11 minutes reading time

Global Macro and Rates

The third quarter saw divergence in monetary policy across major economies as central banks navigated competing pressures from stubborn inflation, weakening labour markets, and uncertain growth outlooks. While global trade uncertainty continued to simmer, domestic economic conditions dominated central bank deliberations during Q3.

One year into the global easing cycle, policymakers faced increasingly complex conditions. Inflation had moderated but remained vulnerable to resurgence, while labour markets began showing signs of weakness after years of restrictive policy. These competing forces within central banks’ mandates on employment and price stability suggested no clear pathway forward, potentially leaving policy rates above neutral for longer. This nuanced landscape prompted a strategic pause in monetary settings. The ECB, Bank of England, and Bank of Japan all held rates unchanged, reflecting this cautious approach. In contrast, the US Federal Reserve and Bank of Canada prioritised growth support, delivering rate cuts during the quarter.

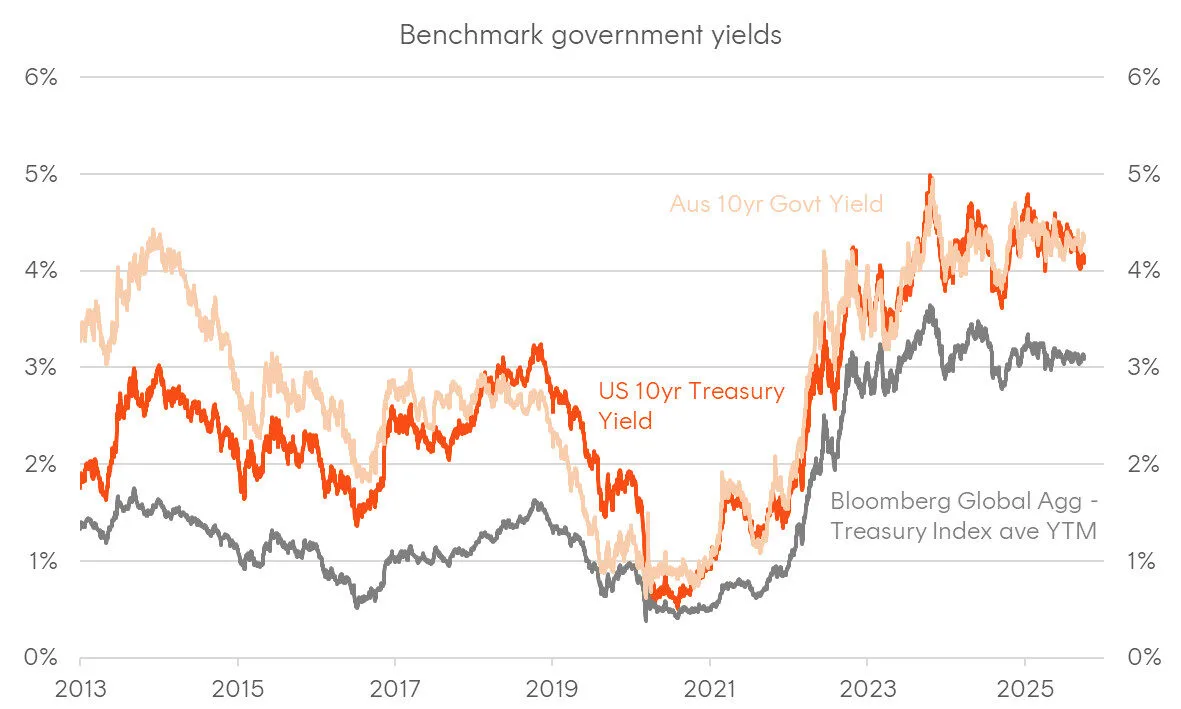

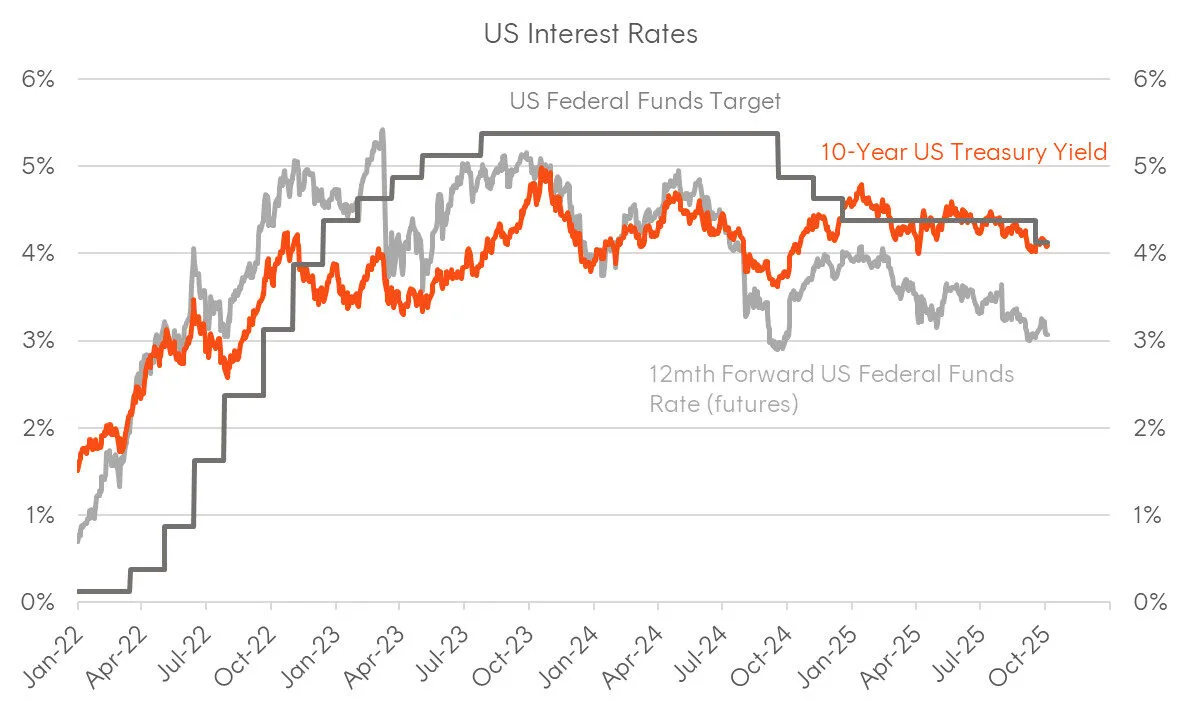

The US Federal Reserve cut rates by 25 basis points to 4.00 – 4.25% while undergoing major personnel changes. Governor Stephen Miran, viewed as a Trump proxy, replaced Adriana Kugler at the September meeting and was the sole dissent, advocating for a larger 50 basis point cut. Economic projections were mildly hawkish, lowering the unemployment forecast by 0.1% to 4.4% and raising 2026 PCE inflation by 0.2% to 2.6%. However, the median dot plot implied one additional cut versus the prior publication, suggesting a more dovish reaction function. US 10-year Treasury yields ended the quarter 8 basis points lower, though they had retreated from session lows before the September FOMC meeting. In contrast, the European Central Bank paused following aggressive earlier easing, citing a more balanced outlook, which drove German 10-year bund yields 11 basis points higher.

The Bank of England followed a similar path to the previous quarter, cutting in August but holding in September, as it weighed temporary inflation resurgence against weak GDP and a loosening labour market. The Bank of Canada restarted its easing cycle in September, lowering rates to 2.5% to combat rising unemployment. The Bank of Japan maintained its 0.50% rate and signalled caution amid tariff and political uncertainty. Both the Bank of England and Bank of Japan announced quantitative program adjustments, with the former reducing its tightening pace and the latter beginning normalisation by commencing disposal of ETF and J-REIT holdings. The Bloomberg Global Treasury Index rose 7 basis points, reflecting broader tightening bias among major economies outside the United States, where renewed inflation risks and labour market weakness warranted a more balanced approach.

