6 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

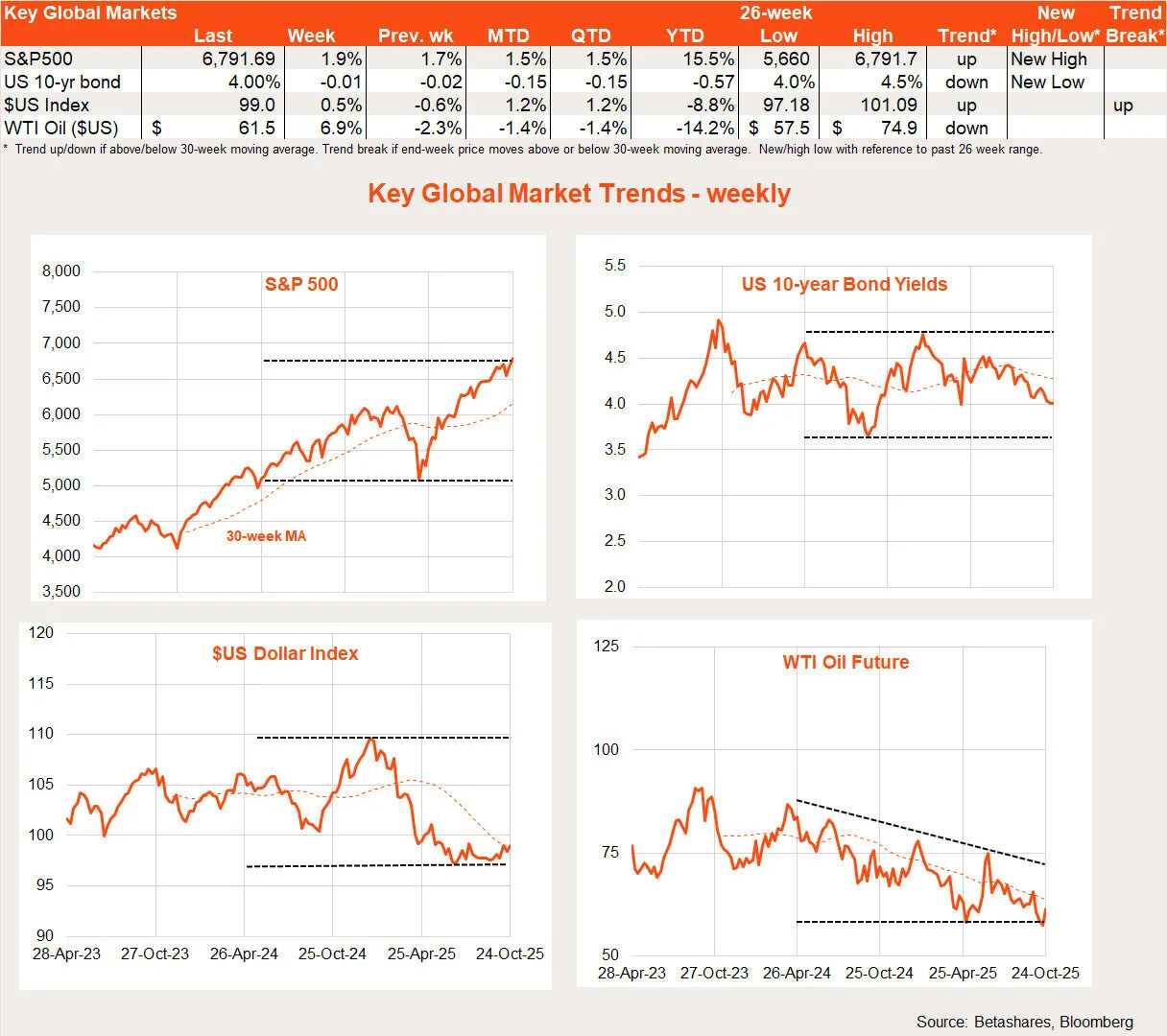

Global equities continued to rise last week, reflecting hopes of a US-China trade deal and a lower than expected US inflation report. Oil prices rebounded on news of US sanctions on two large Russian producers.

