Important dates to know

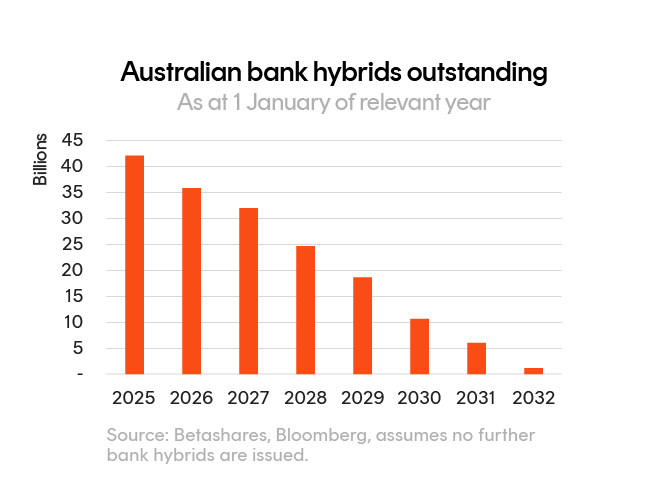

Investors should be aware of the key dates that existing bank hybrids will be called. This chart illustrates the value of the hybrids that will be called in the next seven years, with most of the $40 billion roll-off to come well before 2030.

There are risks associated with investments in the Betashares fixed income funds, including interest rate, credit and market risk, as well as hybrid complexity risk and sector concentration risk in relation to HBRD and BHYB. An investment in any Betashares fund should only be considered as a component of a broader portfolio. For more information on the risks and other features of each fund, please read the relevant Product Disclosure Statement and Target Market Determination, available at www.betashares.com.au.

Insights and Resources

Further expand your knowledge of bank hybrids.

What is happening to hybrids?

In December 2024, APRA announced it will gradually phase out the use of Additional Tier 1 (AT1) capital instruments (hybrid securities) by Australian banks. As a result, banks are not expected to issue new hybrid securities. Insurance firms and other corporates that issue hybrids are not affected by APRA’s decision.

APRA believes AT1 hybrid securities haven’t effectively served their prudential purpose of absorbing losses in times of financial stress. The regulator is of the view that replacing AT1 with more ‘reliable’ forms of capital (such as Tier 2 and CET1 capital) will better protect Australian investors if another global banking crisis, like the collapse of Credit Suisse, were to occur.

New issuance is likely finished as of now. The updated prudential framework relating to these changes will come into effect on 1 January 2027 and the final first call date on existing hybrids will be in 2032. Around $40 billion of direct bank hybrids will be called in the next seven years.

Investors can either hold their hybrids until they are called, or sell their hybrids on market. For investors seeking exposure to alternative investments that share some similar characteristics with hybrids, we outline some possible ETF options for consideration.

On 27 February 2026 it was announced that the Betashares Australian Hybrids Active ETF (ASX: HBRD) would be undergoing a Fund name and strategy change effective following market close on 31 March 2026. HBRD will be renamed the Betashares Australian Credit Income Active ETF (ASX: HBRD). This new name reflects a broader investment approach. Further details about the change can be found in the ASX announcement and Supplementary PDS.

The changes to HBRD have been prompted by APRA’s decision to gradually phase out the use of hybrids issued by Australian banks. Existing bank hybrids are expected to be redeemed at their respective first call dates over the period until 2032. This change does not apply to hybrids issued by insurance companies and other non-bank issuers. This regulatory change affects HBRD’s investable universe by significantly reducing the size of the hybrids market and the relevance of the Fund’s existing performance benchmark.

The Betashares Australian Major Bank Hybrids ETF (ASX: BHYB) only comprises bank hybrids issued by the Big 4 Australian banks. The Fund’s portfolio is therefore expected to “run-off” gradually over time. The Responsible Entity intends to determine an appropriate course of action for the Fund prior to 1 January 2027, taking into account the best interests of unitholders, and inform unitholders accordingly.

Until the course of action determined by the Responsible Entity has been implemented, BHYB will continue to pursue its investment objective of tracking its index, and is expected to continue to provide monthly income and franking credits from exposure to listed bank hybrids issued by Australia’s Big 4 banks.

Investors in HBRD who have considered the upcoming changes and wish to remain invested in the Fund are not required to take any action in connection with the announced changes.

Investors in BHYB should consider the Responsible Entity’s proposed course of action, once announced prior to 1 January 2027, in light of their personal circumstances.

Please refer to the applicable PDS for further information.

Betashares Capital Limited (ABN 78 139 566 868, AFSL 341181) (“Betashares”) is the issuer of the Betashares Funds. This information is general only, is not personal financial advice, and is not a recommendation to buy units or adopt any particular strategy. It does not take into account any person’s financial objectives, situation or needs. Investments in Betashares Funds are subject to investment risk and the value of units may go down as well as up. Any person wishing to invest should obtain a copy of the relevant PDS from www.betashares.com.au and obtain financial advice in light of their individual circumstances. You may also wish to consider the relevant Target Market Determination (TMD) which sets out the class of consumers that comprise the target market for each Betashares Fund and is available at www.betashares.com.au/target-market-determinations.