Domestic Macro and Rates

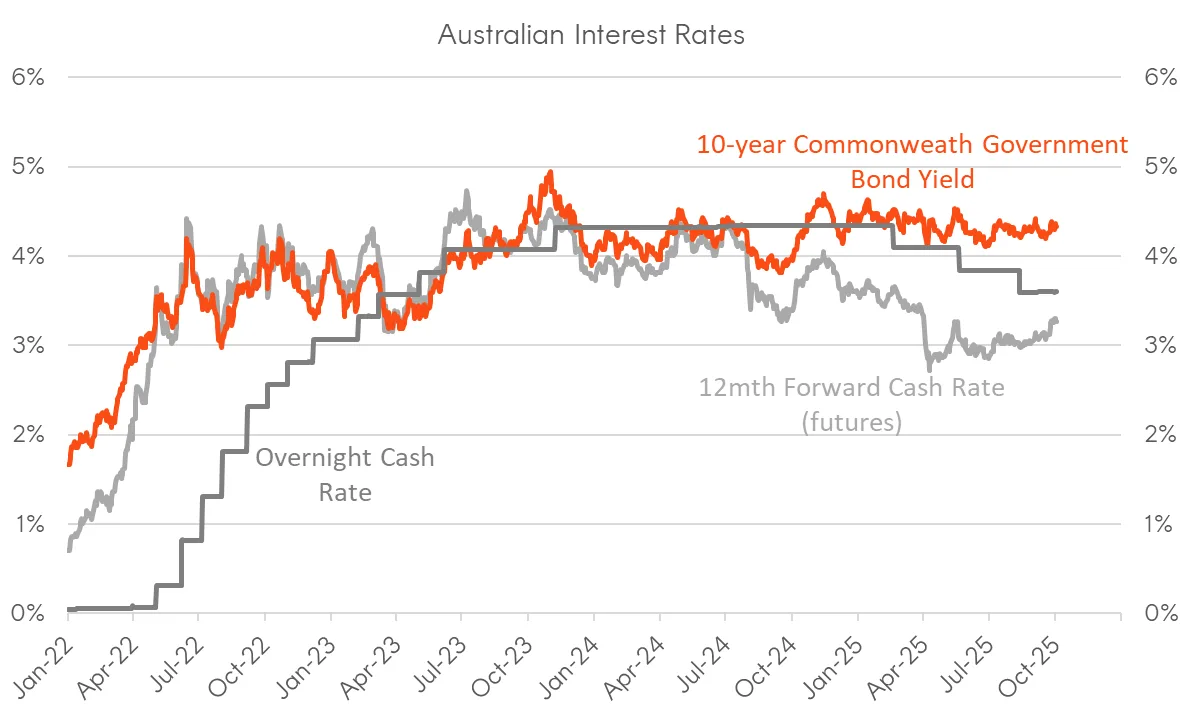

The sideways pattern in Australian government bond yields over the past year continued through Q3, with most of Q2’s yield decreases reversed. Growing uncertainty around the disinflationary trend resulted in a cautious RBA delivering only one 25 basis point cut in August, taking the cash rate to 3.60% where it remains today. Market pricing shifted accordingly. At the end of Q2, markets priced three additional cuts by year-end, implying a December policy rate of 3.1%. By Q3 close, the implied December rate had risen to 3.46%, with probability of another 2025 cut falling to just 30%.

This RBA repricing had greater impact on the front end of the curve, resulting in bear flattening. 3-year yields rose 29 basis points versus 14 basis points for 10-year yields.

The RBA held three policy meetings during the quarter. After holding steady at 3.85% in July, the bank delivered a 25 basis point cut in August, followed by another hold on September 30. The latest Statement on Monetary Policy was interpreted as mildly hawkish, with Governor Bullock discussing the need to be “a little bit cautious” about upside inflation surprises in the post-statement conference. Markets viewed this as a shift in the RBA’s reaction function, placing greater weight on higher-than-expected inflation versus higher-than-expected unemployment. Attention now turns to the Q3 CPI release on October 29, with September employment data on October 16 providing an important supplementary signal.

Global Credit Markets

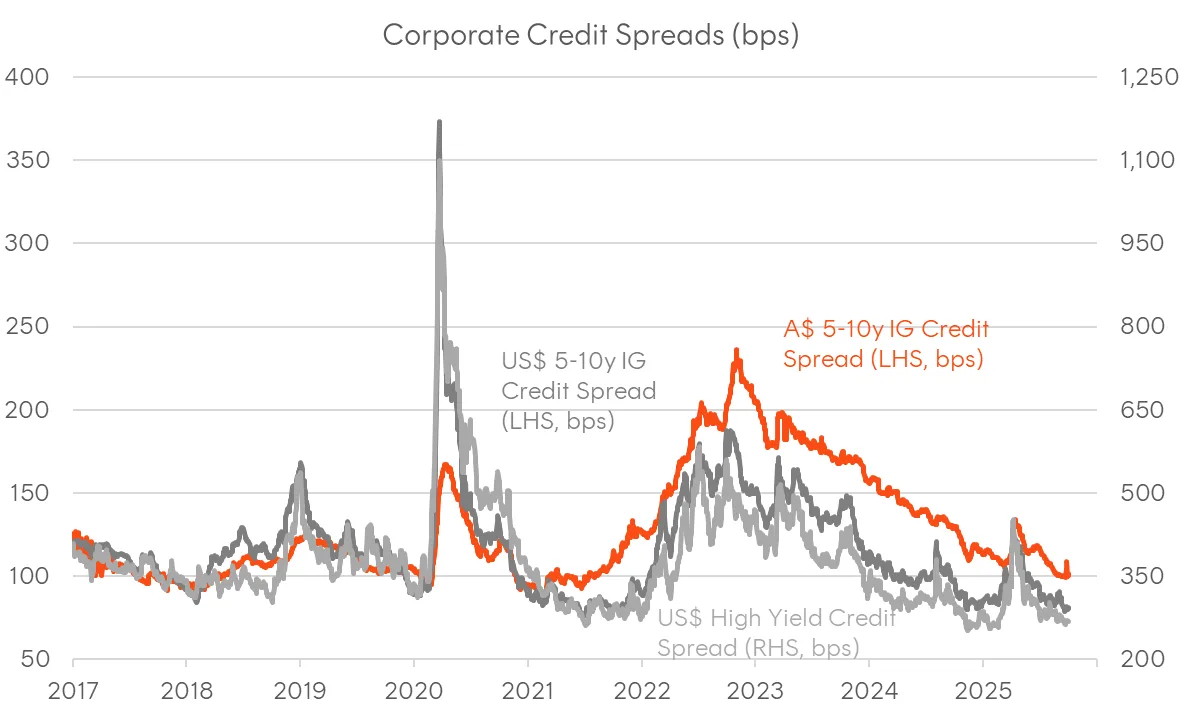

Global credit markets extended their rally through Q3, with spreads tightening across investment-grade and high-yield segments. US 5-10 year investment-grade spreads compressed 13.1 basis points over the quarter, falling from 93.6 basis points at end-June to 80.5 basis points by Q3 close, 4.5 basis points tighter year-to-date. US high-yield spreads demonstrated more pronounced tightening, narrowing 21.1 basis points from 291.5 to 270.4 basis points over Q3, bringing year-to-date compression to 11.3 basis points. The steady grind tighter throughout the quarter reflected sustained appetite for corporate risk assets and improved confidence in the global growth outlook following Q2 volatility.