Global week in review: US-China trade talks

The on-again, off-again US-China trade talks were back on again last week after initial concerns that the US would place even more restrictions on China. The week ended with confirmation that Trump and Xi will hold talks this Thursday and both sides had already agreed to some de-escalation, with China delaying planned restrictions on critical mineral exports in exchange for the US dropping its 100% tariff threat.

China’s economy meanwhile is still holding up well with annual growth of 4.8% to Q3, down from 5.2% to Q2 although a touch better than the market expectation of 4.7%. Despite ongoing weakness in the property market and consumer spending to a degree, exports are filling the gap and keeping the government’s 5% growth target for this year on track.

In the US, some official economic data managed to get released despite the government shutdown, with a lower-than-feared 0.2% rise in core CPI prices in September (market +0.3%). While some tariff effects are still flowing through the goods sector – namely in clothing and car parts – they remain (surprisingly) modest elsewhere, while slower growth in housing rents helped to hold down overall core inflation. That said, it’s still too early to celebrate. Firmer house prices of late suggests rental inflation should rebound in 2026, while we’re likely to see further tariff effects flow through eventually.

So far this quarter, US earnings reports are also holding up well, although both Netflix and Tesla were punished by investors last week due to earnings misses. According to FactSet, 87% of the 30% of S&P 500 companies that have reported so far have beaten earnings estimates – above the 10-year average of 75%.

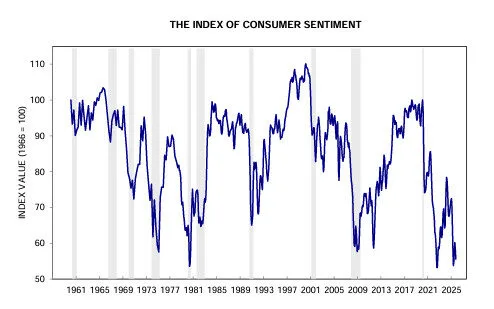

Less encouraging was the University of Michigan consumer sentiment October reading, which was revised down to near-April lows amid peak tariff concerns. Households seem concerned about a weakening labour market and stubborn inflation pressures. On Friday, however, Wall Street remained more focused on the good inflation result and revived US-China trade deal hopes.

Source: University of Michigan

In Japan, equities resumed their ascent with a newly formed coalition government early last week establishing the LDP’s new leader, Takaichi Sanae, as the country’s first female Prime Minister. Markets like her preference for stimulatory fiscal and monetary policies.

In New Zealand, despite the weak economy, annual inflation lifted to 3% in Q3 from 2.7% in Q2, in line with market expectations and reflecting non-domestic demand related strength in food, council rates and electricity prices. The lift in inflation is expected to be temporary however, and should not stand in the way of further RBNZ rate cuts to support faltering economic growth.

After its recent parabolic rise, gold prices corrected somewhat last week although the underlying positive fundamentals – such as a weaker US dollar and US policy uncertainty – remain in place.

Global week ahead: Fed & trade talks

Key highlights this week include the Fed meeting, where another 0.25% rate cut is widely expected on Thursday morning (Australian time). On Thursday (US time), Trump and Xi are scheduled to hold trade talks.

Both the Bank of Japan and the European Central Bank also meet this week, but are expected to keep official rates on hold.

