7 minutes reading time

Emerging markets are the engines of global growth. With vast populations, a rising middle class and advancements in technology, this region is expected to contribute about 65% of the world’s economic growth by 20351.

No longer are these nations reliant on traditional sectors such as agriculture and cheap goods manufacturing but have instead transitioned to become leaders of the new world in domains covering technology and finance.

Despite this, investors often underappreciate these growth dynamics with emerging markets underrepresented in global portfolios.

In this note we explore how emerging markets are driving the future of global growth through unique demographics and technology, the roles they can play within investors’ portfolios, and why a passive exposure might make sense for investors.

Engines for tomorrow’s future

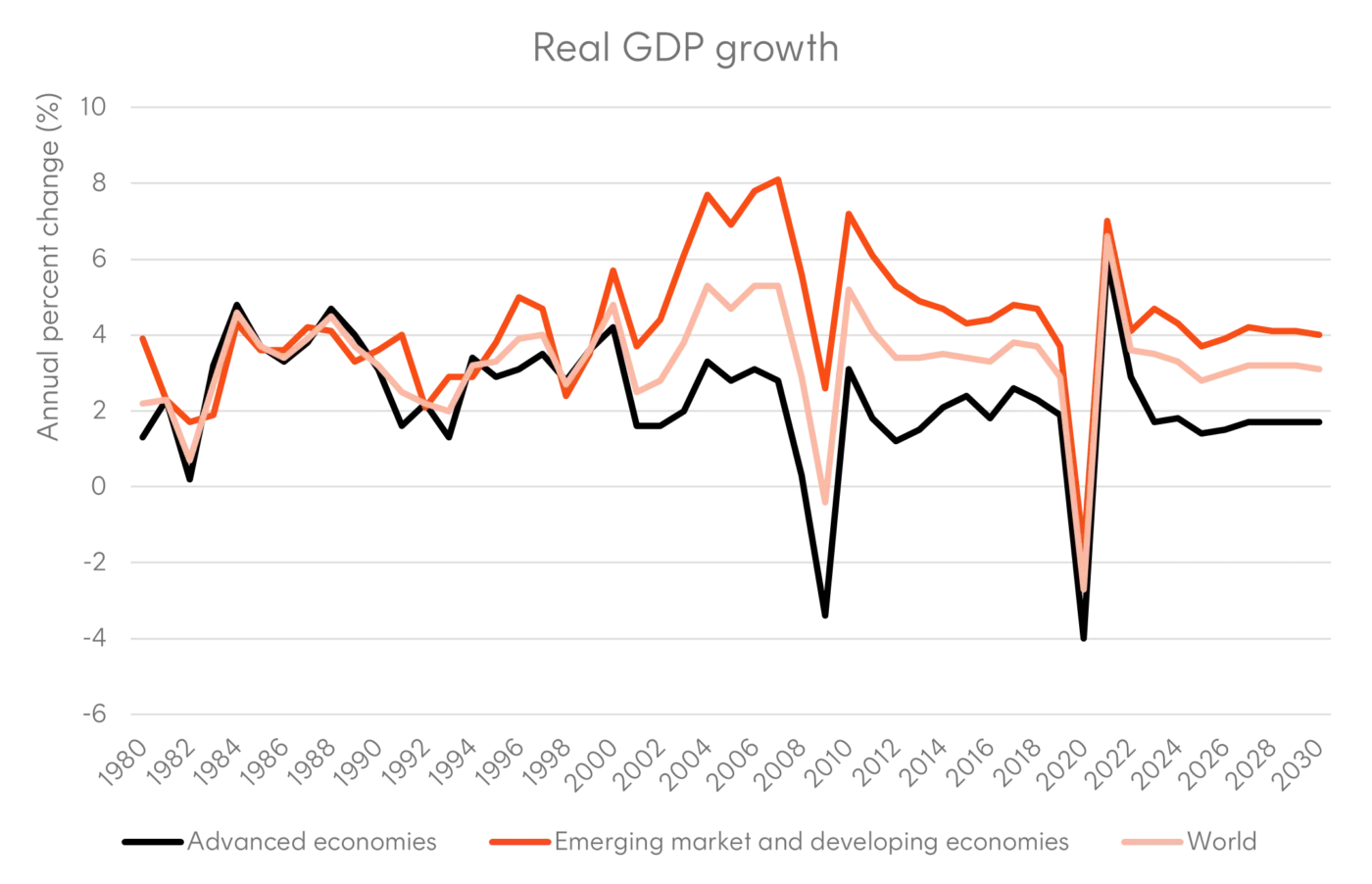

While many developed nations face falling fertility rates and lower potential growth, emerging markets offer strong structural growth opportunities with expected real GDP growth of 4.0% per year by 2030, compared to just 1.7% for developed markets according to the International Monetary Fund (IMF).

