5 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast:

Equities were treading water last week until US President Donald Trump threatened to impose 100% tariffs on China as well as export controls on critical US-made software. The news led to a sharp sell-off in equities, the US dollar and some commodities.

Global week in review: Trump’s turnaround

Up until last Friday, it’s fair to say global markets were meandering last week.

The US government shutdown was not yet hurting sentiment while Open AI’s pledge to buy a lot of AMD computer chips helped further bolster sentiment around the AI theme. Political instability in France saw French bond yields spike while a new leader in Japan saw Japanese stocks and bond yields rise on expectations of more fiscal stimulus. Finally, minutes to the recent Fed meeting confirmed the view it was likely to cut rates further this year.

Market sentiment was also buoyed to a degree by news of a major peace deal in Gaza.

But the major drama for markets happened on Friday following President Trump’s threat to impose 100% tariffs on China, due to the latter’s apparent announcement of new restrictions on rare earth exports the previous day. Markets reacted, with the S&P 500 and NASDAQ 100 down 2.7% and 3.5% respectively on Friday.

Whatever the reality behind China’s apparent new restrictions, it all became moot over the weekend with Trump posting:

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

Trump seems to have chickened out once again.

Global week ahead: CPI, PPI and retail sales (maybe!)

This week was supposed to be one in which we’d receive a smattering of key US economic data on consumer and producer prices along with retail sales. But whether we get it or not depends on whether the US government reopens, and there seems little sign of that anytime soon.

Either way, market expectations had pencilled in a 0.3% gain in core consumer prices for September – which would have been the third rise in a row – keeping annual core inflation steady at 3.1%. Producer prices (PPI) were expected to bounce back 0.3% after a surprise 0.1% drop in August. While not great, these numbers would likely not be bad enough to stop the Fed cutting rates further this year given its newfound concern over the labour market.

How’s the labour market going? It’s hard to be sure as the shutdown is also preventing release of the latest payrolls report and will likely disrupt critical survey work for all future reports until it ends. It’s just as well the Fed now has a firm easing bias and private sector AI activity is booming as otherwise Washington might be having a larger negative effect on markets.

Indeed, another distraction from the Washington circus in coming weeks will be the Q3 US earnings reporting season. It kicks off, as usual, with key bank reports this week. According to FactSet, earnings are expected to be up 8% on last year’s levels, underpinned by solid growth in the technology, utilities, materials and financial sectors. There’s been a modestly higher-than-normal level of positive earnings guidance.

