7 minutes reading time

Investors would be familiar with the Magnificent 7 megacap tech stocks, for good reason.

Since the launch of ChatGPT in November 2022, the Magnificent 7 companies have accounted for more than half the S&P 500 Index’s 70%-plus rise, as AI has become the dominant theme for markets. From its potential to enable long-term productivity gains to becoming a geopolitical bargaining chip among the world’s economic powerhouses, the market’s fervour for AI looks here to stay.

However, the investment opportunity set is now broader than the Mag 7, with many other firms likely to thrive as AI technologies proliferate and data centre capacity grows.

These include AI-enabled platforms like Palantir, which has seen its share price more than double this year as its Foundry and Gotham software systems have become embedded in US military operations, and businesses across other industries, such as Walmart and Airbus. Another example is Broadcom, a semiconductor and software company benefiting from the increasing demand for custom-built ASICs (application specific integrated circuits) – chips specifically tailored to process singular tasks like AI inferencing1.

That said, the original seven are not going away.

Collectively, they account for almost 35% of the S&P 500 and remain critical to the build-out of the AI infrastructure layer – which includes the physical data centres that house components from accelerator chips, memory chips and networking devices, to power, cooling and security systems.

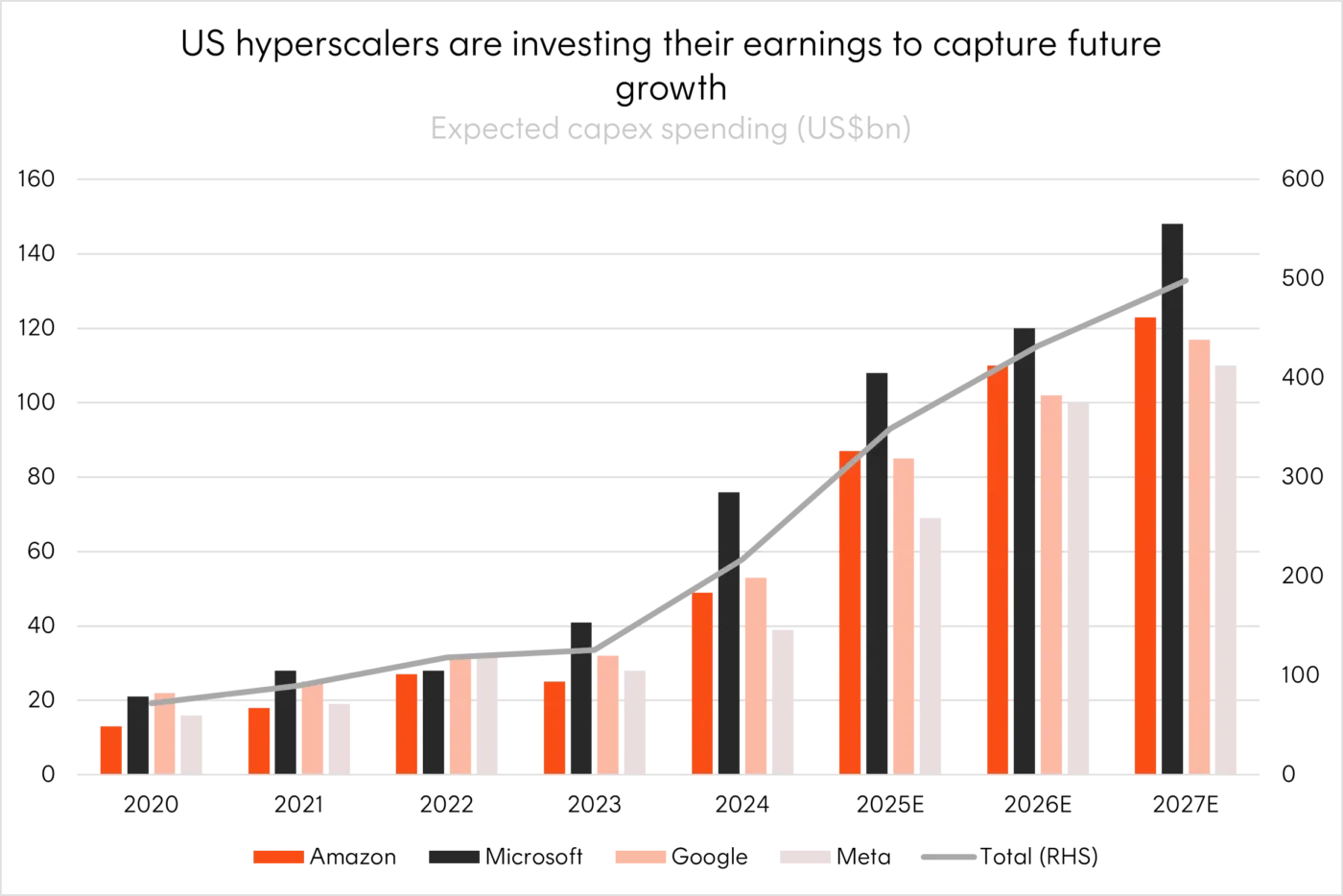

This year alone, these companies are expected to spend over US$340 billion in capital expenditures, a scale that’s already influencing US GDP growth and supporting the broader semiconductor supply chain.

Source: Company data, Goldman Sachs Global Investment Research. As at 1 August 2025. Historical and projected capital investments for US cloud and hyperscale providers (post 2Q25).

However, there have been increasing concerns around the sustainability of this spending with AI infrastructure capex predicted to reach US$3-4 trillion by 2030 according to Nvidia CEO Jensen Huang. Whether these companies can earn an excess return on their cost of capital from AI remains a key question for investors moving forward, particularly as debt markets have been tapped to fund this build out.

