6 minutes reading time

H2 2025 in review

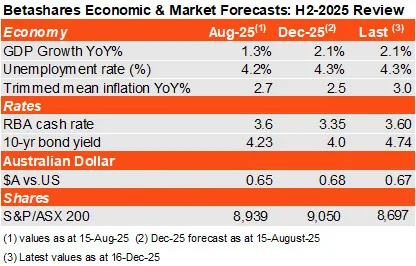

The second half of 2025 saw some notable hits and misses with regard to my H2’25 set of economic and financial forecasts.

In the main part, the global economy and financial markets panned out as expected, with resilient economic growth, contained inflation, and steady bond yields and equity valuations. This allowed equity markets to grind higher on the back of earnings growth, albeit not without brief hiccups due to the US government shutdown and emerging AI bubble concerns. Perhaps the one surprise was the resilience in the US dollar, which capped gains for the Australian dollar.

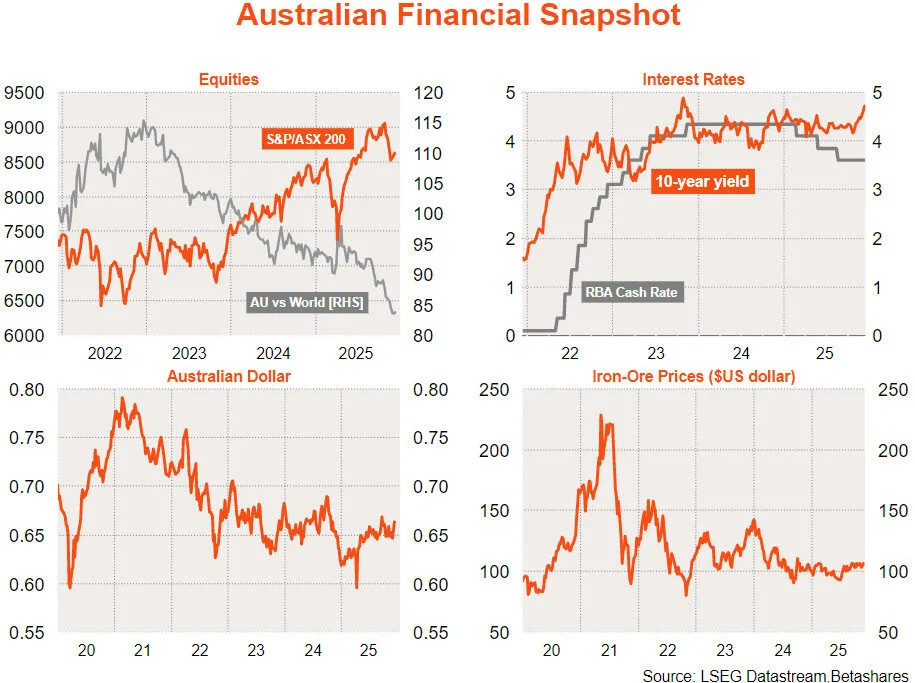

In Australia, economic growth also continued to strengthen as expected, although an upside inflation surprise led to a marked change in the RBA interest rate outlook. This placed upward pressure on bond yields and the Australian dollar, although downward pressure on equity valuations. In turn, this held back equity market gains despite a welcome upgrade to the earnings outlook.

