7 minutes reading time

- Currencies

- Currency hedged

This information is for the use of financial advisers and other wholesale clients only. It must not be distributed to retail clients.

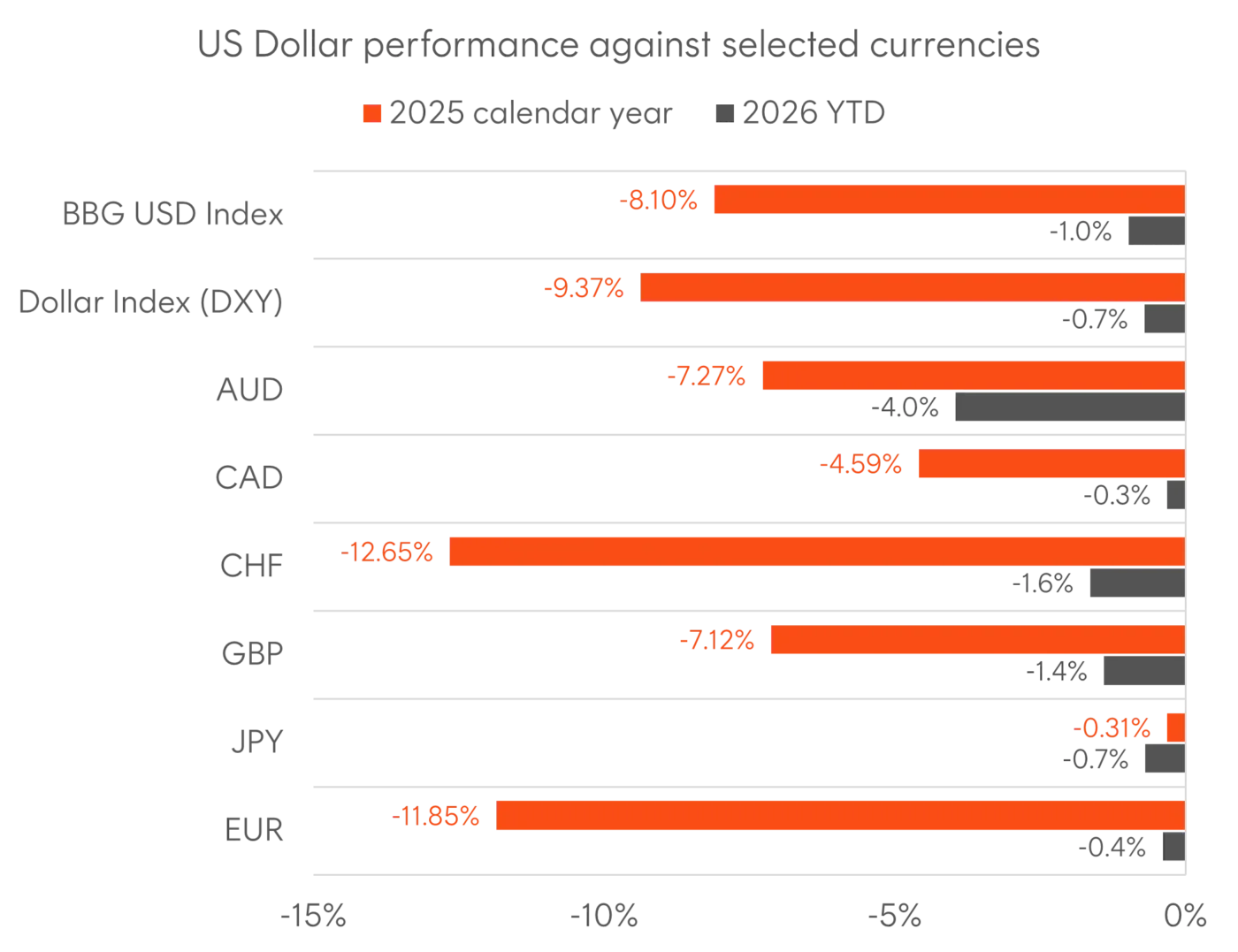

In our 2025 outlook, we highlighted the risks to the greenback amid the Trump Administration’s likely policies and fundamental overvaluation, and this largely played out, with the broad trade-weighted US Dollar Index ending the year down 8%.

However, much of the decline occurred during the first half of the year, especially during the Liberation Day volatility and spent the remainder consolidating. What potentially mitigated the USD’s decline and supported it during the second half was that interest rate differentials remained positive against most other major currencies, combined with a fresh round of yen weakness.

