5 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

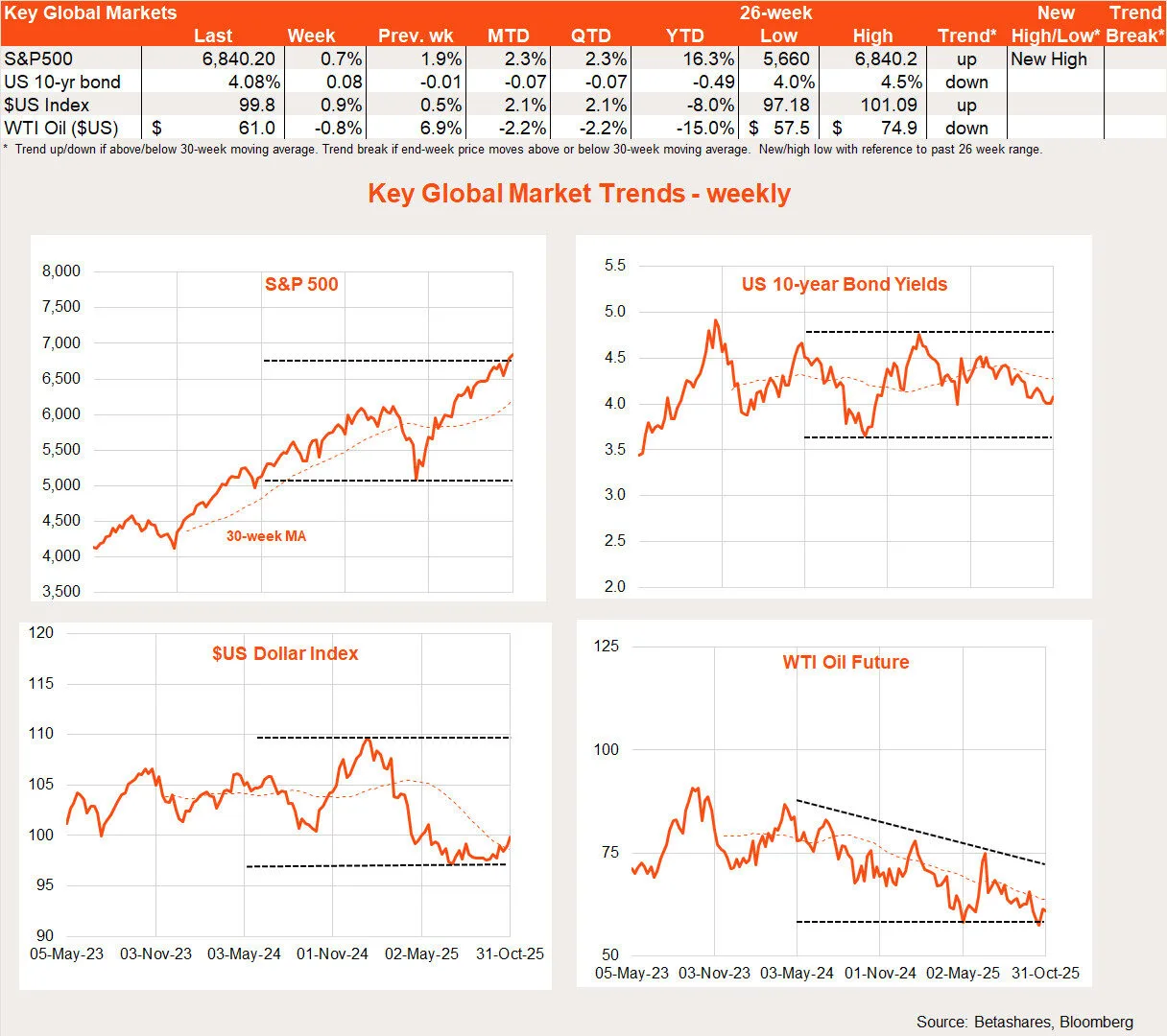

Despite a ‘hawkish cut’ from the US Federal Reserve, global equities rose last week, supported by a positive US-China trade outcome and continued strength in US corporate earnings results.

