3 minutes reading time

ETF Industry roars back to growth

-

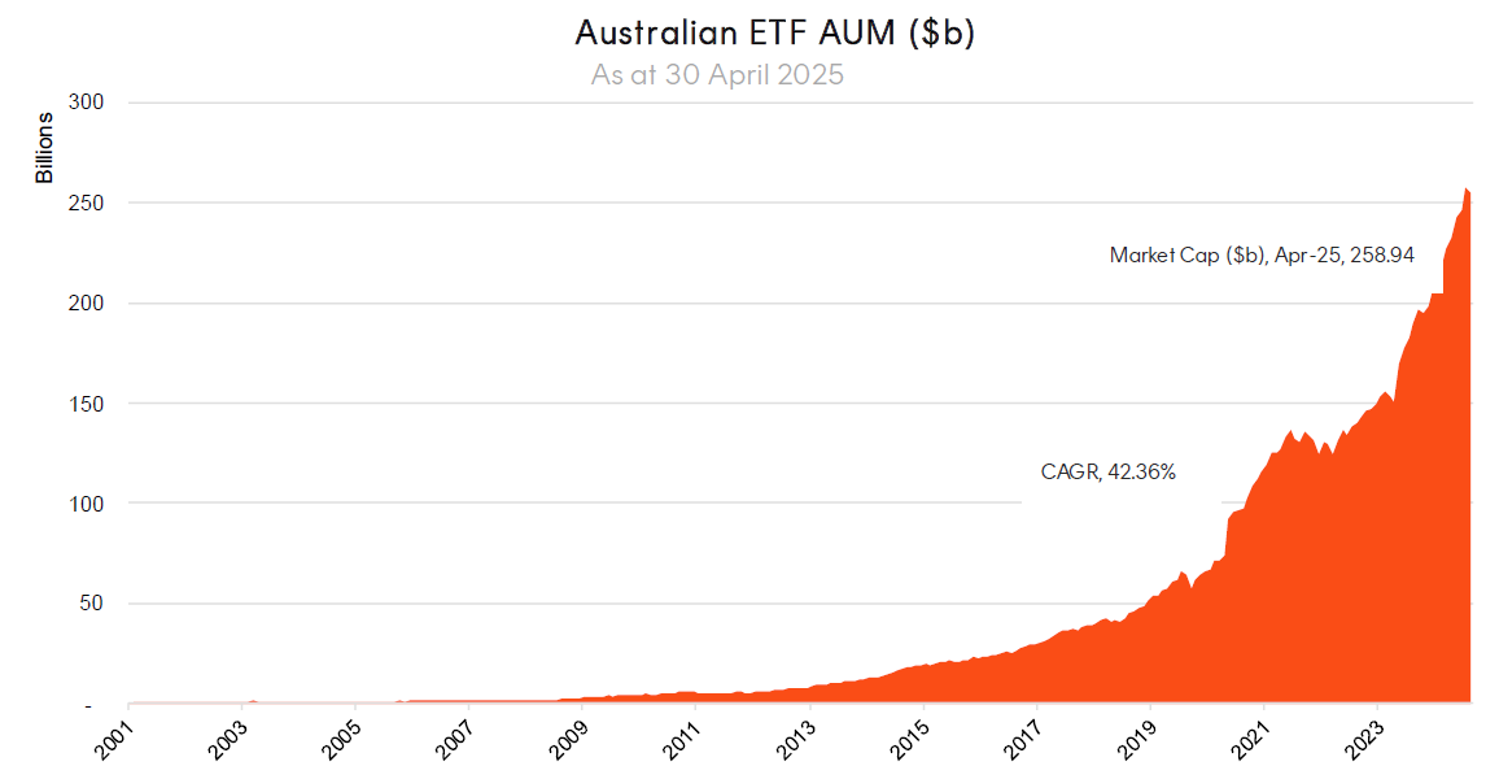

The Australian ETF industry surged to a new record high after strong inflows and positive sharemarket performance during April.

