6 minutes reading time

If you’d prefer to listen to this week’s edition in podcast form, please click the below player:

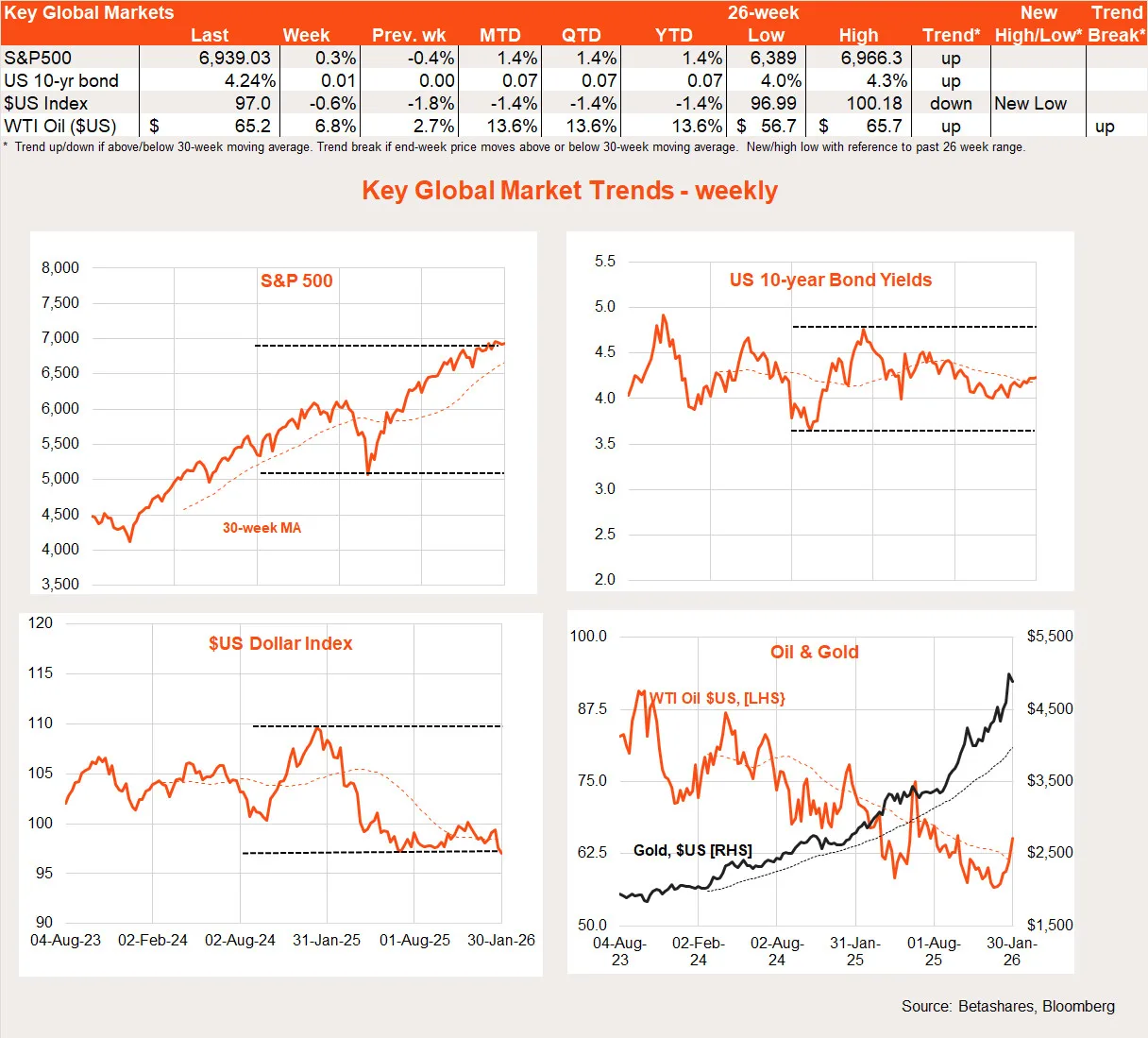

Global stocks inched higher last week, supported by a fairly neutral US Fed meeting that left the door open for further rate cuts later this year.

