5 minutes reading time

Bitcoin and the broader crypto market managed to rally from the week’s lows to end the week slightly higher. Helping boost prices was cooler than expected US inflation, which eased rate concerns.

Bitcoin and Ethereum were up 1.6% and 0.4% respectively over the seven days to 15 February 2026. Bitcoin’s market capitalisation is now US$1.4 trillion while the global crypto market cap is US$2.42 trillion. Bitcoin’s market dominance is at 58.4%, as at 15 February 2026.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$70,372 |

$71,878 |

$65,367 |

1.62% |

|

ETH (in US$) |

$2,085 |

$2,134 |

$1,898 |

0.40% |

Source: CoinMarketCap. As at 15 February 2026. Past performance is not indicative of future performance. Performance is shown in US dollars and does not consider any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

BlackRock moves into DeFi

BlackRock’s tokenised Treasury fund (BUIDL) is now tradable directly on Uniswap, the largest onchain marketplace. The move gives eligible institutions access to onchain liquidity rather than traditional rails via Securitize, a leading tokenisation platform. The fund already holds over US$2 billion in tokenised US Treasuries, so this seems to be more than a pilot or marketing exercise. It is regulated and access-restricted, meaning it is not open to retail DeFi users. Nonetheless, it is still an important structural innovation in the crypto ecosystem.

The move also means one of the world’s largest asset managers is now using decentralised infrastructure for real settlement. Regardless of short-term price moves, the integration between traditional finance and crypto continues to deepen1.

LSEG Brings Tokenised Private Funds into Core Market Infrastructure

London Stock Exchange Group (LSEG) has launched its Digital Markets Infrastructure platform and executed its first private fund transaction. Built with Microsoft on Azure, the system digitises issuance, distribution and post-trade workflows within regulated market infrastructure rather than outside it2.

Private markets remain fragmented and operationally inefficient, so this positions tokenisation as a core upgrade to financial plumbing. If adoption scales, it signals blockchain-based workflows are being embedded inside mainstream capital markets infrastructure.

CRYP company spotlight

Morgan Stanley on bitcoin miner

Morgan Stanley’s has initiated formal coverage on TeraWulf (NASDAQ: WULF), saying the company represents a strategic play beyond pure Bitcoin mining. This view also reframes TeraWulf not just as a miner but a potential provider of broader computing infrastructure with less direct dependence on Bitcoin price swings.3