-

Very strong inflows to ETFs during April in combination with positive market performance saw the Australian ETF industry hit $258.9B in funds under management – a rise of $8.6B or 3.43%.

-

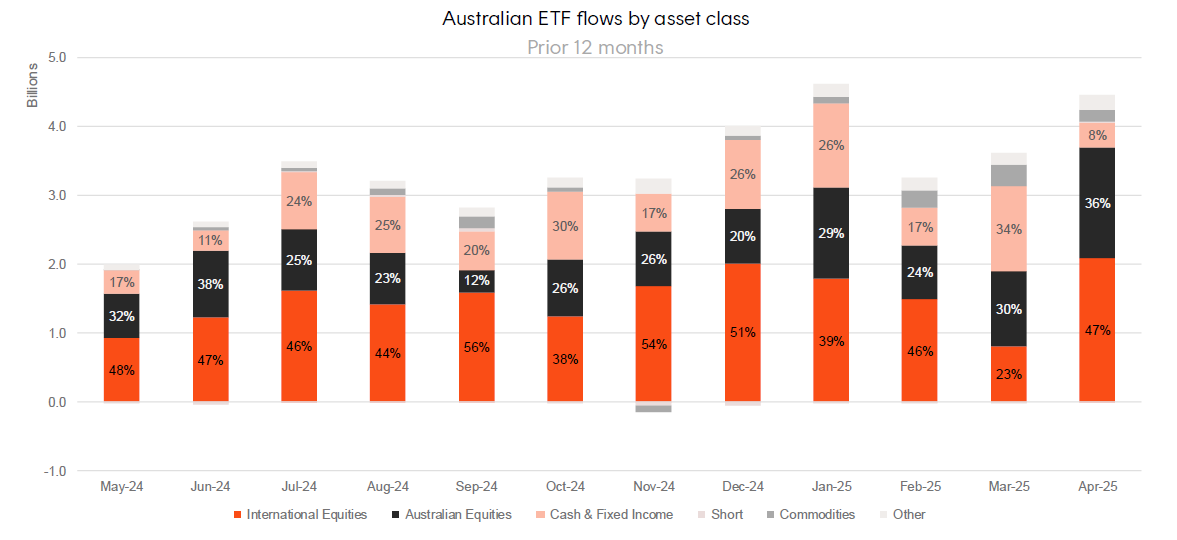

Industry inflows for the month were just shy of the record set in January at $4.46B, as investors continued to allocate to their portfolios amid ongoing market volatility.

-

ASX trading value hit $22B in April – another record high. This comes as investors continued to rebalance their portfolios and take advantage of buying opportunities.

-

Over the last 12 months the Australian ETF industry has grown by 32.8%, or $63.96B.

-

7 new funds launched in April, while one fund (VanEck’s Global Carbon Credits Complex ETF) closed.

-

Crypto related exposures, including the Betashares CRYP Crypto Innovators ETF and the Betashares QBTC Bitcoin ETF , were the top performing funds during April.

