5 minutes reading time

2025 is shaping up to be another solid year for investors despite earlier concerns around the impact of tariffs on global growth and inflation. Continued investments into AI infrastructure and strong US corporate earnings underpin much of the rise in equity markets this year.

While 2026 may see these developments continue, there are of course risks to consider. The potential of an AI investment bust, a resurgence of inflation, fiscal stress in major economies, and heightened geopolitical tensions all present vulnerabilities for markets next year.

Amid this backdrop, investors should be reminded on the importance of diversification in mitigating the impact of negative shocks to one’s portfolio.

In this article, we take a look at how the charts submitted by members of the Betashares Investment Strategy & Research team, played out in 2025.

The impact of tariffs were more bark than bite

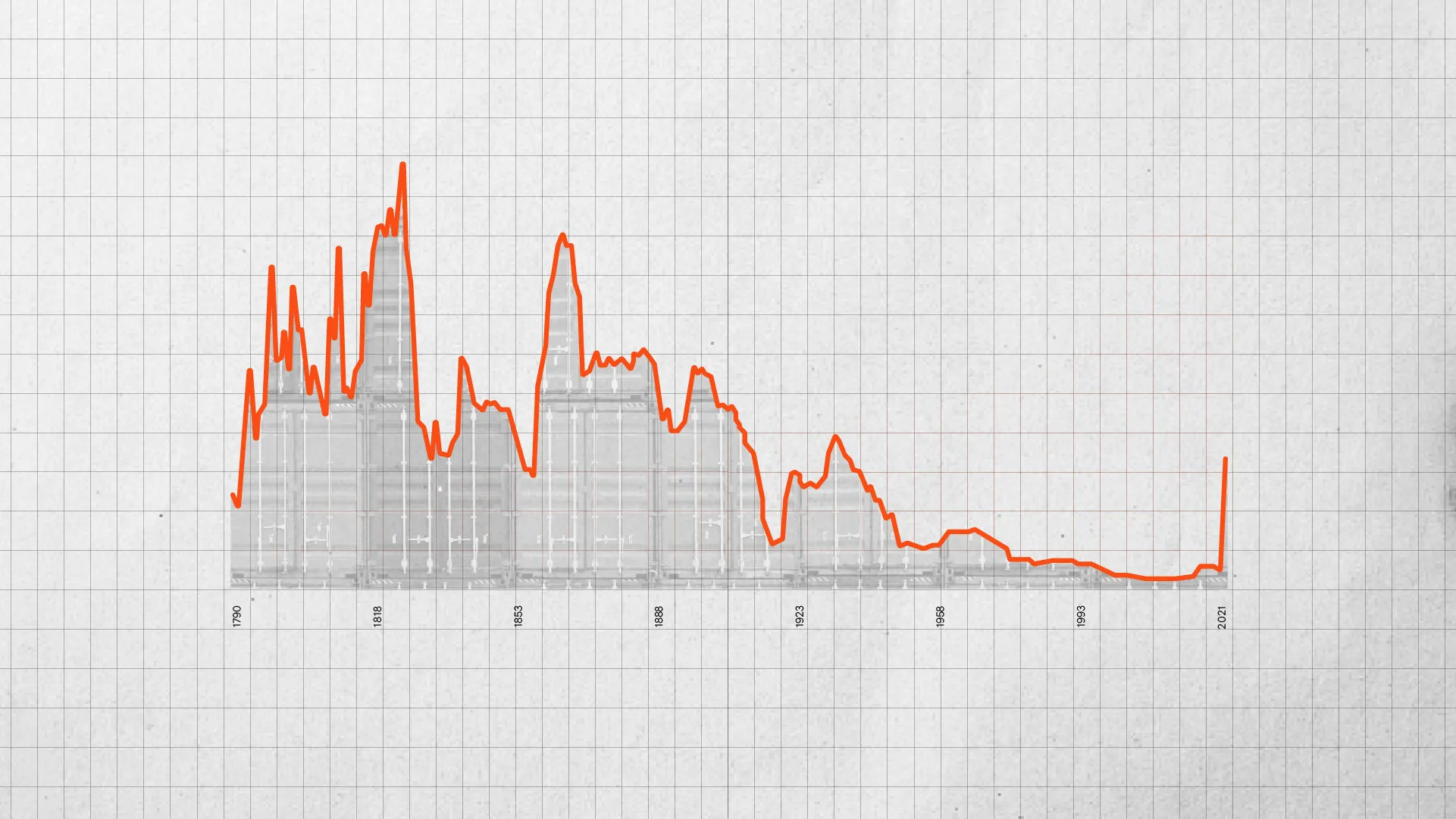

Nominated by: David Bassanese, Chief Economist

Source: Historical Statistics of the United States Ea424-434, Monthly Treasury Statement, Bureau of Economic Analysis, The Budget Lab analysis. As at 17 November 2025.

Why this was important: Heading into 2025, the main concern for markets was whether tariffs would drag global economic growth lower and reaccelerate inflationary pressures through higher consumer prices. However, markets proved resilient in the face of these threats with companies absorbing much of these costs, and broader disinflationary forces (cooling services and housing inflation) placing a lid on any upshoot in inflation.

Term premiums remained elevated in 2025

Nominated by: Chamath De Silva, Head of Fixed Income

Source: Bloomberg, Betashares. As at 11 December 2025. Shaded region illustrates the 2025 period.

Why this was important: The US Treasury 10-year term premium remained elevated in 2025 after moving back into positive territory in October 2024. This may suggest investors are continuing to demand more compensation given the uncertainty of greater fiscal deficits and reflationary concerns under a second Trump administration.

Both earnings and dividend yields continue to fall

Nominated by: Cameron Gleeson, Senior Investment Strategist

Source: Bloomberg, Betashares. As at 30 November 2025. Past performance is not indicative of future performance. Shaded region illustrates the 2025 period.