Underpinning this are sizeable populations which are both growing fast and becoming increasingly affluent. Over 80% of global population growth is expected to occur in these regions with the middle-class population forecast to double over the next decade from 354 million households in 2024 to 687 million households by 20342.

These trends will likely drive consumption levels higher with a trend towards premiumization and discretionary spending. Local companies are also positioned to capitalise on rising demand across goods and services – increasing both profit and share market return potential.

Source: IMF Data Mapper. Real GDP growth data from 2026 to 2030 are IMF estimates. Real GDP measures the Gross Domestic Product (GDP) of a country adjusted for inflation.

Source: IMF Data Mapper. Real GDP growth data from 2026 to 2030 are IMF estimates. Real GDP measures the Gross Domestic Product (GDP) of a country adjusted for inflation.

Transitioning towards the new world economy

Beyond demographics, much of emerging markets growth will be driven by the new world economy as nations such as China and India have or are already transitioning away from old world sectors such as traditional goods manufacturing and agriculture.

No longer are these countries subject to swings in these cycles but are instead home to new leaders across technology and consumer sectors, paving the way for more sustained periods of growth.

The resurgence of Chinese equities this year has been driven by the likes of Alibaba, Tencent and Xiaomi which have all seen strong earnings growth from the integration of home-grown AI models including DeepSeek R1 and Qwen3. Technological leadership has become a key strategic national priority for China, much as it has for the US.

Further, India’s push to integrate technology throughout its economy began in 2015 with the launch of the Digital India Program which consists of two layers: a) Aadhaar – a unique social security ID that uses biometric and demographic data, and 2) UPI (Unified Payments Interface) – an instant payment system.

Together, they set the right framework that would eventually facilitate the flow of credit across the country. In fact, more than 560 million bank accounts have been opened over the past 11 years with 67% of accounts opened in rural/semi-urban areas3. This surge has fundamentally transformed access to banking facilities for millions of previously unbanked citizens and has created a strong foundation that fuels investment and innovation.

Beyond technology, we have also seen promising government-led economic reforms that have strengthened India’s capital markets including the country’s Systematic Investment Plan (SIP) where individuals can save and invest monthly deposits into mutual funds.

Abroad in other emerging markets, Brazil’s pension reforms in 2019 and Indonesia’s focus on building infrastructure capacity are other developments aimed at creating a foundation for long-term economic growth.

How do emerging markets fit in an investor’s portfolio?

