5 minutes reading time

Overview

- The FOMC cut rates by 25bps to 3.75% – 4% range as widely expected.

- The FOMC also announced the Quantitative Tightening (QT) program will end from 1st of December, with MBS runoff continuing at current pace (capped at $35B per month) to fund for T-bill purchases while Coupon Treasury runoff will be reinvested in full at auction.

- Historic dissents in both directions: Newly appointed Governor Stephen Miran again voted for a 50bps cut, while Kansas City Fed President Jeff Schmid preferred no change at this meeting.

- The press conference had a hawkish tone, with Powell’s stating, fresh off the bat, that a December cut is “far from a foregone conclusion”.

- Powell acknowledged the difficulty of operating under limited data due to government shutdown and having to rely on alternative public and private data. If the shutdown continues, there is a chance the October labour and CPI data won’t be available before the next FOMC.

- Despite the lack of full dataset, the FOMC statement upgraded the US growth status to “expanding at moderate pace”, while acknowledging inflation risks have also moved up. Powell also stated plainly, without tariffs, the inflation number would not be far from the Fed’s 2% target.

Market reaction

Equity indices were trending up and bond yields were flat before the FOMC press conference, however the apparent hawkish tone saw equity indices drop and bond yields shot up immediately. Overall S&P 500 index was flat during the day and Nasdaq was up 41bps while UST yields re-priced higher across the curve.

Table 1: Market movers, Bloomberg, as of 30/10/2025

|

Equities |

Current level |

Prior close level |

1d change |

Last FOMC (7/05) level |

Changes between FOMC meetings |

|

S&P 500 |

6890.59 |

6890.89 |

0.00% |

6600.35 |

4.40% |

|

NASDAQ |

26119.85 |

26012.16 |

0.41% |

24223.69 |

7.83% |

|

ASX 200 SPI futures |

8908.00 |

8940.00 |

-0.36% |

8854.00 |

0.61% |

|

Bonds |

Current level |

Prior close level |

1d change |

Last FOMC |

Changes between |

|

UST 2-year yield |

3.60 |

3.49 |

11 bps |

3.55 |

4 bps |

|

UST 10-year yield |

4.08 |

3.98 |

10 bps |

4.09 |

-1 bps |

|

UST 10-year real yield |

1.77 |

1.68 |

9 bps |

1.69 |

8 bps |

|

UST 10-year inflation breakeven |

2.30 |

2.29 |

1 bps |

2.39 |

-9 bps |

|

AU 3y bond futures yield |

3.66 |

3.58 |

8 bps |

3.43 |

22 bps |

|

AU 10y bond futures yield |

4.33 |

4.24 |

10 bps |

4.26 |

7 bps |

|

US Investment Grade Credit Spread |

110.29 |

111.94 |

-1.65 bps |

116.19 |

-5.9 bps |

|

Commodities & FX |

Current level |

Prior close level |

1d change |

Last FOMC |

Changes between |

|

WTI Oil |

60.48 |

61.31 |

-1.35% |

64.05 |

-5.57% |

|

Spot Gold |

3930.07 |

3982.21 |

-1.31% |

3659.90 |

7.38% |

|

AUDUSD |

0.6574 |

0.6585 |

-0.17% |

0.6653 |

-1.19% |

|

Bitcoin |

111537.06 |

112832.31 |

-1.15% |

115656.22 |

-3.56% |

|

VIX |

16.92 |

15.79 |

1.13 |

15.72 |

1.20 |

Desk Commentary

Market was pricing in, with almost full certainty, two rate cuts before yesterday’s FOMC meeting and it looked like a steady sail towards the end of the year. However, the meeting decision and post-conference revealed a more nuanced picture. The historic dissents in both directions suggest FOMC voting members disagree on the economic picture, which is further complicated by the lack of official economic data. While Governor Miran’s view was widely understood, the hawkish dissent from Jeff Schmid is interesting to say the least. Especially when he voted for a 25bps cut in September despite, using Powell’s words, “the outlook for employment and inflation has not changed much since September”. Potentially, for this exact reason, Powell tried to rein in market expectations that a December rate cut was not a done deal.