Global resilience

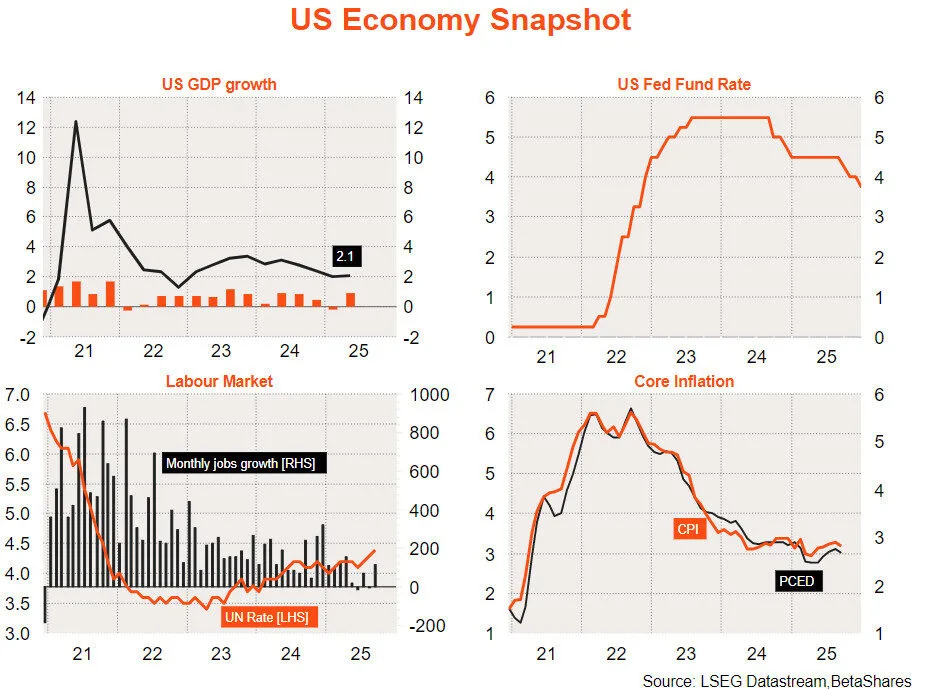

The global economy has ended 2025 on a stronger-than-expected footing. The much-feared drag from tariffs has been less severe than anticipated, while a powerful lift from data centre investment – the physical backbone of the AI boom – has provided a timely offset. US growth has remained firm, albeit with signs of a softening in labour demand. Non-US growth has also been firm, supported by rate cuts and fiscal stimulus in China.

Perhaps more surprising, US inflation has also remained relatively well contained, with only modest upward pressure on goods inflation due to tariffs, largely offset by further reductions in housing inflation and a glacial further easing in service sector inflation.

In turn, contained inflation allowed the Federal Reserve to deliver the three rate cuts expected over H2 2025, helping to provide downside protection to a gradually weakening labour market.

The outlook remains encouraging, albeit not without risk.

The AI investment boom continues to underpin global growth, although history suggests such major technological advances often eventually result in excessive investment and market euphoria.

At this stage, however, we still seem in the early-to-mid stages of a potential bubble. Demand for AI computing capacity is still outstripping supply, equity valuations are still far from dot-com peaks and balance sheets of the major players are not under major strain.

Another risk is the delayed inflationary impact of tariffs, which could still complicate the Fed’s easing path. Another risk is if markets begin to doubt US Federal Reserve independence under President Trump’s new pick for Chairperson, it could result in rising bond yields and a tightening in financial conditions.

My base case, however, remains constructive. Global growth should track close to trend, unemployment is likely to remain around current levels, and the Fed should have scope to cut rates twice in the first half of 2026 before moving to the sidelines.