Global week in review: US dollar jitters and new Fed Chair Warsh

There was more action than usual in currency and commodity markets last week, with the equity market’s moves relatively contained.

Earlier talk of intervention to support a weakening Japanese Yen saw the Yen rebound and the US dollar weaken. This was supported by Trump’s comments suggesting he welcomed a weaker US dollar.

That said, Trump’s announcement of ex-Fed Governor Kevin Warsh as the next Fed chairman – a somewhat more credible candidate than feared – saw the US dollar rebound over the weekend and an overheated gold price to slump. Also supporting the US dollar and hurting gold were comments from US Treasury Secretary Scott Bessent, who played down the idea of currency intervention and reiterated the old Treasury mantra that he supports “a strong US dollar policy”.

Bessent’s comments aside, erratic US economic policy still leaves the US dollar vulnerable to further downside, which should continue to support gold prices.

Indeed, it was noteworthy that the US dollar weakened as talk of a renewed US attack in Iran increased, though this did naturally also cause the oil price to rise.

With regard to last week’s Fed meeting, rates were left on hold as widely expected. Although the tone of the statement was mildly hawkish – given less downside labour market risk – markets barely moved and still retain their expectation of more rate cuts later this year.

The other notable development last week was the slump in Microsoft’s share price despite a fairly solid earnings report. Markets focused on a slight miss in expected growth in AI-related cloud revenues, highlighting a growing market impatience for evidence of monetisation from the AI boom.

Global week ahead: US payrolls

Attention turns back to the US economy this week with key manufacturing and services sector ISM surveys as well as the all-important payrolls report on Friday.

ISM surveys are expected to show the manufacturing sector still ailing and the services sector still booming. A job gain of 70k is expected for January, which should keep the unemployment rate steady at 4.4%.

Further small declines in job openings and consumer sentiment are also expected, consistent with a softening in both the labour market and consumer spending.

Both the Bank of England and the European Central Bank meet this week and are expected to leave rates steady.

Last but not least, we need to keep watching Iran, with Trump again threatening military action – perhaps not so much to support protesters but mainly to force a deal over nuclear activity.

