5 minutes reading time

If you prefer to listen to Bass Bites, you can click the player below:

Global week in review

Global equities moved higher last week in a case of ‘bad news is good news’, with ongoing signs of softening in the US labour market all but confirming prospects of a Fed rate cut this week. Also helping were two US inflation reports still suggesting only limited tariff flow-through into prices.

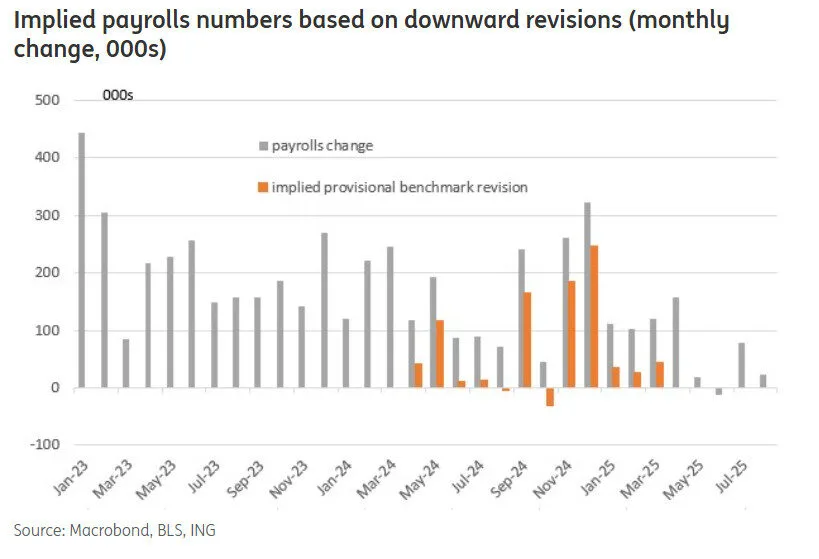

Two reports last week highlighted the weaker outlook for the US labour market. For starters, there was a large downward revision to US employment growth over the past year, after the annual benchmarking of monthly establishment survey employment data to other wage and tax data was completed. Average monthly growth over the year to March 2025 dropped from 147k to only 70k, resulting in the level of employment being 991k less than previously thought!

While large annual historic revisions to US employment growth are not unusual, it’s fair to say this year’s change was at the larger end of the usual range. US President Donald Trump likes to claim political bias in the data reporting but the Bureau of Labor Statistics suggests one problem in recent years has been a post-COVID drop in survey response rates – which adds to sampling error in the monthly employment estimates.

Source: Macrobond, BLS, ING

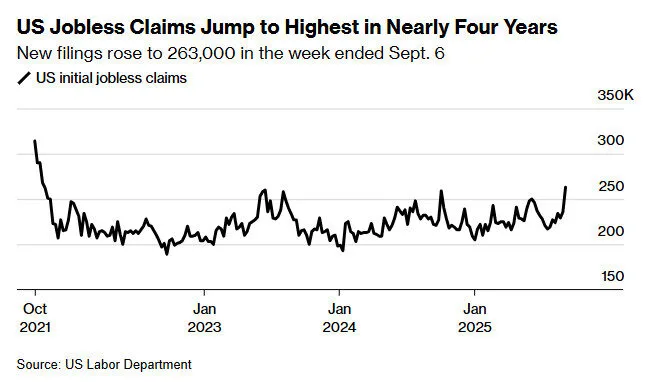

Also on the soft side was a 27k spike in weekly jobless claims to 263k. As evident in the Bloomberg chart below, the occasional spike higher is also not unusual – and need not flag impending labour market doom provided it drops back down again soon. Seasonal quirks and a spike in Texas claims, due to possible delayed hurricane related claims, are thought to have contributed to last week’s outsized increase.

Source: Bloomberg, US Labor Department

Equity markets took these results in their stride, especially as they only heightened the expectation that the Fed would cut interest rates this week.

Markets were also relieved by still limited evidence of tariff effects on US inflation. Producer prices for August were notably lower than expected, while the 0.3% increase in core consumer prices was again in line with expectations. Of course, while US inflation has not spiked higher in recent months, it is still travelling sideways at a level above the Fed’s 2% inflation target.

Moreover, for all the angst over the recent weakening in the US labour market, the NFIB small business survey also released last week suggested sentiment remained at relatively healthy levels – which is a good counter-recessionary signal.

The European Central Bank met on Thursday and left rates on hold as widely expected.