Global equity trends

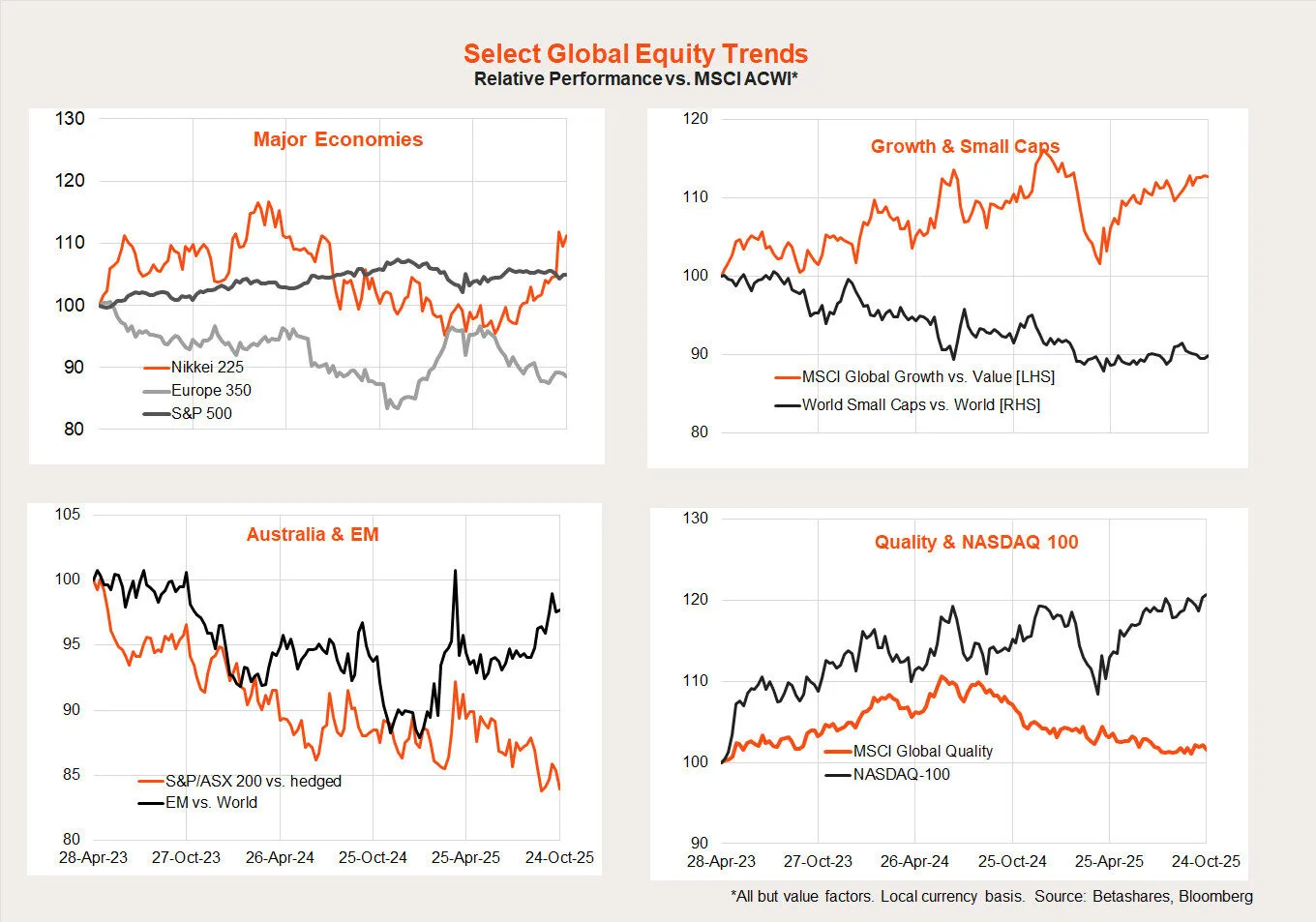

As noted above, Japanese stocks rebounded last week while the NASDAQ-100 was also relatively strong.

All up the relative performance of long popular themes – US/NASDAQ-100/growth – has rolled over somewhat in recent months and been replaced with strength in emerging markets and Japan. Australia and Europe are still underperforming, while quality and small caps are no longer underperforming.

