6 minutes reading time

- Digital assets

This week’s Off the Chain is also available as an audio recording. You can listen here:

Bitcoin and the broader crypto market rebounded over the last seven days, with Bitcoin surpassing US$97K on 15 January 2026 – its highest level since mid-November 2025. Helping to push prices higher were institutional-linked demand and a break above key technical resistance levels.

Bitcoin and Ethereum were up by 4.96% and 7.12% respectively over the seven days to 18 January 2026. Bitcoin’s market capitalisation is US$1.9 trillion while the global crypto market cap has risen to US$3.2 trillion. Bitcoin’s market dominance is sitting at 58%.

|

Price |

High |

Low |

Change from previous week |

|

|

BTC (in US$) |

$95,131 |

$97,571 |

$90,174 |

4.96% |

|

ETH (in US$) |

$3,313 |

$3,381 |

$3,088 |

7.12% |

Source: CoinMarketCap. As at 18 January 2026. Past performance is not indicative of future performance. Performance is shown in US dollars and does not take into account any USD/AUD currency movements.

Source: Glassnode. Past performance is not indicative of future performance.

Crypto news we’re watching

Clarity Act stalls

Coinbase CEO Brian Armstrong has withdrawn his support for a major US crypto bill, saying it would leave the industry worse off. His comments triggered an immediate delay in Senate action on the proposed Digital Asset Market Clarity Act.

Armstrong warned the bill could restrict stablecoin rewards, sideline the CFTC and effectively shut down tokenised equities as well as parts of decentralised finance. His verdict was blunt: better no bill than a bad one.

Coinbase CEO Brian Armstrong sharing his view on the Clarity Act on X. (Source: X/@brian_armstrong)

After Coinbase’s intervention, the Senate Banking Committee postponed debate on the legislation, throwing the future of long-awaited US crypto rules back into uncertainty1.

State Street launches Digital Asset Platform

State Street, the world’s fourth largest asset manager, has announced a new Digital Asset Platform designed to support tokenised versions of familiar financial products such as money market funds, ETFs and other assets. This is alongside on-chain cash instruments like tokenised deposits and stablecoins.

Rather than a pivot into ‘crypto trading’, this is best read as an infrastructure move and positioning as a bridge between traditional and digital finance: custody, wallet management, cash movement and compliance controls intended to integrate blockchain-style settlement into existing institutional workflows.2.

CRYP company spotlight

Cipher expands into AI

Cipher Mining (NASDAQ: CIFR) isn’t limiting its ambitions to crypto alone. The company is expanding into AI-focused data centres, using partnerships with established players to position itself for growth beyond traditional Bitcoin mining.3

Cipher Mining is held in the Betashares Crypto Innovators ETF (ASX: CRYP)4. CRYP provides exposure to global companies at the forefront of the crypto economy.5

Bitcoin (BTC): US Spot ETF Net Flows [BTC]

This metric shows the total net flow of funds of the leading Bitcoin and Ethereum ETFs traded in the US, reflecting the day-to-day changes in the ETFs’ holdings. It is calculated as the difference between today’s balance data point and the previously available balance data point in native units.

According to data from Glassnode, as of 16 January 2026, Bitcoin ETFs had its first solid week of net inflows in 3 months.

Source: Glassnode. Past performance is not indicative of future performance.