Global week in review: Earnings support

Although the US Federal Reserve followed through with a widely expected rate cut last week, market enthusiasm was tempered by Fed Chair Jerome Powell’s declaration that a follow up December rate cut was “far from a foregone conclusion”. Powell also suggested that a “growing chorus” of Fed members were inclined to skip cutting interest rates again in December and await more information on the economy.

That said, while bond yields moved higher on the day, markets are still attaching a 70% chance of a rate cut at the next meeting. Equities shrugged off the comments, ending the day little changed ahead of the following day’s US-China trade talks.

As it turned out, the trade talks ended with an agreement of sorts: China would postpone restrictions on rare earth exports, resume buying US soybeans and promise to crack down on the trade in fentanyl chemicals. In exchange, the US agreed to lower the effective tariff rate on Chinese imports from 57% to around 47%. In essence, this was a ‘kick the can down the road’ exercise, leaving both countries another year to negotiate a deeper trade truce.

Along with the positive trade outcome, markets were also buoyed last week by ongoing solid US earnings reports. Of the five Magnificent Seven companies that reported last week, only Meta failed to beat earnings estimates – and this was largely due to a one-off tax write-down. All companies said they will continue to pour money into AI investments and saw solid demand for their services ahead. Even Alphabet’s search business seemed to be holding up in the face of AI rivals, helped by the integration of convenient AI summaries into its search results.

In other news, both the European Central Bank and Bank of Japan left rates on hold as widely expected, while the Bank of Canada followed the Fed and cut rates by 0.25%.

Global week ahead: Private data and the courts

With the US government still in shutdown, major official economic data releases remain missing in action. That said, we’ll get useful updates on the economy from private sector sources this week – including ISM manufacturing and service sector reports, the ADP payrolls report and the University of Michigan consumer sentiment survey.

Another key event will be the Supreme Court’s mid-week decision on the legality of President Trump’s use of tariffs on national emergency grounds. According to most experts in trade law, Trump seems to have clearly overreached, but whether the right-leaning court will agree remains to be seen, given it has already waved through much of his tough crackdown on illegal immigration.

