6 minutes reading time

If you prefer to listen to Bass Bites, you can click the player below:

Global week in review

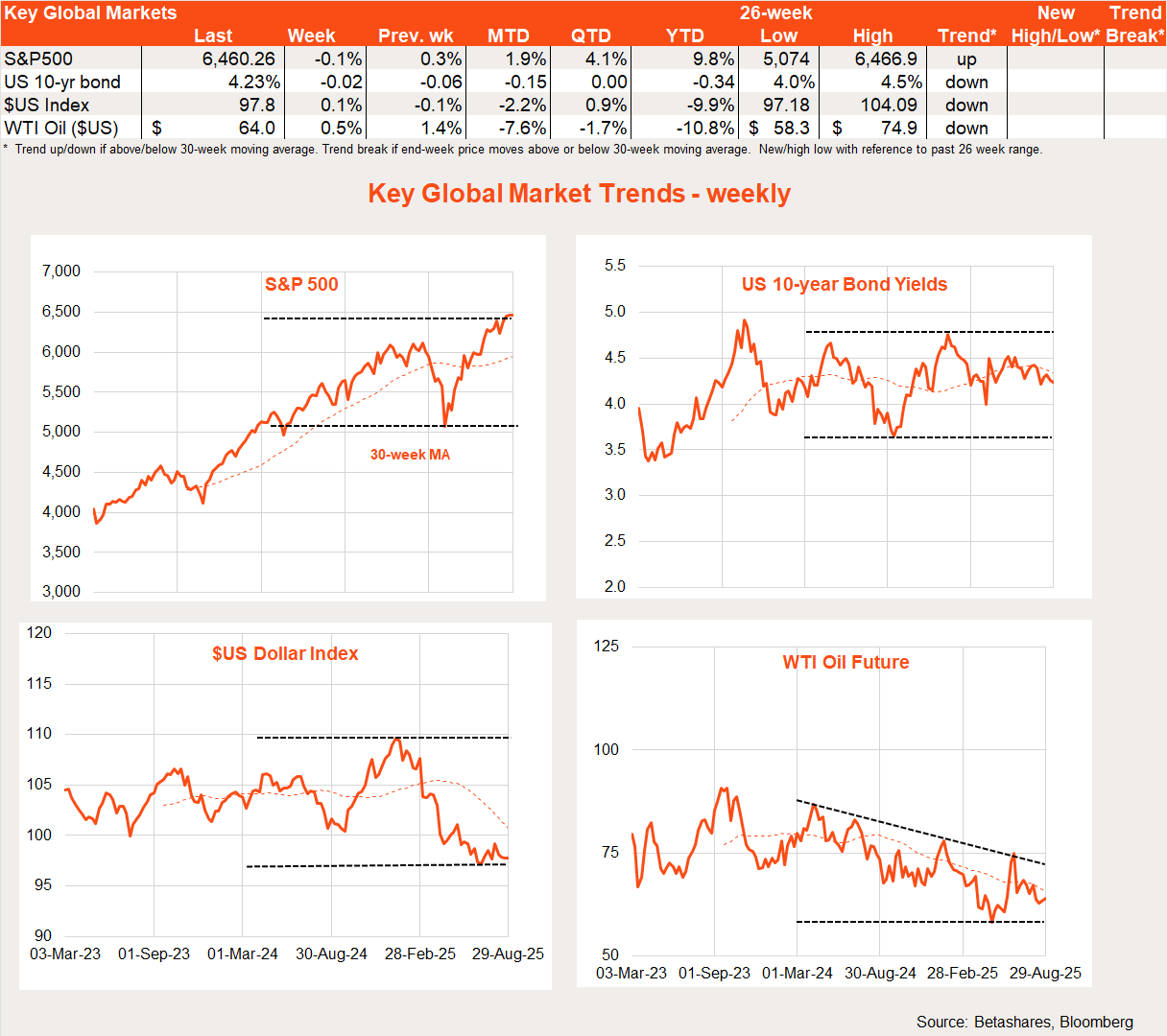

Global markets were fairly subdued last week, with the S&P 500 edging down 0.1%. Trump’s battle with the Fed was a focus of attention, while Friday’s key US inflation report was in line with expectations.

