9 minutes reading time

- Digital assets

Retirement planning has always been about looking ahead – 20, 30, or even 40 years into the future – and asking: how do I build something that lasts and grows stronger over time? For Australians running Self-Managed Super Funds (SMSFs), that question carries particular significance as the responsibility of ‘steering the ship’ sits in their hands.

An SMSF is generally built for the long-haul. It gives investors the flexibility to choose from a wide range of assets rather than being constrained by existing superannuation fund allocations. Property, shares, bonds, cash, even alternatives like art – the investor decides. The idea is to align investment choices with long-term goals, time horizon and appetite for risk.

But the investing landscape never stands still. What was once unconventional can become mainstream, and that’s exactly what’s been happening with Bitcoin.

Once dismissed as a fad, Bitcoin now seems to be part of the playbooks of global asset managers, pension funds and listed companies. Australian SMSF trustees have been following suit, with Australian government data showing SMSFs now hold over $3 billion in cryptocurrencies (as at the end of June 2025)1.

Diversifying the diversifiers

One of the cornerstones of investing is diversification: spreading capital across different asset classes so that when one stumbles another might hold steady or rise.

But traditional diversifiers don’t always deliver when needed. Bonds have traditionally provided ballast against equity sell-offs, but in 2022 that relationship broke down, with both asset classes falling simultaneously.

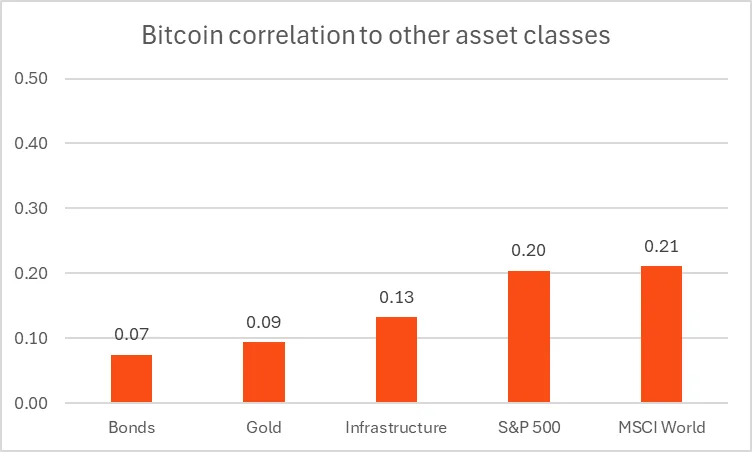

This is where Bitcoin can potentially add value. Studies of its historical performance show it has demonstrated low correlation to traditional assets like equities, bonds and property over the long term. In plain language, it generally has tended to do its own thing. During periods of market stress, Bitcoin can fall significantly in value and should not necessarily be considered defensive, but it has at times bounced back faster or taken a different path.

For SMSF trustees with multi-decade horizons, this lower correlation could add diversification benefits beyond simply combining stocks and bonds. As with any asset, Bitcoin (and crypto more generally) should be evaluated on its own merits against an investor’s risk tolerance, as well as its contribution to overall portfolio outcomes.

10-year correlations of Bitcoin to traditional assets (to 30 June 2025)

Source: Bloomberg. Average correlations calculated using daily returns over 10-year period ending 30 June 2025. Bonds proxied by Bloomberg Global Aggregate TR Index. Infrastructure proxied by FTSE Global Core Infrastructure 50/50 Index. Past performance is not indicative of future performance.

The gold comparison is inevitable. Both assets share qualities investors prize: scarcity, durability and no counterparty risk if held directly. But Bitcoin takes these features into the digital age. Its supply is hard capped at 21 million and mathematically enforced, making its supply arguably more predictable than gold. It’s also more portable – you can send billions of dollars’ worth of Bitcoin across the globe in minutes – and divisible down to the tiniest fraction, opening the door for investors of all sizes.

In short, Bitcoin can offers some of the potential benefits that gold has historically provided, such as protection against currency debasement and systemic risks, but with added efficiency, transparency and accessibility. For SMSF trustees looking to increase portfolio diversification, Bitcoin has been viewed by some investors as the ‘diversifier of diversifiers’.

The best-performing asset class since 2015

Since 2015 – a period that marked cryptocurrency’s transition into a more ‘accessible’ investment following key infrastructure and regulatory developments – Bitcoin’s performance over that period outpaced equities, bonds, property and commodities, although there have been bouts of sharp volatility along the way.

While global stock markets have delivered single- to double-digit annualised returns in the 10-year period to 30 September 2025, Bitcoin’s compounded growth has significantly exceeded these returns over the same period (remembering of course that past performance isn’t indicative of future performance).