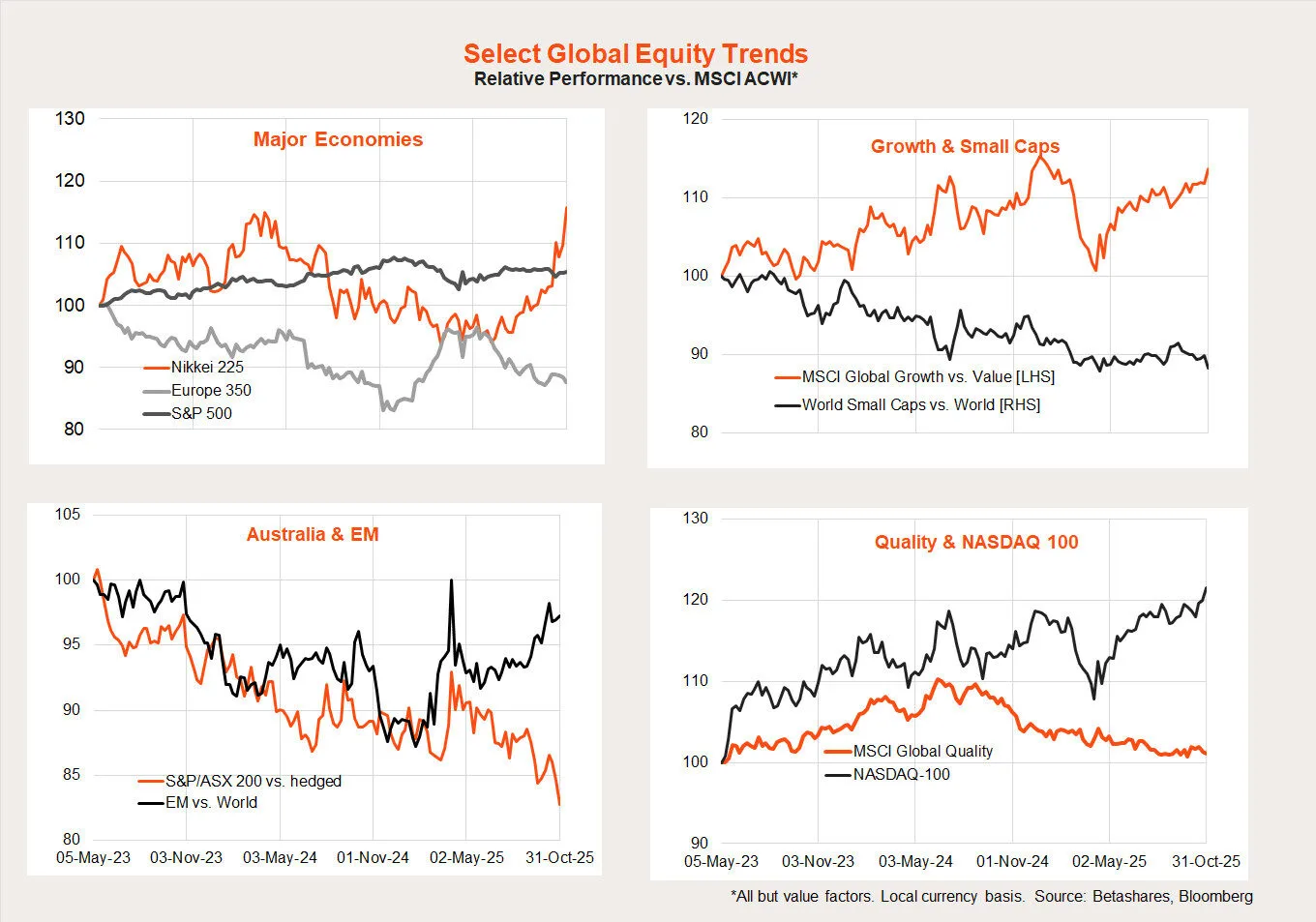

Global equity trends

As was the case in the previous week, Japan’s Nikkei-225 and the NASDAQ-100 recorded especially strong performances last week, with gains of 6.3% and 2.0% respectively.

All up, an interesting bifurcation is developing in markets, with the NASDAQ-100 still doing relatively well even though the US market overall is only tracking global market performance. Instead, we’re seeing strong relative performance in Japan and emerging markets, though not Europe or (sadly) Australia.