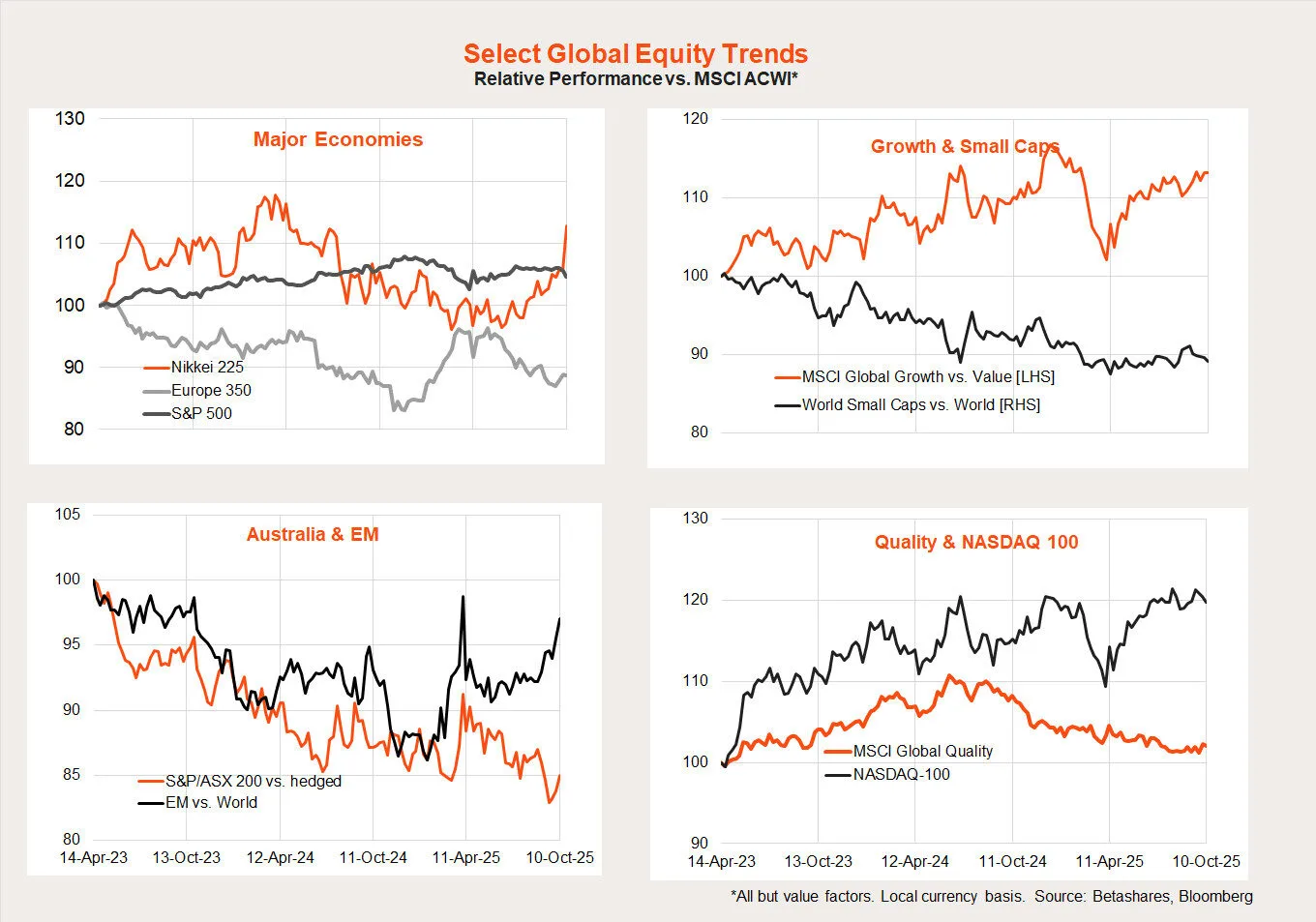

Global equity trends

As evident in the charts below, there’s been some notable new trends emerging in global equity markets over recent weeks, although whether it lasts remains to be seen.

The relative performance of long popular themes – US/NASDAQ-100/growth – has rolled over somewhat and been replaced with strength in emerging markets and Japan in particular. Australia and Europe are still underperforming, however, while quality and small caps are at least no longer underperforming.

