4 minutes reading time

US markets continue to make new all-time highs as we enter the midst of earnings season. A trade deal with Japan, continued optimism around the adoption of AI and a generally resilient economy have sent stock markets higher in July.

In this edition of Charts of the Month, we look at five interesting charts that caught our eye this month across trade, inflation and artificial intelligence.

1 – Are tariff impacts showing up in inflation data?

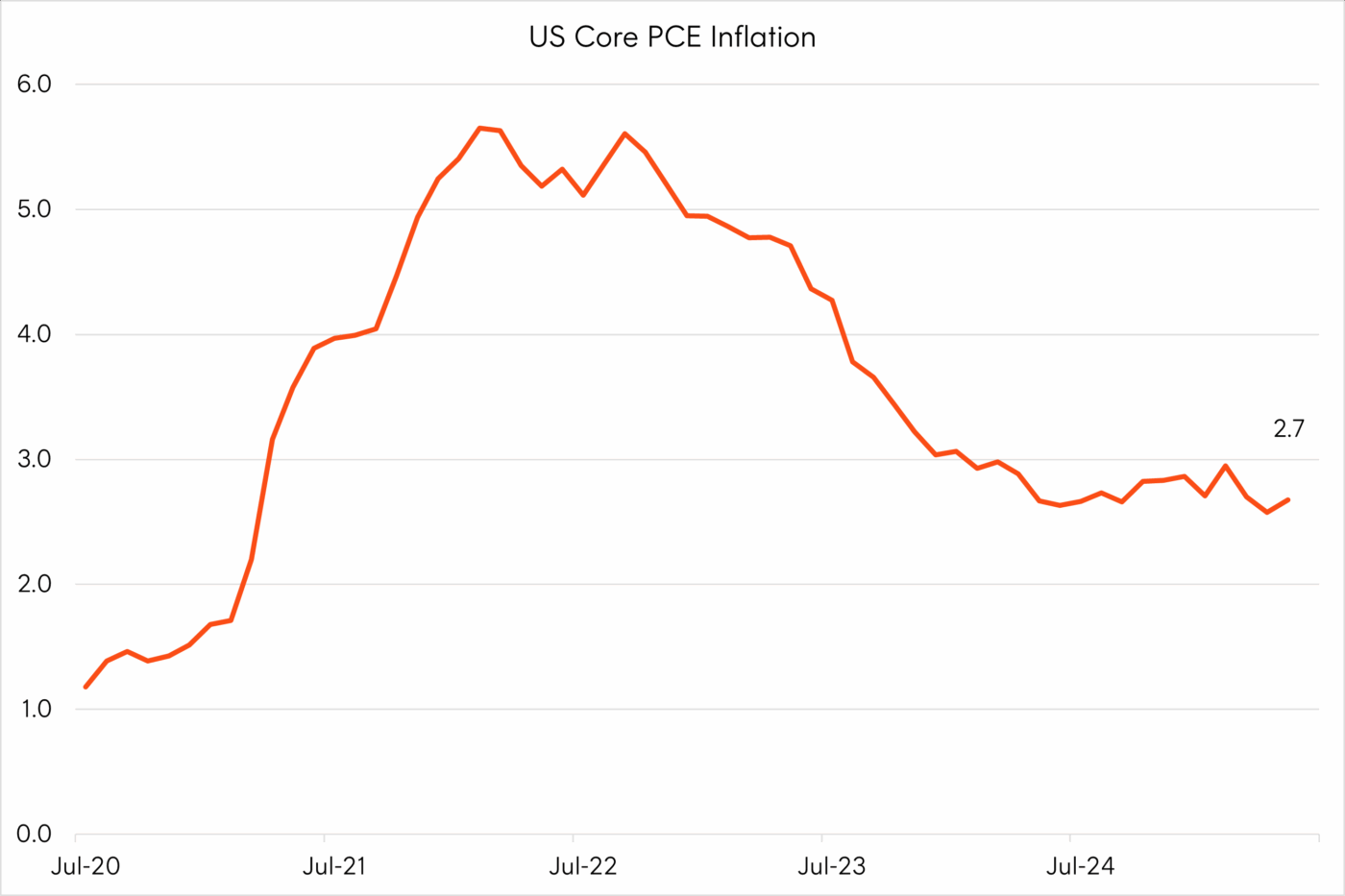

The inflationary impacts of tariffs have been a key concern on investors’ minds throughout 2025. The biggest unresolved question has been whether these impacts will show up in inflation data.