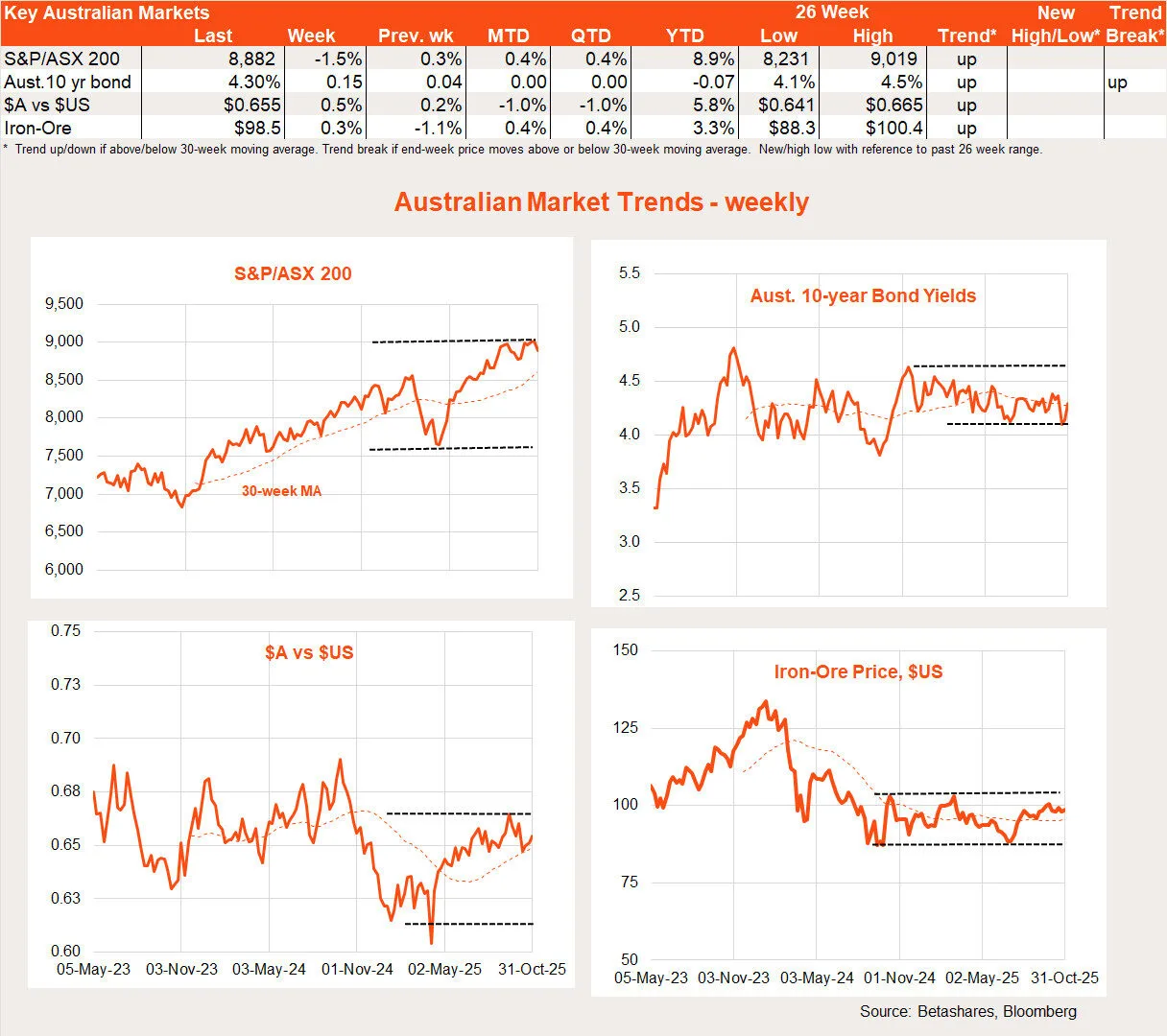

Australian week in review: Hot CPI kills RBA rate cut hopes

The obvious local highlight last week was the higher-than-expected Q3 CPI report, with trimmed-mean underlying prices up 1% quarter-on-quarter and 3% over the year.

The all-important trimmed mean outcome was higher than the market (including myself) and the RBA expected and effectively killed off the chance of an RBA rate cut this week. Naturally, this deflated stocks, with the S&P/ASX 200 bucking the positive global trend to end last week down 1.5%. Local bond yields rose and the Australian dollar firmed.

The hope is that the firming in price pressures during Q3 was really only a temporary profit re-building, given the lift in consumer spending and housing demand so far this year. The risk, however, is that the sticky level of inflation points to an economy still operating at a high level of capacity and with pockets of still-limited competition. If so, this will limit the degree to which the RBA can unshackle the current remaining interest rate constraints on economic growth.

I now see a rate cut as early as February next year as only a 50-50 prospect, and will crucially depend on the degree of any further labour market softening in coming months and the late January Q4 CPI report.

Australian week ahead: RBA on hold

The market now firmly expects the RBA to leave rates on hold on Tuesday and, in my opinion, the accompanying statement is likely to be cautiously hawkish in tone. So be prepared!

Not helping the local rates outlook was another firm house price report for October which was released yesterday. National prices are up 1.1% – the strongest monthly gain since June 2023.

