Bitcoin struggles as sentiment sours

6 minutes reading time

If you prefer to listen to Off the Chain, please click the player below.

Note: The audio was generated with the help of an AI play-to-listen software.

Bitcoin and the broader crypto market slid over the last seven days with Bitcoin trading as low as $107K per unit last weekend. August has historically been a weak month for crypto markets, with September often the weakest month of all.

Bitcoin and Ethereum were down -5.36% and -6.45% respectively over the seven days to 31 August 2025. Bitcoin’s market capitalisation is down to US$2.17 trillion while the global crypto market cap is downto US$3.81 trillion. Bitcoin’s market dominance sits at 57.2%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$108,716 |

$114,869 |

$107,665 |

-5.36% |

|

ETH (in US$) |

$4,451 |

$4,948 |

$4,290 |

-6.45% |

Source: CoinMarketCap. As at 31 August 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Backed by Ethereum

MicroStrategy’s Bitcoin reserve may be the largest of its kind, but the second-largest crypto reserve comprises primarily Ethereum. Last week, BitMine Immersion Technologies purchased 1,782,690 ETH for its treasury, at a cost of more than US$7.9 billion at today’s prices.

On 30 June 2025, the company unveiled its “5% Alchemy” play. It’s a bold strategy which will see the company aim to acquire 5% of Ethereum’s total supply. A spokesperson described it as “the place where Wall Street is building the 21st-century banking and payments network.” The move has already caught the eye of big names like Ark Invest, Pantera Capital and Founders Fund –clear signs that institutional interest in ETH is heating up1.

Stablecoin market at all-time highs

Fresh data from DeFiLlama shows the market capitalisation of the stablecoin market has reached an all-time high, sitting above US$280 billion. Tether (USDT) is miles ahead with more than US$168.4 billion in circulation, while Circle’s USDC is in second place at US$70.3 billion2.

What does it mean? Rising stablecoin balances can cut both ways. It might signal that investors are stepping out of higher volatility plays like Bitcoin and Ethereum. But it may also point to a massive pool of dry powder sitting on the sidelines. Historically, more stablecoins on exchanges has translated to stronger liquidity and potential more buying power. We believe this signifies a bullish undertone for the broader crypto market.

CRYP company spotlight

Brokerage stocks ride the bull market

As of 22 August 2025, global stock markets (represented by the MSCI World Index3) hit a new all-time high. As these markets reach new records and the volume of trades increases, brokerage stocks have been swept along by the same upward momentum.

Robinhood (NASDAQ: HOOD) has been one of the biggest movers. The share price began 2025 below US$40 but is now US$104 as at the end of August. The surge has been fuelled by a jump in trading volumes, a resurgence in options activity and a wave of new retail investors chasing momentum. With markets running hot, platforms like Robinhood are back in the spotlight.4

Robinhood is a holding in the Betashares Crypto Innovators ETF (ASX: CRYP)5. CRYP provides exposure to global companies at the forefront of the crypto economy.

Bitcoin (BTC): Fear and Greed Index

The Crypto Fear & Greed Index is an indicator from Alternative.me that aims at capturing investor sentiment in a single number by incorporating data from multiple sources. The index ranges from 0 to 100, where 0 denotes “extreme fear”, and therefore, times of exaggerated negative investor sentiment. On the other hand, 100 means “extreme greed” and is an indication of maximum FOMO (fear of missing out).

According to data from Alternative.me, as of 30 August 2025, the index has dipped to 39 indicating “Fear”. The price of Bitcoin has steadily declined since hitting an all-time high of above US$123K on 13 August.

Source: Glassnode. Past performance is not indicative of future performance.

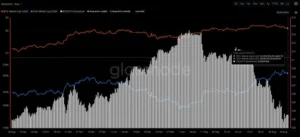

Bitcoin (BTC): BTC-ETH Market Cap Dominance

The BTC-ETH Dominance metric is an oscillator that tracks which of the two largest cryptocurrencies is outperforming. It considers only the market capitalisation of Bitcoin, relative to the combined market capitalisation of Bitcoin plus Ethereum.

- Higher values and uptrends indicate Bitcoin is outperforming.

- Lower values and downtrends indicate Ethereum is outperforming.

According to data from Glassnode, BTC to ETH dominance has fallen from 0.13 (on 7 May 2025) to 0.035 (as at 30 August 2025).

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The top 20 altcoins were all in the red to 31 August 2025. The exception is Cronos (CRO), which is up over 85% and is now sitting in the Top 20 largest cryptocurrencies. The big news that helped push the crypto price higher is the announcement of a partnership between Trump Media & Technology Group (NASDAQ: DJT) with Crypto.com. CRO tokens will be purchased for its Truth Social rewards program with the potential of building a $6.42 billion CRO treasury.

CRO is the utility token of the Cronos blockchain, an EVM (Ethereum Virtual Machine) cryptocurrency which is developed and run by the cryptocurrency exchange Crypto.com6.

Investing in crypto-assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://icobench.com/news/bitmine-aims-to-reshape-finance-with-massive-ethereum-bet

2. https://news.bitcoin.com/lifetime-peak-stablecoin-market-explodes-past-280b-as-ethenas-usde-rockets-past-12b/

3. You cannot invest directly in an index. Past performance of the index is not indicative of future performance of the index or ETF.

4. https://www.barrons.com/articles/robinhood-markets-interactive-brokers-stock-price-613532e3

5. As at 29 August 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

6. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. No assurance is given that this company will remain in the portfolio or will be a profitable investment. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

Off the Chain is published every second Tuesday. It provides the latest news on Bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.