5 minutes reading time

In January 2021, American bricks-and-mortar retailer GameStop became the biggest story in the financial world – not because it was making great strides in AI or paying out giant dividends. It was because a group of retail investors thought it was undervalued.

GameStop became the poster child of a story that could be seen as a modern-day David vs Goliath. The share price soared almost 200 times from its April 2020 low, hitting a pre-market high of nearly US$500 per share on 28 January 20211. It looked like a win for the retail investors who were trying to upset the pros at their own game. Four days later, however, the stock price was worth 80% less – and a lot of those same investors were left licking their wounds.

GameStop’s story would prove not to be the last in the “meme stock” saga, and its significance continues to be felt by investors of all stripes.

GameStop has had many imitators since

GameStop was the original example of what has come to be known as a meme stock. These are companies that gain popularity (in some cases, cult-like) among retail investors through social media. They are often proliferated through websites like X and Reddit forums such as r/WallStreetBets, which is where the GameStop story started.

Other stocks have become meme stocks too. Examples include

- BlackBerry

- Nokia

- Bed Bath & Beyond, and more recently

- Krispy Kreme

- OpenDoor Technologies

Although these are five vastly different businesses, their stories have similar traits. As the Nasdaq Index Research Team summarise:

- Early adopter phase: A large handful of investors believe a particular stock is undervalued and begin to buy in large quantities.

- Middle phase: People who are paying attention begin to notice the increase in volume. More individuals start buying and the stock’s price skyrockets.

- Late/FOMO phase: Word about the stock spreads across social media and online forums. Fear of missing out, or FOMO, takes hold and more retail investors join in.

- Profit taking phase: Sometimes, after only a few days, some investors begin to cash out. Just like the buying phase, the selling phase becomes a chain reaction as people fear losing money. This is when the meme stock cycle ends.

In other words, it’s a ripple effect: volume builds, investors pile in and the hype gathers pace. But when sentiment turns, those ripples can quickly become waves in the opposite direction, pulling the stock price down along with it.

