4 minutes reading time

- Fixed income, cash & hybrids

For financial intermediary use only. Not for distribution to retail investors.

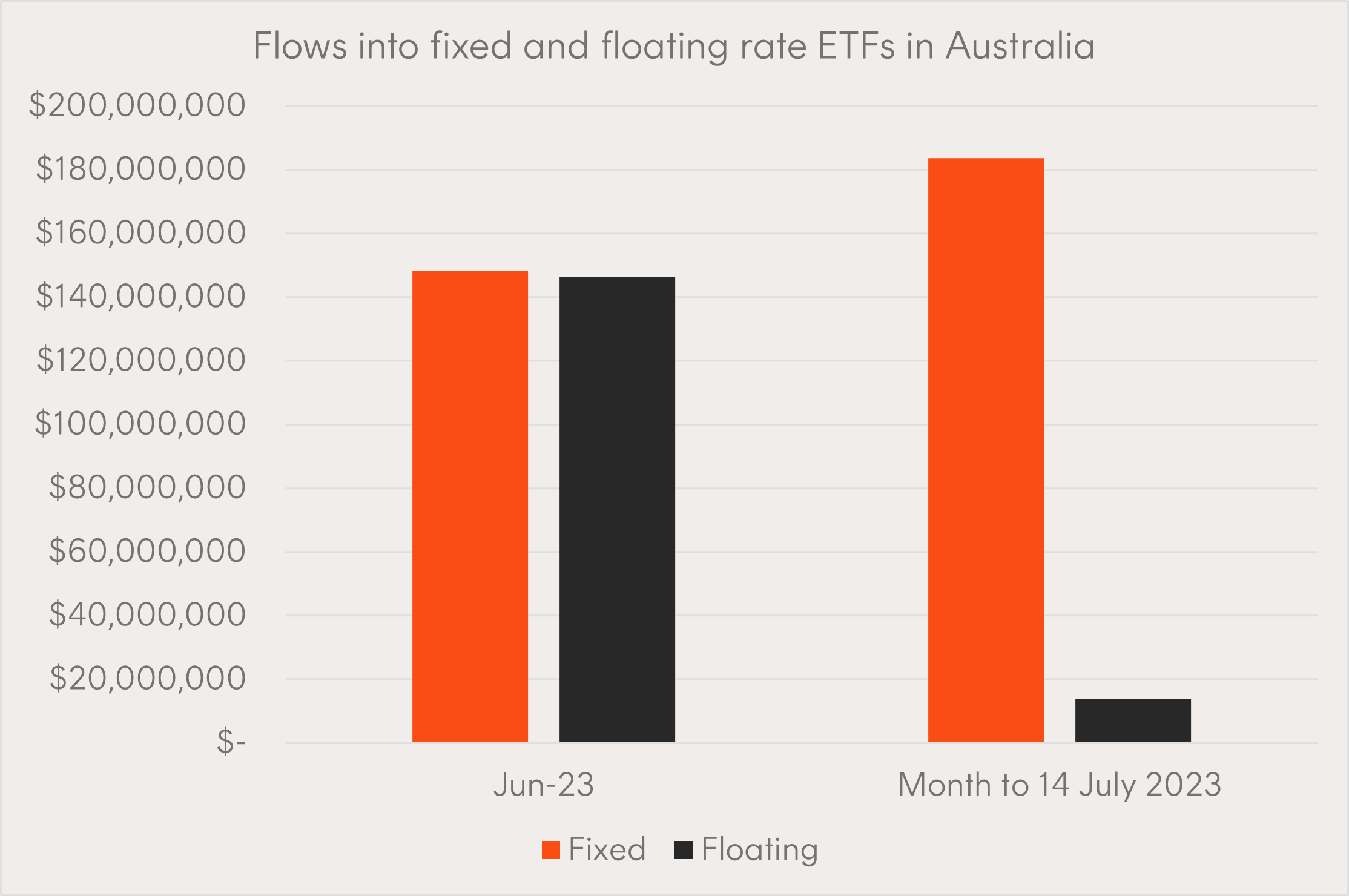

Over the past month, we have noticed a significant increase in client inquiries regarding our fixed-rate bond exposures. This has coincided with an estimated $184 million of net flows across the Australian ETF industry into fixed-rate bond ETFs, compared to only $14 million flowing into floating-rate bond ETFs (these estimates are based on our analysis of CBOE and ASX trading data over the two-week period from 1 July 2023).

