7 minutes reading time

As we move into 2026, many of the forces that reshaped responsible investing over the past year remain firmly in place. But their implications are becoming clearer.

Global events, technological advances and evolving societal expectations continue to influence how environmental, social and governance considerations are assessed and embedded within investment strategies.

The past year reinforced the idea that ESG integration is increasingly defined by execution rather than intent, as investors and companies respond to tightening regulatory requirements, greater scrutiny of disclosures and more complex stakeholder expectations. What began as a period of adjustment in 2025 is now giving way to a phase where credibility, consistency and governance are under closer examination.

Against this backdrop, the following five responsible investment themes are expected to be central to investment decision-making and stewardship discussions in 2026.

#1. Climate reporting enters its first reporting cycle

Australia’s mandatory climate and sustainability reporting regime moves decisively from design to delivery in 2026. While the legislative framework is now established, the coming year will mark the first cycle in which sustainability reports will be scrutinised at scale.

Under the Corporations Act amendments and the Australian Sustainability Reporting Standards, large entities will be required to disclose climate-related financial information in alignment with International Sustainability Standards Board (ISSB) standards.1

The new standards are significant in their application. As the first group of reporting entities publish sustainability disclosures alongside financial statements, investors will gain their first meaningful opportunity to assess consistent, decision-useful information across peers.

Regulatory oversight will sharpen this dynamic. ASIC has indicated that it will review sustainability reports lodged, similar to the way it reviews financial reports.2 This signals a shift away from narrative disclosure towards substantiation and assurance.

For investors, the implications are material. Improved disclosure should reduce reliance on third-party estimates and enable more disciplined pricing of transition and physical risks. It will also expose when assumptions are overly optimistic or poorly explained. In 2026, sustainability reporting is likely to play an important role in stewardship and engagement discussions.

#2. AI, data centres and the sustainability test

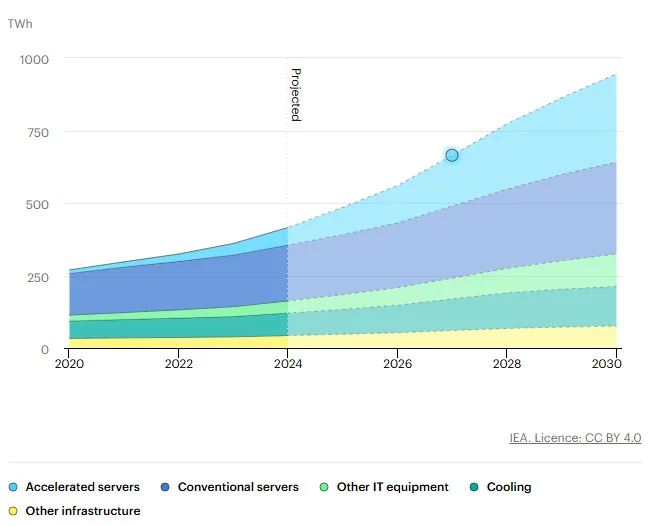

The rapid expansion of artificial intelligence (AI) is reshaping global electricity demand, pushing data centres from a niche infrastructure segment into one of the fastest-growing sources of power consumption. The International Energy Agency (IEA) estimates that global data centre electricity demand could more than double by 2030 to around 945 Terawatt-hours (TWh), driven largely by AI workloads, with generation required to supply data centres rising from roughly 460 TWh in 2024 to more than 1,000 TWh by the end of the decade.3

Global data centre electricity consumption, by equipment, Base Case, 2020-2030

Source: IEA Energy and AI 2025

For Australian investors, this is not an abstract global trend.

Data centres are becoming an increasingly prominent part of domestic infrastructure pipelines and are competing for capacity in electricity systems already under pressure from electrification and the energy transition. In 2026, investor scrutiny of sustainability claims is likely to sharpen.

Rising energy and water intensity, exposure to constrained grids and upstream impacts from the supply chains of critical minerals are increasingly material considerations. While efficiency gains from advanced chips, optimised algorithms and renewable-powered data centres offer mitigation pathways, recent emissions increases reported by major AI operators highlight the gap between ambition and system-wide outcomes.4 As data centres become core infrastructure, investors should be placing greater weight on credible decarbonisation strategies, operational efficiency, water stewardship and governance oversight to assess which operators are positioned to scale sustainably.

For further insights into AI and energy requirements, refer to our note from 2024.

#3. Remuneration and governance

While climate reporting represents this year’s most visible regulatory change, governance remains the most enduring driver of investor confidence. In Australia, shareholder scrutiny of boards and executive pay has intensified, and there is little indication this will ease in 2026.