The Federal Reserve’s preferred measure of inflation the core PCE (Personal Consumption Expenditures) has trended lower since the highs of 2022, however, is still running at a 2.7% annual rate. Whilst tariffs take some time to work their way through the economy and may show up in future data points, forward inflation pricing indicates any inflationary impact may be temporary.

Chart 1: Personal Consumption Expenditures Price Index, Excluding Food and Energy (percent change from one year ago)

Source: LSEG Datastream, Betashares. As at 27 June 2025.

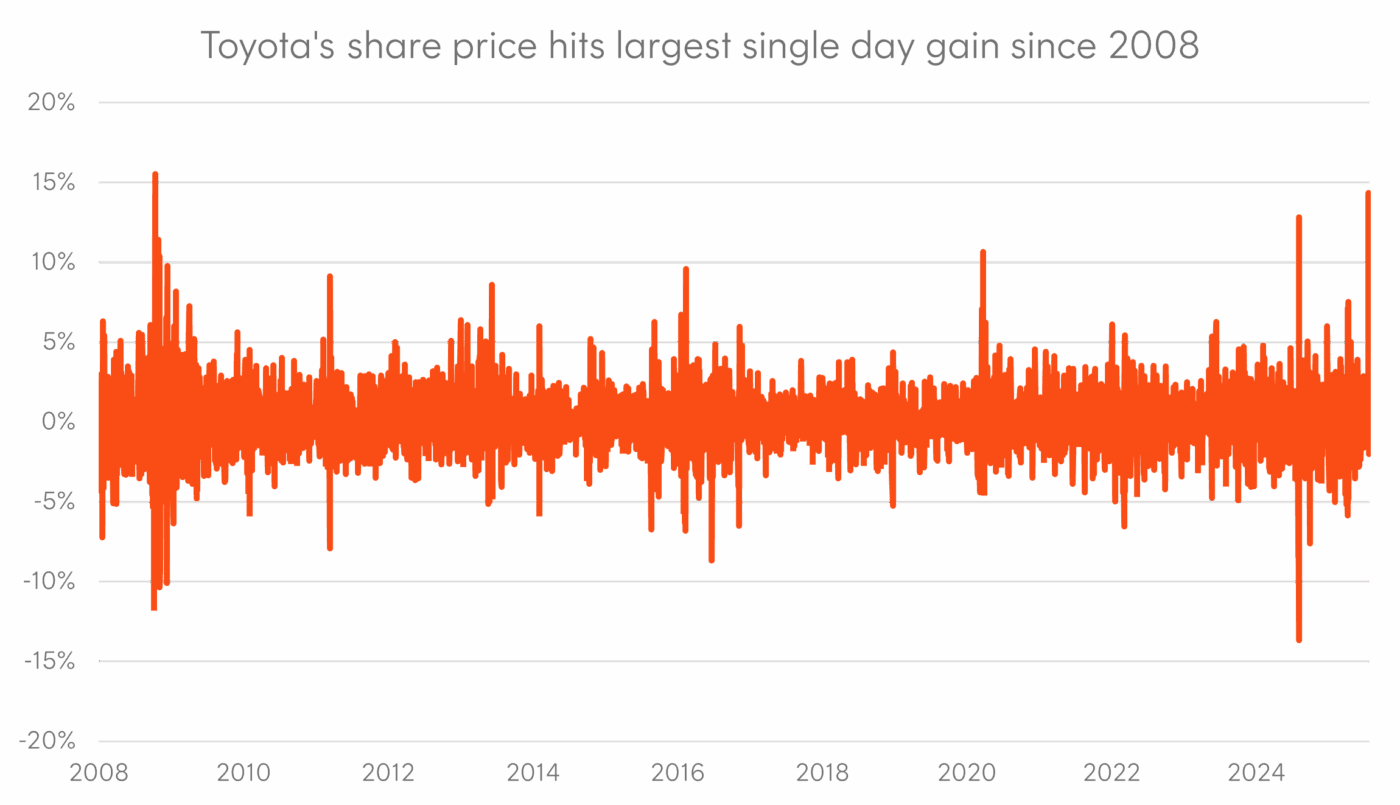

2 – Japanese autos rev up

The share prices of Toyota, Honda and Nissan surged on the announcement that the Trump administration and Japanese government struck a trade deal last week. While the deal includes a 15% tariff on these automakers, this is significantly less than the previous rate of 27.5%.