Limits of power

The checks and balances of the US political system remained under stress last week, with US President Trump seeking to sack Fed Governor Lisa Cook and a US court ruling many of the President’s tariff hikes illegal. Market reactions have remained contained to date as both matters are still winding their way through the judicial process. For now, Fed Governor Cook remains in place, and so do Trump’s tariffs.

Sticky inflation, easing economic growth

In terms of economic data, annualised Q2 US GDP growth was revised modestly higher from 3.1% to 3.3%, with growth in consumer spending revised up from 1.4% to a still subdued 1.6%. The solid GDP gain was partly payback from the 0.5% annualised decline in Q1 GDP. Looking through the quarterly volatility caused by the surge and decline in imports ahead of Trump’s tariffs, overall US economic growth still appears to have shifted down a gear in H1 2025.

Most important last week, however, was the July consumer inflation report. Core prices rose 0.3% – in line with expectations – causing annual core inflation to edge up from 2.8% to 2.9%. Markets still assign a high probability of a September rate cut, on the Fed’s apparent view that the labour market is softening. We’ll clearly learn more when the August payrolls report is released this Friday.

Global week ahead: August payrolls

As noted above, Friday’s US payrolls report will be critical to the Fed outlook. A strong employment bounce back of more than 200k or so would pour cold water over the idea that the labour market is weakening, and make the Fed look foolish (or politically compromised) if it went ahead with a rate cut this month.

As it stands, however, markets anticipate an employment gain of only 74k – broadly in line with the 73k gain in July – with the unemployment rate expected to edge up from 4.2% to 4.3%. Such a result would likely be weak enough to keep prospects for a rate cut this month alive and well. It could be a case of ‘bad news is good news’ for markets this week.

Also of note this week will be the ISM reports for manufacturing and services, both should still show the US economy holding up well despite suffering from a pipeline of pricing pressures.