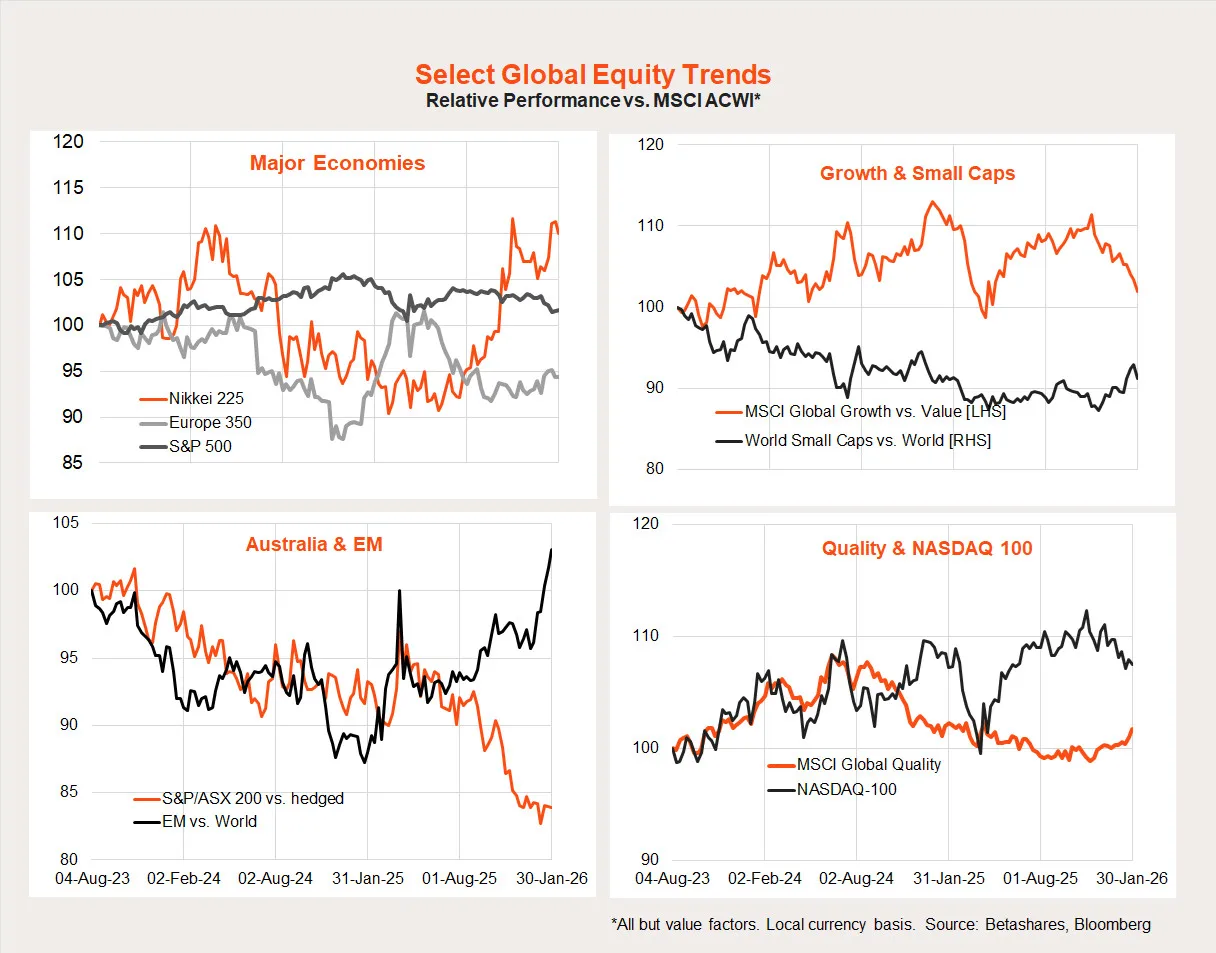

Global equity trends

The NASDAQ-100 underperformed a little further last week, supporting the ‘great rotation’ theme. Since the end of October 2025, we’ve seen underperformance of US/growth/technology, replaced by strength in Japan, emerging markets and small caps. Sadly, Australia’s trend of underperformance continues despite renewed optimism in the resources sector.