One of those automakers, Toyota, saw its share price jump 14% on the news – its largest daily gain since 2008.

Chart 2: Daily returns of Toyota’s share price since 2008

Source: Bloomberg. As at 25 July 2025.

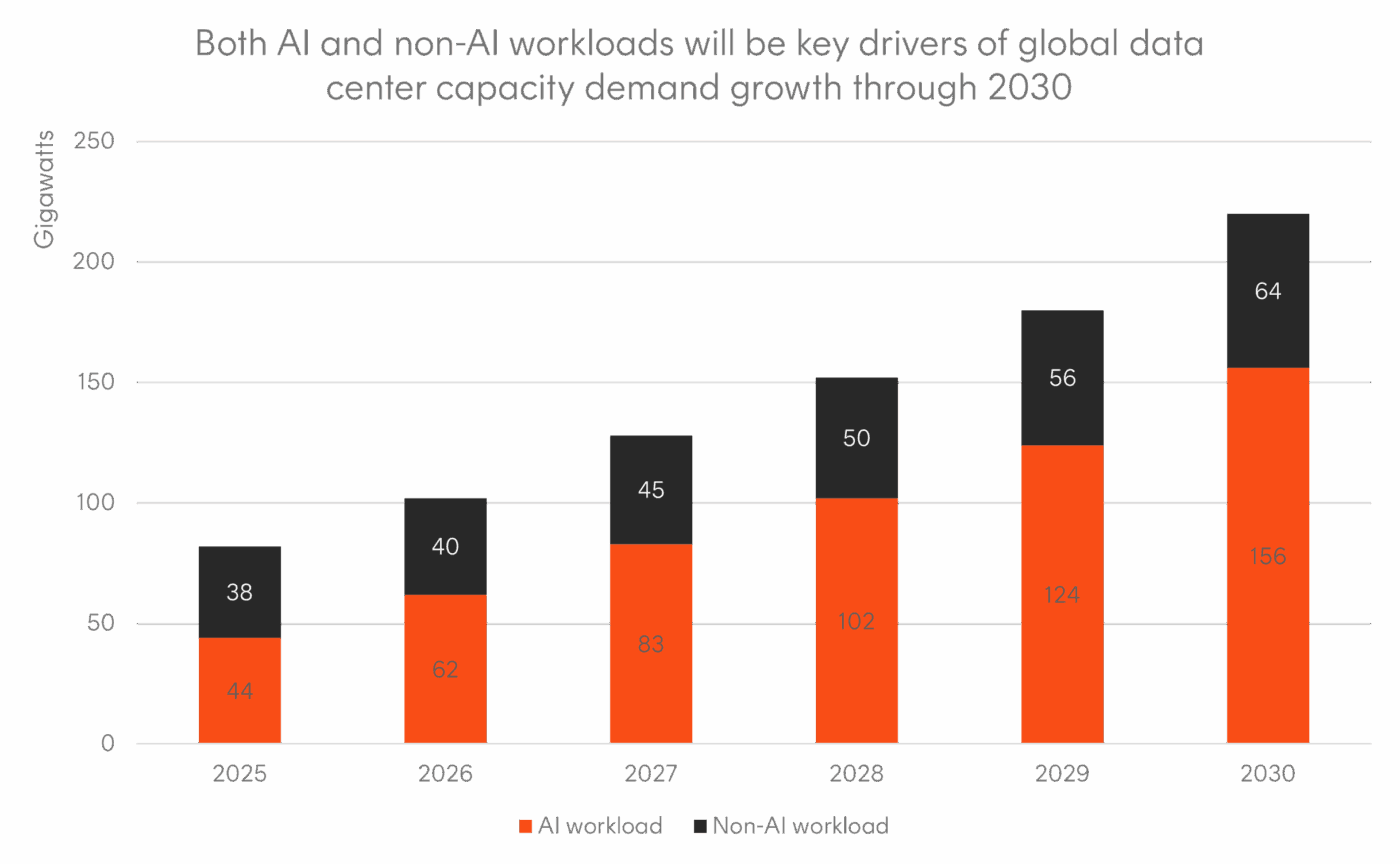

3 – Entering the era of AI infrastructure

AI is fuelling immense demand for computing power and energy, with companies spending billions of dollars to build out multi-gigawatt data centres.

With AI workloads demanding an ever-increasing amount of energy, McKinsey expects global data centre capacity demand to reach approximately 156 gigawatts by 2030. For reference, 1 gigawatt can power approximately 750,000 homes.