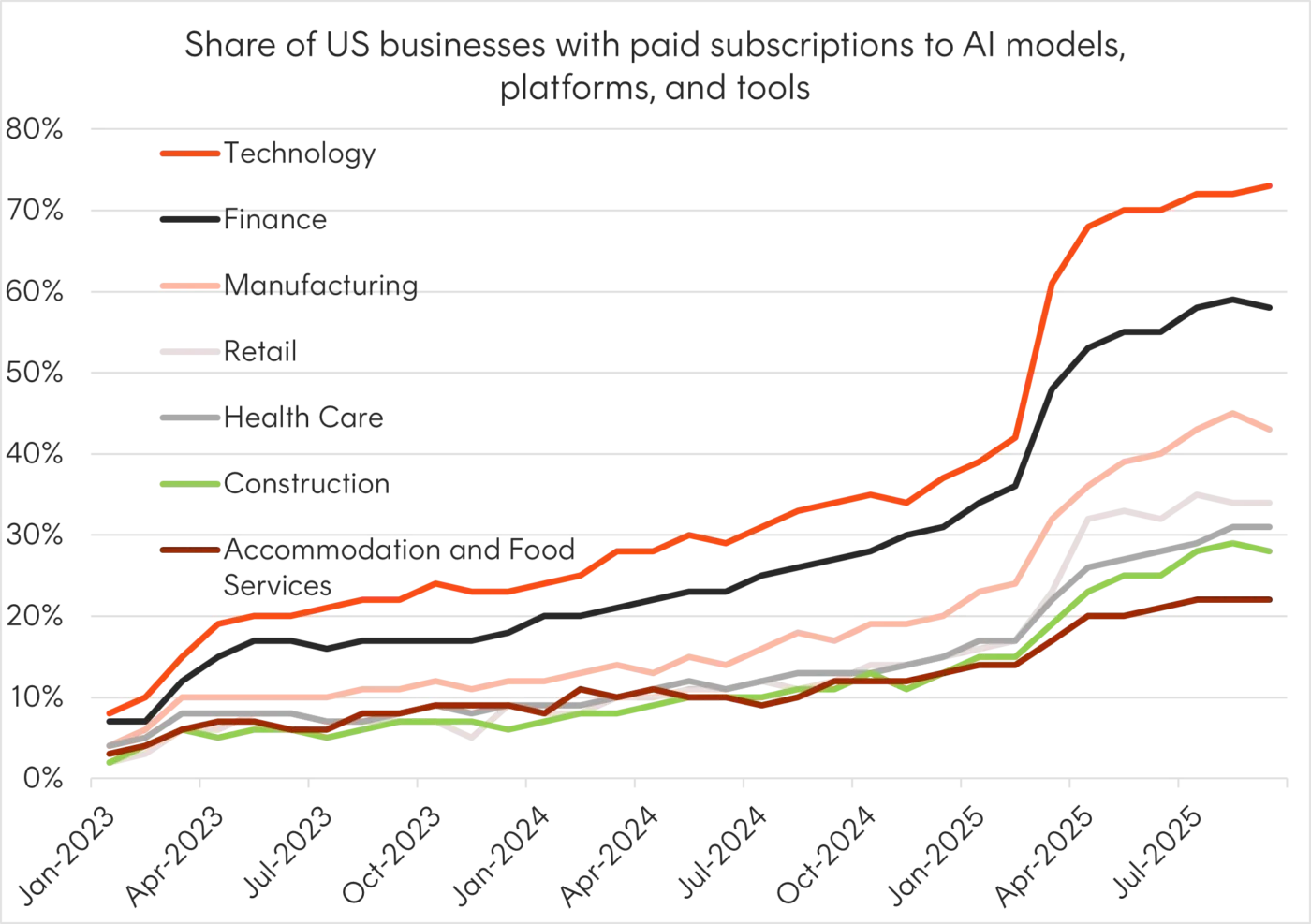

To that end, we are seeing the benefits of AI percolate across the semiconductor supply chain but also through to adjacent sectors such as cybersecurity and robotics – a trend likely to continue as adoption rates grow across businesses in other industries.

Source: Ramp AI Index, business spend data from Ramp. Data as at September 2025.

All roads lead to Asia

The immense amount of data centre spending from the likes of Amazon, Microsoft, Google and Meta is providing significant tailwinds for companies across the semiconductor supply chain, particularly in Asia.

