down.

In somewhat reassuring US labour market news, weekly jobless claims dropped back down last week after having spiked higher in the previous week. The week ended with markets again encouraged by trade talks between the US and China – these persistent rumours are becoming the gift that keeps on giving!

The news was less cheery in New Zealand, with a much weaker than expected 0.9% decline in Q2 GDP (markets expected a 0.3% decline). The NZ economy continues to flirt with recession, suggesting the RBNZ can and should go harder in cutting interest rates in coming months.

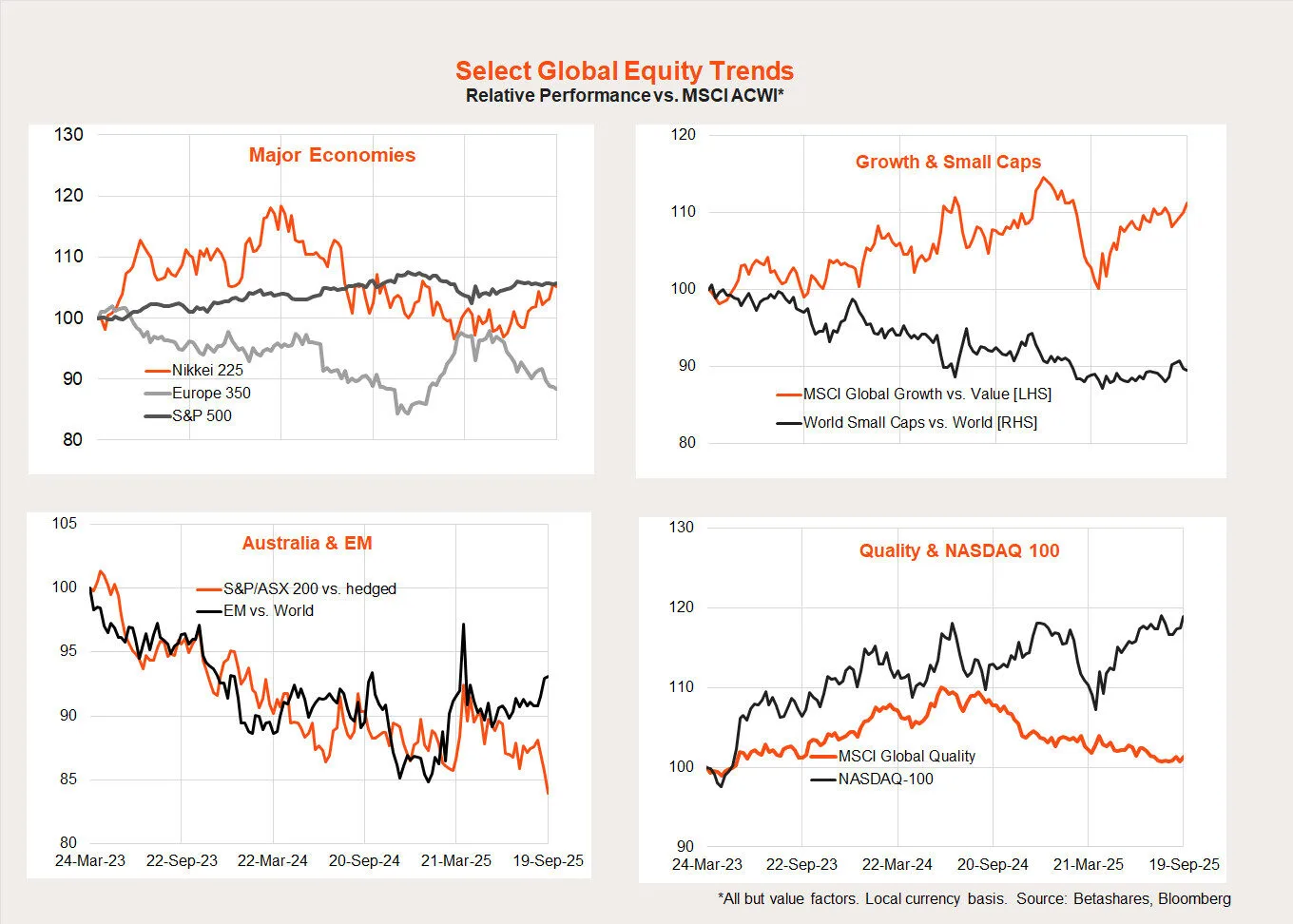

Global share market trends

Although the US market is not outperforming as clearly as it has in recent years, global growth is still beating value and the NASDAQ-100 is still tending to outperform in global markets. Japan and emerging markets are also doing relatively well, whereas Europe and Australia have come off the boil.

Global week ahead: US PCED inflation report

Friday’s August US personal consumption expenditure deflator (PCED) will be the key highlight this week. Based on the already known CPI and PPI results, the core PCED is expected to rise only 0.2% in the month (down from 0.3% in the previous two months) which, while welcome, would still keep annual core inflation steady at 2.9%.