Chart 3: Forecast data centre capacity demand in gigawatts over next 5 years

Source: McKinsey Data Centre Demand Model; Gartner reports; IDC reports; Nvidia capital markets reports. Actual results may differ materially from forecasts.

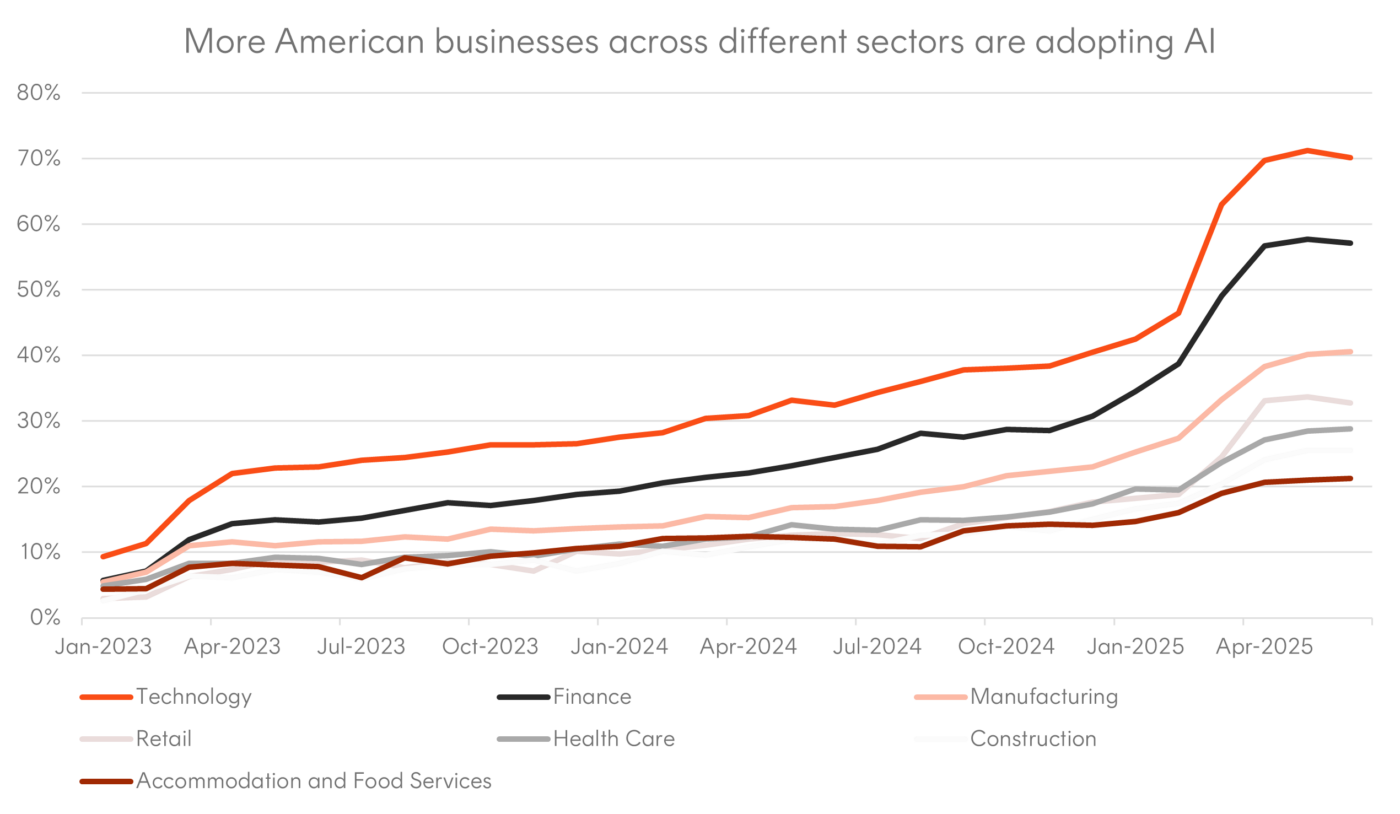

4 – AI adoption has taken off in 2025

Data from Ramp, a leading provider of credit card infrastructure, recently updated their own Ramp AI Index tracking adoption rates across US businesses. Their data shows a meaningful inflection in AI usage across a range of sectors since advancements in ChatGPT and Gemini’s capabilities were made.