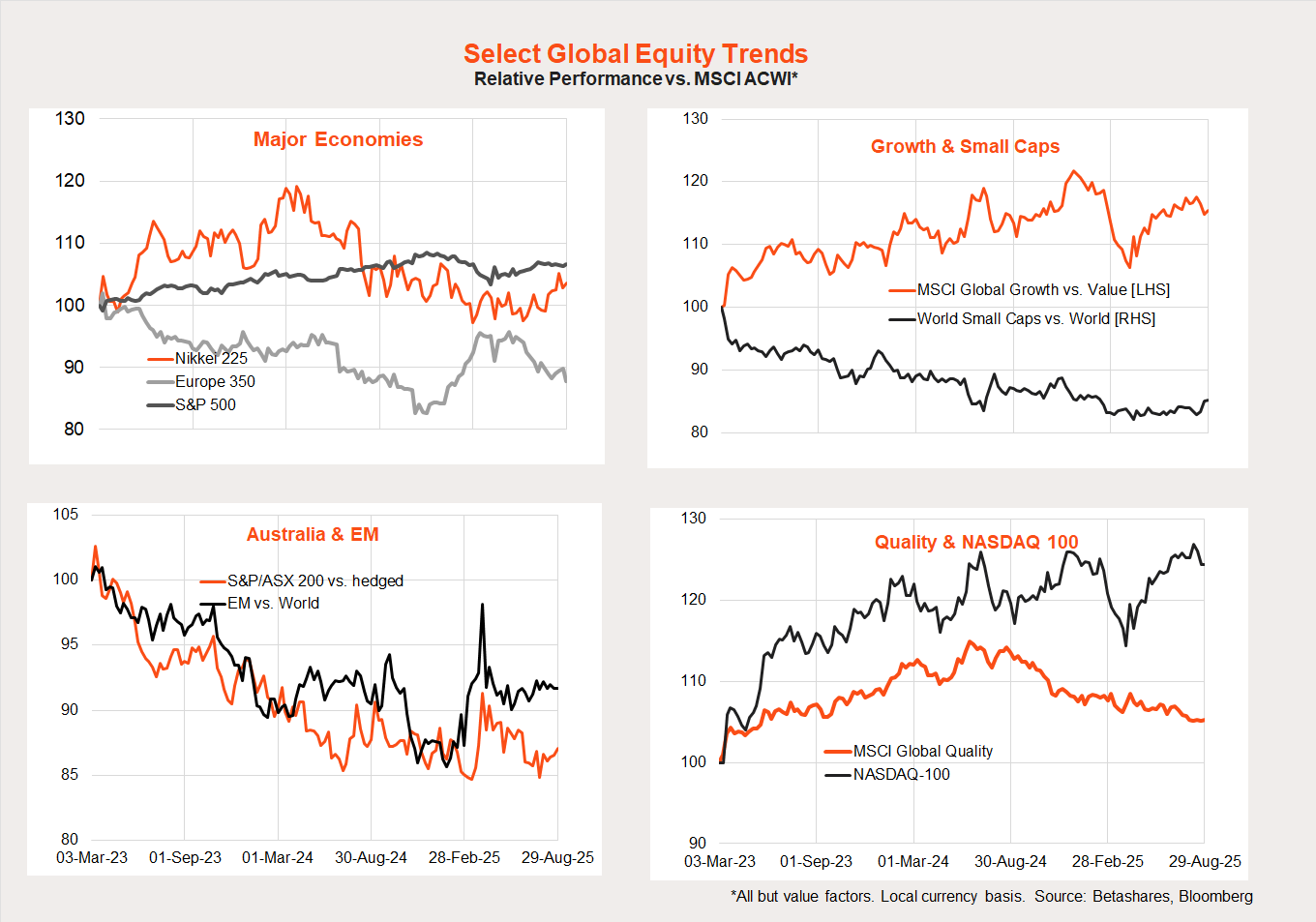

Global share market trends

It’s only tentative so far, but the US/technology/growth/large cap outperformance trend since early April has come off the boil a little in recent weeks. In its place has been a resumption of Japanese outperformance and even early signs of a bounce in small-cap performance.