That said, such a result would again have markets wondering about the continued absence of a major tariff effect on prices – given the average tariff rate on US imports has increased from 2.5% at the start of the year to 18%, and US tariff revenue has increased by US$250 billion (annualised rate) which is equal to 1.2% of US consumption.

Also out this week will be the global PMI industry survey which is expected to show activity still holding up at reasonable levels.

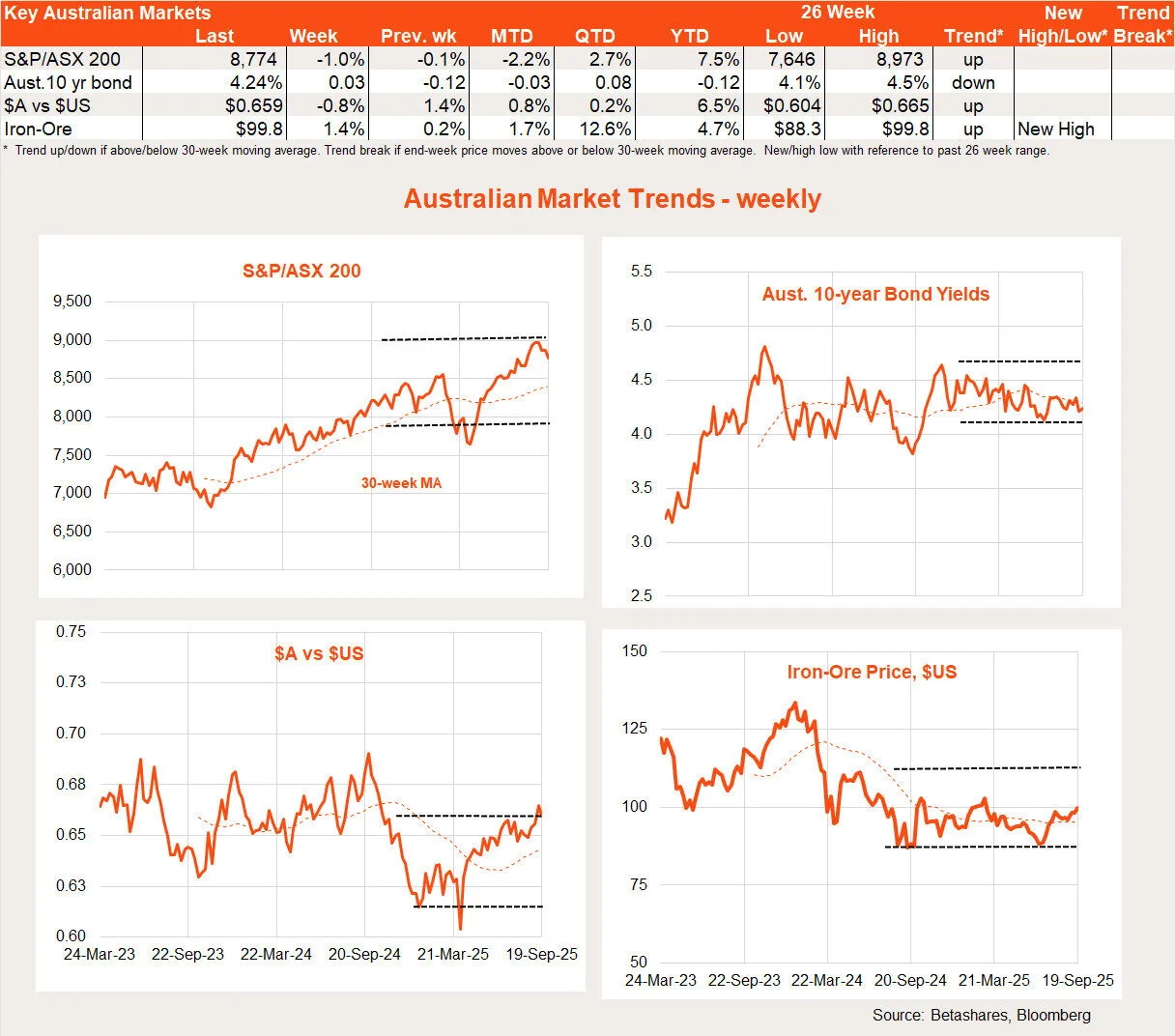

Australian week in review

The highlight last week was the weaker than expected August employment report.

As is the case in the US, employment growth has clearly slowed in Australia in recent months even though hiring intentions remain above average – with part of the slowdown reflecting weaker labour supply.

Indeed, employment fell by 5.4k in August compared to market expectations of a 22k gain. Despite that, weaker labour force participation and slowing immigration meant the unemployment rate held steady at 4.2%. Given the inherent volatility in monthly employment and the fact that the unemployment rate held steady, my view is the report was not weak enough to force the RBA’s hand at next week’s policy meeting.

