US dollar higher while Gold, Silver and Bitcoin plunge

8 minutes reading time

If you prefer to listen to Off the Chain, please click the player below.

Note: The audio was generated with the help of an AI play-to-listen software.

Bitcoin and the broader crypto market rallied over the last seven days as Bitcoin and Ether hit three-week highs. Helping to push prices higher has been a shift in sentiment that now suggests a September rate cut from the Fed may be locked in1. If that happens, it will be the first Fed rate cut in a year.

Bitcoin and Ethereum were up by 4.49% and 8.15% respectively over the seven days to 14 September 2025. Bitcoin’s market capitalisation is now US$2.3 trillion while the global crypto market cap is up to US$4.06 trillion. Bitcoin’s market dominance is down to 57.5%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$115,809 |

$116,573 |

$110,846 |

4.49% |

|

ETH (in US$) |

$4,650 |

$4,725 |

$4,276 |

8.15% |

Source: CoinMarketCap. As at 31 August 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Two crypto companies make strong Nasdaq debut

Gemini Space Station (NASDAQ: GEMI) surged more than 32% in its Nasdaq debut on Friday. The crypto exchange – founded in 2014 – raised $425 million after selling 15.2 million shares at $28 a piece. The shares opened at $37.01, giving the company an implied valuation of US$4.4 billion2.

A day earlier, blockchain lender Figure Technologies (NASDAQ: FIGR) made its Nasdaq debut. The company raised $787.5 million in an upsized IPO, selling 31.5 million shares above its already-increased range of $20-$22. The stock opened at $36 a share, giving Figure an implied valuation of US$7.62 billion3.

The back-to-back listings add Gemini and Figure Technologies to the growing wave of crypto-native firms hitting public markets this year, alongside Circle, Bullish and eToro. They are part of a broader IPO boom for the sector, fuelled by regulatory winds and rising institutional adoption. 2025 is shaping up to be a breakout year for crypto IPOs – turning the sector into one of the busiest corners of the equity market.

Polymarket targets $10B valuation

Just three months ago, Polymarket was valued at US$1 billion after raising capital from Peter Thiel’s Founders Fund. Thiel is the co-founder of Paypal and Palantir Technologies and is a well-known venture capitalist. Now, the crypto-powered prediction market is eyeing a valuation as high as US$10 billion. The leap comes after new funding and a long-awaited green light from the CFTC4 to operate in the US – a big turnaround after being barred from the market in 2021.

Polymarket lets users bet on everything from political elections to court rulings and global flashpoints. During the last US election alone, more than US$8 billion in wagers flowed through the platform5.

CRYP company spotlight

Strategy gets rejected for inclusion in the S&P500

Although meeting many of the key requirements for inclusion to the S&P 500, Bitcoin treasury company Strategy failed to get approval by S&P Dow Jones Indices last week. S&P declined to provide comment around why the company was excluded6. Analysts from JP Morgan believe the exclusion is a reflection of rising caution around companies that effectively serve as proxy Bitcoin funds.

Strategy is currently held in the Betashares Crypto Innovators ETF (ASX: CRYP)7. CRYP provides exposure to global companies at the forefront of the crypto economy.8

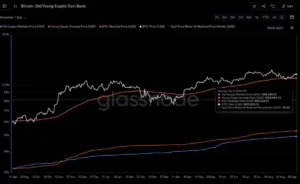

Bitcoin (BTC): Old/Young Supply Cost Basis

Realised Price reflects the aggregate price when each coin was last spent on-chain. Using Young Old supply heuristics, we can calculate the realised price (estimated average acquisition price) for each investor cohort.

- The Realised Price reflects the average price at which all Bitcoin in circulation was last bought.

- Young Supply Realised Price reflects the average price paid for coins that moved in the past six months. This is a guide to what newer or more active investors paid.

- Old Supply Realised Price reflects the average on-chain acquisition price for coins that have not moved in the last 6 months. This is a guide to what longer-term holders may be thinking.

- Periods where spot price falls below all cost basis models typically occur in deep bear markets where the average investor, irrespective of hold time, is holding an unrealised loss.

Note: The cost basis for these cohorts tend to separate during macro uptrends as coins are revalued to higher prices. Conversely, convergence tends to occur during bear markets as the investor base consolidates to higher conviction, longer-term investors.

According to data from Glassnode, as of 13 September 2025, the young supply average price is US$109,969 per unit while the old supply average price is at US$49,260 per unit. The realised price now sits at US$53,228 per unit.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): BTC-ETH Market Cap Dominance

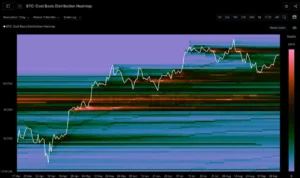

The Cost Basis Distribution (CBD) Heatmap provides a detailed visualisation of supply density across price levels over a specified period (e.g., 1 year). This metric displays a heatmap where the y-axis represents the cost basis on a log scale, set from 1% below the minimum price to 1% above the maximum price within the chosen period. Each pixel’s colour intensity reflects the concentration of supply at that price level, allowing investors to identify where significant portions of the asset supply were acquired.

This visualisation enables a clearer understanding of how price levels correlate with accumulated supply density, offering insights into potential support and resistance areas based on historical acquisition levels.

Note: All CBD metrics utilise an address-based approach, analysing holdings based on individual wallet addresses for consistency across digital assets and comparability across blockchain architectures.

According to data from Glassnode, as of 13 September 2025 potential strong support zones are in the US$103K-108K range and lower in the US$93K-99K range.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Most of the top 20 altcoins were in the green over the last seven days to 14 September. The biggest outperformer was Dogecoin (DOGE), up over 33%. DOGE rallied despite news that its much-hyped US ETF debut has been pushed back. The DOGE ETF was originally slated to launch Friday, with issuer Re-Osprey securing approval under the Investment Company Act of 1940, a rulebook used for mutual funds and diversified ETFs.

This is a different path than the ones taken by Bitcoin and Ethereum ETF issuers, which fall under the Securities Act of 1933 and are treated more like a commodity or asset-back products. The distinction matters because it shows regulators are still experimenting with how to slot DOGE into the financial system9.

Investing in crypto-assets or companies servicing crypto-asset markets should be considered extremely high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. According to the CME Group’s FedWatch Tool, as of 15 September 2025 at 10am Sydney time, there is a 96.4% chance of a 25 basis point rate cut according to interest rate traders. Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

5. https://www.ft.com/content/57c4404c-0ce1-42d8-87d8-07be666b4030

7. As at 12 September 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

8. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

9. https://cointelegraph.com/news/dogecoin-price-rises-despite-us-etf-delay

Off the Chain is published every second Tuesday. It provides the latest news on Bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.