The frenzy almost never ends well

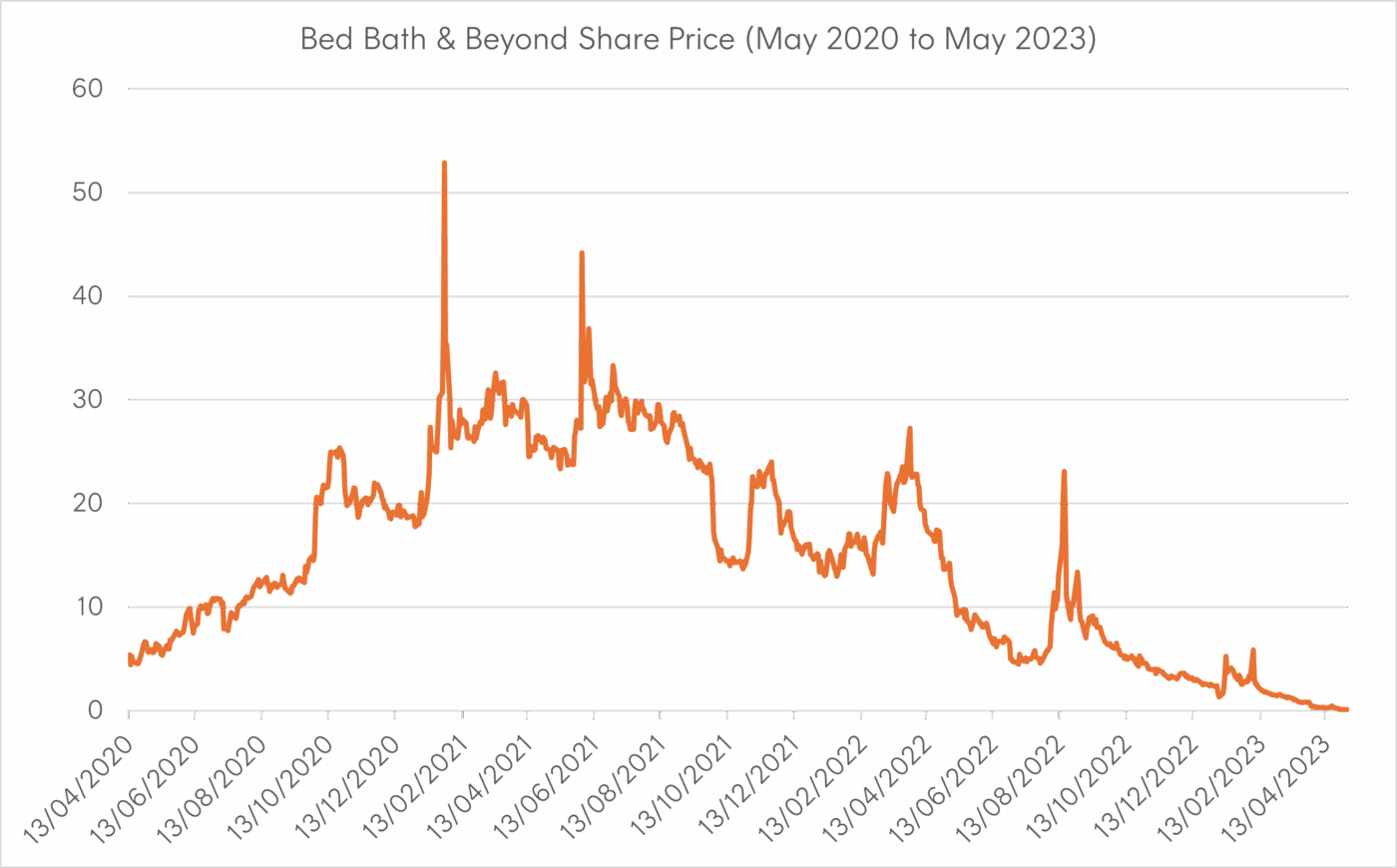

In the case of Bed Bath & Beyond, the share price of the home furnishings retailer surged in January 2021. In one day (11 January 2023), Bed Bath & Beyond shares jumped 69%2. Its stock was among the top three companies traded in a single day on an American retail trading platform.

But in just a matter of days, it lost all that steam. Less than two years later, Bed Bath & Beyond filed for bankruptcy and delisted from the stock exchange.

Source: Bloomberg. Note, Bed Bath and Beyond delisted in May 2023.