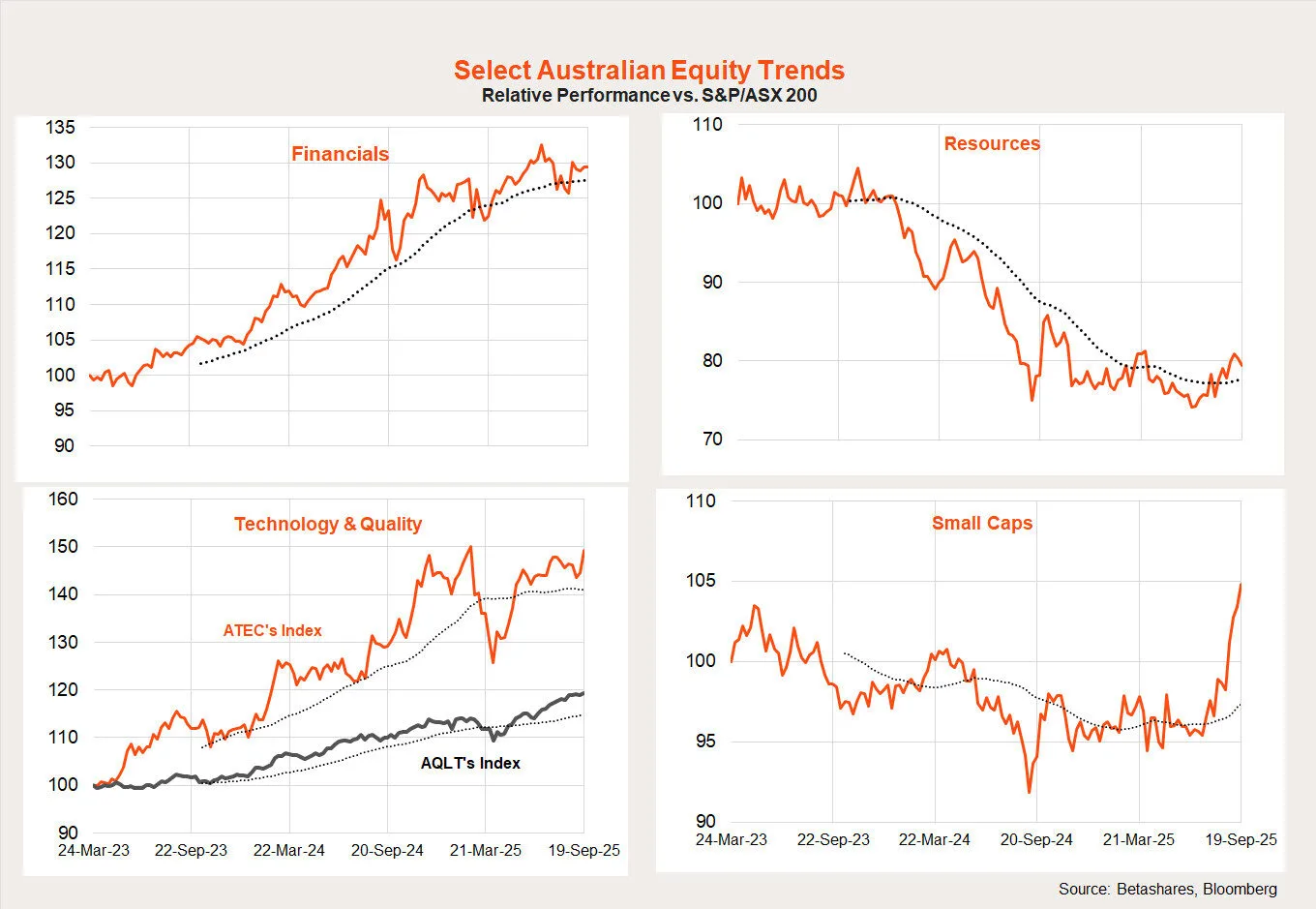

Australian share market trends

In terms of local equity trends, tentative signs of a rotation from financial to resource stocks remain in place. There’s also been a notable bounce in relative small-cap performance in recent months. Quality – and increasingly technology also – continues to perform well.

Australia week ahead: Monthly CPI

The local highlight this week will be Wednesday’s monthly CPI report. After a jump from 2.1% in June to 2.7% in July, the focus will be on the annual trimmed mean inflation result.

Part of the reason for last month’s trimmed mean jump was likely indirect effects from the 13% rise in electricity prices, after government subsidies in NSW and ACT were temporarily ended. As these subsidies were reinstated in August, it’s likely electricity prices will fall again which may indirectly help bring down the trimmed mean measure of annual inflation – perhaps to at least 2.5% or less.

If so, this should have markets still confident of an RBA rate in November, with a modest chance (currently 10%) attached to a rate cut next week.