3 minutes reading time

Strong ETF inflows continue amid global sharemarket volatility

-

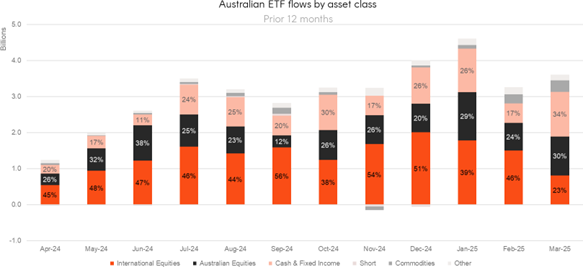

The Australian ETF industry recorded another strong month of net inflows, despite ongoing global market volatility.

-

Strong inflows to ETFs during March were not enough to offset global sharemarket volatility. As a result, ETF industry assets fell around two per cent (-1.94%) month-on-month, for a total monthly market cap decline of $4.96B. The industry now sits at $250.4B.

-

Notwithstanding ongoing market volatility, industry inflows remained strong – with $3.6B of net flows for the month – the third highest monthly inflow on record.

-

ASX trading value was a record $19B during March – a nearly 50% increase on the previous month and higher than the volumes seen during Covid-19. This comes as investors looked to rebalance their portfolios, take advantage of buying opportunities and take risk off the table amid the volatility.

-

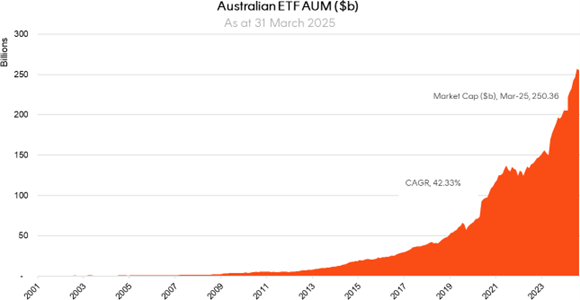

Over the last 12 months the Australian ETF industry has grown by 27.3%, or $53.7B.

-

6 new funds launched in March, including two new actively managed ETFs.

-

Gold miner ETFs, including the MNRS Global Gold Miners Currency Hedged ETF , were the best performing funds during March.

-

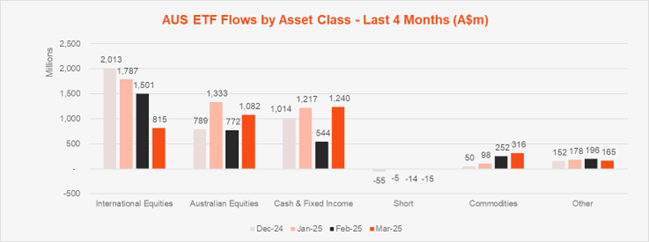

Australian Equities products ($1b) saw the strongest inflows in March, while Fixed Income ($882m) took second, followed by International Equities ($815m).

Market Size and Growth: March 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Market Cap

- Australian Exchange Traded Funds Market Cap (ASX + CBOE): $250.4B

- ASX CHESS Market Cap: $213.17B1

- Market Cap change for March: -1.94%, -$4.96B

- Market cap growth for last 12 months: 27.3%, or $53.7B

New Money

- Net inflows for month: $3.6B

Products

- 411 Exchange Traded Products trading on the ASX & CBOE

- 6 new funds launched in March, including two new actively managed ETFs

Trading Value

- ASX trading value was a record $19B during March – a nearly 50% increase on previous month

Performance

- Gold miner ETFs, including the MNRS Global Gold Miners Currency Hedged ETF were the best performing funds during March

Industry Net Flows

Top Category Inflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| Australian Equities | $1,081,740,895 |

| Fixed Income | $882,491,851 |

| International Equities | $814,991,516 |

| Cash | $357,181,175 |

| Commodities | $316,006,039 |

Top Category Outflows (by $) – Month

| Broad Category | Inflow Value |

|---|---|

| Short | -$14,825,449 |

Top Sub-Category Inflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| Australian Equities – Broad | $863,287,281 |

| Australian Bonds | $550,125,519 |

| International Equities – Developed World | $379,613,857 |

| Cash | $357,181,175 |

| Gold | $291,419,000 |

Top Sub-Category Outflows (by $) – Month

| Sub-Category | Inflow Value |

|---|---|

| Australian Equities – Sector | -$126,397,410 |

| International Equities – Emerging Markets | -$120,230,855 |

| International Equities – E&R – Ethical | -$30,687,479 |

| Australian Equities – Short | -$18,592,406 |

| International Equities – E&R – Sustainability | -$11,667,295 |

Performance

Top Performing Products – Month

| Ticker | Product Name | Performance (%) |

|---|---|---|

| GDX | VanEck Gold Miners ETF | 14.02% |

| MNRS | Betashares Global Gold Miners Currency Hedged ETF | 13.96% |

| IBTC | Monochrome Bitcoin ETF | 12.39% |

| GEAR | Betashares Geared Australian Equity Fund (Hedge Fund) | 10.18% |

| EBTC | Global X 21Shares Bitcoin ETF | 9.84% |