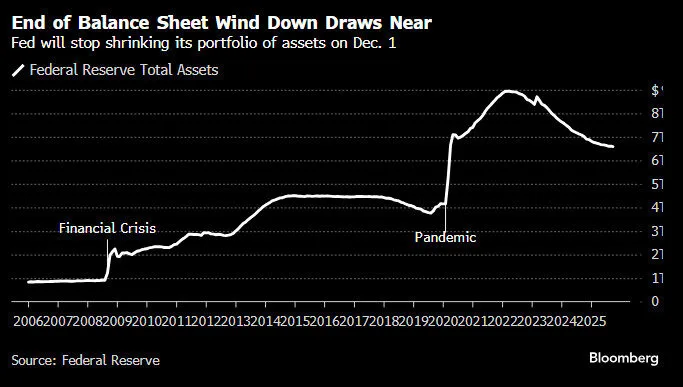

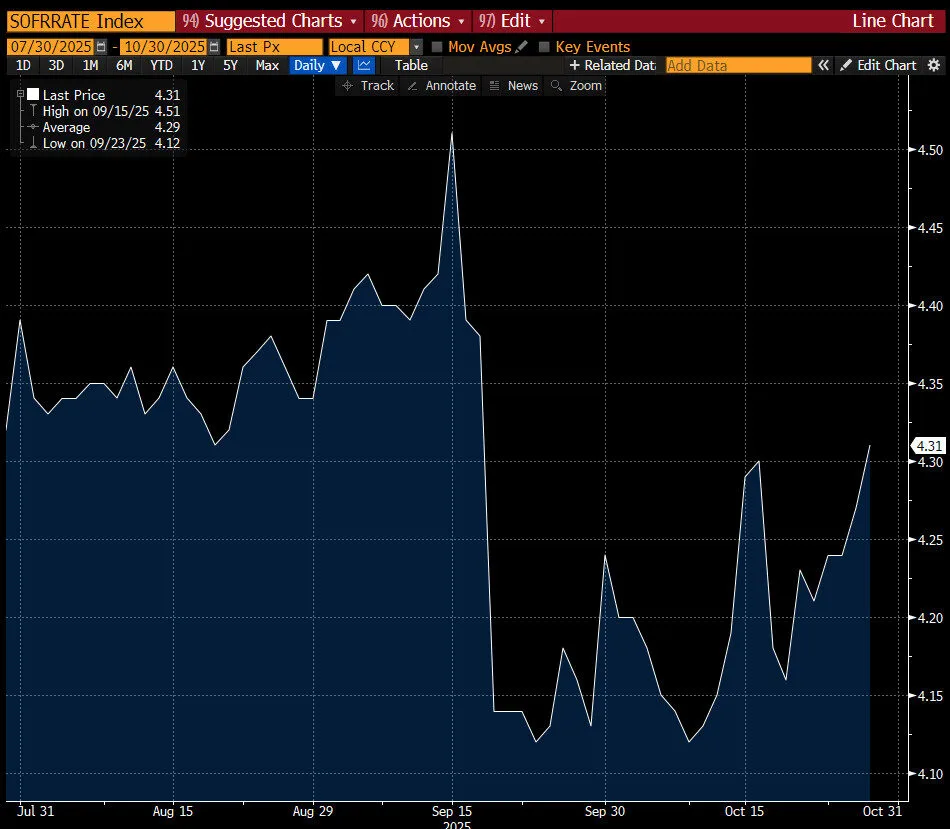

Markets were also anticipating the ending of the QT program, but the timing of the 1st of December suggests the Fed is concerned about market liquidity before year end, which has shown up as volatility in short-term funding rates. Whilst, the new program will see the Fed focuses on the short-end of the curve, the re-jigging of the program re-affirms Fed’s commitment to the UST market and probably will take some pressure off the treasury quarterly refunding tasks due next week.

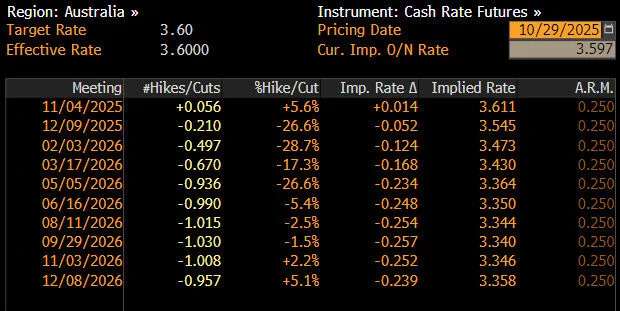

While the December rate cut maybe in flux, the market’s pricing still reflects a more aggressive rate-cutting path in the US than Australia. The Fed is expected to bring rates close to terminal rates by as early as September next year, with three full cuts to 3.1%, which is lower than Australia’s market implied cash rate at 3.34% (one cut priced in). This would finally see AUD/USD FX hedging carry turn positive. Given next year’s market pricing, for our UST suite investors, this not only presents an appealing investment case for potential capital gains, but with gold having rallied to historical heights, USTs are likely to be the best hedge against any equity drawdowns. The short-term yields tick up post FOMC presents a good opportunity as an entry point, especially as the FX hedging carry eventually turn positive, eliminating the holding costs for such UST exposures.

Chart 1: US repo rates have gone up in recent weeks

Chart 2: Fed Funds effective rates were also trending towards upper band

Table 2: US market implied cash rates post Oct FOMC

Table 3: Australia market implied cash rates

Chart 3: The end of QT program starting on Dec 1st