2 minutes reading time

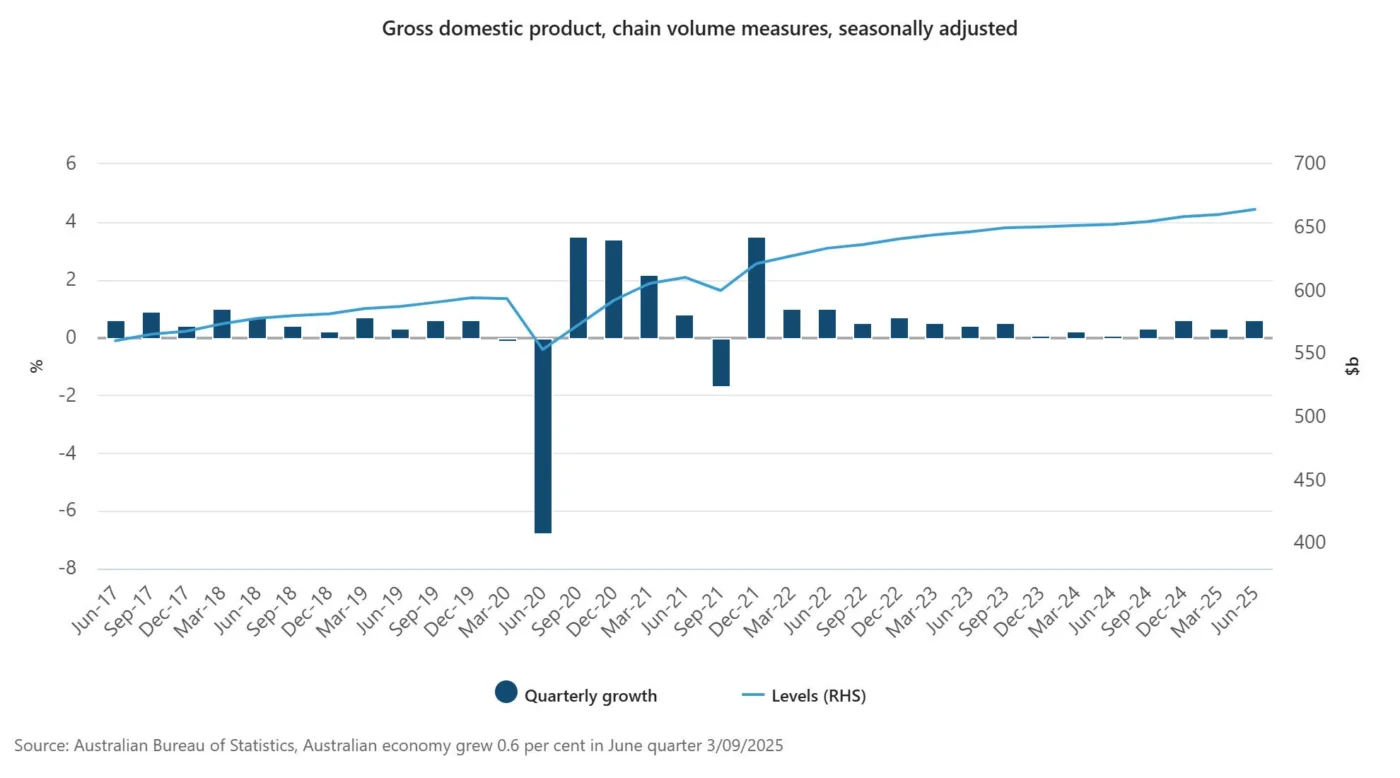

Australia’s economy is slowly crawling out of its hole. While economic growth in the June quarter was slightly better than expected, it was still relatively subdued. GDP grew by 0.6% in the quarter and 1.8% over the year. Annual economic growth has continued to gradually recover from a low of 0.8% in the September quarter of 2024.

GDP Growth, Real (seasonally adjusted)

Source: Australian Bureau of Statistics

A bright spot in today’s report was a stronger-than-expected 0.9% gain in consumer spending which, along with a step-down in public investment so far this year, is helping to rebalance economic growth back towards private demand. With further RBA cuts likely and inflation easing, the outlook for consumer spending remains encouraging, though far from buoyant.

Disappointingly, private business investment remains missing in action, with a 0.2% decline in the quarter after a small 0.1% gain in the March quarter. The recovery in housing construction also appears to have stalled, with only a 0.4% gain in the quarter after solid gains over recent quarters. Exports enjoyed a modest recovery, with a 1.7% gain after a 0.7% decline in the March quarter due to weather-related disruptions to mining exports.

In terms of monetary policy implications, today’s report was not weak enough to justify an RBA rate cut at this month’s policy meeting, but also not strong enough to rule out a rate cut in November provided the September quarter CPI inflation report is benign. The RBA will be especially cautious about a rate cut this month given the sharp bounce back in annual trimmed mean (underlying) inflation from 2.1% to 2.7% in the July monthly CPI report.

My base case remains that the RBA will cut rates in November, assuming that Q3 annual trimmed mean inflation is no higher than 2.6%.