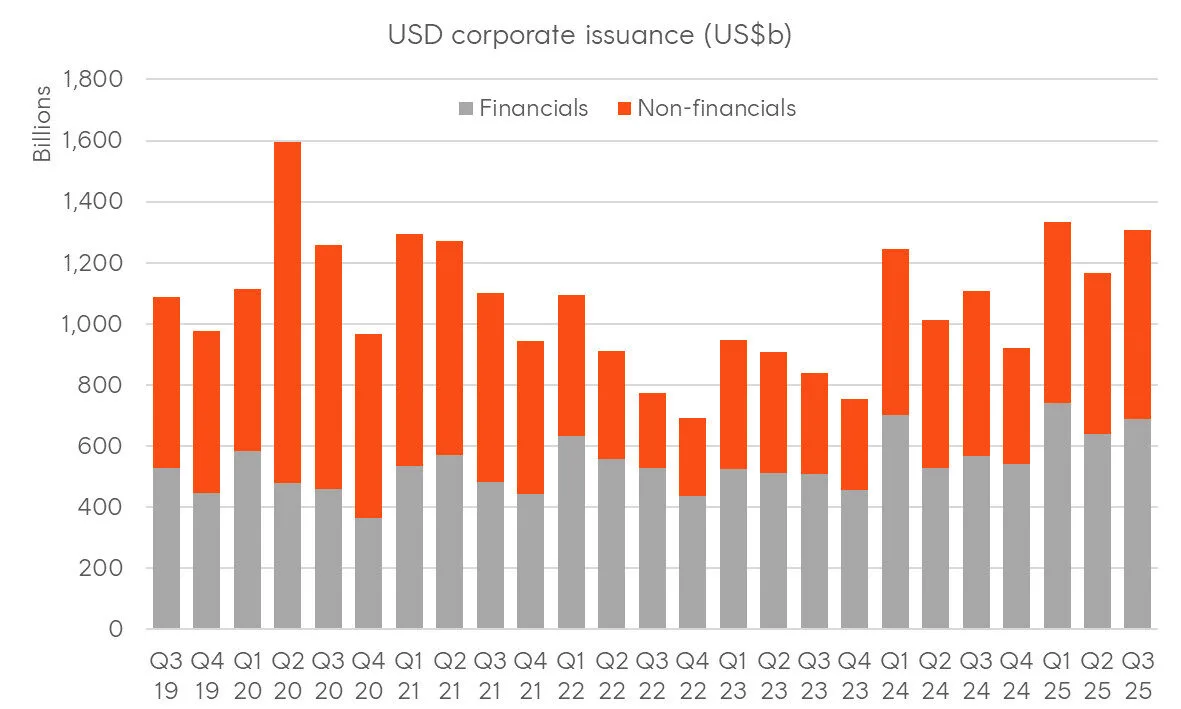

Global issuance surged, with total volumes reaching $1,306.8 billion, up $140.1 billion from Q2’s $1,166.7 billion. Financial issuance rose to $688.2 billion from $638.6 billion, an increase of $49.6 billion. Non-financial corporate issuance accelerated more substantially, climbing $90.6 billion to $618.7 billion from Q2’s $528.1 billion. Year-over-year, total Q3 issuance increased 18.1%, rising $200.6 billion versus Q3 2024’s $1,106.3 billion. The robust issuance activity combined with tightening spreads underscored favourable technical conditions as markets absorbed elevated supply while maintaining pricing discipline.

Domestic Credit

Australian credit markets delivered strong performance over Q3, with spreads tightening as the domestic market followed the global trend. Australian 5-10 year investment-grade spreads compressed from 116.6 basis points at the beginning of July to 100.2 basis points by quarter-end, a 16 basis point tightening that brings year-to-date compression to 29.1 basis points. Having lagged the global rally through much of H1, Australian credit found momentum as both domestic and offshore investors increased allocations.