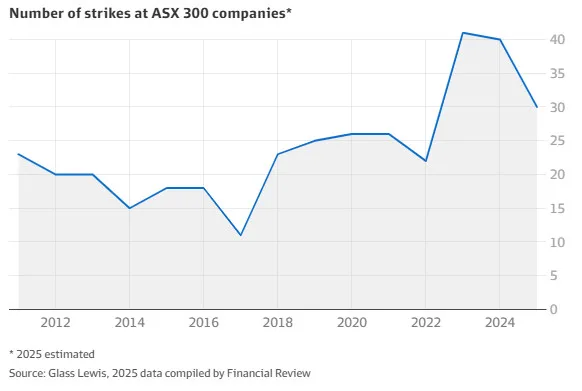

Australian shareholders have shown a renewed willingness to use their votes, particularly on remuneration and director elections. Reporting from the 2025 AGM season points to heightened dissent and scrutiny of board practices, pay outcomes and transparency.5 Proxy advisers have also highlighted the scale of remuneration disputes between management and shareholders. About 30 companies in the ASX 300 have thus far recorded pay strikes in 2025, down from 40 last year and the record 41 strikes in 2023, based on historical data compiled by CGI Glass Lewis, a proxy research and governance advisory firm. Despite the drop, 2025 remains well above the average before the surge in shareholder revolts since 2023.6, 7

Remuneration will remain a focal point. Investors are increasingly sceptical of incentive structures that reward ESG metrics without clear linkage to strategy or value creation, or that allow generous outcomes despite weak risk management. The design and calibration of non-financial metrics are under particular pressure, especially where targets are perceived to be disconnected from operational reality.

More broadly, governance expectations are expanding beyond remuneration to encompass board capability, oversight of complex risks and responsiveness to stakeholder concerns. For responsible investors, governance is increasingly viewed as the transmission mechanism that determines whether environmental and social commitments are credible.