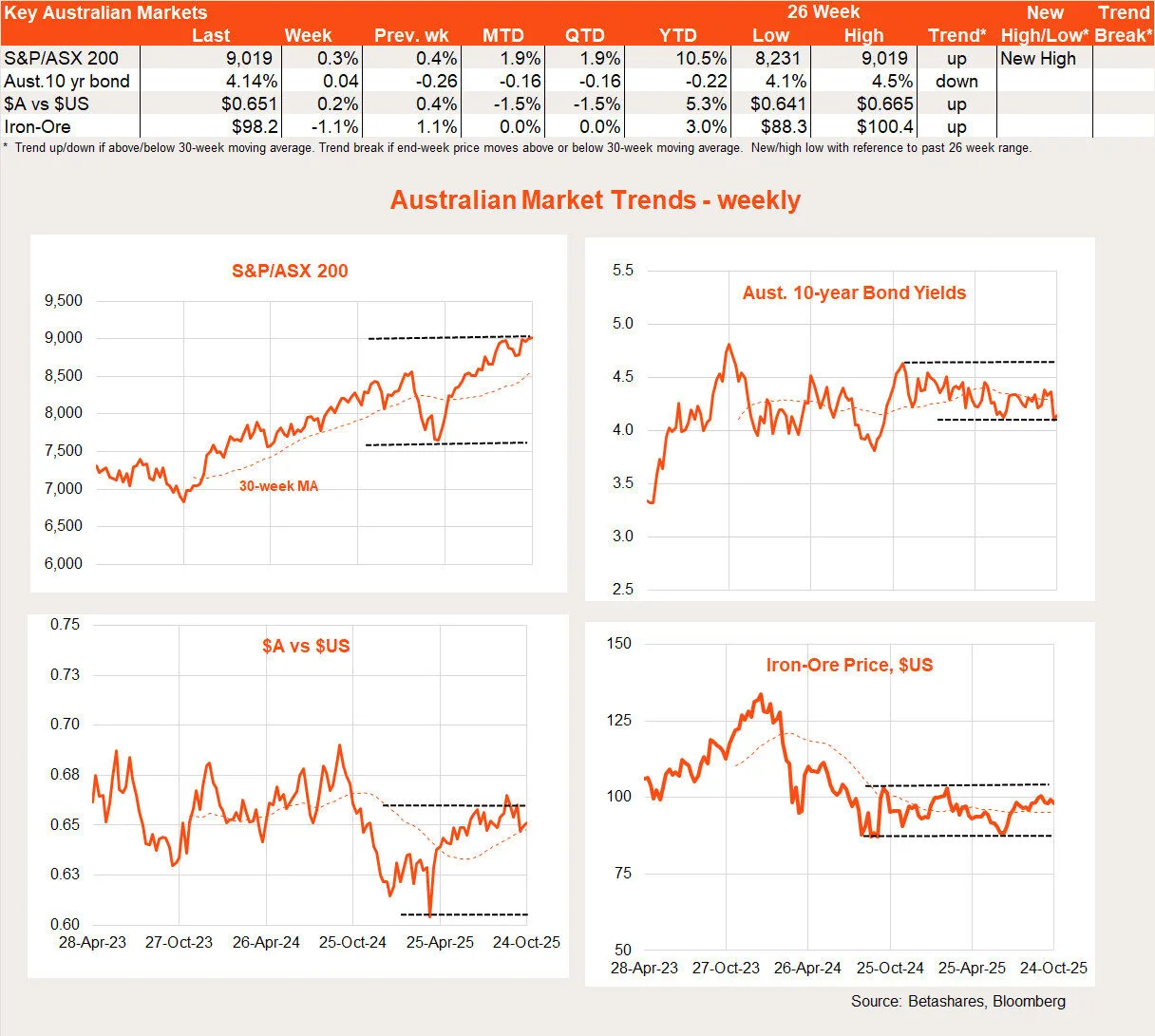

Australian week in review: Trade deal

There was little in the way of major domestic economic news last week, with the highlight being the US-Australia trade deal over critical minerals. The latter will no doubt lead to more excitement within the resources sector.

Australian week ahead: Q3 CPI

After a long wait, this week we finally get the Q3 consumer price index (CPI) report on Wednesday, which will be critical to the RBA’s decision on whether to cut interest rates at next week’s meeting. According to the market consensus, the news may be just good enough to see the RBA cut rates next week although it would be far from a done deal.

The consensus forecast is for a 0.8% quarterly gain in the trimmed mean measure of underlying inflation, which would keep annual growth steady at 2.7%. That’s probably a touch higher than what the RBA expected, given it would then require a low 0.5% gain in Q4 to achieve the RBA’s year-end 2.6% forecast as outlined in the August Statement on Monetary Policy. Indeed, the RBA recently indicated that the August monthly CPI report contained some higher-than-expected price outcomes in housing and market services.

That said, given the recent weak labour market report in which the unemployment rate jumped to 4.5%, I still feel a steady 2.7% underlying inflation rate could be good enough for a November rate cut. After all, the RBA would still have another quarterly inflation report before it could be certain its 2.6% Q4 trimmed mean inflation forecast would be missed. If so, it could see the RBA hold off cutting rates in February 2026 instead.

Given volatility in the monthly inflation numbers, there’s also a chance that some of the upside pressure evident in August could unwind in the September monthly report (which would feed into the overall Q3 result). My base case is a trimmed mean inflation quarterly gain of 0.7%, allowing the annual rate to ease to 2.6%.

