5 minutes reading time

- Cash & fixed income

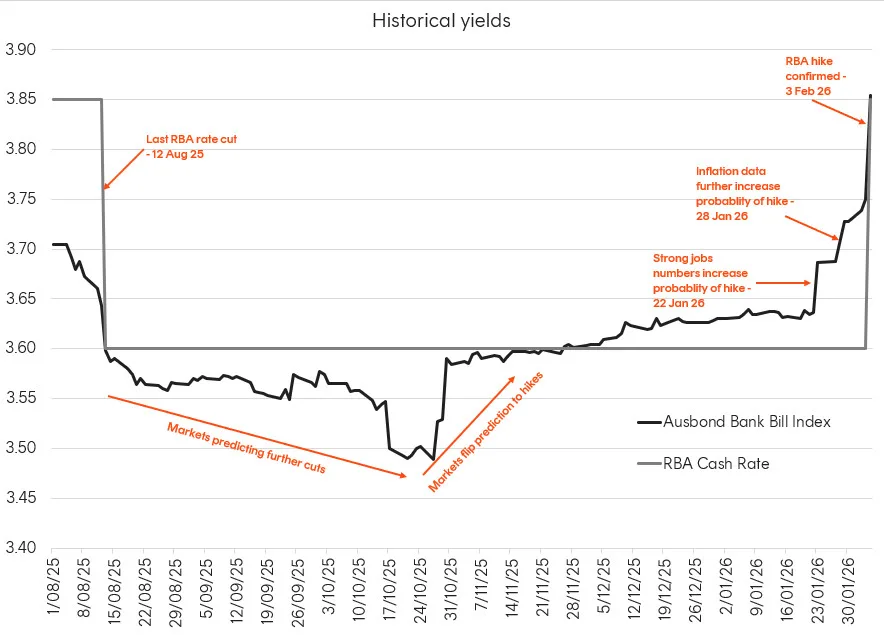

Markets expected the RBA’s 0.25% hike to 3.85% last week. But they didn’t anticipate that core inflation may not return to the central bank’s target range until mid-2028.

For investors, such a swift return to a rate-hiking cycle creates both challenges and opportunity. History shows banks are often slow to pass higher rates to depositors, leaving yields on everyday cash lower than the official cash rate. This gap creates a chance for investors to earn more by using short-term cash investments that track market rates.

Looking ahead, markets are pricing in roughly 1.6 additional hikes this year, but predictions range from rates holding steady to as many as two more increases. Unless inflation data delivers a positive (lower than forecast) surprise, more hikes are very possible, making it crucial for investors to position portfolios strategically.

Why waiting doesn’t necessarily pay

In financial markets, prices often move before an event actually happens.

Last week’s inflation report, for example, came in higher than expected. Even before the report, investors had already priced at least one rate hike by May. After the report and the RBA’s decision, markets began pricing in up to three hikes by the end of the year. Most of the market reaction had already occurred, so short-term yields were already elevated by the time the decision was announced.

Source: Bloomberg, RBA. As at 4 Feb 2026.

This means that markets often move ahead of official announcements. Having said that, surprises can still have an effect. Yields on short-term cash and bond-like instruments rose slightly further following the RBA’s recent interest rate decision, once RBA’s updated inflation forecast was made clear. But again, this was a small adjustment from those already-elevated levels. This means investors who had already locked in term deposit rates earlier may miss out on the extra income.

More broadly, Australia is now on a different path from other major economies. The RBA is raising rates while the US Federal Reserve and other central banks are either cutting or holding rates. This divergence has made Australian fixed income investments more attractive compared with similar investments overseas.

Finally, it should be said this pattern occurs across many asset classes – stocks, fixed income, cash, gold and oil.