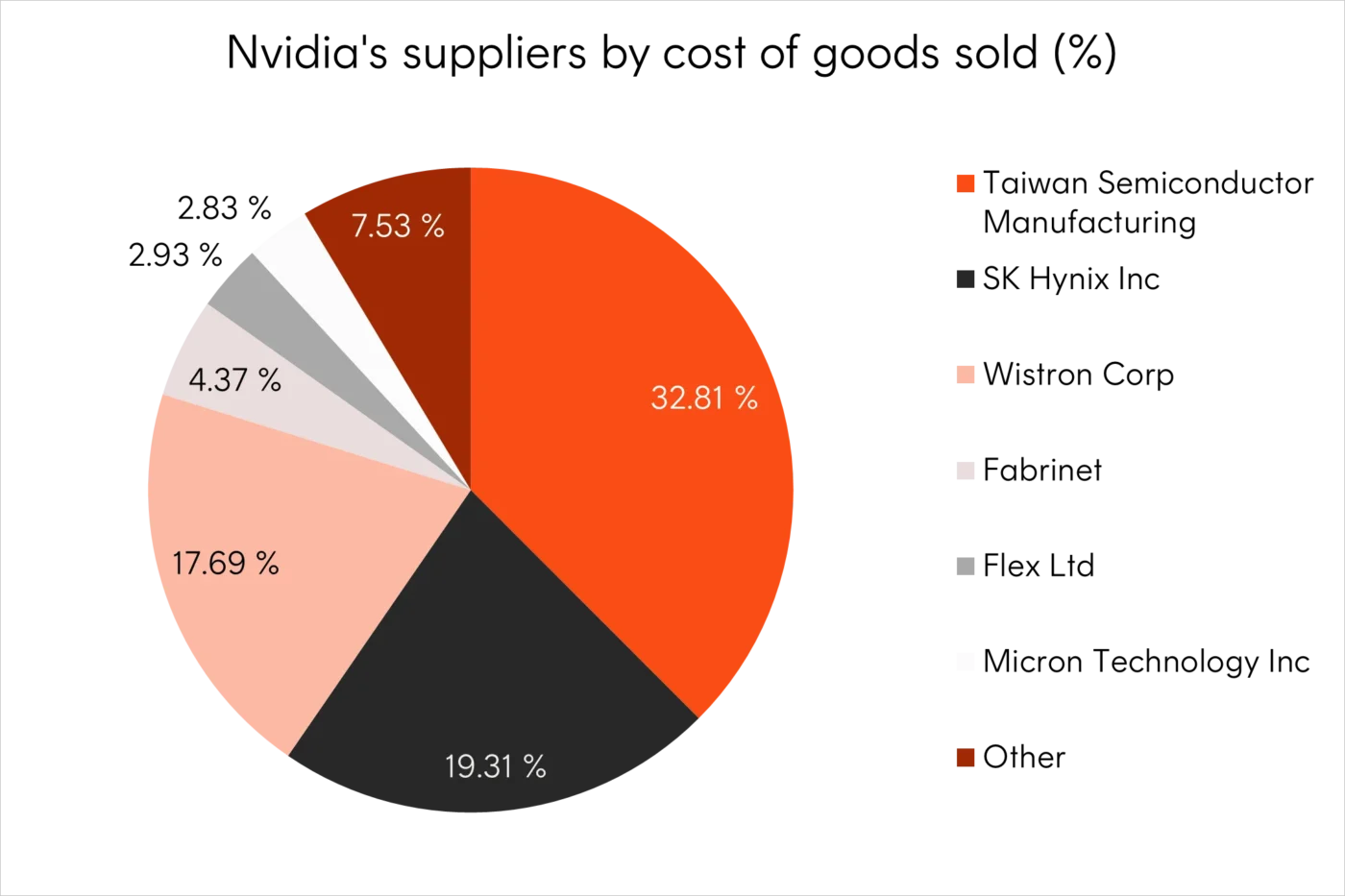

A large part of this spend involves purchasing leading edge accelerator chips designed by the likes of Nvidia and AMD but manufactured by a company called Taiwan Semiconductor Manufacturing (TSMC). This model of outsourcing chip manufacturing to a specialised ‘foundry’ has allowed TSMC to become one of the world’s most valuable semiconductor companies.

The company recently reported a 30% increase2 in third-quarter sales and generates more than half its net revenue (51%) from high-performance computing (HPC), an area that has become increasingly profitable for TSMC’s bottom line.

Beyond manufacturing, memory is another critical component found within an accelerator chip that helps AI applications process huge amounts of data in a seamless way.

Leaders in this space are SK Hynix and Samsung, based in South Korea, which together account for nearly 80%3 of the high-bandwidth memory (HBM) market. Both companies recently signed letters of intent to supply memory chips for OpenAI’s data centres as part of the Stargate Project, announced by President Trump in January.

The key takeaway is that there are businesses across the supply chain, particularly in Asia, that are benefiting from the billions of dollars being spent on critical AI infrastructure build-out.

As the chart below illustrates, more than half of Nvidia’s cost of goods sold goes to two major suppliers alone: TSMC and SK Hynix. These Asian technology companies represent the broader AI supply chain and also allow investors to geographically diversify away from US equity-heavy portfolios.

Source: Bloomberg. As at 9 July 2025.

Harnessing AI in cybersecurity and robotics

Beyond Asian technology companies, AI is reshaping the cybersecurity industry, particularly as geopolitical tensions continue to simmer and national self-sufficiency needs rise.

While AI has the potential to unlock major productivity benefits, it is also being exploited by adversaries that often target critical network systems and infrastructure.

Against this backdrop, governments, businesses and individuals are all becoming more proactive in protecting their data. Global cybersecurity spending is expected to see sustained growth of double-digit rates, reaching US$377 billion by 2028, according to the International Data Corporation.