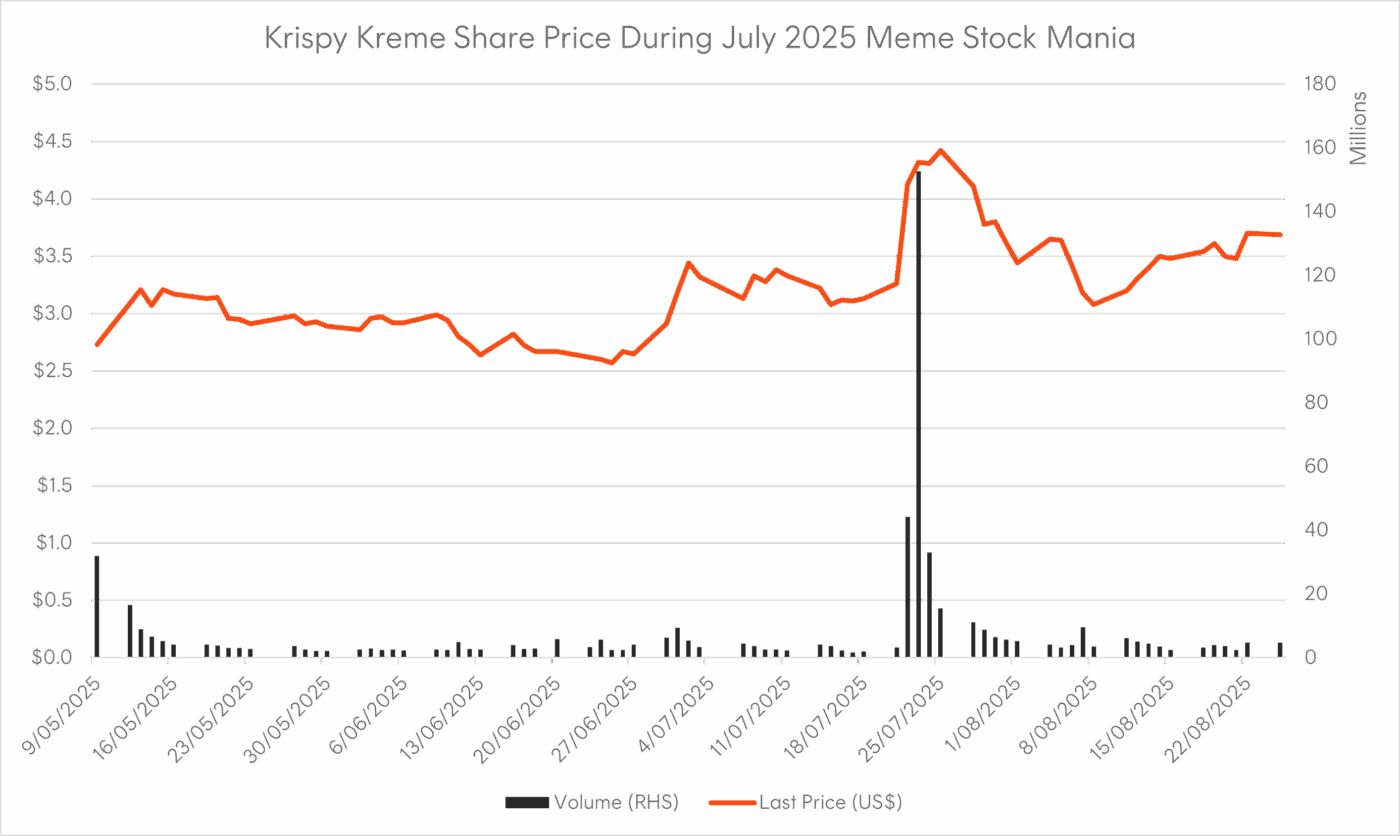

More recently, donut icon Krispy Kreme was the subject of a meme stock-inspired rally. On the first day of its rally (23 July 2025), Krispy Kreme shares soared 27%. Less than two weeks later (7 August 2025), a combination of a disappointing earnings report and news of the end of its partnership with McDonald’s, led to shares falling back to its pre-meme stock rally levels.

Source: Bloomberg. Past performance is not an indicator of future performance.

This meme mania has even affected ETFs in the past. In late 2021, the MEME ETF was launched by Roundhill Investments. It tracked the performance of stocks that had elevated social media activity and high interest from short sellers. The ETF closed less than two years later because of, ironically, too little trading volume and investor interest.

It’s worth clarifying that not all meme stocks end in disaster – but often, these stories play out like Bed Bath & Beyond and Krispy Kreme.

What building long-lasting wealth takes

The meme stock phenomenon shows that ‘getting rich quick’ is both hard to pull off. In most cases, far less rewarding than building wealth sustainably over time. There’s a reason that compounding – not meme investing – has been dubbed the eighth wonder of the world.

It’s also a great case in behavioural finance. Emotions play a key role in many of life’s decisions. But in investing, recognising your biases and learning how to manage them is one of the most powerful skills you can develop. To learn about some common investment biases, you can see a list of five of them here.

So, what can you learn from all this? Here are five tips to being a better investor:

- Have a plan, and set a clear goal you’re confident you can stick to

- Contribute regularly through Auto-invest so your emotions have less influence on your decisions

- Diversify your portfolio across a range of asset classes and investments

- Avoid checking your performance every hour of every day

- Use reputable sources and research your investments.

Best of all, you don’t need a fortune to action any of these tips; just consistency and the ability to separate the signals from the noise.

Sources:

1. https://www.thestreet.com/investing/stocks/a-timeline-of-the-gamestop-short-squeeze ↑

2. https://www.reuters.com/business/retail-consumer/retail-darling-bed-bath-beyond-set-rise-third-straight-session-2023-01-11/ ↑