How to make the most of the ‘expected’ hikes

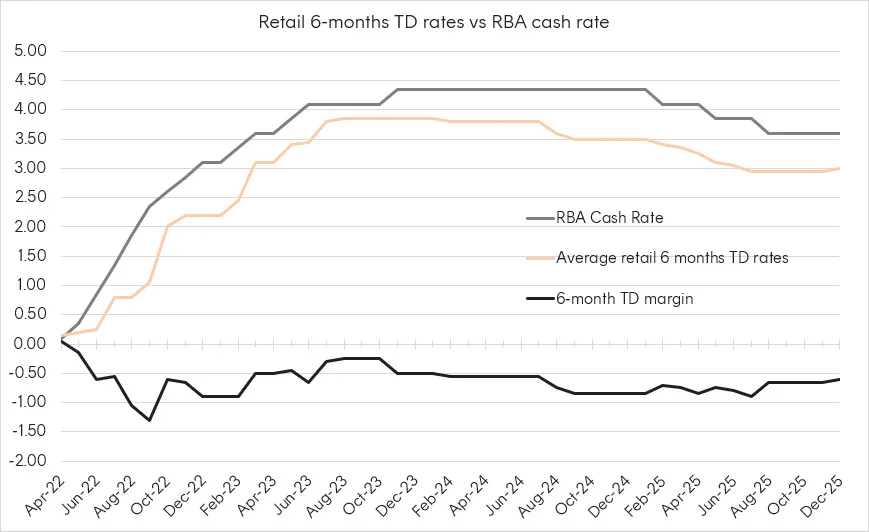

Most of Australia’s major banks have already passed on the full rate hike to mortgage holders, but they may not necessarily do the same for term deposit holders.

Since April 2022, the average six-month term deposit rate has been 0.63% below the RBA cash rate, meaning many Australians are earning less than they could.

Given that the RBA cash rate is an overnight rate, depositors would reasonably expect to be paid more, not less, for locking up their money for six months. With Australians holding approximately $1.2 trillion in non-transaction deposits such as term deposits with banks, this implies that over the past year more than $7 billion in interest income has been forgone relative to the RBA cash rate.

Source: RBA. Most recently published data is for December 2025.

Source: RBA. Most recently published data is for December 2025.

One way investors are approaching rising rate expectations

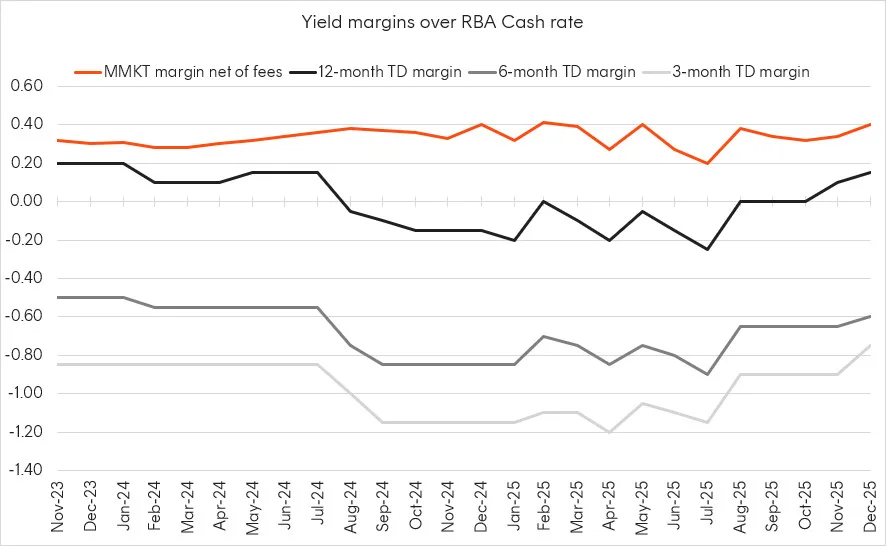

Investors in the MMKT Australian Cash Plus Active ETF have received an additional 0.37% per year in returns over the RBA cash rate since the fund started.

This compares favourably with 1-month, 3-month, 6-month and 12-month term deposits, while still offering daily access to cash and settlement through the ASX in two business days.

Source: RBA, Betashares. Most recent published deposits data is for December 2025. MMKT shows estimated YTM net of the fund’s management costs. Past performance is not indicative of future performance.*1 month TD rate has averaged a yield of between 2.4% and 3% below the RBA cash rate over the period

Source: RBA, Betashares. Most recent published deposits data is for December 2025. MMKT shows estimated YTM net of the fund’s management costs. Past performance is not indicative of future performance.*1 month TD rate has averaged a yield of between 2.4% and 3% below the RBA cash rate over the period