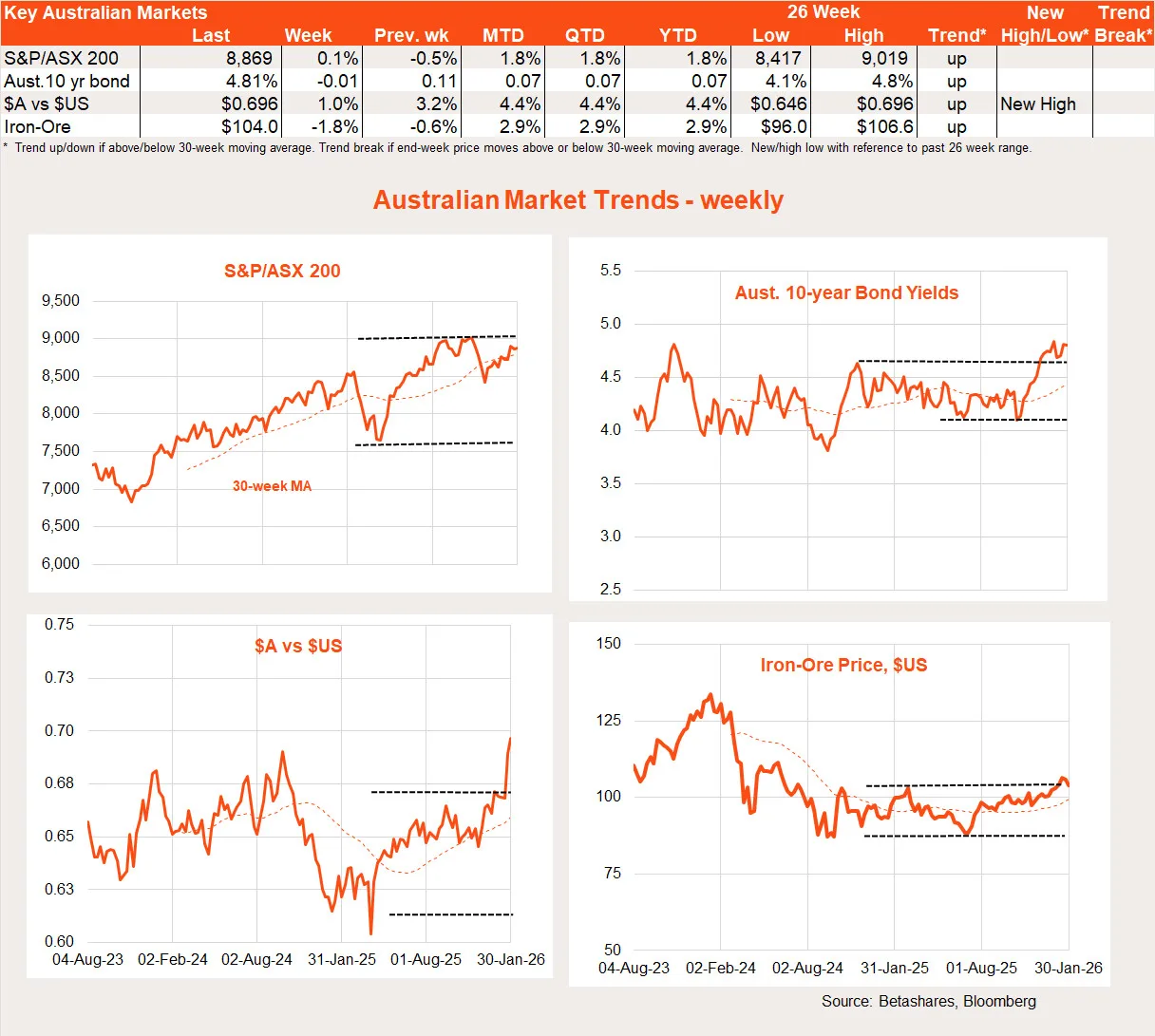

Australian week in review: hot CPI

Australian shares were flat last week, not helped by a hot CPI which has significantly raised the risk of an RBA rate hike this week.

The major highlight last week was the long-awaited Q4 consumer price index (CPI) result. The quarterly trimmed mean increase of 0.9% was a touch higher than mine and the market’s expectation. Back in November, the RBA also implicitly forecast a 0.8% gain after a 1.0% gain in Q3.

Australian week ahead: RBA finger on the trigger

Is a quarterly trimmed mean gain of 0.9% high enough to justify a rate increase? The case for a rate increase is based on:

- We’ve now had two consecutive annualised gains in quarterly trimmed mean inflation well above the RBA’s 2-3% target range.

- The price gains in Q4 were in demand-sensitive areas such as travel, hospitality and housing.

- The December labour market report was strong, with the unemployment rate dropping back to 4.1%.

- Domestic demand has lifted in recent months, with broad based gains in consumer spending, housing activity and business investment.

That said, some counter arguments are that:

- The 0.9% quarterly trimmed mean gain was only a ‘slight’ miss relative to the RBA’s 0.8% expectation back in November.

- Some of the price gains may reflect one-off factors such as high travel costs due to the Ashes cricket test series and the Federal Government’s renewed support for first home buyers.

- Some have also noted a declining trend in the monthly trimmed mean increases through the quarter (the trimmed mean monthly increases were 0.33%, 0.26% and 0.24% in October, November and December respectively).

All up, the market still sees a reasonable 30% chance that the RBA won’t raise rates meaning it’s far from a done deal.

On balance, however, I suspect the RBA will raise rates as:

- The RBA specifically warned it may be forced to act if the Q4 CPI was hot (which it was). Credibility suggests it now needs to follow through.

- The RBA said it would focus on the quarterly result given the seasonal adjustment patterns in the monthly report are still too unreliable. Indeed, there was also a deceleration in the monthly gains through Q3 2025!

- The RBA could soften the blow by trying to couch the move as a policy recalibration (taking back one of the rate cuts of last year) rather than the start of a new tightening cycle. Of course, further rate hikes could not be ruled out as it would depend on future inflation reports.