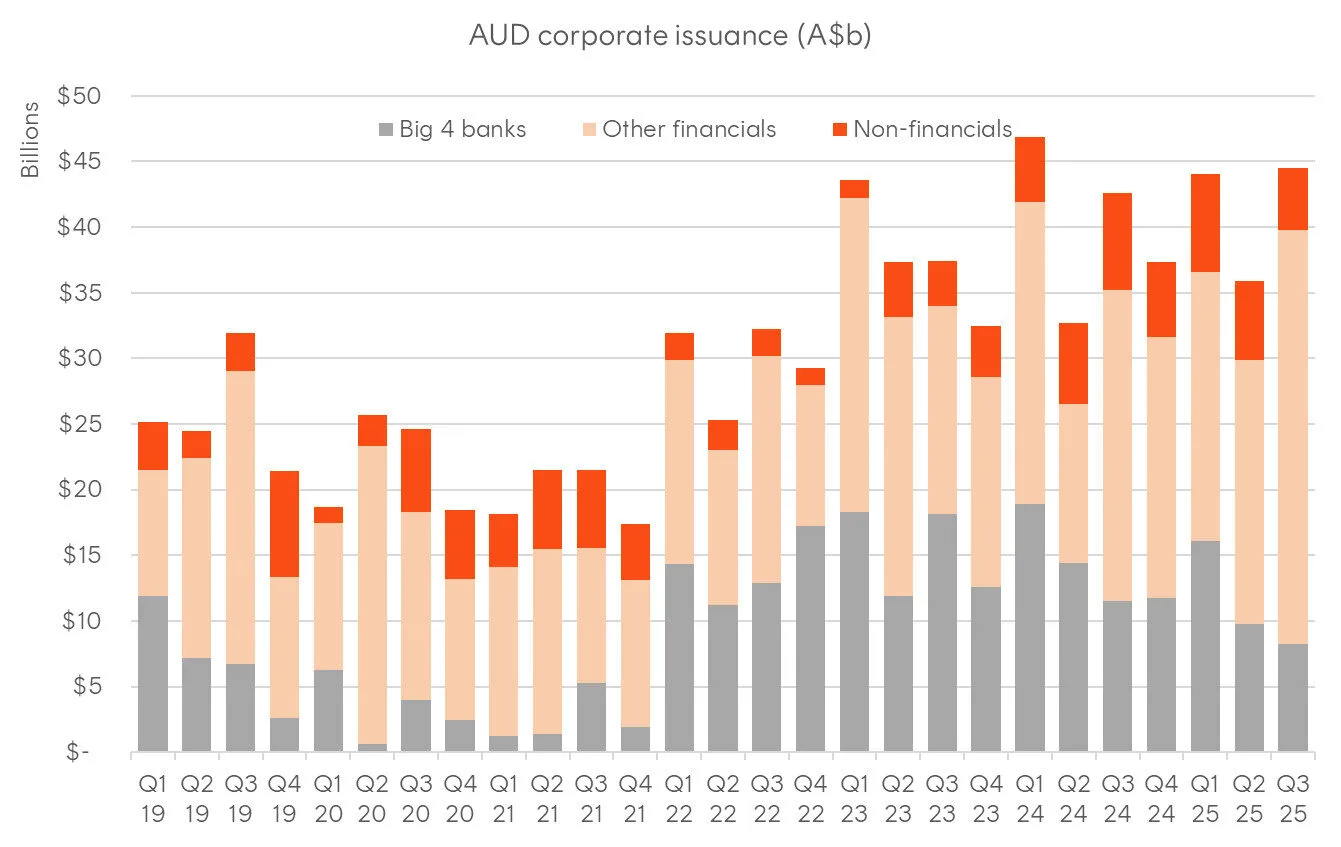

AUD corporate bond issuance totalled $44.5 billion in Q3, up from $35.9 billion in Q2. Other financials drove the quarterly increase, issuing $31.6 billion compared to $20.2 billion previously, an $11.4 billion rise. Big Four bank issuance declined to $8.2 billion from $9.8 billion in Q2. Non-financial corporate issuance fell to $4.7 billion from‑$6.0 billion.

Year-over-year, total Q3 issuance rose 4.4% from $42.6 billion in Q3 2024. Big Four bank issuance fell 28.7%, while other financials increased 33.4%. Non-financial corporate issuance declined 36.8%. Within non-financials, Utilities dominated at $1.9 billion (40.6% of segment issuance), followed by Consumer Discretionary at $1.3 billion (28.1%), Industrials at $965 million (20.6%), and Materials at $500 million (10.7%). Credit markets absorbed this supply comfortably, with tight spreads and strong technicals throughout the quarter.