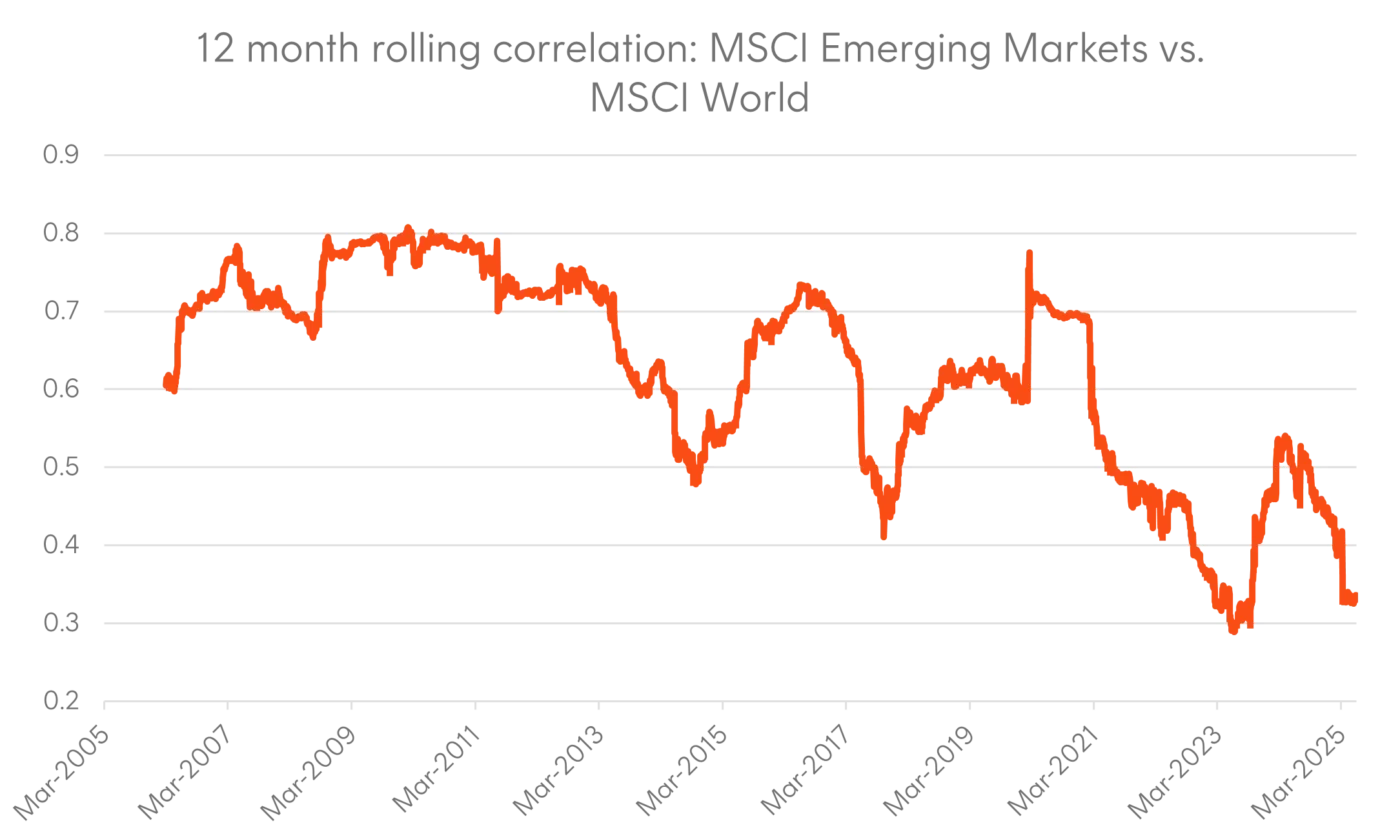

With these unique characteristics, emerging markets have historically demonstrated lower correlations and asynchronous economic and market cycles to US and developed markets. Hence, including emerging markets can increase overall portfolio diversification.

Source: Bloomberg. As at 30 June 2025.

Source: Bloomberg. As at 30 June 2025.

Additionally, emerging market equities are currently trading at attractive valuations which may provide further upside support. At a forward price to earnings ratio4 of around 14x, the MSCI Emerging Markets Index currently trades at a 35% discount to its developed market counterpart, significantly higher than the 20-year average discount of 21%.

While part of that discount has been driven by weaker equity market performance in China since the 2020 covid period, we are seeing these emerging economies maturing with stronger institutional frameworks, fundamentals, and improving current account surpluses.

Source: Bloomberg. As at 31 July 2025. Past performance is not an indicator of future performance. You cannot invest directly in an index.

Why use a passive approach in emerging markets?

With the case outlined for emerging markets, investors next need to consider how they can gain exposure to this region.

Active managers often come to mind when one thinks of emerging markets given the conventional wisdom that less efficient markets like emerging markets provide a fertile hunting ground for alpha to be made.

However, data from Morningstar below paints a different picture with many Australian domiciled emerging market equity funds underperforming the MSCI Emerging Markets Index.

Source: Morningstar Direct. As at 30 June 2025. Analysis across 29 Australian domiciled Emerging Market Equity funds.

