Bitcoin struggles as sentiment sours

7 minutes reading time

If you’d like to listen to an audio version of Off the Chain, click here:

Bitcoin and the broader crypto market hit new all-time highs over the last seven days, with Bitcoin topping the US$124K level on 11 August 2025. However, after the US PPI inflation print came in higher than anticipated, catching markets off guard, prices pulled back.

Bitcoin and Ethereum were up by 0.26% and 6.85% respectively over the seven days to 17 August 2025. Bitcoin’s market capitalisation is now over US$2.3 trillion while the global crypto market cap is up to US$4 trillion. Bitcoin’s market dominance, however, sank to 58.7%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$118,098 |

$124,457 |

$105,398 |

0.25% |

|

ETH (in US$) |

$4,471 |

$4,782 |

$4,169 |

6.85% |

Source: CoinMarketCap. As at 17 August 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not consider any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Harvard goes long on Bitcoin

Harvard University has quietly made one of the biggest Bitcoin bets ever disclosed by a US university endowment. As of 30 June, Harvard Management Company – steward of the school’s US$50 billion endowment fund – declared a US$116 million stake in BlackRock’s iShares Bitcoin Trust (NASDAQ: IBIT).

The position, revealed in its latest SEC filing, highlights how Bitcoin is moving from the fringes into some of the most traditional and conservative institutional portfolios. For a university endowment of Harvard’s scale to allocate at this level is a milestone moment for both digital assets and mainstream finance1.

US retirement funds open to crypto

In a sweeping move, President Trump has signed an executive order that could reshape the future of American retirement savings. The US$12 trillion defined contribution (DC) market2 could soon be opened to cryptocurrency, gold and private equity, pushing beyond the familiar world of stocks and bonds.

The Department of Labor has 180 days to review the new rules but big players aren’t waiting around. Asset management giants like State Street and Vanguard have already struck partnerships with alternative managers to roll out private equity focused retirement products.

While this shift could allow access to alternative asset classes, it also brings new risks into everyday retirement accounts – higher fees, greater volatility and reduced liquidity. For millions of Americans, this could mark the beginning of a new era in retirement investing: one that blends opportunity with uncertainty3.

CRYP company spotlight

Marathon to acquire HPC and AI company

Marathon Digital holdings (NASDAQ:MARA), one of the biggest Bitcoin miners on the planet, is buying a 64% majority stake in Exaion, a heavyweight in high-performance computing (HPC) and AI infrastructure. The price tag of this transaction is US$168 million. The move is MARA’s largest push beyond mining and into the AI/HPC arena, with the deal expected to close by late 2025 or early 2026.4

Marathon Digital Holdings is held in the Betashares Crypto Innovators ETF (ASX: CRYP).5 CRYP provides exposure to global companies at the forefront of the crypto economy.6

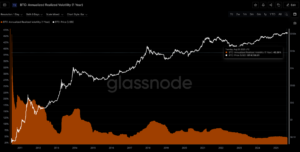

Bitcoin (BTC): Annualised Realised Volatility (1 Year)

Realised volatility shows how much the price of Bitcoin moves up and down, based on daily changes over the past year. Higher volatility means the price is less stable and carries more risk. We measure this by looking at how much the price changes each day, then adjust the number to show what it would be over a full year. This helps investors understand how unpredictable the market can be.

As of 16 August 2025, Glassnode data suggests annualised realised volatility over the last 12 months is at all-time lows of 44.66%. This could suggest that historic volatility of +50% is on the decline due to the size of the asset (> US$2 trillion) coupled with the entry of institutional investors.

Source: Glassnode. Past performance is not indicative of future performance.

Bitcoin (BTC): 4-year Compound Annual Growth Rate (CAGR)

This chart presents the 4-year Compound Annual Growth Rate (CAGR) for Bitcoin through its history. CAGR is the mean annual growth rate over a period longer than one year and is believed to be one of the most accurate methods for calculating the returns of an asset or portfolio. The 4-year period was selected to capture both the classic halving cycle, whilst also accounting for the typical bull/bear cycle which tends of be of a similar duration.

As of 16 August 2025, Glassnode data suggests the 4-year CAGR is at 27.3% with realised volatility falling (as per previous chart).

Source: Glassnode, as at 2 August 2025. Past performance is not indicative of future performance.

Altcoin news

Most top 20 altcoins were higher in the seven days to 17 August 2025. Making headlines was the official end to one of crypto’s biggest legal battles: Ripple Labs vs. the US Securities and Exchange Commission (SEC).

The saga started in December 2020 when the SEC argued that Ripple’s XRP was an unregistered security offering. But last week, the SEC stated it had ended its case with Ripple Labs. In 2023, US District Judge Analisa Torres ruled that XRP was a security when it was sold to institutions, but not when XRP was sold by Ripple on public exchanges. A US$125 million fine was imposed in August 2024, but both parties have agreed to dismiss their appeals of the fine and leave the amount intact, thereby marking “an end” to the case7.

XRP is currently the third largest cryptocurrency by market cap as measure on CoinMarketCap.

Investing in crypto-assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

CRYP provides focused exposure to companies involved in servicing crypto-asset markets or which have material investments in crypto-assets. Crypto-assets are highly speculative in nature and companies with significant exposure to crypto-asset markets can be expected to have a very high level of return volatility. CRYP does not invest in crypto assets directly, and does not track price movements of any crypto assets.

For more information on risks and other features of the fund, please see the relevant Product Disclosure Statement and Target Market Determination at www.betashares.com.au

References:

2. https://www.ici.org/statistical-report/ret_25_q1

3. https://www.bbc.com/news/articles/c62w8ewg849o

5. As at 15 August 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

6. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.