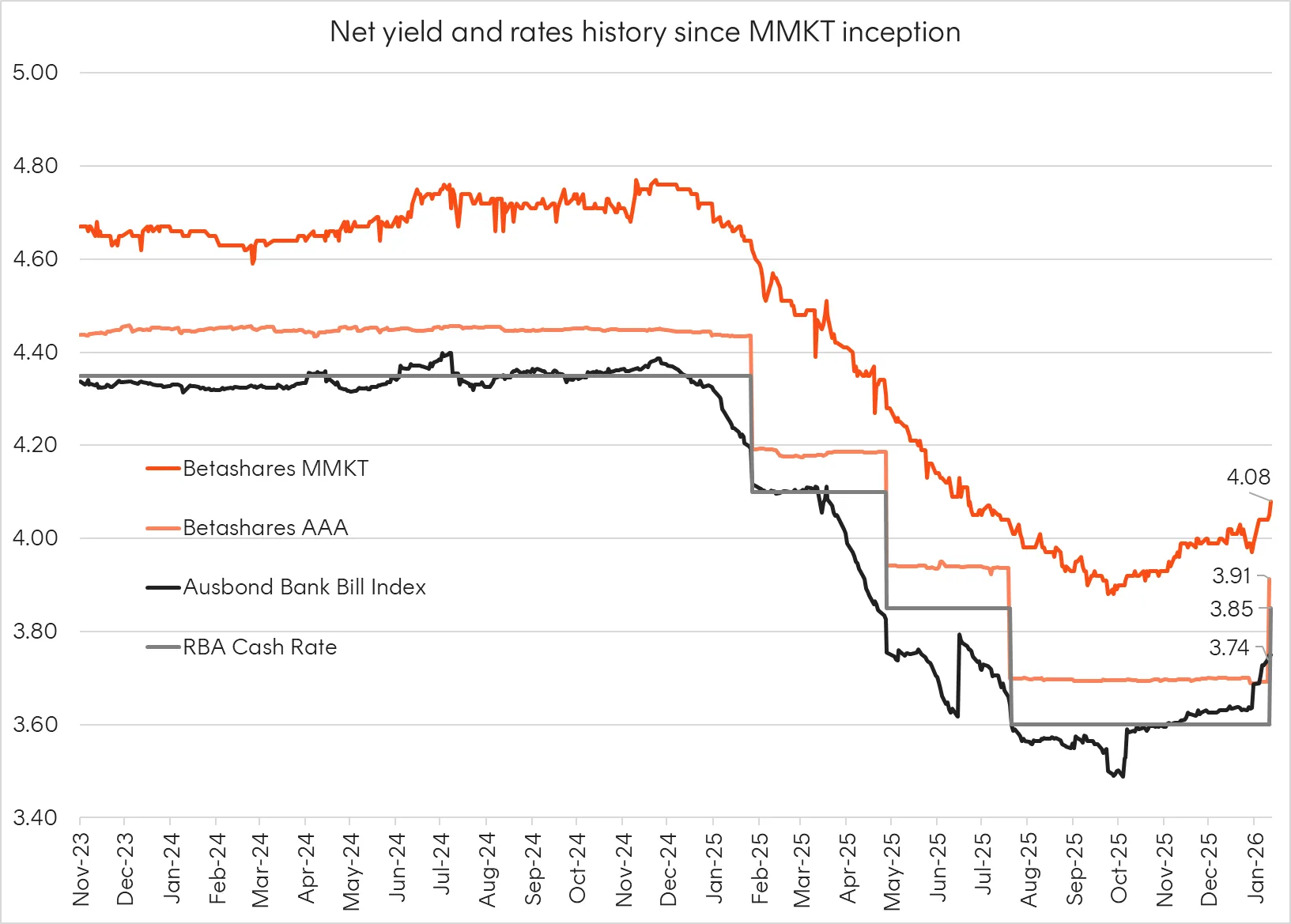

MMKT aims to track the Bloomberg AusBond Bank Bill Index, which moves ahead of official RBA decisions. This means the fund’s yield tends to rise as markets anticipate rate hikes, allowing investors to capture opportunities before they’re reflected in traditional deposit accounts.

Source: Bloomberg, Betashares. As at 4 February 2026. AAA shows the interest rate earned on AAA’s bank deposits, net of management costs. MMKT shows estimated YTM net of the fund’s management costs. Yield will vary and may be lower at time of investment. Past performance is not indicative of future performance.

Source: Bloomberg, Betashares. As at 4 February 2026. AAA shows the interest rate earned on AAA’s bank deposits, net of management costs. MMKT shows estimated YTM net of the fund’s management costs. Yield will vary and may be lower at time of investment. Past performance is not indicative of future performance.

For investors, the broader takeaway is that markets tend to move ahead of official decisions. Thinking about how cash is positioned in those periods can help ensure portfolios stay aligned with changing conditions. More information on MMKT is available on its fund page or through Betashares Direct.