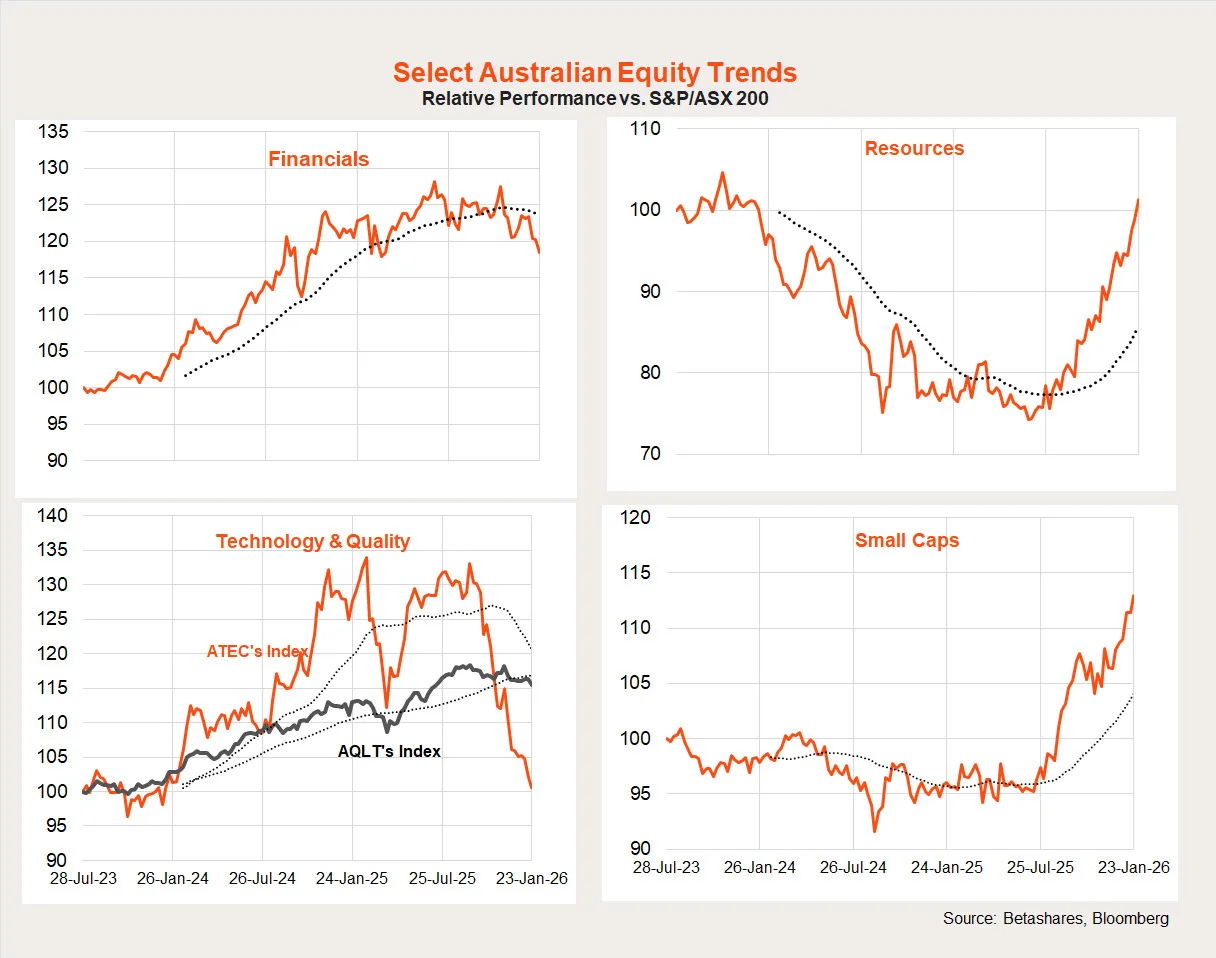

Australian equity trends

A rotation from financials/technology to resources and small caps has been clearly evident in the Australian market over recent months. Upgrades to resource sector earnings and general optimism around commodity prices is supporting both large and small cap resource companies.