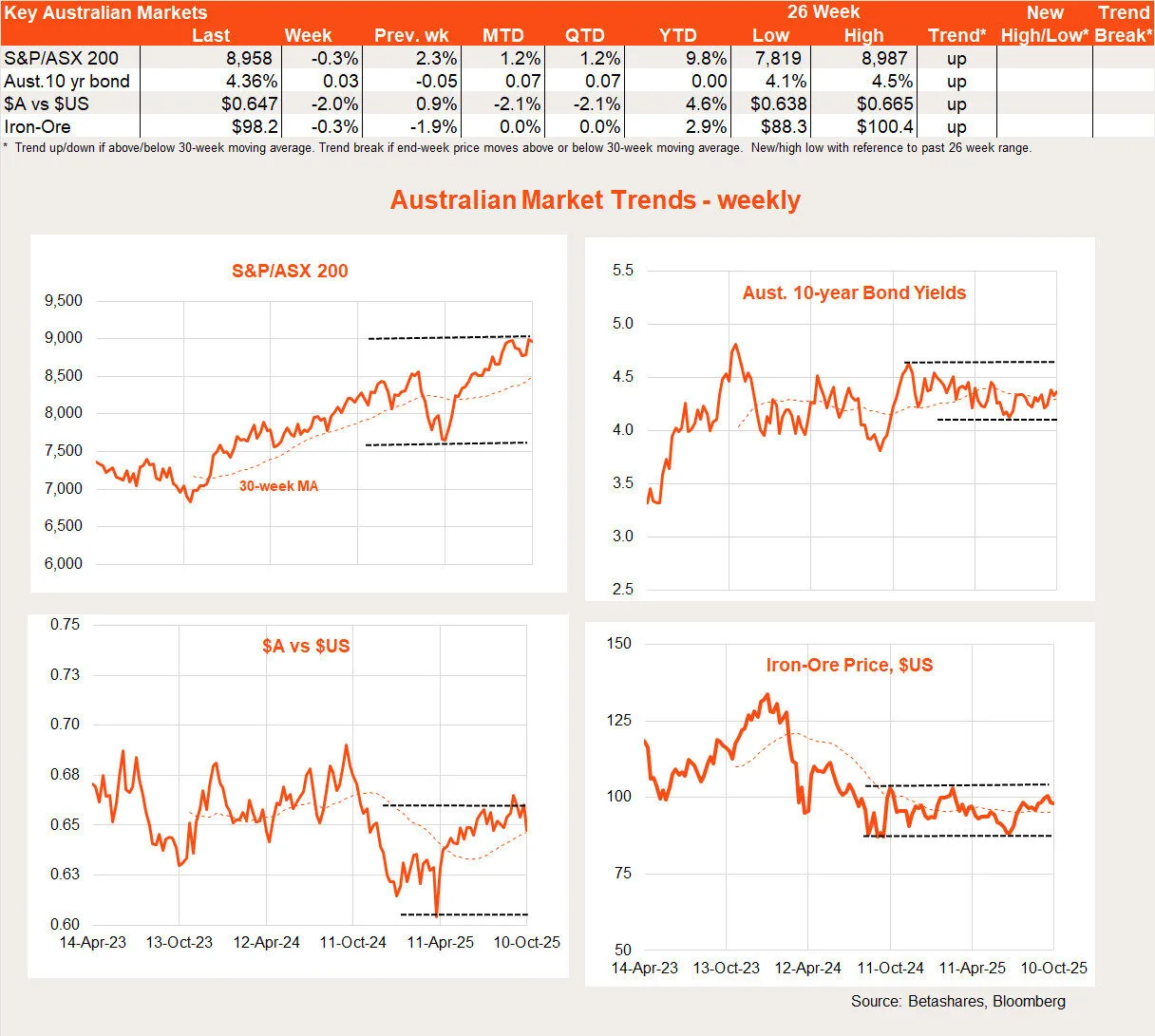

Australian week in review: Sentiment slump

Australian markets were to have reacted to Friday’s US slump this morning, although Trump’s soothing words on the weekend are likely to limit the damage.

The only economic event of note last week was a 3.5% drop in consumer confidence, likely reflecting disappointment over the RBA’s failure to cut rates at the last meeting. The drop highlights the continued sensitivity of consumers to the interest rate outlook.

Australian week ahead: Employment rebound?

The main highlight this week will Thursday’s labour market report, with a 20k rebound in employment expected in September after the surprise 5k drop in August. The unemployment rate is expected to edge up to 4.3% from 4.2%. I’d consider such a result to be ‘neutral’ and still make November’s interest rate decision critically dependent on the upcoming Q3 CPI report.

Of course, another surprisingly weak employment report would boost chances of a November rate cut and make the decision somewhat less dependent on the upcoming CPI report – we’ll see!

The NAB business survey for September will also be released tomorrow.