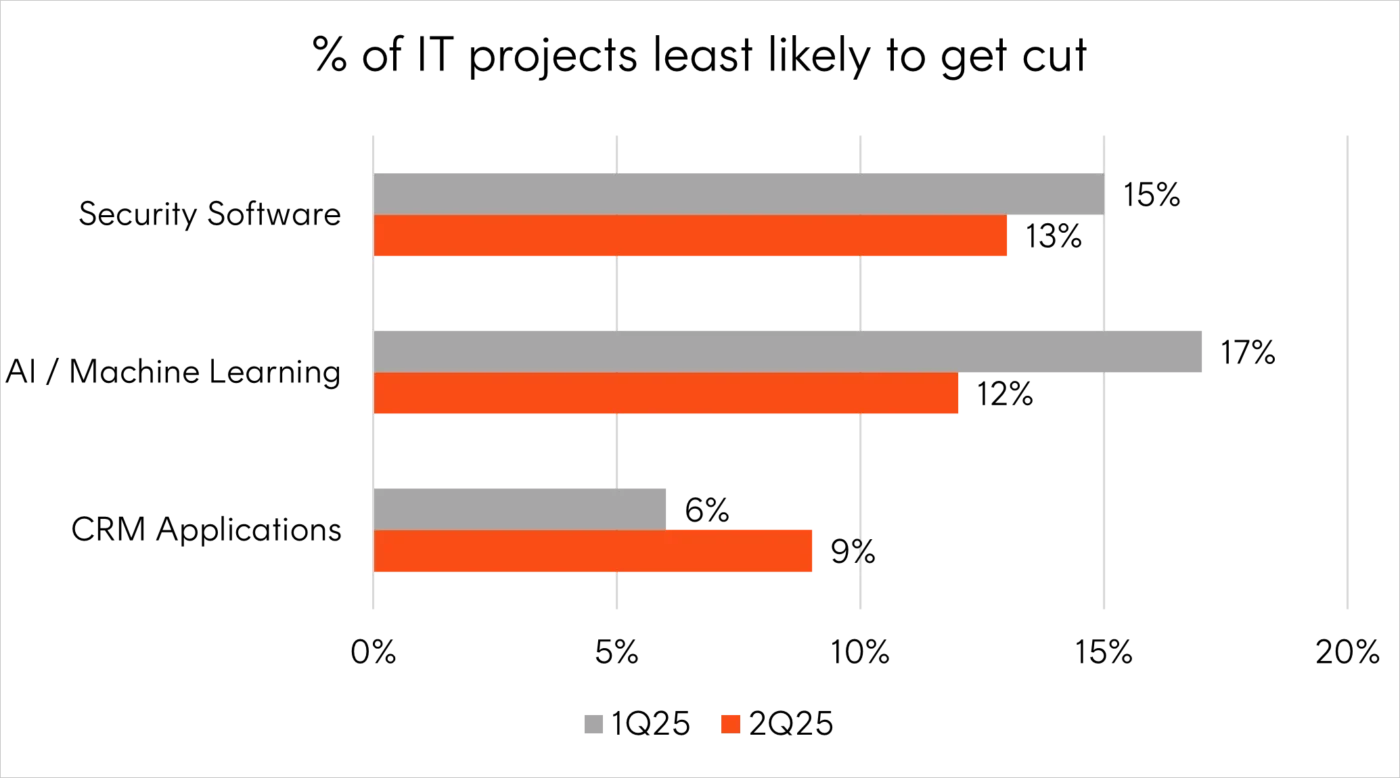

This amount is not only large but also highly defensible in nature, with Chief Information Officers surveyed by Morgan Stanley viewing security as the category least likely to get cut in an economic downturn.

Source: Morgan Stanley 2Q25 CIO Survey. Percentage of total responses.

This spending backdrop has driven new product offerings from leading cybersecurity firms, including Palo Alto Networks and CrowdStrike, which are developing AI agents that work alongside humans to automate complex security tasks like malware analysis and cyberattack interception.

Robotics is another adjacent industry that AI is reshaping. For some time, the development of robots struggled to kick off due to high manufacturing costs, a lack of demand and nascent software development tailored for robotics. However, as AI technologies have advanced rapidly and supply chains become vertically integrated, robotics has become a key theme in 2025 and Nvidia’s next biggest market for potential growth beyond AI.

While still in its infancy, Betashares sees robotics becoming a bigger and more recognised investment exposure over time as developed market economies seek automation as a critical solution to counter structural macro issues including labour shortages and falling population growth rates.

The next wave of AI investing

Investing in AI has become much broader than the Magnificent 7 companies. While they continue to lead the market in scale and innovation, there is a growing cohort of companies and sectors, including cybersecurity and robotics, that are already benefiting from the diffusion and advancement of AI technologies.

Of course, there are risks. AI has driven equity markets to record high valuations, and concerns around the sustainability of data centre spending remain front of mind for investors.

However, it’s hard to deny that AI is presenting a once-in-a-generation investment opportunity spearheaded by some of the most innovative and cash flow-generative companies in the world.

Sources:

1. AI inference refers to the process where a pre-trained artificial intelligence model uses its learned knowledge to make predictions on new, unseen data. This effectively places the AI into action to perform a real-world task. ↑

2. https://www.bloomberg.com/news/articles/2025-10-09/tsmc-reports-better-than-expected-sales-on-sustained-ai-demand ↑

3. https://biz.chosun.com/en/en-it/2025/09/24/ZVRYFUIP75CSZBJHQ5DE7D2HWY/ ↑