For context, in the month of June, there were estimated net flows of $148 million into fixed-rate bond ETFs and $146 million into floating-rate bond ETFs. This represents a distribution split of approximately 50% fixed-rate versus 50% floating-rate for June. However, in July so far, the distribution has shifted to approximately 90% fixed-rate and 10% floating-rate.

Source: CBOE, ASX, Betashares. Estimates based on CBOE and ASX trading data over the two-week period from 1 July 2023. Data includes fixed and floating-rate bond ETFs available in Australia and does not include cash ETFs.

Alongside these inquiries and flows, we have also observed and disseminated market commentary regarding the attractiveness of fixed-rate bonds in the current market environment.

It was highlighted in the AFR that the three-year bond yield crossed the nominal dividend yield on the S&P/ASX 200 Index for the first time in over a decade (as at 30 June 2023) at a time when households and institutions have been moving money into fixed income and cash. Similarly, some wealth management firms, like LGT Crestone, are warning investors may be nearing their last chance to lock in elevated returns from fixed-rate securities for a number of years.

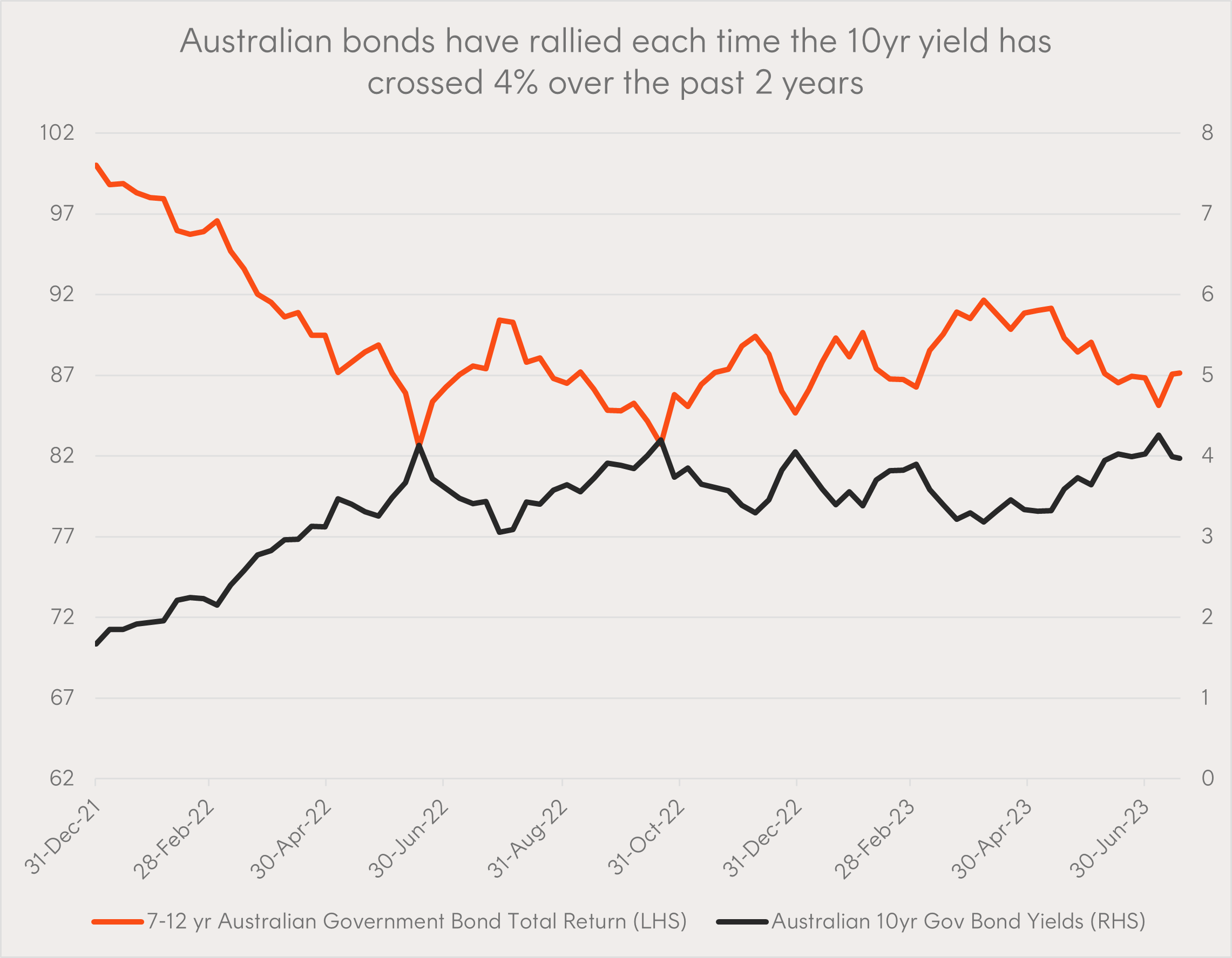

We wrote an insight into why fixed-rate bonds have been appealing again in 2023, with investors benefiting from an income buffer to returns and negative correlations to equities returning. We highlighted that the Australian 10-yr government bond yield crossing 4%, as it did again on 30 June, signalled a potential buying opportunity for fixed-rate bond investors over the past 12 months. Investors have seemingly been comfortable that yields will not need to rise materially before the end of this rate hiking cycle and can provide income and defensive benefits. Recent soft US inflation prints, and central bank pauses, may be a sign these investors could be correct.