Figure 1: USD performance against selected currencies during 2025 and January 2026

Source: Bloomberg. As at 2 February 2026

That support has faded in early 2026 as the interest rate differential advantage has eroded and President Trump has injected fresh policy uncertainty.

The Fed has maintained dovish guidance and the US rates market is expecting further cuts, with recent FOMC meetings revealing more concern about labour market weakness than inflation. This dovish tilt stands in stark contrast to central banks elsewhere, including Australia, where sticky inflation has seen markets pricing in a fresh hiking cycle.

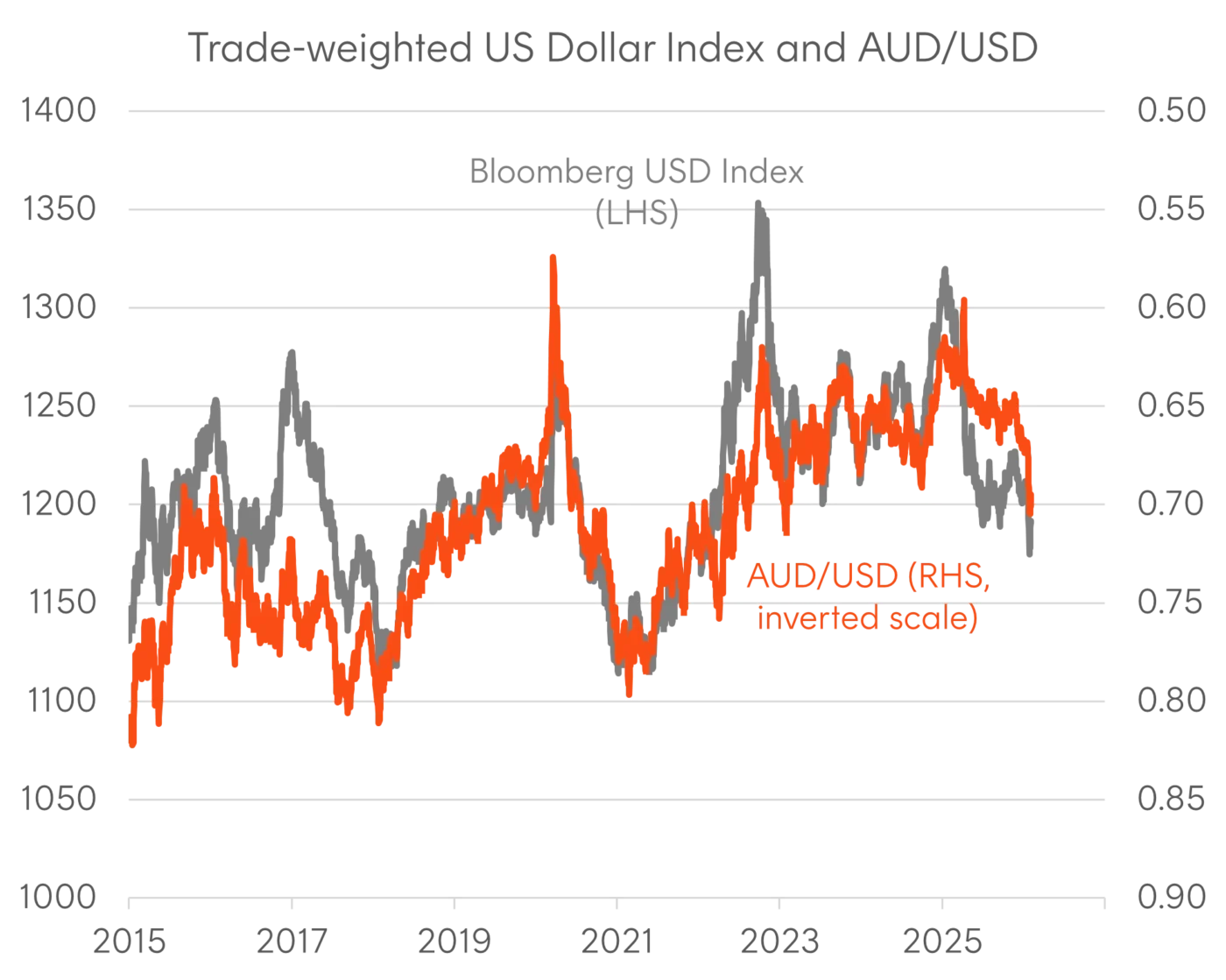

January saw the broad USD make a fresh cycle low, with the AUD among the best performers, up over 4% against the greenback to breach 70 US cents for the first time in three years alongside a surge in commodity prices. President Trump’s recent comment that the dollar “hasn’t declined too much” only added fuel to the move, reinforcing the view that the administration is comfortable with a weaker currency.

