3 minutes reading time

Better investing starts here

Get Betashares Direct

Betashares Direct is the new investing platform designed to help you build wealth, your way.

Scan the code to download.

Learn more

Learn more

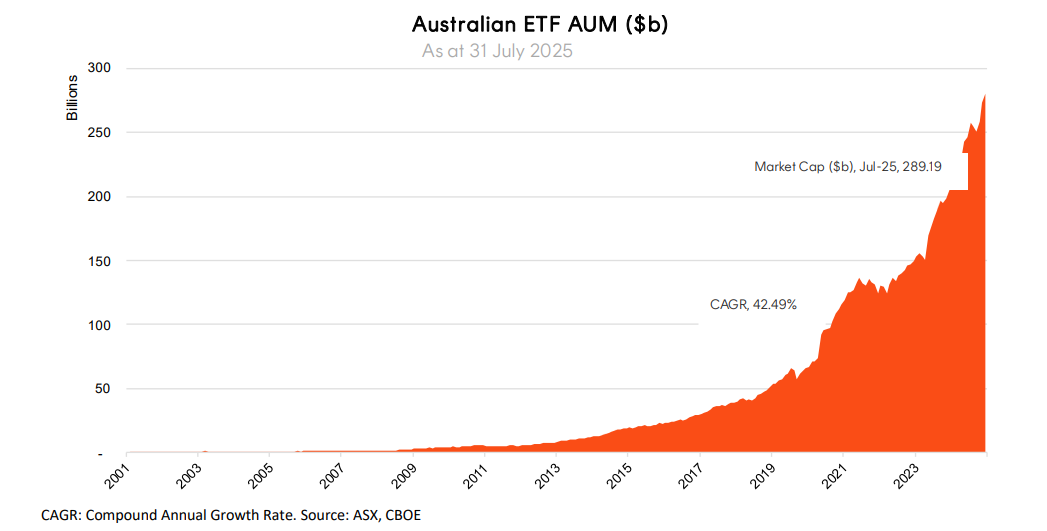

- Record inflows, combined with positive market performance, pushed the Australian ETF industry to a new record high of $289.2B in funds under management– a rise of $8.7B or 1%.

- Industry inflows for the month were a record $5.82B – beating the previous record set in January by over $1B.

- ASX trading value hit ~$16B in July – an elevated level but less than the record set in May this year.

- Over the last 12 months the Australian ETF industry has grown by 1%, or $73.6B.

- No new funds were launched in July.

- Crypto related exposures, including the Betashares Ethereum ETF (ASX: QETH), were the top performing funds in July.