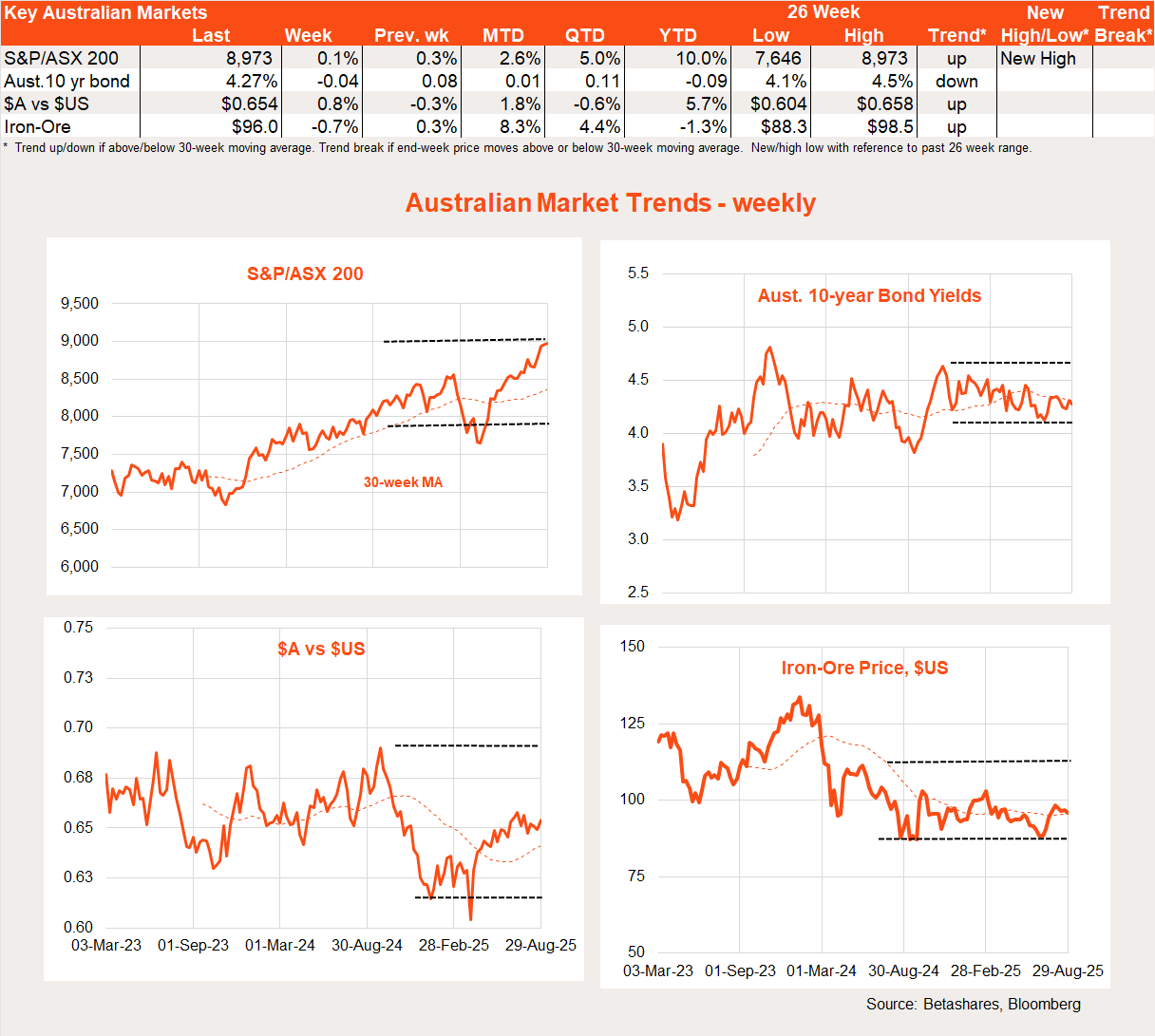

Australian week in review

The key highlight last week was the disappointing July monthly CPI report, with trimmed mean annual inflation leaping from a benign 2.1% to a less pleasing 2.7%.

While the RBA will see another monthly CPI report on 24 September – ahead of its next meeting over September 29-30 – the ongoing volatility in the monthly inflation reports will make it hard for the RBA to cut rates again this month, barring a major local/global growth scare. Markets currently attach only a 30% chance of a rate cut this month.

My base case remains the next rate cut will come in November, on Melbourne Cup day, assuming the Q3 CPI report shows annual trimmed mean inflation no more than 2.6% (from 2.7% in Q2).

Although inflation has eased nicely over the past year, one lingering concern is the degree to which government cost-of-living support measures in areas such as electricity have indirectly biased down underlying inflation measures.

After all, although underlying measures of inflation such as the trimmed mean strip out the most volatile price movements (such as electricity prices over the past year) large changes in the prices of certain items can indirectly influence underlying inflation estimates as they can shift the central point of the distribution of prices changes among remaining items. For example, a sharp drop in electricity prices can cause CPI items that usually have low price increases – typically excluded from trimmed mean calculations – to be included. As such, this can indirectly drag down trimmed mean CPI estimates. The same effect works in reverse when electricity prices rise strongly.

Therefore, it is possible the decline in underlying inflation may not have been as significant as we’ve been led to believe!

Last week also saw the end of the Australian full-year reporting season. While individual company reports were mixed as usual, the past saw month saw the expected decline in S&P/ASX 200 FY25 earnings increase to -1.7% (from -0.6%). This largely reflects further downgrades in the materials (mining) sector. The market anticipates a 4.5% bounce back in market earnings in FY26 (again, largely thanks to a rebound in mining profits), although earnings estimates still remain under downward pressure.

Australian week ahead

The local highlight this week will be Q2 GDP on Wednesday.

Markets anticipate a modest 0.5% gain in GDP, following a 0.2% gain in Q1, suggesting Australia’s economic recovery remains very gradual after an encouraging 0.6% lift in Q4 GDP last year.

Why? Overall consumer spending remains subdued, while there’s been a step down in previously robust public demand, with private investment and housing construction not as yet picking up much of the slack.

A very weak Q2 GDP report could heighten expectations for an RBA rate cut this month, but the RBA would still likely feel under pressure to wait for confirmation of benign inflation with the Q3 CPI report in late October.