Source: Bloomberg. 7-12 yr Australian Government Bond performance represented by total return of Betashares Australian Government Bond ETF (ASX: AGVT) net of fees and costs. Past performance is not indicative of future performance.

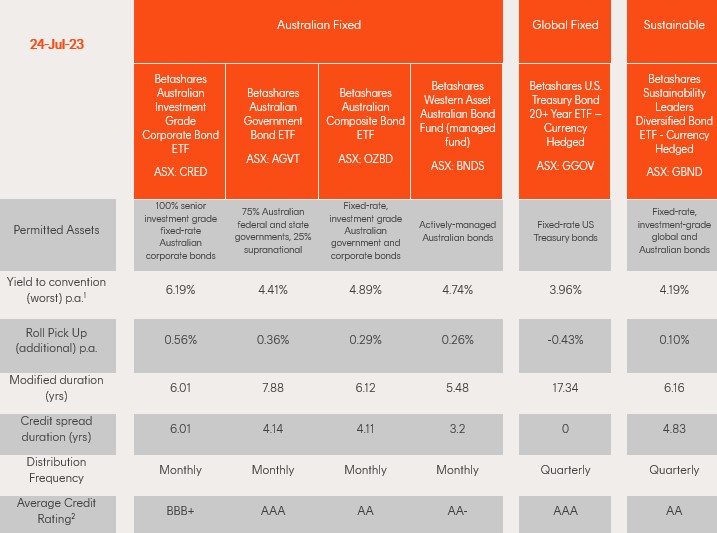

Implementation

Betashares has continued to be the dominant fixed income ETF provider in the Australian market, capturing 44% of net flows into cash and fixed income funds ETFs over the 12 months to 30 June 2023 (Source: Morningstar). We currently offer the largest range of fixed rate bond ETFs in the Australian market. For more information on any of the below funds please reach out to your respective sales representative.

Source: Betashares. Data as at 24 July 2023.

1. Total expected return from the bond portfolio, if held to maturity or called, the bonds do not default and the coupons are reinvested. Assumes no change in interest rates. Subject to change over time. Data for GGOV & GBND are unhedged yields and do not take into account FX hedging impact. Estimated FX hedging impact for GGOV is -1.12% p.a. and for GBND is 0.19% p.a.

2. Average credit rating for the bonds in the portfolio. Credit ratings should not be used as a basis for assessing investment merit. Ratings are subject to change.

Betashares Capital Ltd (ABN 78 139 566 868 AFSL 341181) (Betashares) is the issuer of the funds mentioned. This is general information only and does not take into account any person’s particular circumstances. Investors should read the Product Disclosure Statement and Target Market Determination (at www.betashares.com.au) before deciding to buy or hold units. To the extent permitted by law, Betashares accepts no liability for any loss from reliance on this information. Future outcomes are inherently uncertain. Actual outcomes may differ materially from those contemplated in any opinions, estimates or other forward-looking statements given in this information.