6 minutes reading time

Bitcoin fell marginally last week while the broader crypto market saw sizeable declines. Macro risks, in addition to the ongoing conflict between Israel and Iran, are partly to blame.

Bitcoin and Ethereum were lower by -2.83% and -10.22% respectively over the seven days to 22 June 2025. Bitcoin’s market capitalisation is down to US$2.03 trillion while the global crypto market cap fell to US$3.14 trillion. Bitcoin’s market dominance is up to 64.9%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$102,491 |

$108,845 |

$101.229 |

-2.83% |

|

ETH (in US$) |

$2,271 |

$2,671 |

$2,240 |

-10.22% |

Source: CoinMarketCap. As at 22 June 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

SEC Chair considers exemption framework for DeFi

Recently, US Securities and Exchange Commission (SEC) Chairman Paul Atkins suggested the regulator is working on policy that would ease barriers for decentralised systems and protect developers from overreach. This ‘Innovation Exemption’ would aid DeFi by aligning US financial regulations with Web3 innovation. It has the potential to generate significant growth for blockchain-based platforms.

In early June, at the last of five crypto roundtables, Atkins suggested that software developers who are building DeFi tools should not be blamed for how they are used. Atkins said, “Many entrepreneurs are developing software applications that are designed to function without administration by any operator1.” DeFi is a blockchain-based system that provides financial services with code instead of traditional intermediaries.

Stablecoin adoption looms

Last week, Visa announced an expansion of its stablecoin settlement capabilities across Central and Eastern Europe, Middle East and Africa. The expansion is being made possible through a new partnership with pan-African fintech Yellow Card. The partnership will experiment with stablecoins across licensed African markets, looking to smooth treasury operations and enhance liquidity.

Regarding the future of financial transactions, Visa believes it will be necessary to integrate stablecoins into global payment systems, meaning any company involved in moving money will need to consider its own stablecoin strategy2.

CRYP company spotlight

Road to 10,000 Bitcoin

Bitcoin-first company Metaplanet now holds 10,000 BTC and is the ninth largest corporate holder of Bitcoin. The company started acquiring Bitcoin in 2024 and had only 1,761 BTC by the end of the year. Metaplanet is targeting 100,000 BTC by the end of 2026 and 210,000 BTC by the end of 2027.

Once a budget hotel business called Red Planet Japan, the company pivoted towards crypto, web3 and non-fungible tokens (NFTs) after COVID hit in 20203. Over the last 12 months, its stock price has increased over 1600% (as at 23 June 2025).

Metaplanet is a holding in the Betashares Crypto Innovators ETF (ASX: CRYP)1. CRYP provides exposure to global companies at the forefront of the crypto economy.

No assurance is given that this company will remain in the portfolio or will be a profitable investment.

HODL Waves

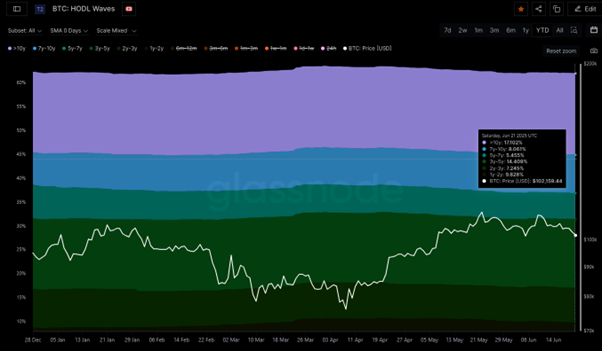

This metric uses blockchain data to show the amount of Bitcoin in circulation grouped into different age bands, aka HODL waves. Each coloured band shows the percentage of BTC in existence that was last moved within the time period denoted in the legend.

According to data from Glassnode, 37.9% of BTC in existence moved in the last year, as at 21 June 2025. 31.48% of Bitcoin in existence have not moved in the last one to five years while roughly 30% of BTC have not moved in more than five years.

Source: Glassnode. Past performance is not indicative of future performance.

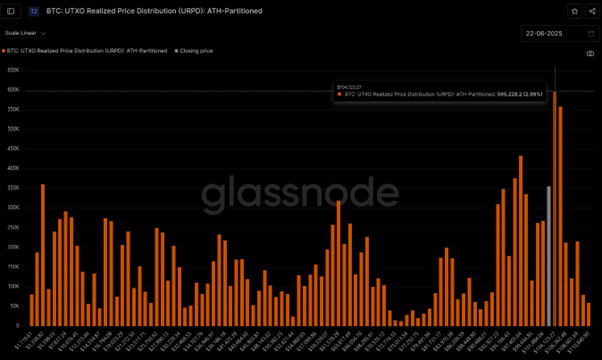

UTXO Realised Price Distribution (URPD): ATH-Partitioned

UTXO Realised Price Distribution (URPD) shows the prices at which the current set of Bitcoin UTXOs were created. That is, each bar shows the number of existing Bitcoins that last moved within that specified price bucket.

The price specified on the X-axis refers to the lower bound of that bucket. ATH-partitioned means that the price buckets are defined by dividing the range between 0 and the current ATH in 100 equally spaced partitions.

According to data from Glassnode, about 5% of BTC UTXOs were created between $104,123 and $105,242 (as at 22 June 2025). This suggests a stronger price floor at those levels.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

Most of the Top 20 altcoins were down over the last seven days to 22 June. However, there was positive news last week regarding the XRP token.

Canadian regulators approved a spot XRP ETF which began trading on 18 June on the Toronto Stock Exchange. The asset manager of the world’s first spot bitcoin ETF in 2021, Purpose Investments, launched the Purpose XRP ETF trading under the ticker (TSX: XRPP)6. XRP is the 4th largest cryptocurrency by market cap, sitting at $123 billion at the time of writing.

References:

1. https://www.coindesk.com/policy/2025/06/09/u-s-sec-chair-says-working-on-innovation-exemption-for-defi-platforms

2. https://news.bitcoin.com/visa-all-money-moving-institutions-will-need-stablecoin-strategy-this-year/

3. https://www.ccn.com/news/crypto/metaplanet-bitcoin-budget-hotel-btc-treasury/

4. As at 20 June 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. https://www.coindesk.com/markets/2025/06/16/spot-xrp-etf-set-to-start-trading-in-canada-this-week-after-regulatory-nod-token-up-7

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.