Q3 GDP report hints at capacity constraints

3 minutes reading time

A change to US tax law could deliver a cash boost to some of the Nasdaq 100’s biggest names – just as earnings momentum slows. Find out why a tweak to research and development (R&D) rules could reignite innovation and lift investor returns.

US company earnings have faced some headwinds recently, as slower economic growth and higher tariffs put pressure on profits. Analysts have been trimming earnings forecasts, with some companies warning that results may come in below expectations.

Even so, earnings across the broader US market are still expected to grow by 9.1%[1] in 2025. While the next quarter might be softer, with growth forecast at just 5%[2], the slowest pace since late 2023, there may be a surprise on the horizon for some of the market’s biggest tech names.

That surprise comes from President Trump’s One Big Beautiful Bill Act (OBBBA).

A key section of the bill gives a near-term cash flow boost to companies that invest heavily in R&D, especially in sectors like technology and healthcare.

What’s in the bill?

One provision in the bill, known as Section 70302, would allow US companies to immediately expense domestic R&D costs, in turn reducing both taxable income and tax payments. This would then leave more cash in hand to reinvest in innovation.

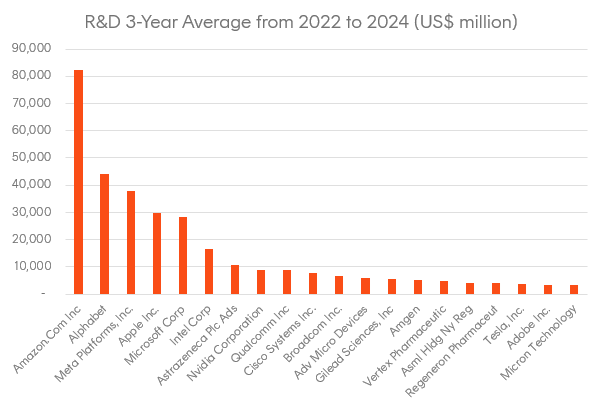

It’s a potential gamechanger for R&D-heavy firms like Alphabet, Amazon and Meta, which thrive on constant product and technology development.

For example, Alphabet’s self-driving car business, Waymo, is currently unprofitable, but the tax deductions could help fund the technology and infrastructure needed to scale its fleet operations.

Source: Nasdaq Global Indexes, FactSet. As of June 27, 2025.

Why it matters for the Nasdaq 100

With the bill headed into law after passing the US House of Representatives, it could give companies in the Nasdaq 100 a short-term lift by boosting cash flow and improving consensus estimates. That, in turn, could be a tailwind for the index in the second half of the year.

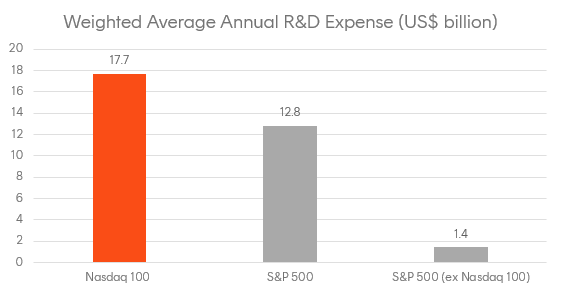

The Nasdaq 100 includes some of the world’s most innovative companies, and it shows in the numbers. The average Nasdaq 100 company spends about US$17.7 billion a year on R&D, which is around 1.4 times more than the average S&P 500 company.

If you exclude companies that are in both indexes, Nasdaq 100 companies spend about 12.8 times more on R&D than the rest of the S&P 500.

Source: Nasdaq Global Indexes, FactSet. As of March 31, 2025.

Investors can get exposure to the Nasdaq 100 through NDQ Nasdaq 100 ETF .

There are risks associated with an investment in NDQ, including market risk, country risk, currency risk and sector risk. Investment value can go up and down. An investment in the Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on this website.

Sources

[1] Factset Earnings Insight, 3 July 2025

[2] Factset Earnings Insight, 3 July 2025