Chart 4: Share of US businesses with paid subscriptions to AI models, platforms, and tools by sector

Source: Card spend data from Ramp; U.S. Census Business Trends and Outlook Survey

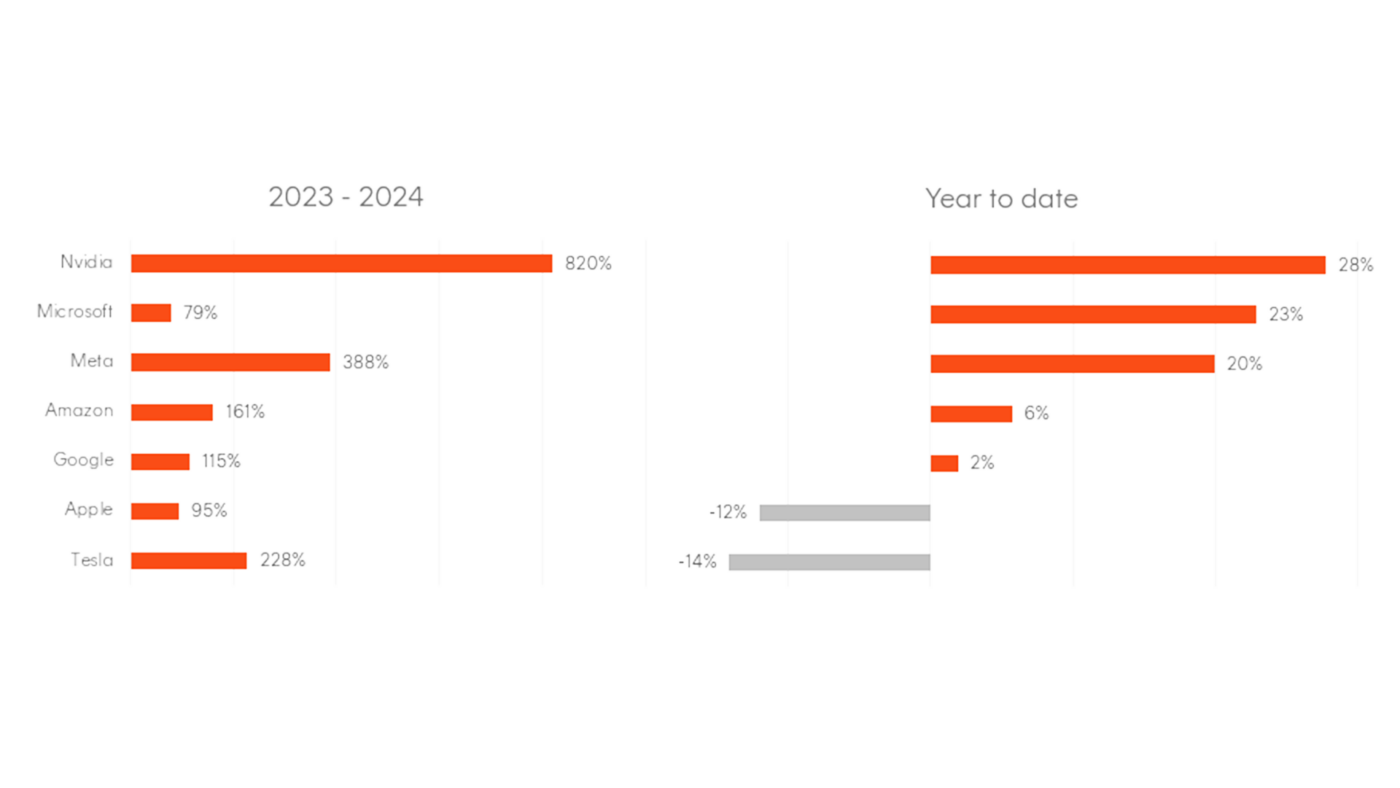

5 – RIP the Mag 7, long live the Nasdaq

After collectively leading markets higher in 2023 and 2024, the Magnificent 7 are decoupling this year with dispersion in returns widening.

Non-Mag 7 names like Broadcom, Palantir and Netflix have taken over leadership from the likes of Apple and Tesla, as investors switch to companies that have shown stronger evidence of AI related earnings growth. As with the development of any new technology, new leaders can be expected to emerge over time.

Chart 5: The return dispersion among the “Magnificent 7” companies continues to widen this year

Source: Bloomberg. As at 28 July 2025.

That’s all for this edition of Charts of the Month. For more investment and market insights, visit the Betashares Insights page here.