Outlook

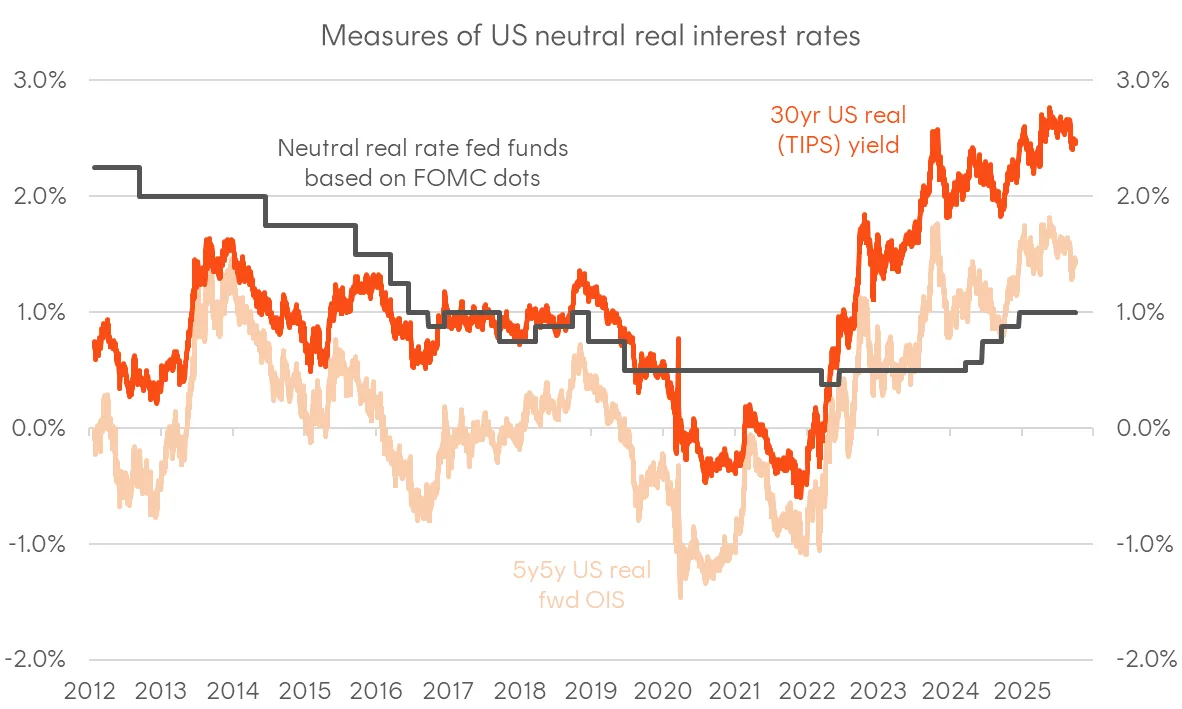

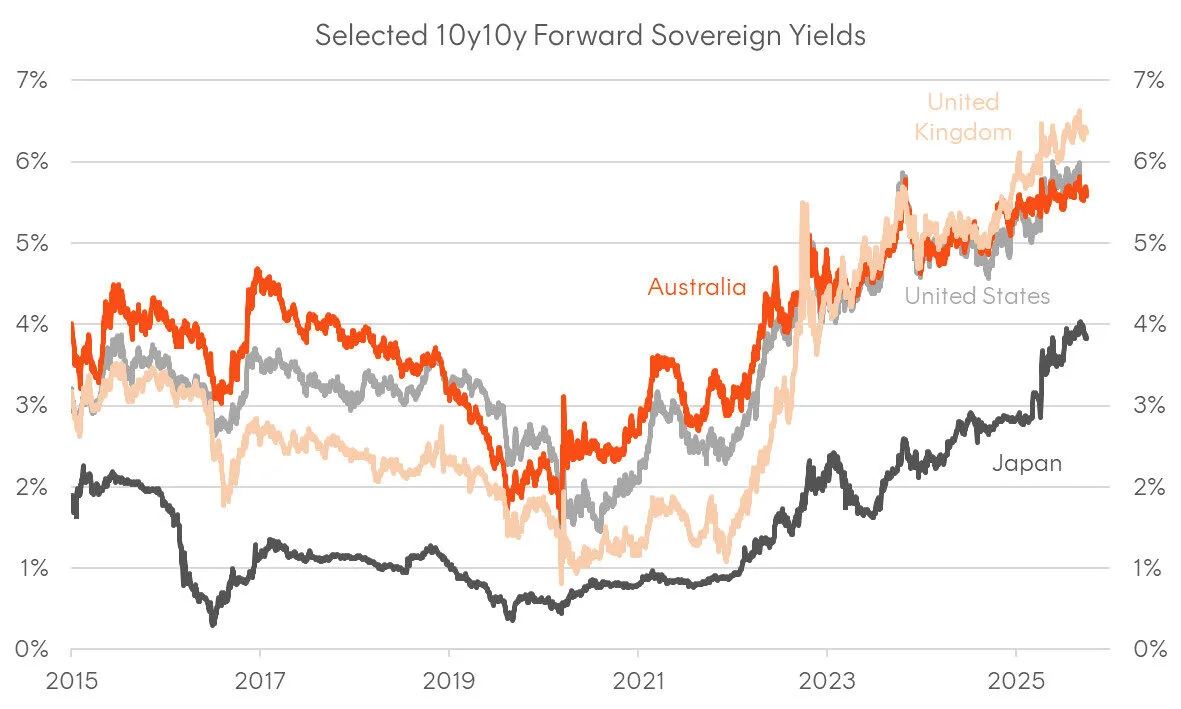

Q3 saw global bond markets consolidate after Q2 volatility, with steepening in government curves moderating but leaving long-term yields elevated despite the global easing cycle. Implied long-term forward yields remain around decade highs and well above most neutral policy rate estimates, while long-term real yields offer attractive compensation against elevated global equity valuations. Several key developments will shape fixed income returns ahead.