Terawulf is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.5

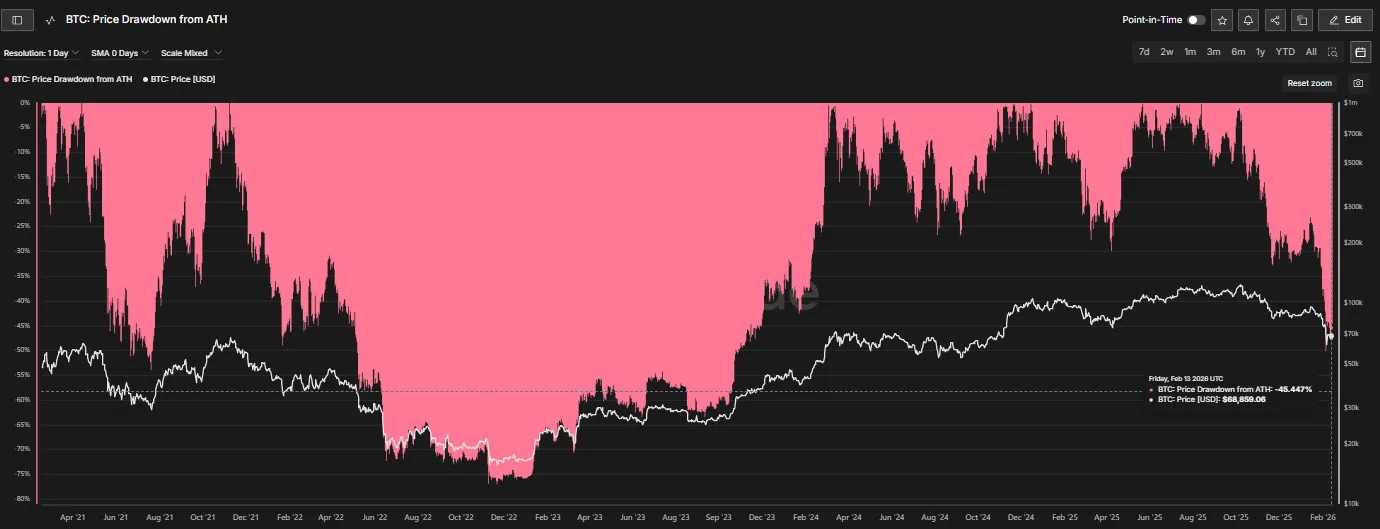

Bitcoin (BTC): Price Drawdown from ATH

This metric is the percentage drawdown of Bitcoin’s price from the previous all-time high.

According to data from Glassnode, as of 14 February 2026, Bitcoin is down 44% from its last all time high. This may seem intense but relatively speaking, it is a much smaller decline than seen in previous cycles.

Source: Glassnode. Past performance is not indicative of future performance.

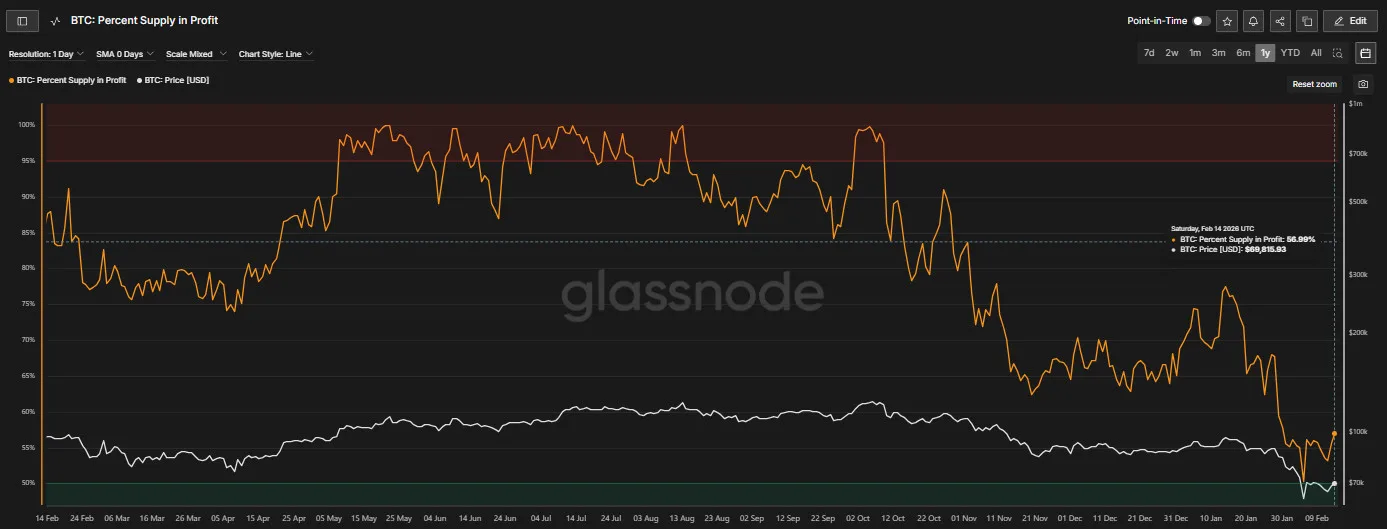

Bitcoin (BTC): Percent Supply in Profit

This metric represents the percentage of circulating supply in profit, i.e. the percentage of existing coins whose price at the time they last moved was lower than the current price.

According to data from Glassnode, as of 14 February 2026, the percentage of circulating supply in profit has fallen to 56% at current prices.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Most top 20 altcoins ended up higher over the last seven days to 15 February 2026. There was notable news from Ripple – it has secured its first European asset manager partnership to build tokenised investment products on the XRP Ledger, marking a concrete step into regulated institutional finance6.

According to Coinmarketcap, XRP is the third largest altcoin and has returned 11% and -43% over the last seven days and 1-year respectively (as at 15 February 2026).

Investing in crypto-assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

4. As at 13 February 2026. No assurance is given that this company will remain in the portfolio or will be a profitable investment.5. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.6. https://news.bitcoin.com/ripple-secures-first-europe-asset-manager-deal-xrpl-eyes-institutional-scale/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.