Figure 2: Broad US dollar index and AUD/USD exchange rate

Source: Bloomberg. As at 2 February 2026

Japan looms large in this policy divergence and broad USD story. The BoJ has taken the policy rate to 0.75%, with the 10-year JGB yield breaching 2% for the first time since 1998. More striking has been the action at the ultra-long end, where 30-year yields have approached 4% amid growing fiscal concerns following Prime Minister Takaichi’s snap election announcement and the growing likelihood of further stimulus.

Despite this dramatic bear steepening in JGB yields, the yen has remained under pressure. Ultimately due to the slow pace of the policy normalisation and the highest inflation rates in decades, short-term real rates in Japan remain negative, and BoJ policy simply isn’t restrictive enough to support the currency. The yen remains favoured as a funding currency, and this is unlikely to change until the BoJ accelerates its hiking cycle or intervenes more aggressively in FX markets, which would likely accelerate the broad US dollar weakness.

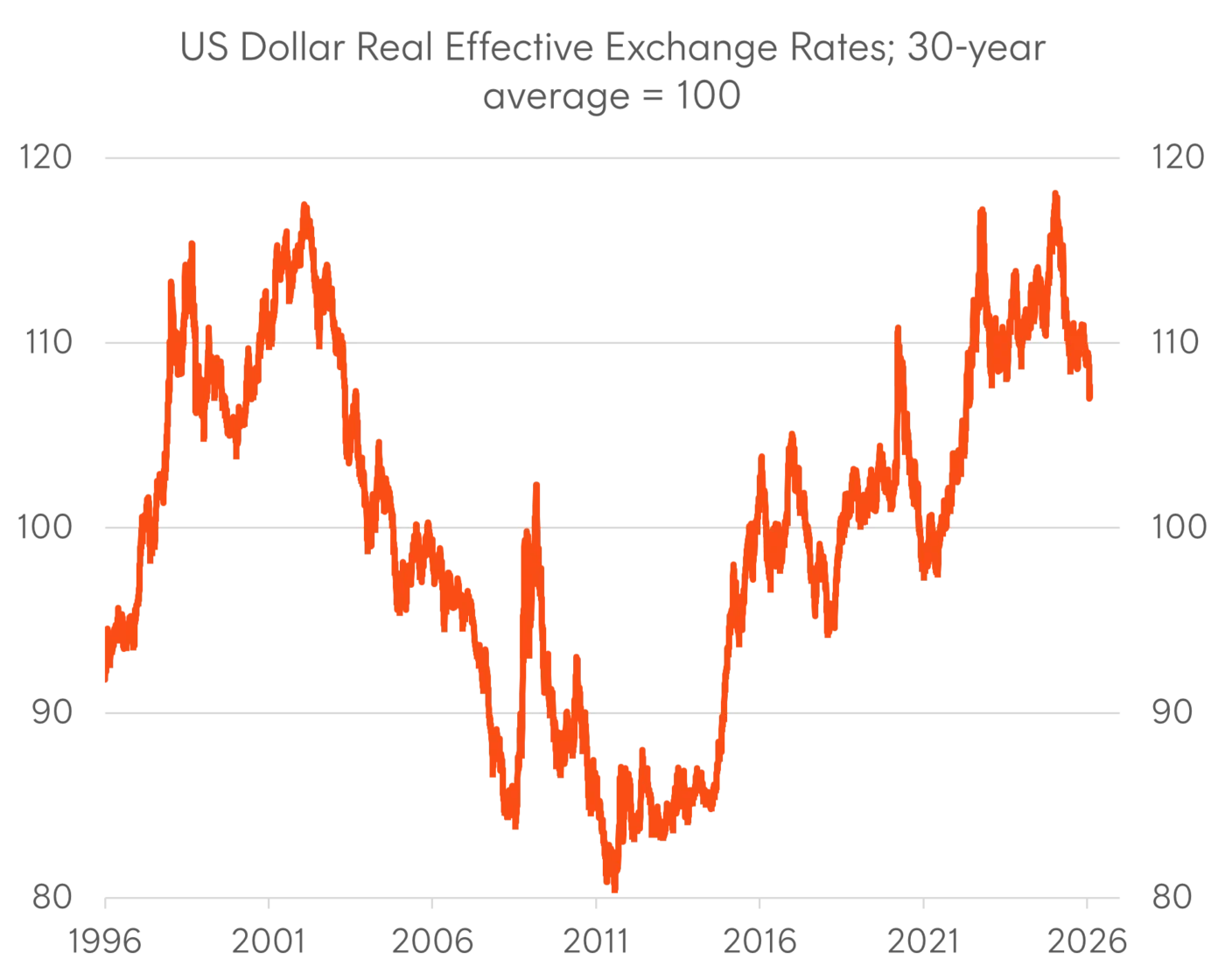

Beyond diverging rate expectations, the structural case for USD weakness remains intact. Currency cycles last years, with overshoots in both directions. The last major USD bear market (2002-2011) produced a 30% real depreciation during a period of significant US fiscal expansion and hawkish foreign policy.

Despite the 7% decline in 2025, the USD real effective exchange rate (the exchange rate adjusted for purchasing power vs trading partners) remains around 6% above its 30-year average. If the Trump administration is serious about narrowing the trade deficit and rebuilding America’s industrial base, the USD may need to fall further in real terms.

Figure 3: USD real effective exchange rate based on purchasing power parity

Source: Citi. As at 2 February 2026

While the Trump administration officially maintains the “strong dollar” policy, this could be seen as referring to the USD’s reserve status rather than the exchange rate level. However, the administration will need to strike a delicate balance between facilitating a more competitive currency and not sparking capital outflows that accelerate the trend away from USD reserve assets.

Investment implications

For Australian investors with unhedged global equity exposures, these dynamics have meaningful portfolio implications.

US equities now account for over 70% of the global developed market benchmark, well above the 30-year average of 56%1, meaning currency movements can have an outsized impact on returns for globally diversified portfolios.