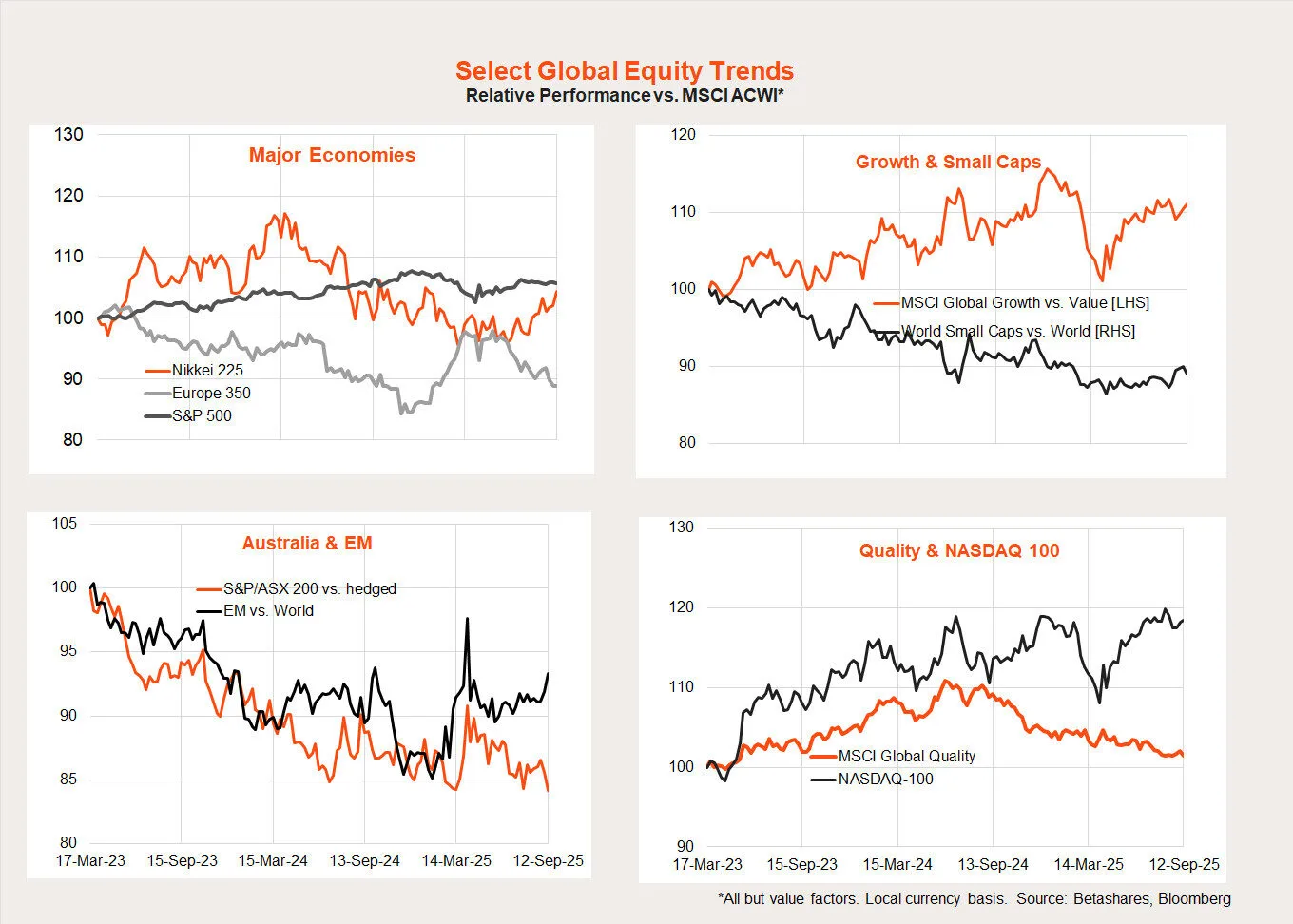

Global share market trends

Although the US market is not outperforming as clearly as has been evident in recent years, global growth is still beating value and the NASDAQ-100 is still tending to outperform in global markets. Japan and emerging markets are also doing relatively well, whereas Europe has come off the boil.

Global week ahead: Federal Reserve

Thursday’s Federal Reserve meeting will be the highlight of the week. A 0.25% rate cut is widely expected, with markets attaching a small 5% chance to a 0.5% cut.