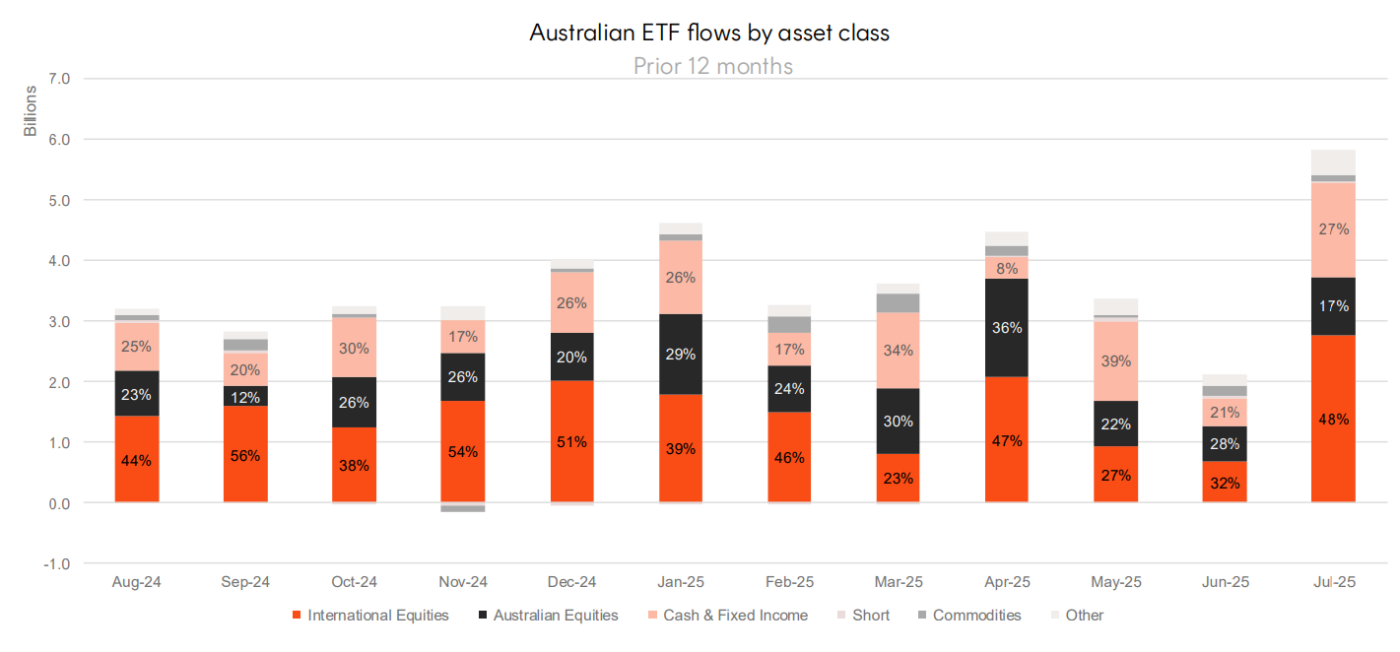

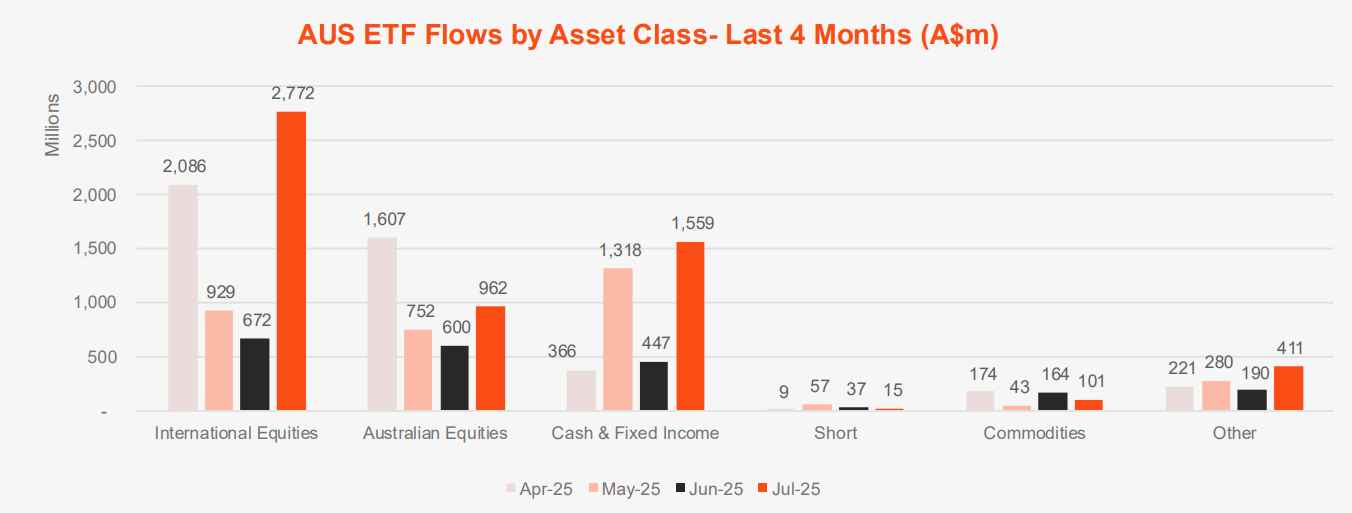

- International Equity ETFs received the highest level of flows with $2.8b, while Fixed Income ($1.3b) took second, followed by Australian Equities ($962m) in third.

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $289.2B – all time high

- ASX CHESS Market Cap: $246.67B1

- Market Cap change for July: 11%, $8.7B

- Market cap growth for last 12 months: 1%, or $73.6B

New Money

- Net inflows for month: $5.8B – all time high

Products

- 430 Exchange Traded Products trading on the ASX & CBOE

- No new funds launched in July

Trading Value

- ASX trading value was ~$16B in July

Performance

- Ethereum related exposures, including the Betashares Ethereum ETF (ASX: QETH), were the top performing funds in July

Industry Net Flows

Top Sub-Category Inflows (by $) – Month

|

Broad Category |

Inflow Value |

|

International Equities |

$2,771,541,976 |

|

Fixed Income |

$1,304,196,437 |

|

Australian Equities |

$961,849,975 |

|

Cash |

$254,311,446 |

|

Multi-Asset |

$219,514,805 |

Top Sub-Category Outflows (by $) – Month

No outflows recorded by broad category.

|

Sub-Category |

Inflow Value |

|

Australian Equities – Sector |

-$65,051,323 |

|

Australian Equities – Large Cap |

-$19,423,523 |

|

Oil |

-$8,582,428 |

|

Australian Equities – Geared |

-$8,408,349 |

|

Fixed Income – E&R – Ethical |

-$7,031,610 |

ETF Flows by Asset Class

Performance – Top Performing Products (Month)

|

Ticker |

Product Name |

Performance (%) |

|

IETH |

Monochrome Ethereum ETF |

57.87% |

|

EETH |

Global X 21Shares Ethereum ETF |

57.20% |

|

QETH |

Betashares Ethereum ETF |

50.86% |

|

MCCL |

Munro Climate Change Leaders Fund (Managed Fund) |

26.66% |

|

MCGG |

Munro Concentrated Global Growth Fund (Managed Fund) |

23.20% |

Explore

Markets