6 minutes reading time

- Digital assets

Bitcoin has set fresh all-time highs, soaring above US$111K on institutional demand and regulatory clarity. The performance of the broader crypto market was mixed. Renewed tariff concerns caused a slight pullback following the highs earlier in the week.

Bitcoin rose by 3.54% and Ethereum fell by -0.72% over the seven days to 25 May 2025. Bitcoin’s market capitalisation was up to around US$2.13 trillion while the global crypto market cap was at US$3.38 trillion. Bitcoin’s market dominance was up to 63.3%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$107,686 |

$111,935 |

$102,306 |

3.54% |

|

ETH (in US$) |

$2,494 |

$2,722 |

$2,354 |

-0.72% |

Source: CoinMarketCap. As at 25 May 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

This is GENIUS

The GENIUS Act, a crypto regulation bill, passed the US Senate last week. This moves it one step closer to becoming law. This bill aims to provide a regulatory framework for stablecoins and their issuers. Stablecoins are a type of cryptocurrency where the value is pegged to another asset, like the US dollar or gold.

The bill sets rules for stablecoin issuers, including a mandate that firms hold a reserve of assets underlying the cryptocurrency. This is to protect consumers in the event of a fire sale of the relevant stablecoins. Further protection includes requiring issuers to grant holders of stablecoins priority for repayment in the event of bankruptcy. In addition, issuers must abide by certain anti-money laundering and anti-terrorism sanctions.

If the bill becomes law, it will be the first legislation in the US regulating the US$248 billion stablecoin market. This could lead to further adoption of digital assets.1

JPMorgan to allow clients to buy Bitcoin

Jamie Dimon, JPMorgan’s CEO, announced that it will soon allow clients to buy Bitcoin. This move comes as a shock because Dimon has been a vocal sceptic for years. In the past, Dimon has called Bitcoin “worthless”2 and only good for criminal activities.

Last week, Dimon told investors that “we are going to allow you to buy it, we’re not going to custody it. We’re going to put it in statements for clients.”

The CEO also reiterated his long-held scepticism about cryptocurrencies. The bank will now be able to offer Bitcoin, like other major banks such as Morgan Stanley, which already allows its financial advisers to offer some Bitcoin ETFs to eligible clients3.

CRYP company spotlight

Coinbase makes history

Last Monday, cryptocurrency exchange Coinbase (NASDAQ: COIN) joined the S&P 500. This is the first time a crypto-native company has been added to the broad market index. Coinbase first listed on the Nasdaq exchange in 2021.

According to Wall Street brokerage Bernstein, the Coinbase listing could lead to roughly $16 billion of buying pressure for Coinbase – around $9 billion from passive funds linked to the S&P 500 and $7 billion from active allocations4.

Coinbase is currently held in the CRYP Crypto Innovators ETF 5. CRYP provides exposure to global companies at the forefront of the crypto economy6.