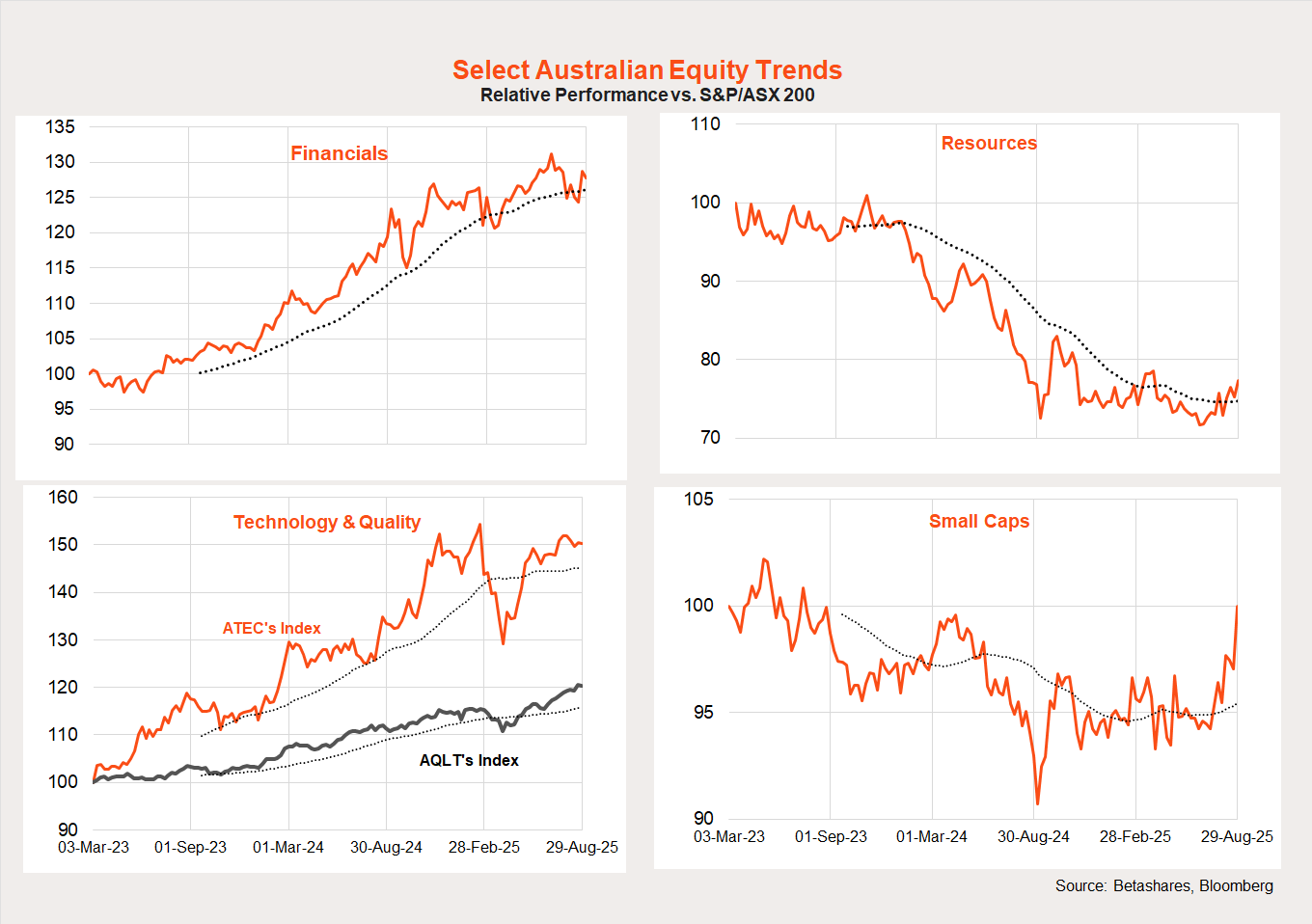

Australian share market trends

In terms of local equity trends, tentative signs of a rotation from financial to resource stocks remain in place, with markets perhaps feeling the worst could be over for earnings downgrades in the latter sector. There was also a notable bounce in small-cap performance last week!