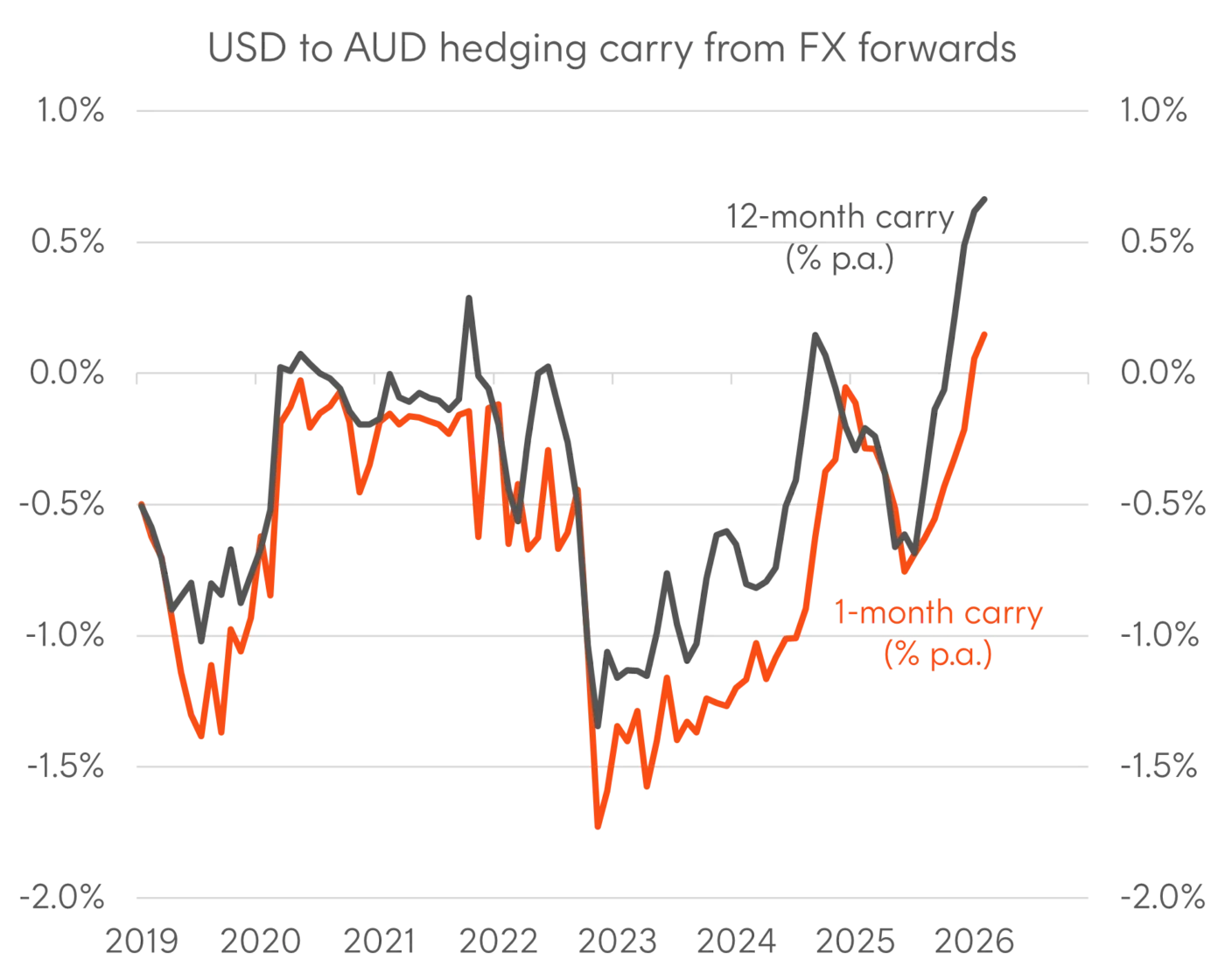

Perhaps the most notable shift has been in AUD/USD forward points, which have turned negative across all tenors as rate differentials have reversed. This means investors now receive positive carry when hedging USD exposures back to AUD – a stark reversal from the cost of hedging that prevailed throughout much of the post few years. Combined with a broader AUD tailwind from recovering commodity prices and a growing rate divergence between the RBA and Fed, the case for raising FX hedge ratios on global equity portfolios has strengthened considerably.

Beyond the hedging implications, the performance of the broad US dollar may have a large bearing on the relative performance across global equities and will be key to any rotation narrative playing out. Ultimately, US equity market outperformance has coincided with USD strength in recent years, and a sustained USD bear market will likely see emerging markets and more cyclically oriented developed markets benefit.

Figure 4: Annualised carry from hedging USD underlying to AUD using FX forwards

Source: Bloomberg. As at 2 February 2026

For these reasons we believe investors should consider currency hedged exposure to US assets alongside both developed and emerging market exposures outside of the US that may benefit in a weaker dollar world.

- Betashares Nasdaq 100 Currency Hedged ETF (ASX: HNDQ)

- Given the potential for USD weakness in 2026 to impact returns, investors may wish to consider HNDQ in order to participate in the Nasdaq 100’s enviable earnings growth whilst minimising currency risk.

our expectation of USD weakness, lead us to believe that ex-US developed markets will outperform US equities in 2026 in AUD terms (on an unhedged basis).

- Betashares Global Shares Ex US ETF (ASX: EXUS)

- EXUS offers low-cost global diversification beyond the US, providing exposure to 900+ companies from 22 developed markets, excluding the US and Australia.

