Bitcoin struggles as sentiment sours

6 minutes reading time

If you prefer to listen to Off the Chain, please click the player below.

Note: The audio was generated with the help of an AI play-to-listen software.

Bitcoin and the broader crypto market are ending the last full week of the month and quarter in the red, with Bitcoin sitting under $110K. Both Bitcoin and Ether ETFs saw net outflows.

Bitcoin and Ethereum were down -5.48% and -10.39% respectively over the seven days to 28 September 2025. Bitcoin’s market capitalisation is at US$2.18 trillion while the global crypto market cap is at US$3.77 trillion. Bitcoin’s market dominance is up to 57.8%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$109,534 |

$115,866 |

$108,776 |

-5.48% |

|

ETH (in US$) |

$4,015 |

$4,496 |

$3,829 |

-10.39% |

Source: CoinMarketCap. As at 28 September 2025. Past performance is not indicative of future performance. Performance is shown in US dollars and does not consider any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Big first for US crypto investing

Last Wednesday, the SEC gave the green light to the country’s first multi-asset crypto ETF. Grayscale’s Digital Large Cap Fund (GDLC) has been cleared to list, giving investors exposure to five of the biggest names in crypto: Bitcoin, Ether, XRP, Solana and Cardano.

It’s a milestone that finally moves US crypto investing beyond single-coin funds and into a diversified basket. For US investors, that should mean easier access, tighter spreads across top assets and less hassle than managing multiple wallets or trades1.

Tether seeks US$20 billion in funding – and a possible US$500 billion valuation

Tether is reportedly chasing a US$500 billion valuation – a level that would rank it among the world’s most valuable private companies. The stablecoin issuer has confirmed it is raising US$15–20 billion in exchange for an approximate 3% stake. Cantor Fitzgerald is advising on the deal.

The move would mark a huge leap for Tether, the quiet giant behind the world’s largest stablecoin. It has turned massive reserves and soaring interest income into eye-watering profits – pulling in US$4.9 billion in Q2 alone and US$5.7 billion year to date. On a per-employee basis, it’s now one of the most profitable companies on the planet.

According to CEO Paolo Ardaino, Tether is looking to expand existing business lines and build new ones including stablecoins, AI, commodity trading, energy, communications and media.2

CRYP company spotlight

Alphabet buys into bitcoin miner

Google’s parent company has secured a deal that could give it a 5.4% stake in New York-based crypto data centre player Cipher Mining (NASDAQ: CIFR). The move comes via a 10-year lease with UK-based Fluidstack, an AI cloud platform that builds and operates HPC clusters. Google has guaranteed US$1.4 billion of commitments, with the option to acquire a matching US$1.4 billion equity stake. If the full deal plays out, Cipher could raise as much as US$7 billion.3

Cipher Mining Inc. is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.5

Bitcoin (BTC): Price drawdown from ATH

This chart shows the percentage drawdown of the asset’s price from the previous all-time high.

According to data from Glassnode, as of 27 September 2025, BTC is down 11% from its all-time high set on 14 August 2025.

Source: Glassnode. Past performance is not indicative of future performance.

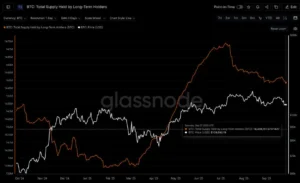

Bitcoin (BTC): Total supply held by long-term holders

This metric shows the total amount of circulating supply held by long term holders. Coins are considered long- or short-term based on when they were bought, using a formula that treats coins older than around 155 days (give or take 10 days) as long-term.

According to data from Glassnode, as of 27 September 2025 there has been a slight decline in long-term holders since July. This indicates that there has been some profit-taking occurring from around US$119K down to current levels.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The top 20 altcoins were all in the red over the last seven days to 28 September 2025. However, since its 17 September 2025 debut, ASTER has rocketed more than 2,400%, catapulting the token into the Top 40 with a market cap of about US$2.9 billion.

ASTER fuels a decentralised perpetuals platform challenging Hyperliquid’s lead, operating on multiple chains but primarily on BNB. The project has received the blessing of some heavy hitters – most notably Binance co-founder and former CEO Changpeng Zhao (better known as CZ), who has given it public support and a push on his X account.6

Investing in crypto-assets or companies servicing crypto-asset markets should be considered extremely high risk. Exposure to crypto assets involves substantially higher risk than traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

1. https://cointelegraph.com/news/sec-first-us-multi-crypto-etp-grayscale-ceo

4. As at 26 September 2025. No assurance is given that this company will remain in the portfolio or will be a profitable investment.

5. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.

6. https://cryptopotato.com/aster-emerges-as-top-trending-token-on-coingecko/

Off the Chain is published every second Tuesday. It provides the latest news on Bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.