Back in the saddle: Chinese equities and beyond

5 minutes reading time

- Global shares

- Technology

AI, cybersecurity and gaming are not just trending topics – they’re transforming industries, economies and portfolios.

The numbers tell the story of their explosive growth.

- AI is fast becoming “the defining technology of our time”, according to the United Nations, with the global AI market forecast to reach US$4.8 trillion by 20331.

- Cybersecurity spending could reach US$213 billion this year and US$240 billion by 2026, according to research firm Gartner2.

- As at October 2024, the global video game industry brings in more money than the film and music industry combined, according to international advertising agency, Dentsu3.

In each case, demand is growing significantly and proving to be remarkably resilient – factors that make these themes some of the most compelling in markets today.

AI: Transforming the world, one prompt at a time

AI was a niche concept to many people even four years ago. Now it’s reshaping everything from how companies operate to how we go about our daily lives.

McKinsey & Company’s research suggests that the long-term AI opportunity could add over US$4 trillion to global productivity and that 92% of companies are planning to increase their AI investments over the next three years4.

From an investing standpoint, Nvidia is the marquee company of the AI megatrend, thanks to its leading role in supplying the chips that power everything from data centres to consumer AI tools.

While mega-cap names such as Nvidia often dominate headlines, the benefit of AI is increasingly extending beyond the Magnificent Seven. In fact, companies like Palantir and Netflix posted faster revenue growth than the Mag 7 during the Q2 reporting season, underscoring how AI adoption is accelerating across a broader swathe of the market. The impact of all this AI investment will also likely be felt across many other sectors, such as utilities, healthcare and transport.

For broad exposure to the AI megatrend, you could consider NDQ Nasdaq 100 ETF . NDQ aims to track the performance of the Nasdaq 100 Index5 (before fees and expenses), offering access to the US technology ecosystem including many of the AI theme’s most important players, as well as some of the more nascent names just beginning to make waves.

Cybersecurity: A necessity for us all

With billions of devices now connected across homes, offices and cloud platforms, cybersecurity is what keeps the modern world running smoothly. It’s why many of us now have two-factor authentication to protect our digital footprint.

Globally, cybercrime is projected to cost global companies more than US$12 trillion by 20316. Many major companies have been affected in the past by compromised systems, including Equifax (2017), Yahoo (multiple large-scale data breaches from 2013-16) and Sony (2011).

Here at home, more than 25 million Australian customer accounts have been compromised as a result of cyber attacks on Qantas, Optus and Medibank7. These attacks weren’t the first and they won’t be the last – and companies need to be ready for what’s next. For many firms, this involves employing the services and products of cybersecurity vendors like Palo Alto Networks and Fortinet.

This is where HACK Global Cybersecurity ETF can come into focus. HACK offers investors targeted exposure to a portfolio of leading global cybersecurity companies. These firms are at the forefront of protecting critical infrastructure, sensitive data and digital systems from ever-evolving threats.

Gaming: An under-the-radar investment theme

Once a niche hobby, gaming has grown into a near-US$300 billion industry – bringing with it a wave of long-term investment opportunities.

Companies like Nintendo, Sega and Take Two have been joined by newer players like Roblox, Tencent and Applovin in a highly competitive sector that now boasts 2.7 billion players in every corner of the world8. Add in the eSports events which attract millions of viewers, and you have an industry with a loyal customer base that has demonstrated its ability to spend regardless of the economic environment.

GAME Video Games and Esports ETF provides exposure to the companies at the heart of this industry and its growth. Roblox, Nintendo and Applovin are some of the most well-known companies featured in the index tracked by GAME.

Three investment opportunities with structural tailwinds

Between AI, cybersecurity and gaming, technology is undergoing profound and rapid change. But for investors looking to grow their wealth alongside the world, these trends may potentially still have a long runway ahead. If the growth stories behind them continue to translate into earnings, the ETFs tracking them could be well-positioned to deliver attractive long-term returns.

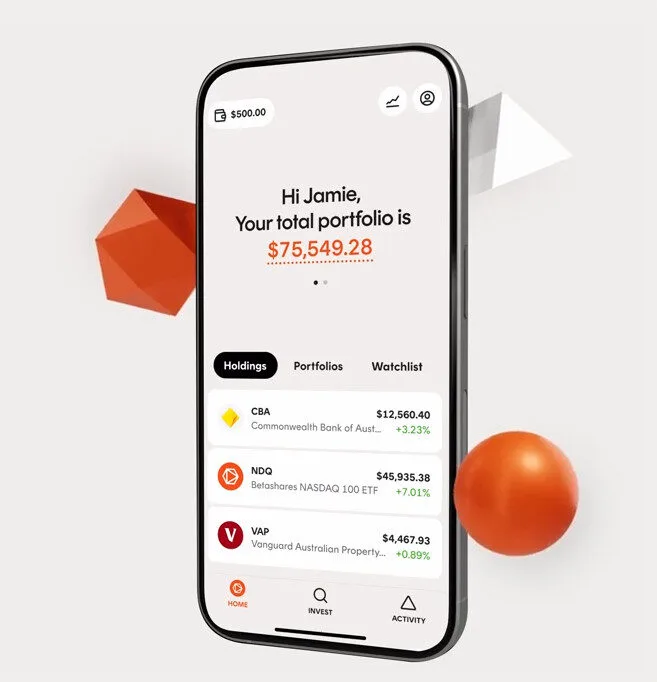

Betashares Direct

Invest in all ASX ETFs, and 400+ ASX-traded shares brokerage free. Automated investing. Low-cost managed portfolios. Create your account in minutes.

Disclaimers:

There are risks associated with an investment in the Funds, including market risk, country risk, cybersecurity companies risk, concentration risk, international investment risk, currency risk and sector risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on www.betashares.com.au. Past performance of the index is not indicative of future performance.No assurance is given that any of the companies in a Fund’s portfolio will remain in the portfolio or will be profitable investments.

Sources:

1. AI market projected to hit $4.8 trillion by 2033 – UNCTAD

2. Gartner forecasts worldwide end-user spending on information security to total $213B in 2025

3. Dentsu gaming data report – Marketing Beat

4. Superagency in the workplace – McKinsey Digital

5. You cannot invest directly in an index. Past performance of the index is not indicative of future performance of the index or ETF.

6. Official Cybercrime Report 2025 – Cybersecurity Ventures

7. Experts say right to erasure removes cybercriminal ‘honeypot’ – ABC News

8. Gaming industry and number of video gamers worldwide – Statista