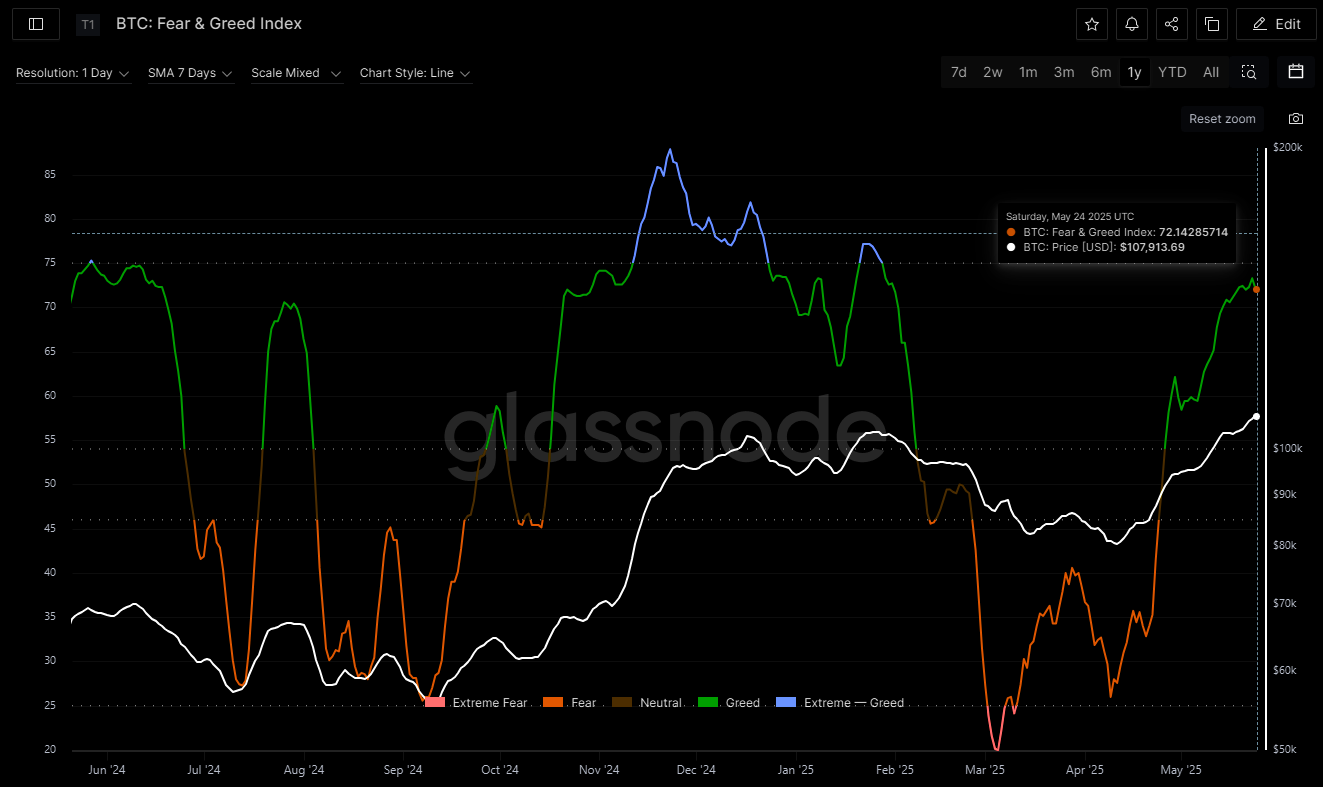

Bitcoin (BTC): Fear & Greed Index

The Crypto Fear & Greed Index is an indicator from Alternative.me that aims at capturing investor sentiment in a single number by incorporating data from multiple sources. The index ranges from 0 to 100, where 0 denotes “extreme fear”, and therefore times of exaggerated negative investor sentiment. 100 means “extreme greed” and is an indication for maximum FOMO.

As at 24 May 2025, the index is sitting in “Greed”. This indicates the current upward momentum for Bitcoin may still have legs.

Source: Glassnode. Greed is indicated by the colourful line (currently bright green). Bitcoin’s price is represented by the white line. Past performance is not indicative of future performance.

Bitcoin (BTC): Accumulation Trend Score

The Accumulation Trend Score is an indicator that reflects the relative size of entities that are actively accumulating BTC on-chain.

The scale of the Accumulation Trend Score represents both the size of the entities’ balance (their participation score) as well as the number of new coins they have acquired/sold over the last month (their balance change score).

A score closer to 1 indicates that on aggregate, larger entities (or a big part of the network) are accumulating. A value closer to 0 indicates they are distributing or not accumulating. This provides insight into the balance size of market participants and their accumulation behaviour over the last month.

According to data from Glassnode, the score hit a peak level of 1.0 last Thursday 22 May 2025. This indicates aggressive buying across the spectrum from investors of all sizes. This is a major shift from January-April when we saw most cohorts reducing their holdings.

Source: Glassnode. Past performance is not indicative of future performance.

The top 20 altcoins were mixed, but the standout was Hyperliquid (HYPE) which gained over 25% in the seven days to 25 May 2025. A flood of decentralised finance protocols and participants on the blockchain helped push the price higher.

Hyperliquid is a new entrant to the Top 20, having only launched in February. It is a Layer 1 blockchain and decentralised exchange. However, it is becoming popular within De-Fi and speculators. The blockchain is Ethereum-compatible, allowing easy integration with Ethereum-based protocols and smart contracts7.

Investing in crypto-assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets. Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://abcnews.go.com/Business/genius-act-crypto-regulation-bill/story?id=121981442

2. https://www.reuters.com/business/jpmorgans-dimon-blasts-bitcoin-worthless-due-regulation-2021-10-11/

5. As at 23 May 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

6. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

7. https://www.dlnews.com/articles/defi/defi-investors-rush-into-hyperliquid-blockchain-protocols/