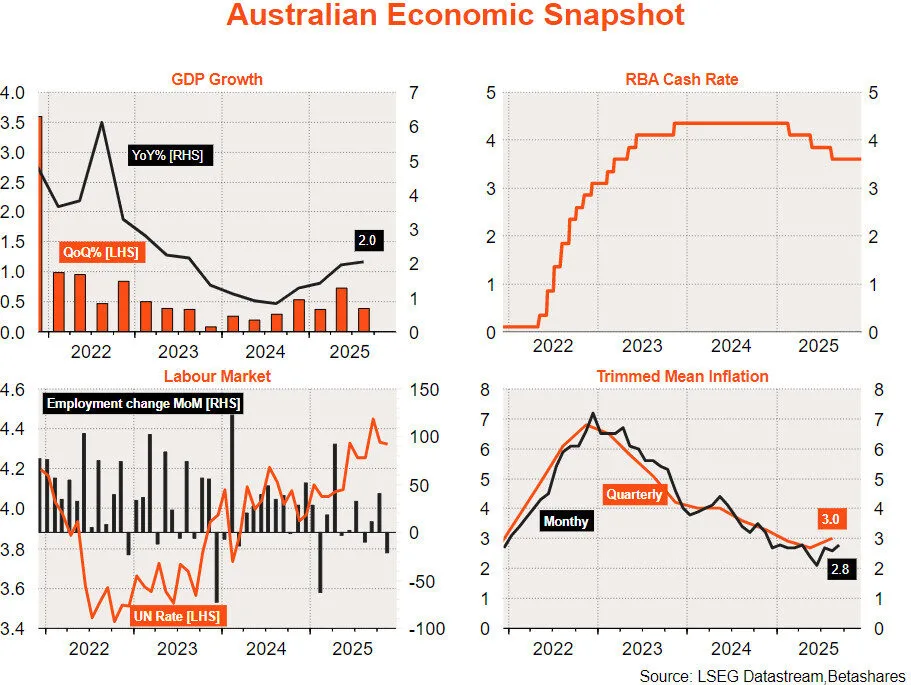

Australia: Testing capacity constraints

Closer to home, the Australian economy continued to strengthen over H2 2025, with a stronger and broader upturn in private demand. Consumer spending, business investment and housing construction were firm in the September quarter. The impact on economic output, however, was moderated by a run-down in inventories and some easing in public demand, as strong growth seen earlier in the “care economy” and public infrastructure projects levelled off.

The fly in the ointment has been inflation. Associated with the lift in private demand, the September quarter inflation outcome was hotter than expected. It effectively killed off earlier hopes of a November rate cut and has raised the risk of higher interest rates in 2026 if inflation fails to ease.

Critical to the outlook next year is whether inflation can moderate without the need for more monetary restraint and slower economic growth. While some of the lift in inflation last quarter reflected demand strength – in areas such as consumer durables, market services and housing – some one-off or temporary factors were likely also at play, such as reduced discounts by home builders and the pass through of higher global food prices.

On the expectation that inflation will moderate from the strong pace evident in the September quarter, the RBA is expected to leave interest rates steady in the first half of 2026. , with two rate cuts still expected, albeit delayed to August and November.

In turn, monetary support should allow continued growth in the economy at around a trend pace of 2% or so, sufficient to keep unemployment steady at around 4.25-4.5%. Further rebalancing in growth from public to private demand should also be associated with a welcome lift in productivity, or output per hour worked.

Constructive outlook for bonds and the Australian dollar

The inflation shock and associated shift in the RBA outlook pushed local bond yields higher over H2 2025, even though US yields eased. Assuming two cuts in both Australia and the US, there’s still scope for yields to fall toward 3.75% by the end of 2026 – implying scope for decent capital returns from fixed-rate bonds on top of a currently attractive yield.

The Australian dollar over H2 2025 was helped by the hawkish local shift in interest rates and stronger iron ore prices. But a resilient US dollar in recent months has capped the upside, with the Aussie lifting from 65 US cents to only 67 US cents. A resumption of modest US dollar weakness – supported by US rate cuts – could see the Aussie dollar test 70 cents by mid-2026, although it’s expected to stabilise at that level for the second half. If the RBA hikes rates, although not anticipated, it would further support the Australian dollar.

Earnings growth and steady bond yields to support equities

As expected, global equities pushed higher through H2 2025, supported by rising earnings and broadly steady valuations. Local corporate earnings also grew, supported by an upgrade to the outlook for resource sector profits, although the impact on equity prices was offset by a reduction in valuations in the face of higher local bond yields.

Looking ahead, steady bond yields and solid earnings growth should remain supportive for global equity markets.

Current market expectations imply 14% growth in US forward earnings by the end of 2026 and 8% growth in Australia. Assuming steady valuations, this could see the S&P/AS200 reach 9,375 by end-2026.

The key risks to the market outlook include local inflationary pressures, further disruptive US economic policymaking, and crumbling global profits if the AI boom prematurely busts.

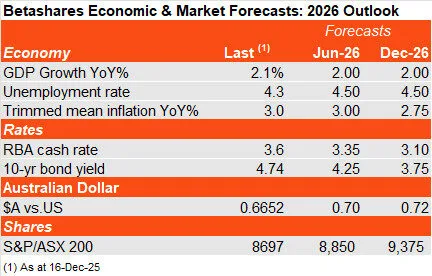

Finally, here are my economic and market forecasts for 2026 in summary.