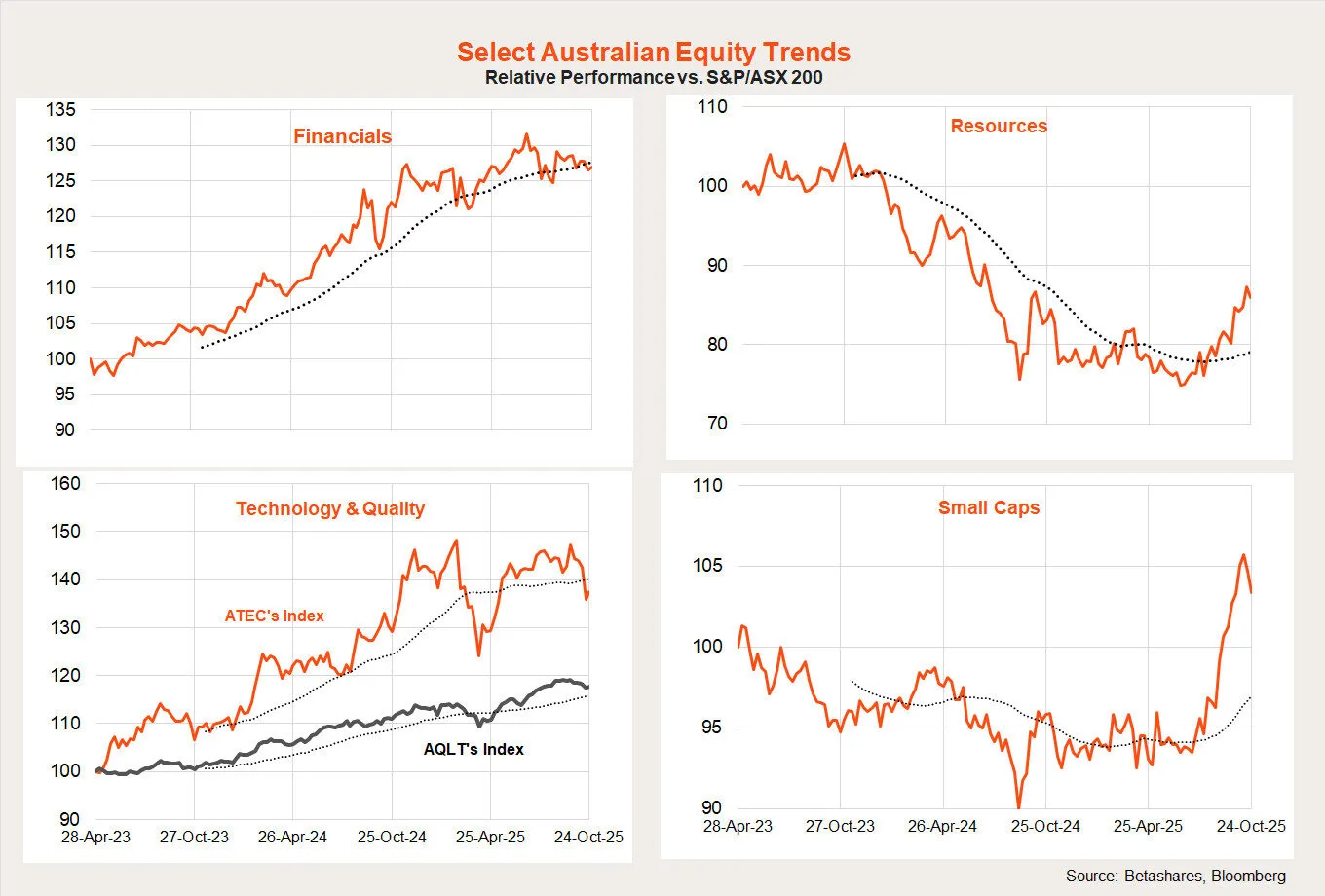

Australian equity trends

As has been the case globally, notable shifts have been taking place in the Australian equity market. Among large caps, there’s been a rotation from financials to resources, along with a notable rotation from large caps into small caps. That said, small caps and materials had a pullback last week, although the energy sector enjoyed a strong bounce (reflecting the rebound in oil prices).