The softening US labour market amid tepid private sector payrolls growth and growing risks to public sector hiring against a backdrop of shrinking labour supply remains the primary macro risk. At the time of writing, the US government has entered a shutdown, deferring key economic data releases. While markets have taken the shutdown and data blackout in stride, a prolonged shutdown raises the risk of mass public sector layoffs.

Beyond fractured US politics, Fed Chair Powell’s term expires in May 2026, and the composition of the post-Powell FOMC may significantly impact US forward rate pricing. Trump ally Stephen Miran was the only September dissent, calling for a 50 basis point cut and consistently advocating for material adjustment on the view that neutral rates are much lower than consensus. Although Miran failed to build a coalition in September, he may find more willing allies as the FOMC’s composition evolves through upcoming regional Fed elections and Powell’s eventual replacement. Whether cuts accelerate from deteriorating labour market data, government-induced disruption, or a more dovish Committee, the direction for US rates appears skewed lower. Combined with elevated real yields and attractive term premia, this backdrop supports a constructive duration view.

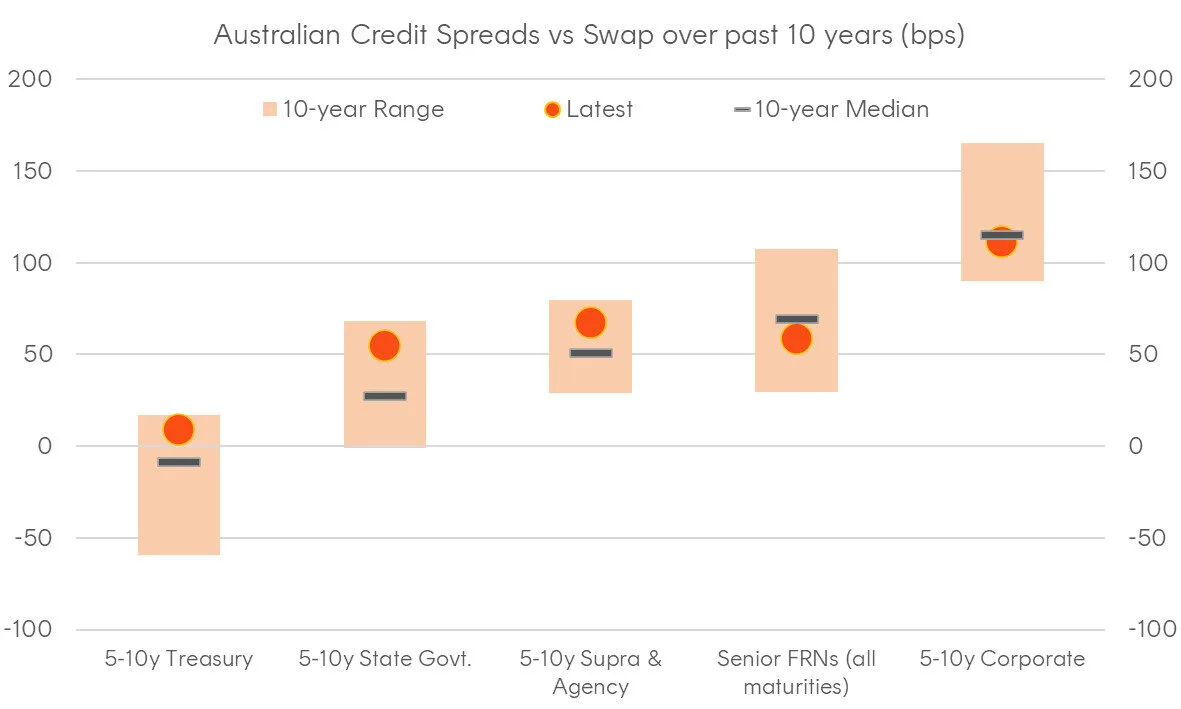

However, one challenge to the duration thesis is that the final stages of disinflation are taking longer than hoped. Australia illustrates the difficulty of moving from “close enough” to target. Despite below-potential growth and rising unemployment, rate cut expectations for the November RBA meeting have fallen from near-certainty to a coin toss amid higher-than-expected monthly CPI prints in July and August, making the official Q3 CPI release critical. Some inflation stickiness notwithstanding, Australian government bond curves remain steep. The 10-year Commonwealth yield sits well above both the current cash rate and where it is expected to be in twelve months, offering meaningful rolldown. Viewed through the lens of swap spreads, Commonwealth bonds, semi-governments, and supranationals all offer compelling relative value compared to their decade averages.

Turning to global credit markets, perhaps the most significant structural development is the scale and financing evolution of AI capital expenditure. Current spending of approximately US$320 billion this year from the top four hyperscalers is projected to reach US$1 trillion annually within four years. With spending targets well beyond free cash flows, a major issuance cycle will be required. Oracle’s $18 billion September bond deal signals what lies ahead. Notably, the transaction attracted over $80 billion in orders, demonstrating robust market appetite. A new capital cycle is forming just as we approach a refinancing wave.