- EXUS was built specifically for Australian investors, providing them access to any available foreign tax credits from dividends received, which may improve after-tax returns compared to investing in a non-Australian domiciled ETF.

A weakening USD should be a tailwind for emerging market countries.

- Betashares MSCI Emerging Markets Complex ETF (ASX: BEMG)

- BEMG is the lowest cost core market capitalisation weighted emerging market ETF available on the ASX.

- BEMG holds units in a UCITS fund that uses a swap-based structure. This allows BEMG to more efficiently track the MSCI Emerging Markets Index and avoids the costs and performance impacts associated with trading in some emerging market countries.

There are risks associated with an investment in each of the Funds. Investment value can go up and down. An investment in any Fund should only be made after considering your particular circumstances, including your tolerance for risk. For more information on the risks and other features of a Fund, please see the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

Betashares Capital Limited (ACN 139 566 868 / AFS Licence 341181) (“Betashares”) is the issuer of this information. It is general in nature, does not take into account the particular circumstances of any investor, and is not a recommendation or offer to make any investment or to adopt any particular investment strategy. Future results are impossible to predict. Actual events or results may differ materially, positively or negatively, from those reflected or contemplated in any opinions, projections, assumptions or other forward-looking statements. Opinions and other forward-looking statements are subject to change without notice. Investing involves risk. To the extent permitted by law Betashares accepts no liability for any errors or omissions or loss from reliance on the information herein.

Past performance is not indicative of future performance.

Betashares is not a tax adviser. This information should not be construed or relied on as tax advice and you should obtain professional, independent tax advice before making an investment decision.

Sources:

1. As at 31 January 2026. ↑