5 minutes reading time

At a time when some of this year’s market darlings are coming under pressure, HYLD S&P Australian Shares High Yield ETF has continued to deliver better outcomes for income-focussed investors. HYLD’s outperformance has been due to its positioning across the big four banks, as well as an approach which could be described as ‘being boring’.

Delivering on performance:

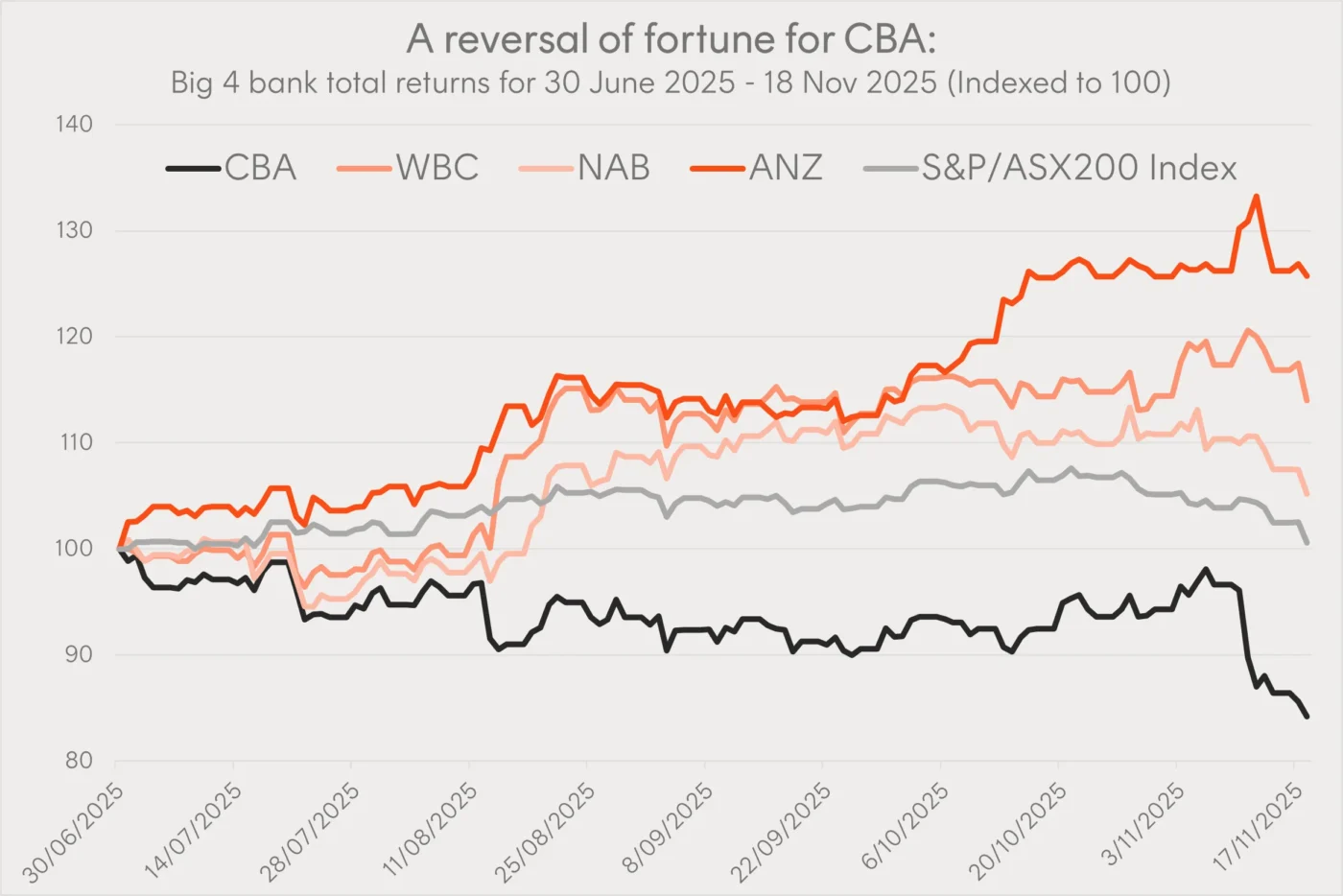

For many years CBA has been the outlier within the banks in terms of performance, seemingly able to defy gravity despite eye watering valuations. Since June that has all changed, CBA is down -16% with investors rotating into ANZ (up 26%), Westpac (up 14%) and NAB (up 5%).