For now, credit markets are absorbing this new supply comfortably, with tight spreads and strong technicals supporting further issuance. However, beneath the surface, early stress signals are emerging. Credit losses have begun appearing in the leveraged loan market, with defaults from subprime auto lender Tricolor and auto supplier First Brands gaining mainstream attention, suggesting that the benign credit environment may be masking deteriorating fundamentals for more leveraged borrowers. While these specific losses remain confined to pockets of the market exposed to lower income US households, they serve as a reminder that the current combination of rising capital intensity and an approaching refinancing cycle could expose vulnerabilities as leverage metrics inevitably rise.

In this environment, fixed income’s role as a genuine portfolio diversifier becomes paramount, particularly given stretched equity valuations and narrowing credit spreads that offer limited risk compensation. Rather than chasing yield in lower-quality segments, investors should favour exposures that provide both income and protection during potential market stress. AUD medium-to-longer term fixed rate investment-grade credit represents a particularly compelling segment: spreads above swap across all sectors (including Commonwealth government bonds), steep curves providing meaningful rolldown, and recent repricing in RBA rate expectations have improved entry points. High-quality domestic and Kangaroo issuers, spanning government, semi-government, supranational, financial, utility, and infrastructure bonds, offer the defensible fundamentals and liquidity characteristics necessary to fulfill fixed income’s traditional role in multi-asset portfolios.

Figure 1: Benchmark government yields; Source: Bloomberg

Figure 2: US interest rates; Sources: Bloomberg, Fed

Figure 3: Australian interest rates; Sources: Bloomberg, RBA

Figure 4: AUD corporate investment grade issuance; Source: Bloomberg

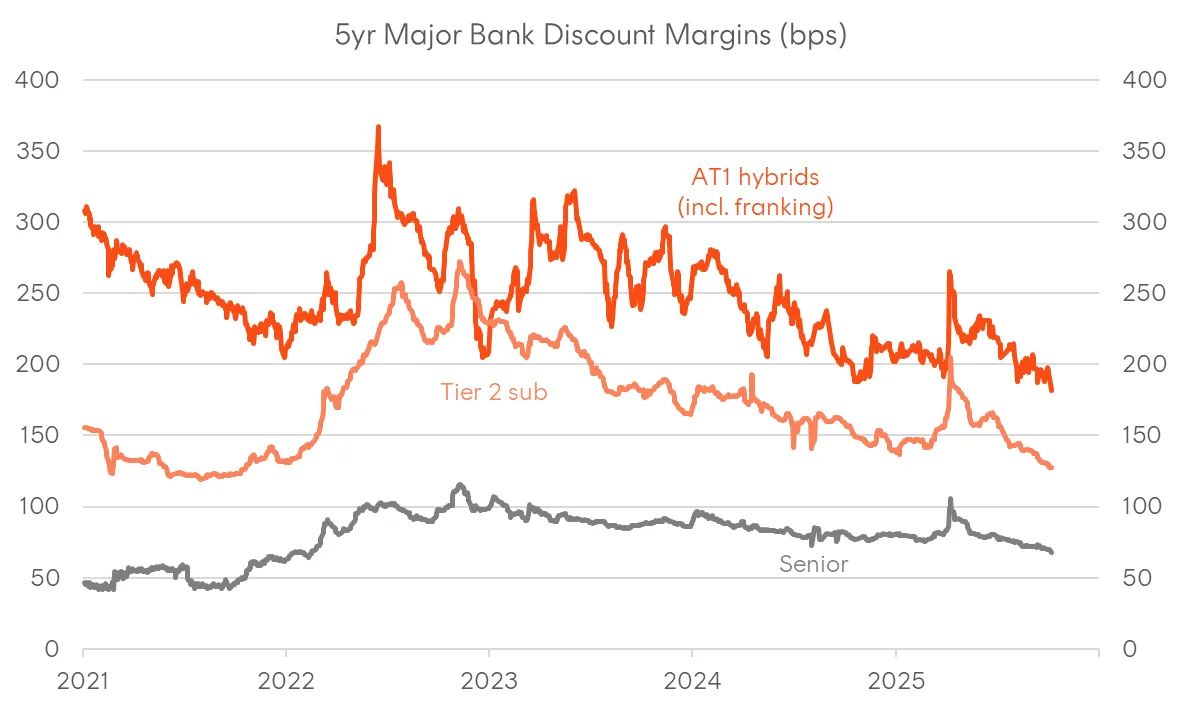

Figure 5: Australian bank discount margins (basis points); Sources: Westpac, Betashares, Bloomberg, ASX

Figure 6: Corporate credit spreads (OAS, basis points); Source: Bloomberg

Figure 7: USD corporate investment grade issuance; Source: Bloomberg

Figure 8: Selected 10y10y forward sovereign yields; Source: Bloomberg

Figure 9: Australian fixed income spreads over swap; Source: Bloomberg

Figure 10: Measures of US neutral interest rates; Sources: Bloomberg, Fed