Also of note in the meeting will be an update of the Fed’s economic and interest rate forecasts. With upside risks to inflation and downside risks to growth, markets are unclear whether the Fed will signal more or less rate cuts over the coming year in its ‘dot plot’ of Fed member forecasts for the Fed funds rate. Back in June, the ‘dot plot’ suggested two further rate cuts this year and one rate cut next year.

Australian week in review

There was only limited local data last week with a small retracement in the Westpac measure of consumer confidence and a small bump higher in NAB’s survey of business conditions.

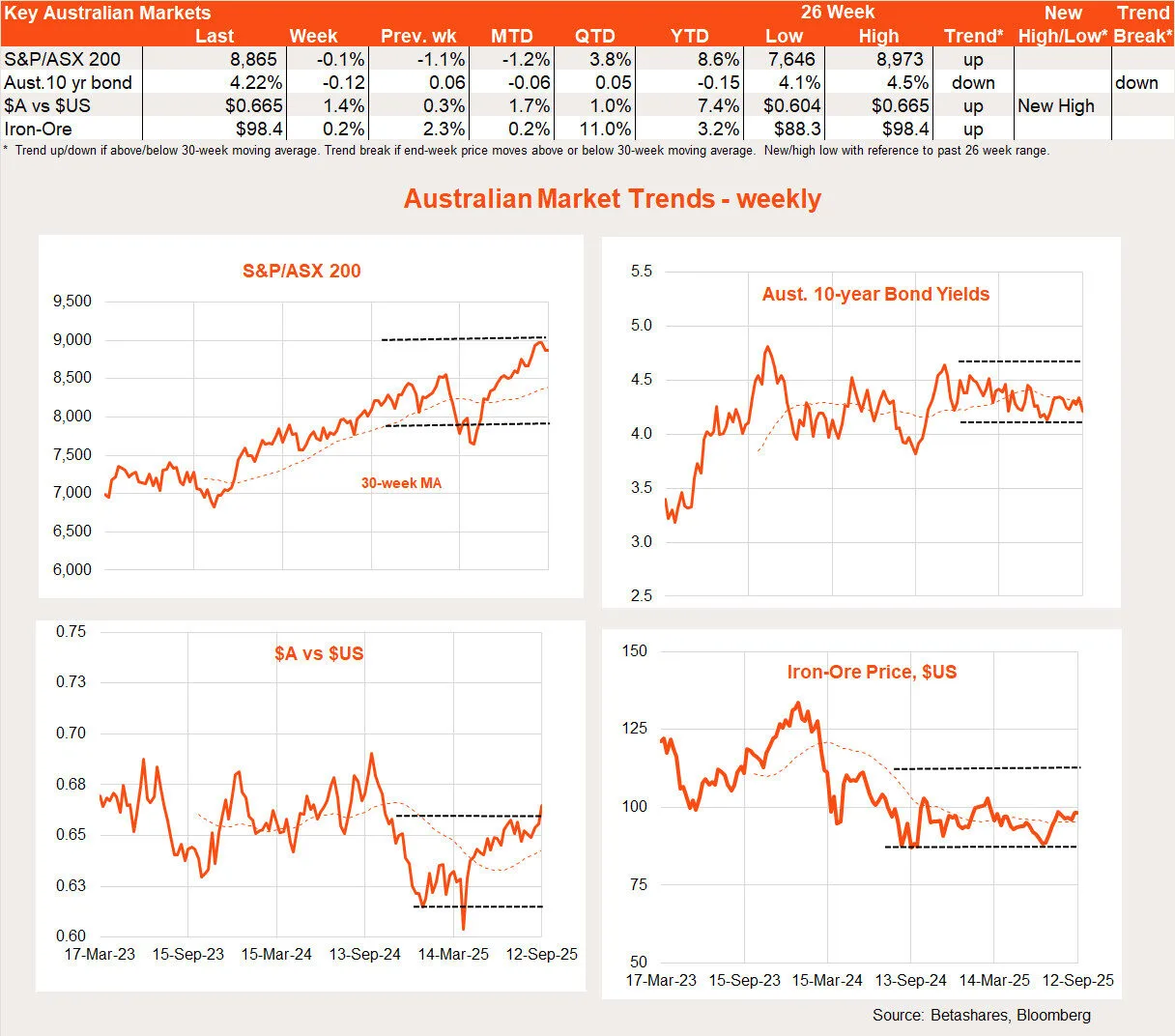

Australian share market trends

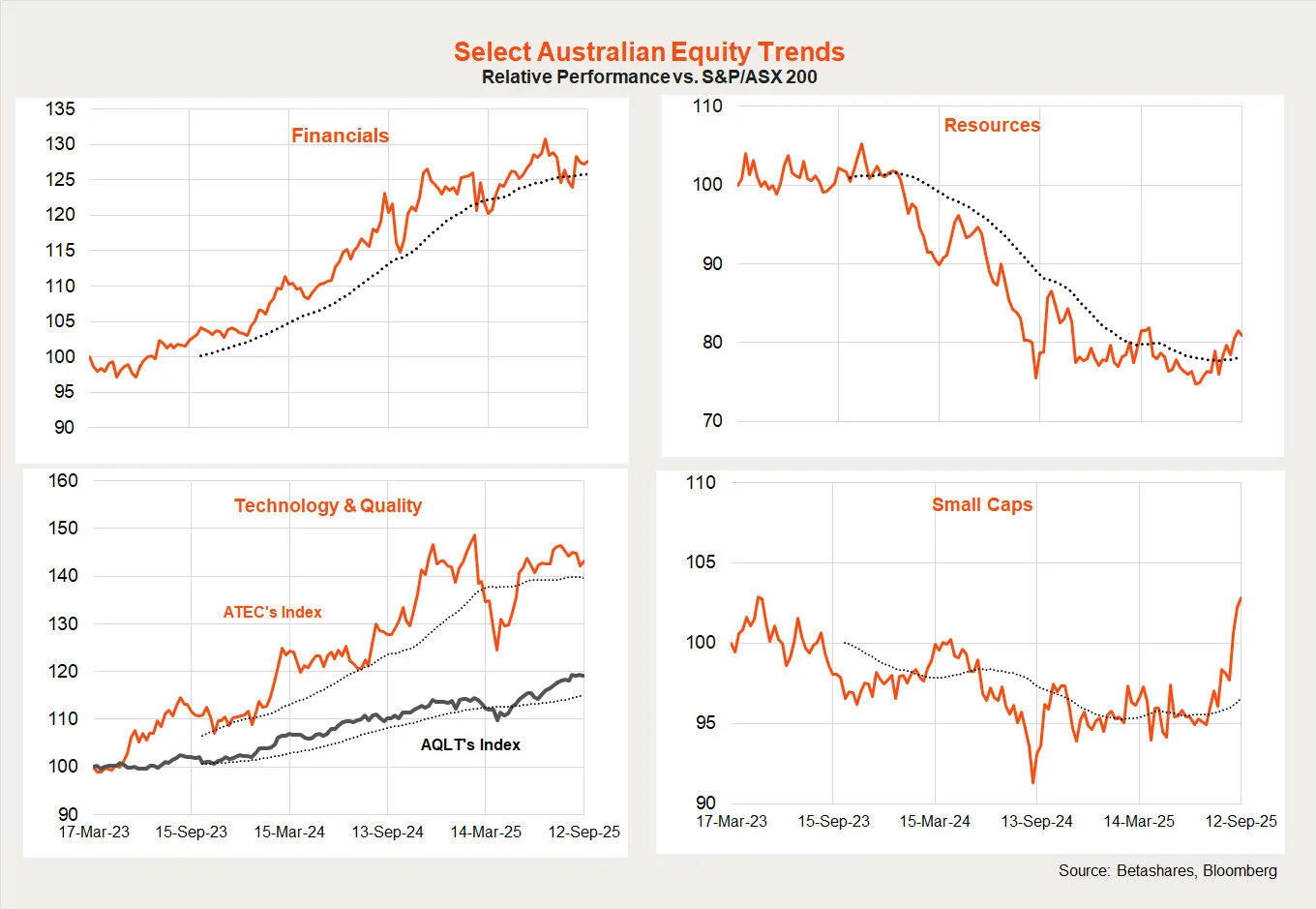

In terms of local equity trends, tentative signs of a rotation from financial to resource stocks remain in place, with markets perhaps feeling the worst could be over for earnings downgrades in the latter sector. There’s also been a notable bounce in relative small-cap performance in recent months. Quality continues to perform well while the relative performance of the local technology sector has moderated of late.

Australian week ahead

The local highlight this week will be Thursday’s August employment report, with a moderate 22k gain in employment expected, which should keep the unemployment rate steady at 4.2%.

If so, this would confirm that the pace of employment growth has slowed in recent months – though not dramatically so. It in part reflects not only weakening demand but a slowing in immigration and a reduction in labour supply. Barring a severely weak report, this should keep market expectations for an RBA rate cut later this month at the currently fairly low level of 15%.