-

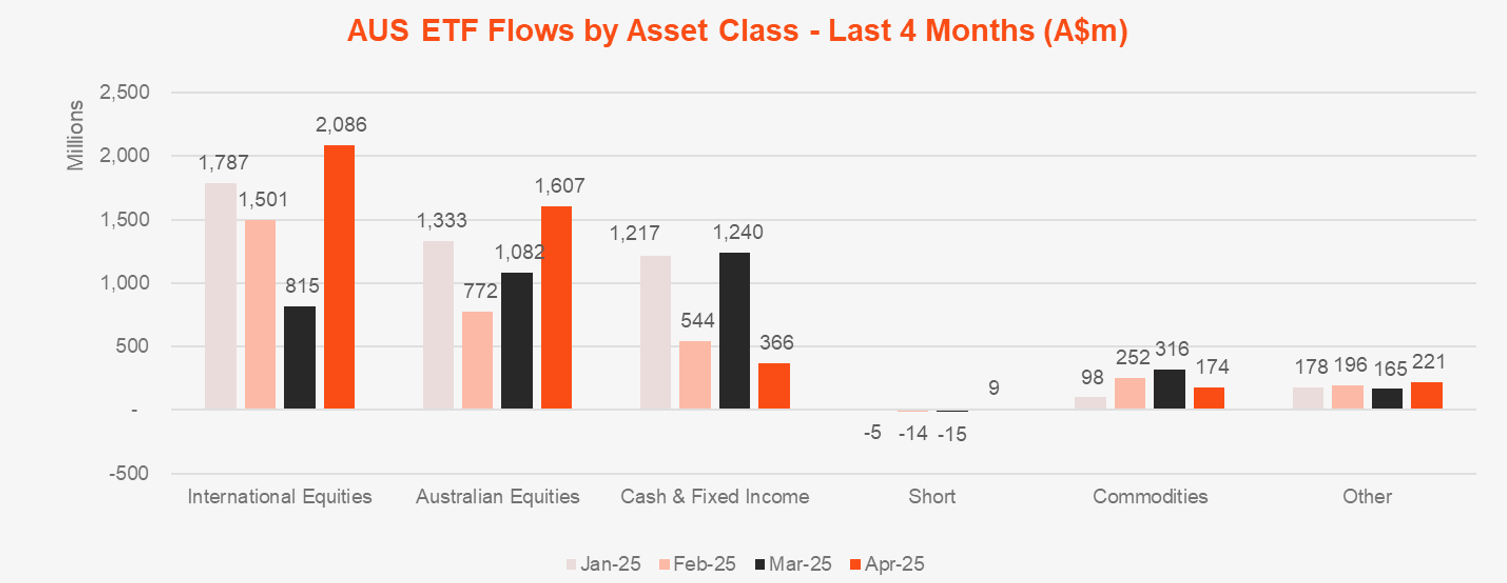

Investors charged back into International Equities products with $2.1b of inflows during April, while Australian Equities ($1.6b) took second, followed by Fixed Income ($371m) in third.

Market Size and Growth: April 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $258.9B – all time high

- ASX CHESS Market Cap: $219.15B1

- Market Cap change for April: 3.43%, $8.6B

- Market cap growth for last 12 months: 32.8%, or $63.96B

New Money

- Net inflows for month: $4.5B

Products

- 418 Exchange Traded Products trading on the ASX & CBOE

- 7 new funds launched in March, including two new actively managed ETFs

Trading Value

- ASX trading value was a record $22B during April – a 16% increase on the previous month and a new record high

Performance

- Crypto related exposures, including the Betashares CRYP Crypto Innovators ETF and the Betashares QBTC Bitcoin ETF , were the top performing funds during April.

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| International Equities | $2,085,877,954 |

| Australian Equities | $1,607,184,400 |

| Fixed Income | $371,048,450 |

| Commodities | $174,226,154 |

Top Category Outflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| Cash | -$5,150,854 |

| Currency | -$910,316 |

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| Australian Equities – Broad | $1,223,352,203 |

| International Equities – Developed World | $1,030,868,773 |

| International Equities – US | $454,305,341 |

| International Equities – Sector | $284,293,136 |

| Australian Bonds | $231,014,986 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| International Equities – Asia | -$21,187,849 |

| Cash | -$5,150,854 |

| International Equities – E&R – Impact | -$3,778,883 |

| Commodities – E&R – Sustainability | -$2,627,981 |

| Currency | -$910,316 |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

|---|---|---|

| IBTC | Monochrome Bitcoin ETF | 13.32% |

| CRYP | Betashares Crypto Innovators ETF | 11.86% |

| QBTC | Betashares Bitcoin ETF | 11.15% |

| VBTC | VanEck Bitcoin ETF | 10.45% |

| DFND | VanEck Global Defence ETF | 10.14% |