Asset class vs bitcoin price returns (cumulative) (to 30 Sept 2025)

|

Asset |

1-Year Return (%) |

3-Year Cumulative Return (%) |

5-Year Cumulative Return (%) |

10-Year Cumulative Return (%) |

|

S&P 500 |

-34.7% |

-66.8% |

-79.9% |

-99.1% |

|

Nasdaq 100 |

-31.2% |

-60.8% |

-78.9% |

-98.7% |

|

Gold |

-18.7% |

-60.5% |

-80.8% |

-99.3% |

|

US Dollar |

-45.5% |

-84.7% |

-90.4% |

-99.8% |

|

Global Property |

-44.5% |

-76.9% |

-86.4% |

-99.6% |

Source: Bloomberg. As at 30 September 2025. US Dollar proxied by Bloomberg Dollar Spot Index. Global Property proxied by S&P Global REIT Index. All returns in USD. Past performance is not indicative of future performance.

Another striking point: every four-year holding period in Bitcoin’s history has tended to deliver a positive return. This pattern aligns with Bitcoin’s ‘halving cycle’, where the rate of new supply is cut roughly every four years. Historically, this cycle has caused an appreciation in the asset’s price. As the below chart demonstrates, many investors who have held through volatility have been rewarded with gains.

Bitcoin’s price performance over 10 years to 1 October vs price drawdowns (as at 1 October 2025)

Source: Glassnode. Past performance is not indicative of future performance.

That said, owning Bitcoin in an SMSF doesn’t always mean a lifetime commitment. Like any asset, it should be judged on fundamentals and its role in the relevant investor’s portfolio. If the long-term story changes – whether due to regulation, tech disruption or adoption shifts – trustees can consider trimming or exiting depending on their circumstances and outlook. But while Bitcoin continues to demonstrate strong performance, the rationale for holding may be strong. Flexibility is part of smart portfolio management, and SMSFs provide trustees with that freedom.

Going passive beats going blind

ETF investors understand the value of passive investing: holding broad market exposure is a simple concept and, if held for a long time, can help an investor compound their returns. With Bitcoin now possessing a US$2.3 trillion market capitalisation (as at 2 October 2025), excluding it from consideration represents an active allocation decision.

Think market weight: the S&P 500 Index has a market cap of roughly US$60 trillion2, US debt securities outstanding at US$48 trillion3, and Bitcoin at US$2 trillion.

Adding a very small allocation (e.g. below 5%) to Bitcoin isn’t necessarily a wild gamble; it could be viewed as just matching its current share of the US ‘most invested’ universe. If Bitcoin were to grow to the market cap of gold (US$26 trillion4), that small initial allocation could become far more meaningful. If it somehow went to zero (or close to zero), the impact within a well-diversified portfolio would not be expected to have a material impact on the broader portfolio.

From store of value to financial tool

Bitcoin is evolving. Today it’s mostly ‘digital gold’ but new layers, like the Lightning Network for payments and protocols for lending and yield, hint at a future where Bitcoin can be used to generate income. For example, imagine SMSFs holding Bitcoin not just for capital appreciation but also tapping yield streams like property rents or equity dividends.

Its role as collateral is also growing. Major banks, brokers, and lenders have been increasingly accepting Bitcoin as security for loans. For SMSFs, that could mean potential liquidity without selling and the option to leverage holdings for other assets. Bitcoin is shifting from a static store of value to a dynamic financial tool.

A maturing asset for long-term plans

SMSFs are utilised by many investors for their increased flexibility and long time horizons. In our view, for investors comfortable with the risks and volatility associated with the asset class, Bitcoin now sits firmly in the conversation as a legitimate part of a broader portfolio: relatively low correlation to traditional asset classes, with strong performance since 2015. Like gold, it can offer portfolio diversification benefits, but with digital-age advantages of scarcity, portability and accessibility.

No asset deserves blind loyalty, but strong historical performance and expanding use cases, including simple access via ETFs such as QBTC Bitcoin ETF , may make the case for inclusion of a small allocation to Bitcoin within a broader portfolio stronger than ever. QBTC offers regulated, ASX-traded exposure to the price of Bitcoin, making it simpler to gain exposure to its growth potential as part of a ‘traditional’ investment portfolio.

That said, traditional asset classes such as shares and fixed income should still form the core of a typical SMSF portfolio. For some investors, a small allocation to Bitcoin may be appropriate as a diversifying component. The power for SMSF trustees lies in choice: sizing allocations to match risk profile, adjusting as circumstances evolve and leveraging Bitcoin’s unique characteristics while maintaining long-term retirement discipline in a shifting landscape.

Sources:

1. https://data.gov.au/data/dataset/2fd970ec-984e-4593-bbad-2e69a5fa7a89/resource/dec379a3-67be-411e-a826-5d7de91cb131/download/smsf-quarterly-statistical-report-june-2025.xlsx ↑

2. Source: Bloomberg, as at 2 October 2025 ↑

3. Source: Bloomberg, as at 2 October 2025 ↑

4. Source: Bloomberg, as at 2 October 2025 ↑