Source: Bloomberg. 30 June 2025 to 18 Nov 2025. Past performance is not an indicator of future performance.

Unlike some other dividend focussed Australian share ETFs, HYLD does not currently hold CBA. CBA was screened out of HYLD’s index due to a combination of its forecast dividend yield, which had fallen to an underwhelming level on account of its multi-year stock price run up, and its volatility. As at the last index rebalance, CBA did not justify its place in the index given its expected contribution to overall yield relative to the risk (or volatility) it would add to the portfolio. In layman’s terms, we would suggest CBA was no longer a stock desirable for investors looking for an attractive dividend yield.

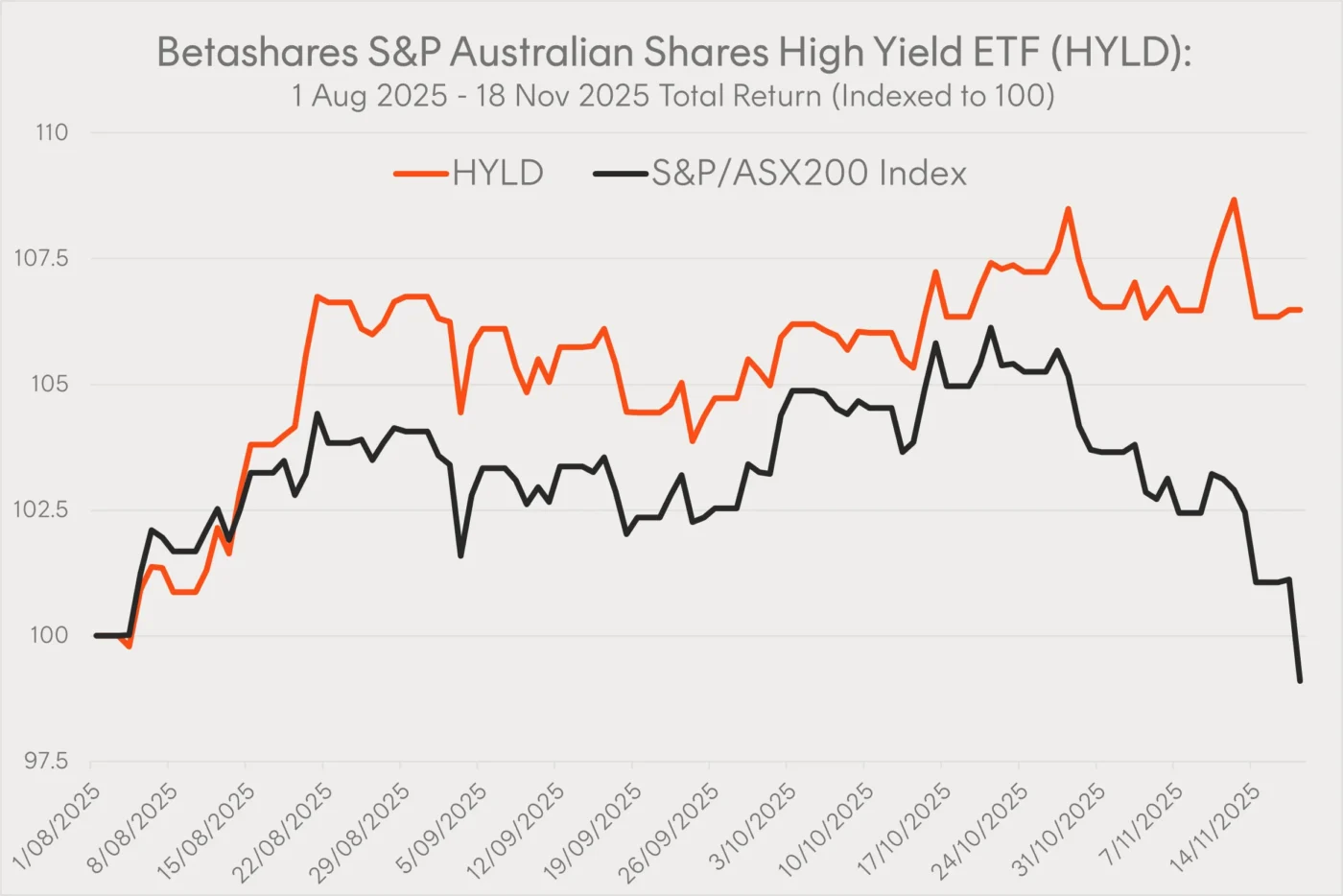

It’s early days, but since its inception on 1 August 2025 HYLD has outperformed the ASX 200 by an impressive 7%.1 About half of this outperformance can be put down to its positioning in the banks – specifically, holding no allocation to CBA and relative overweights to ANZ, Westpac and NAB (all of which have outperformed). In large caps HYLD’s overweight to Rio Tinto (up 22%) and underweight to CSL (down 31.4%) have also helped.

Source: Bloomberg. From HYLD’s inception on 1 August 2025 to 18 Nov 2025. Past performance is not an indicator of future performance.

What is even more pleasing however, is that HYLD has not been exposed to the market drawdown that has impacted the broader ASX 200 over the last month. Small and mid-cap growth stocks like Lynas Rare Earth, Iperionx, Zip Co and Droneshield had been some of the best performing stocks in the ASX200 up until mid-October, but have all since fallen by more than -20%. HYLD holds none of these stocks nor any of the other bottom 20 performers from the last month.2

Instead, the holdings that have contributed most positively to HYLD’s performance over the month have been ‘boring’ but reliable dividend payers like Woodside, Woolworths and engineering group Monadelphous. When risk sentiment falters investors will seek companies that can generate consistent cashflows and dividends.

It is important to note that HYLD’s live performance is over a short time horizon (~4 months), and investors should not expect the current live performance differential versus the ASX200 to be representative of longer-term outcomes. HYLD’s index (the S&P/ASX 200 High Yield Select Index) has outperformed the ASX200 by 1.2% p.a. since its inception (31 July 2011 to 31 October 2025) before fees and costs (HYLD’s management fee is 0.25% p.a.).3

Delivering on Income:

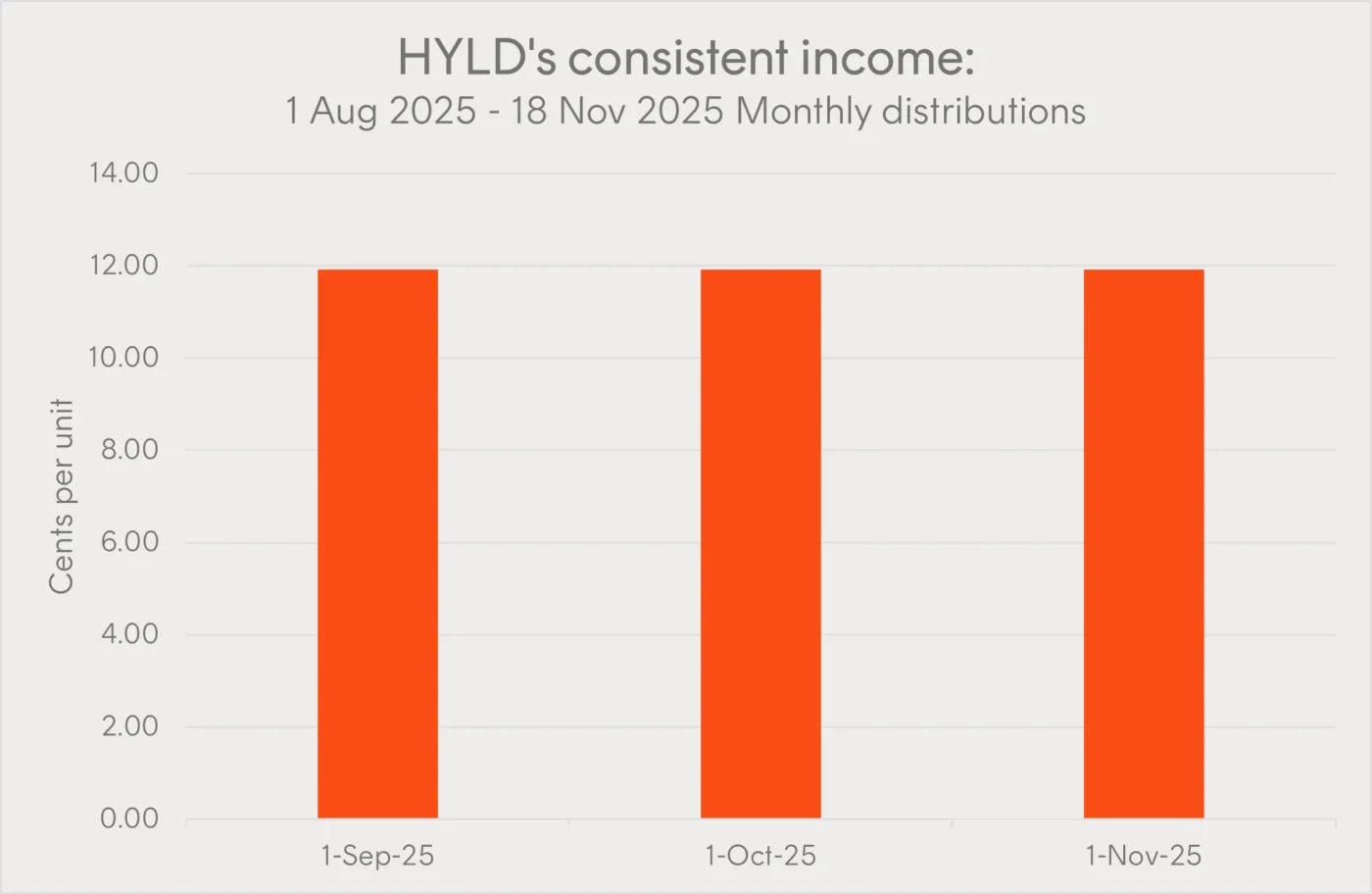

HYLD’s monthly distribution frequency is an important point of differentiation for investors. HYLD has now paid 3 monthly distributions, with an annualised cash dividend yield of 4.63% p.a. (before franking). This is materially higher than the expected 3.3% p.a. cash dividend yield of the ASX200, and HYLD’s smooth distribution profile makes cashflow management simpler for investors than the lumpy ASX dividend season payout timings.

Source: Betashares, as at 18 Nov 2025. Past performance is not an indicator of future performance.

Why invest in HYLD

HYLD has been one of the most successful ETF launches in Australia this year, with over $50 million in assets under management.

HYLD provides Australian investors with:

- Low-cost, diversified, dividend income: HYLD aims to track the S&P/ASX 200 High Yield Select Index (Index), providing diversified exposure to a portfolio of 50 of the highest-yielding stocks. HYLD can be used as an investor’s core Australian shares portfolio allocation. HYLD’s management fee is 0.25% p.a.

- Monthly income with franking4: HYLD pays distributions on a monthly basis, providing investors with a more frequent income stream than other high yield Australian share ETFs that pay quarterly distributions. A monthly cadence also means investors may be able to receive income more frequently than if invested in just individual shares.

- Intelligent approach to enhancing yield: HYLD seeks to improve on traditional strategies that utilise forecast dividends by also aiming to screen out potential ‘dividend traps.’

Sources:

1. From HYLD’s inception on 1 August 2025 to 18 November 2025. ↑

2. For the period from 18 October 2025 to 18 November 2025. ↑

3. Certain additional costs apply. Please refer to PDS. ↑

4. Franking credits are subject to the eligibility of each HYLD investor. Franking credits are determined and distributed at the end of the financial year and may differ from estimates provided during the year. ↑