3 minutes reading time

Today’s relatively benign September quarter wage cost index report provides some reassurance that the labour market is not overly hot, and that unemployment does not need to rise significantly further to keep inflation in check.

Overall wages (excluding bonuses) rose 0.8% and 3.4% over the year. Private sector wage growth was softer still, 0.7% growth in the quarter and 3.2% over the year.

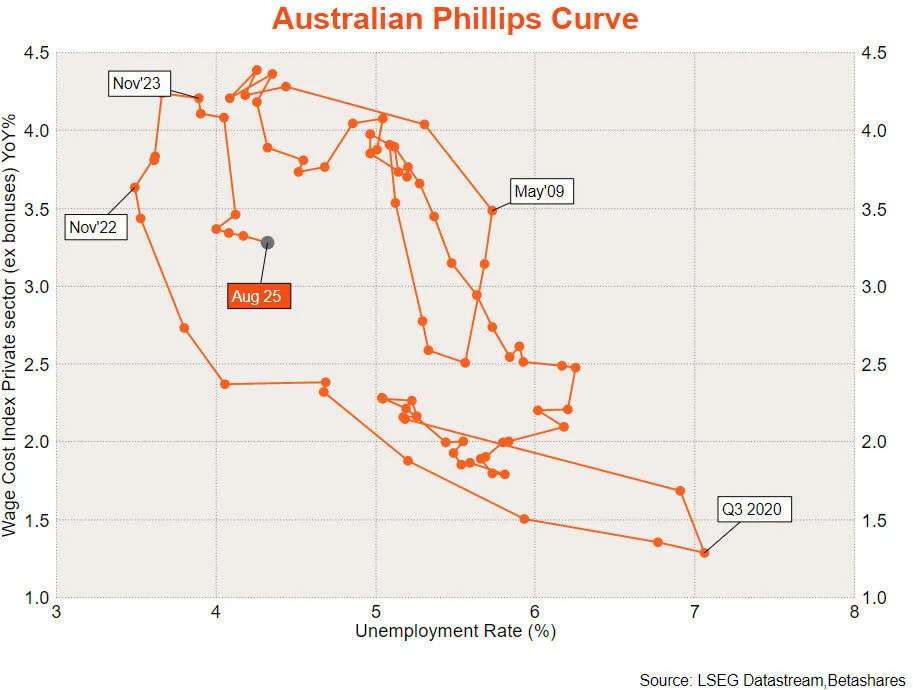

As evident in the chart below, the Phillips Curve – or the tendency of wages growth and the level of unemployment to be negatively correlated – is alive and well in Australia. The modest rise in unemployment since late 2023 (from 3.7% to 4.3%) has been associated with a slowing in annual private sector wage growth from 4.2% to 3.2%.

Even allowing for the Reserve Bank’s recently lowered long-run labour productivity growth assumption of 0.7% p.a., 3.2% private sector wage growth should be consistent with underlying inflation at 2.5% over the long-run, or the mid-point of the RBA’s 2-3% inflation target band.

Of course, the current challenge is that measured productivity growth is notably lower than that at present, rising a mere 0.1% over the year to end-June. Also challenging is the fact that a broader measure of labour costs – average earnings in the national accounts (which includes bonuses, overtime and movement toward higher paying jobs) – is running somewhat higher than the Wage Price Index measure, with growth in the former of 4.9% over the year to end-June. This has meant unit labour costs rose 5% over the year to end-June.

Also concerning is the public sector, with a solid 0.9% gain in wages over the quarter and 3.8% growth over the year. While some pay upgrades for relatively lower paid public servants in area of high need – such as nursing and police – seems easy to justify, both Federal and State Governments seem unwilling to pursue broader public sector wage discipline. That is adding to budgetary strains and likely adding to pricing pressure across the non-market sector.

All up, today’s result should not shift the needle significantly either way regarding the RBA outlook for interest rates. Benign private sector pay at least suggests the labour market is not unduly tight and should not stand in the way of underlying inflation eventually easing back to with the RBA’s 2 to 3% target band over time. Accordingly, the RBA should be relatively comfortable with unemployment rates around current levels.

Of course, the clear challenge to this benign view however stems from continued high growth in unit labour costs due to currently weak productivity growth and stronger growth in broader labour cost measures.