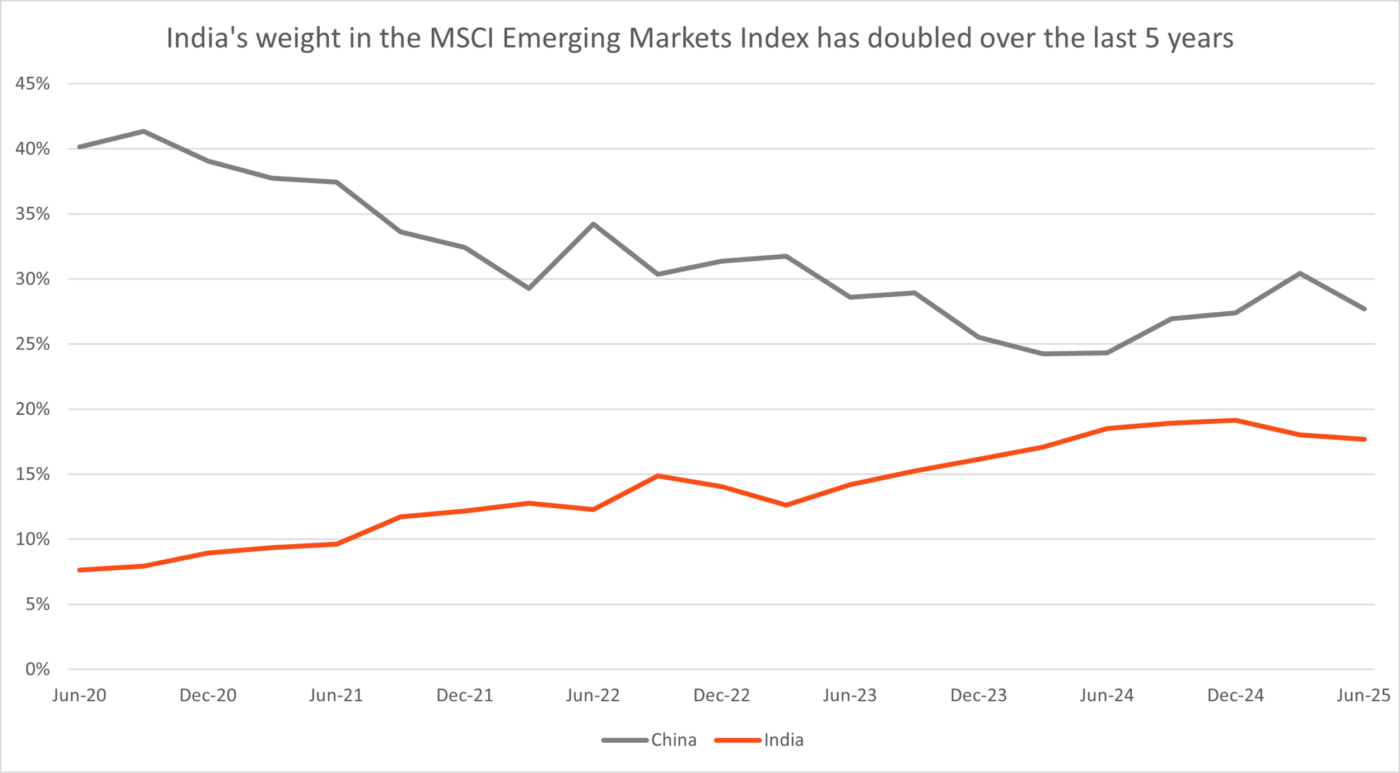

Instead, a passive strategy may help investors capture potential structural growth winners of the future without having to pick individual regions. For example, India’s weight in the MSCI Emerging Markets Index has doubled over the last 5 years. Active managers who were underweight Indian equities during this period would have underperformed the Index.

Source: Bloomberg. As at 30 June 2025. China and India weightings in MSCI Emerging Markets Index represented above.

And whilst there are existing passive emerging market exposures in the market, many often come with high fees that direct physical replication (i.e., holding all securities of an index) approaches introduce.

Investment implications

Instead, the Betashares MSCI Emerging Markets Complex ETF (ASX: BEMG) aims to provide investors efficient exposure to the performance of the MSCI Emerging Markets Net Total Return Index (AUD) through a swap-based exposure5. This structure helps minimise deviations of the fund’s returns from the index and enhances exposure to markets that are costly and complex to access directly

Additionally, at a management fee of just 0.35% p.a., it is one of the most cost-effective ETFs of its kind in Australia.

For more information on BEMG, please visit the fund’s website here.

There are risks associated with an investment in BEMG, including market risk, emerging markets risk, currency risk and derivatives risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Sources:

1. https://www.spglobal.com/en/research-insights/special-reports/look-forward/emerging-markets-a-decisive-decade ↑

2. https://www.oxfordeconomics.com/resource/the-future-of-the-middle-class-in-emerging-markets/ ↑

3. https://www.pib.gov.in/PressReleasePage.aspx?PRID=2161401 ↑

4. A forward price to earnings ratio is a valuation metric that dividends share price (or index level for an equity market index) by its estimated future earnings. ↑

5. BEMG obtains its exposure by investing in the Amundi MSCI Emerging Markets II UCITS ETF, which provides investors exposure to the performance of the MSCI Emerging Markets Index through total return swap arrangements. ↑