#4. Biodiversity becomes financially relevant

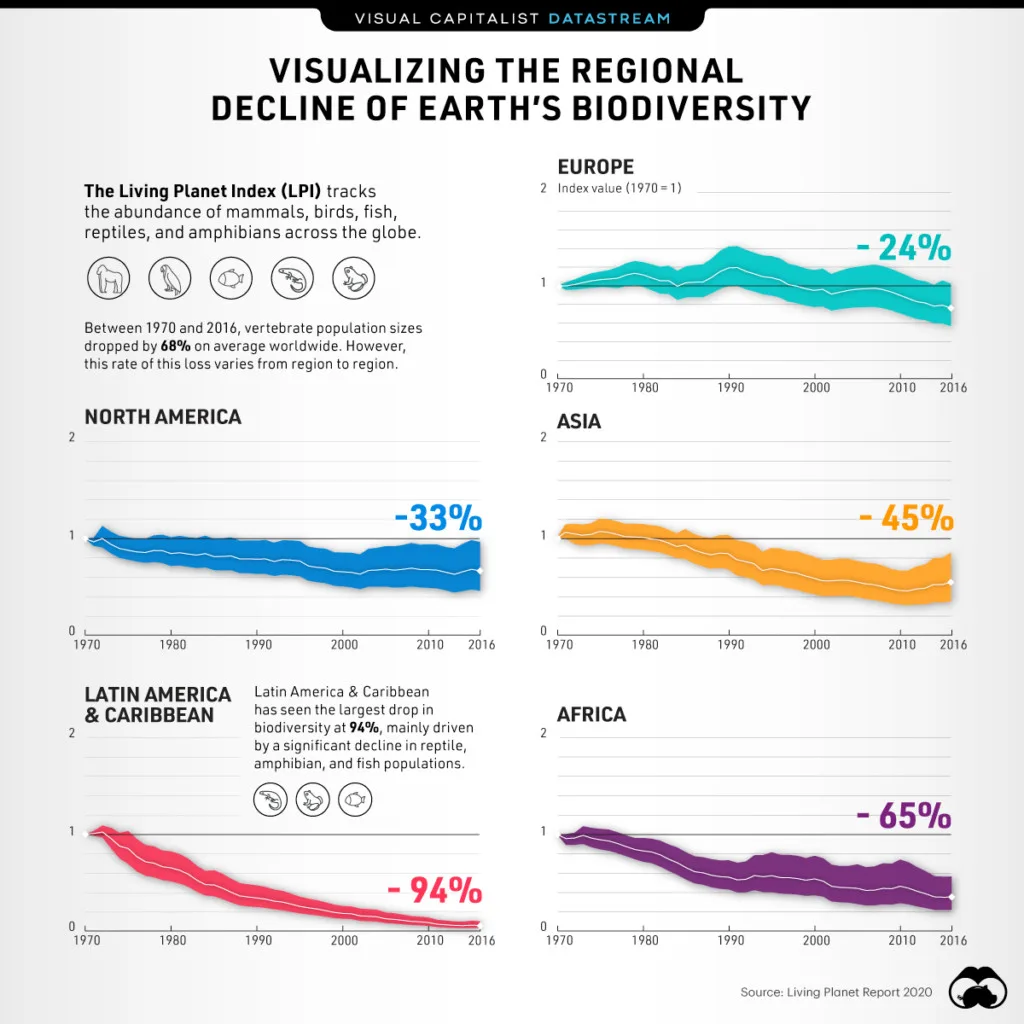

Climate has been the organising principle for responsible investment for much of the past decade. In 2026, nature and biodiversity are poised to become the next major test of investor capability.

The investment case is straightforward: nature is an economic input. Water security, soil health, pollination, flood mitigation and biodiversity underpin the output and productivity of real assets. As ecosystem degradation accelerates, so do the financial risks. Nature-related investment risks are increasingly being assessed in portfolio terms, particularly through the distinction between physical risks such as water scarcity and land degradation as well as transition risks arising from regulatory change and shifting consumer preferences.8

Globally, investors are converging on a disclosure architecture. The Taskforce on Nature-related Financial Disclosures (TNFD)’s recommendations provide a common language for governance, strategy, risk and impact management, and metrics and targets.9 While Australia does not yet require TNFD-style reporting, large investors will increasingly treat nature as a cross-cutting risk lens, especially for sectors with high dependencies and impacts such as resources and agriculture.

The practical implication for Australian asset owners is a shift in expectations of investee companies and managers. In 2026, simply suggesting “we monitor biodiversity” will not be sufficient. Investors will be looking for evidence of location-specific risk assessment, credible mitigation strategies and a clearer articulation of how nature-related risks are incorporated into capital allocation and underwriting. This is particularly so in private markets where disclosure is thinner and asset-level decisions drive outcomes.

Source: WWF and Zoological Society of London / Visual Capitalist

#5. Responsible investment in a more fragmented world

Geopolitics is increasingly shaping the context in which responsible investment decisions are made. Trade restrictions, sanctions, industrial policy and national security considerations are reshaping global supply chains, often in ways that intersect directly with ESG objectives. This fragmentation challenges assumptions about transparency, consistency and comparability across markets.

Geopolitical developments are becoming an important driver of ESG risk, particularly in relation to human rights, climate outcomes and corporate governance. In this environment, responsible investment requires careful judgement and a clearer understanding of how geopolitical forces shape sustainability risks and opportunities across portfolios.10

A more demanding phase for responsible investment

In 2026, responsible investment will look less like a values debate and more like a practical test of execution.

Climate disclosures will be audited, remuneration votes will attract closer scrutiny, and claims around technology, nature and transition will be assessed with greater financial discipline. The question, ultimately, is whether governance, data and capital allocation are robust enough to meet rising investor and regulatory expectations.

Sources:

1. https://www.allens.com.au/insights-news/insights/2024/09/mandatory-climate-related-financial-reporting-legislation/ ↑

2. https://www.asic.gov.au/regulatory-resources/sustainability-reporting/asic-s-administration-of-the-sustainability-reporting-requirements/ ↑

3. https://www.iea.org/reports/energy-and-ai ↑

4. https://www.theverge.com/2024/7/2/24190874/google-ai-climate-change-carbon-emissions-rise ↑

5. https://www.theaustralian.com.au/business/companies/why-australian-shareholders-are-using-their-votes-to-fire-directors-and-reject-pay/news-story/804d07273f066634ce5941a1715cc6f5? ↑

6. https://www.afr.com/markets/equity-markets/the-great-tech-revolt-and-4-other-surprising-stats-from-agm-season-20251127-p5nizg ↑

7. https://www.glasslewis.com/article/a-closer-look-at-the-2024-agm-season-in-australia? ↑

8. https://www.betashares.com.au/insights/the-nature-of-investing/ ↑

9. https://tnfd.global/wp-content/uploads/2023/08/Recommendations_of_the_Taskforce_on_Nature-related_Financial_Disclosures_September_2023.pdf ↑

10. https://finsif.fi/geopolitics-has-entered-the-responsible-investing-discourse-takeaways-from-pri-in-person-2024/ ↑

1 comment on this

An extremely well-written article; clear, concise and comprehensive.