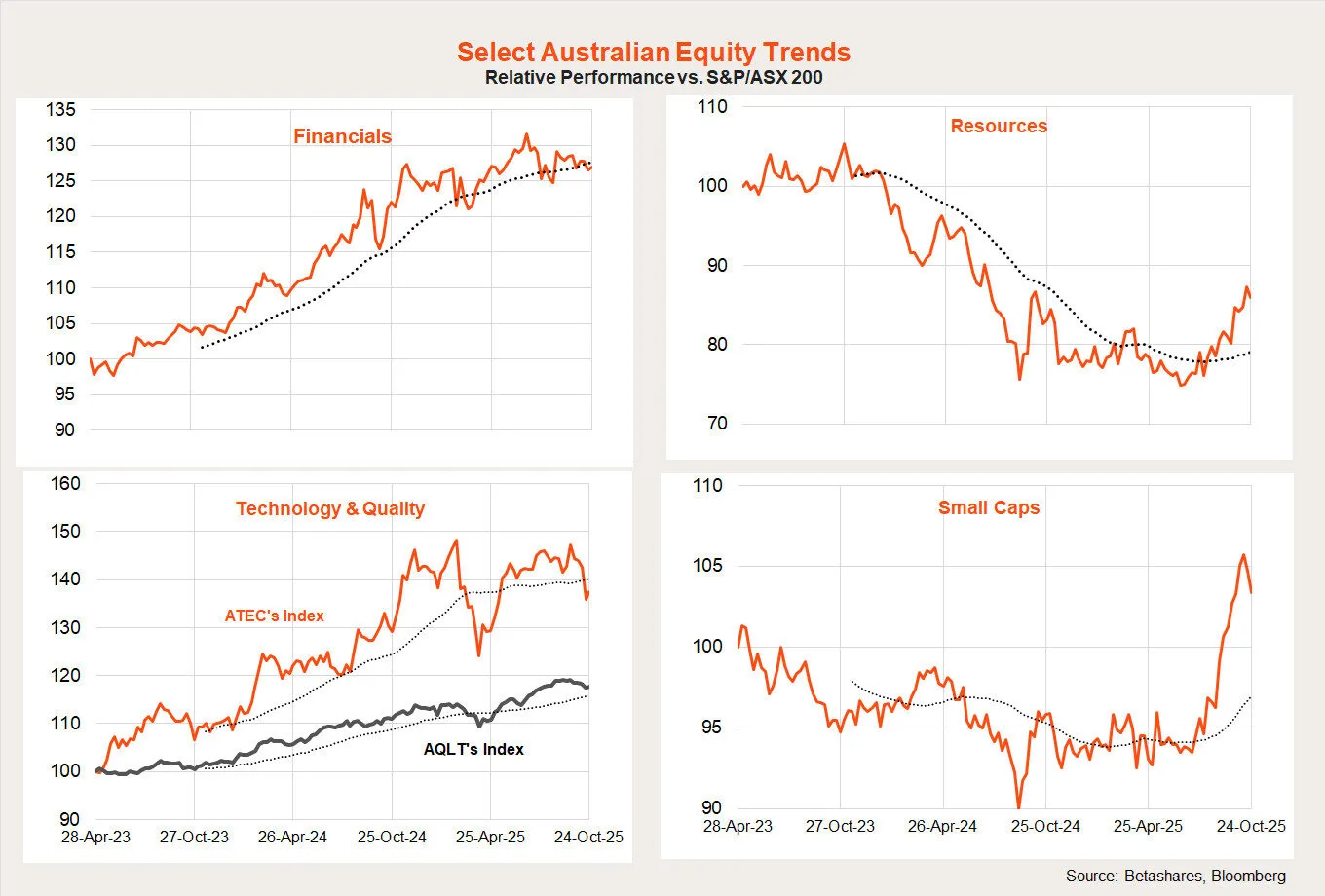

Australian equity trends

As has been the case globally, notable shifts have been taking place in the Australian equity market. Among large caps, there’s been a rotation from financials to resources, along with a notable rotation from large caps into small caps.

That said, small cap relative performance has consolidated in recent weeks. The strong earlier performance of the technology sector has also unwound somewhat of late.