Why this was important: Many Australian investors seek income through dividends paid out by companies listed on the ASX 200. However, with earnings and dividend yields continuing to fall throughout 2025, investors are seeking a smarter income solution from the Australian share market.

The Betashares S&P Australian Shares High Yield ETF (ASX: HYLD) provides investors exposure to a share portfolio of 50 high-yielding Australian companies and seeks to improve on traditional high-dividend strategies by screening out potential ‘dividend traps’ and companies that exhibit high levels of relative volatility.

Will performance broaden out across US equities next year?

Nominated by: Hugh Lam, Investment Strategist

Source: LSEG. As at November 21, 2025. The Magnificent 7 includes Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Why this was important: The group of Magnificent 7 stocks continued to drive a large portion of the S&P 500 returns higher this year. While these companies remain important to the AI infrastructure build out, it may be time for the rest of the S&P 500 index to shine in 2026.

An expected broadening out of earnings and a positive fiscal impulse from Trump’s OBBBA (One Big Beautiful Bill Act) will likely support value and pro-cyclical sectors such as Industrials, Materials, Energy and Financials, favouring an equal weighted exposure such as the Betashares S&P 500 Equal Weight ETF (ASX: QUS).

Where to from here for China’s economy?

Nominated by: Tom Wickenden, Investment Strategist

Source: National Bureau of Statistics China. Quarterly data from Q1 2016 to Q3 2025. Shaded region illustrates the 2025 period.

Why this was important: China’s economy has remained resilient this year driven by strong exports, proactive fiscal policy and accommodative credit conditions. While household consumption has recovered partially this year, ongoing weakness in the property sector and consumer sentiment remain structural challenges heading into 2026.

However, the bright spot for China this year has been its local technology sector with companies such as Alibaba, Tencent and Baidu developing and integrating their own AI models which has in turn driven new areas of profit growth. With the Chinese government embracing science and technology as a strategic national priority, and valuations much lower than their US megacap tech counterparts, there may be significant investment opportunities within the Asian tech complex.