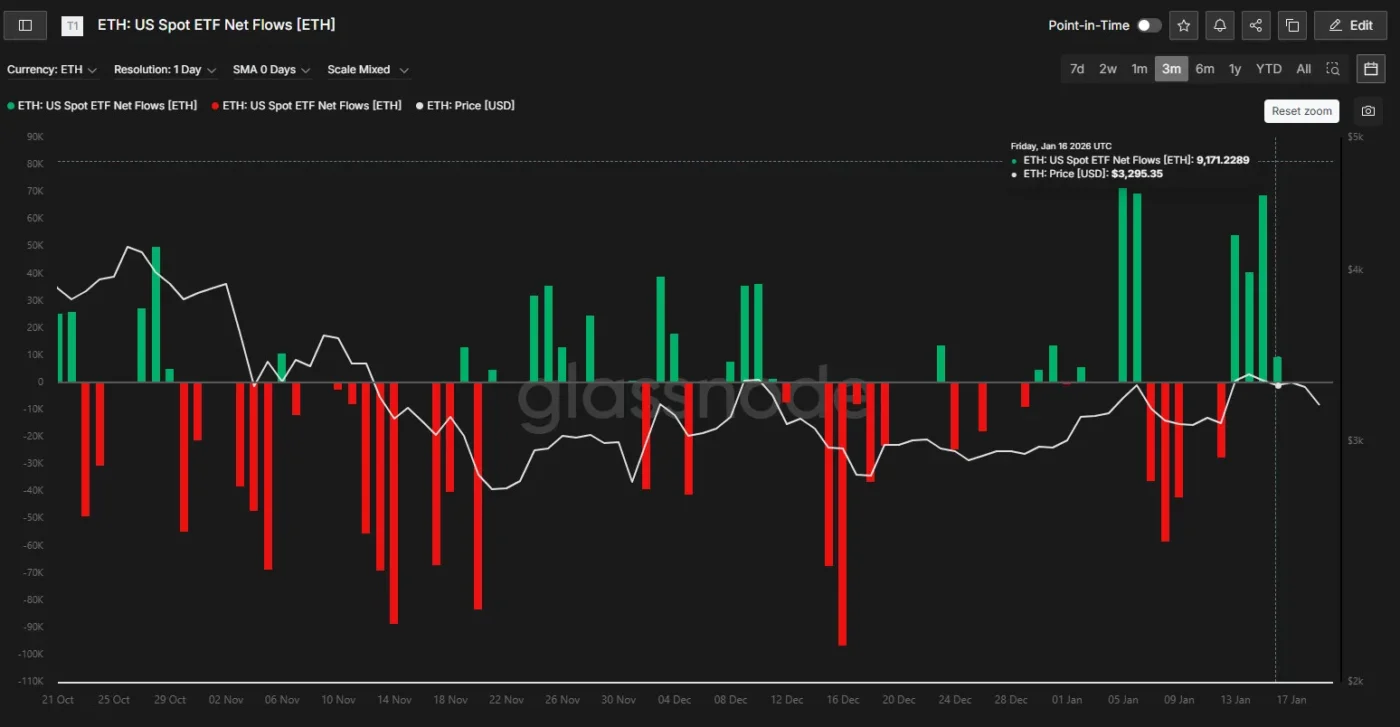

Ethereum (ETH): US Spot ETF Net Flows [ETH]

Over the same period, Ethereum also had a solid week of net inflows, reversing the trend of previous weeks.

Source: Glassnode. Past performance is not indicative of future performance.

Altcoin news

The top 20 altcoins were mixed, and any gains were limited to single digits over the last seven days to 18 January 2025. One altcoin that did make significant gains was Monero (XMR), up 22% and 165% over the last 7 days and 1-year period respectively to 18 January.

Monero is a cryptocurrency which is private, untraceable, fungible and decentralised. XMR recently surged to multi-year highs, driven by renewed interest in privacy coins and its strong technical setup6.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have an extremely high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment. Any investment in crypto assets or crypto-focused companies should only be considered as a very small component of an investor’s overall portfolio.

References:

3. https://stockstotrade.com/news/cipher-mining-inc-cifr-news-2026_01_16-2/

4. As at 16 January 2026. No assurance is given that this company will remain in the portfolio or will be a profitable investment.5. CRYP does not invest in crypto assets directly and does not track price movements of any crypto assets. For more information on risks and other features of CRYP, please see the Product Disclosure Statement and Target Market Determination (TMD), available at www.betashares.com.au.6. https://crypto.news/xmr-price-pumps-as-a-rare-pattern-points-to-monero/

Off the Chain is published every second Tuesday. It provides the latest news on bitcoin and the rest of the crypto market, along with analysis and insights into the world of crypto.

It provides general information only and is not a recommendation to invest in any crypto asset, crypto-focused company or investment product.