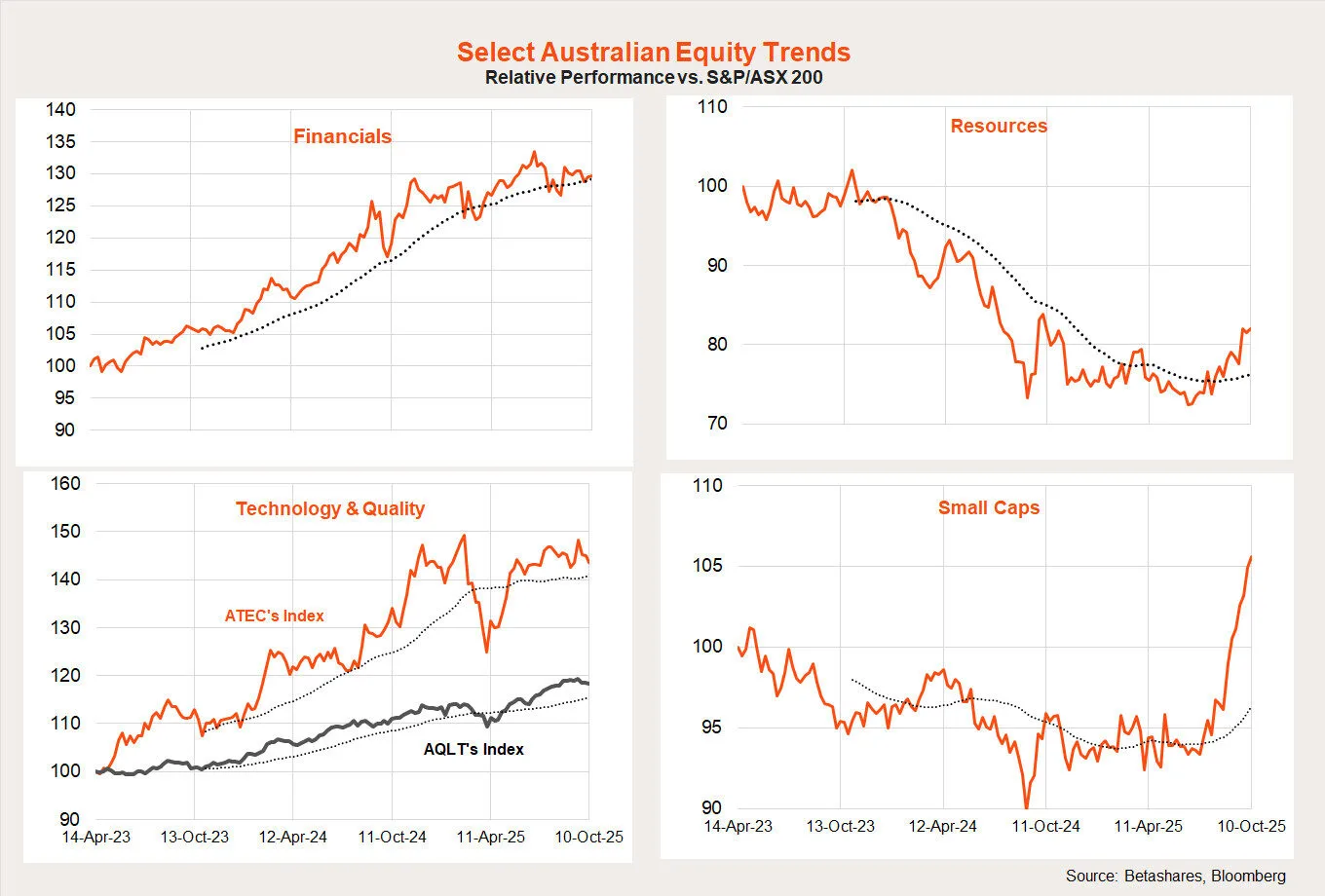

Australian equity trends

As has been the case globally, there’s also notable shifts taking place in the Australian equity market. As evident in the chart below, there’s a rotation from financials to resources taking place among large caps, and a notable rotation from large caps in general into small caps.