Your investing calendar for 2026

6 minutes reading time

- Thematic

The uranium thesis in brief

The investment thesis for uranium is relatively straightforward, and at its core, a story of cyclicality like we’ve seen play out in many industries. It’s a story of supply and demand. But there are two key differences, which we’ll get to later.

The supply side story

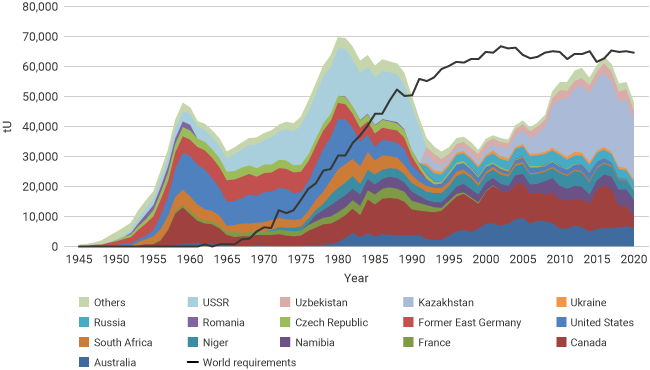

While the last uranium cycle ended in 2011, Kazakhstan, which had only recently entered as a major player, continued to ramp up production until a peak in 2016. At this point, Kazakhstan accounted for nearly 40% of global production1.

Global uranium production from mining

Sources: OECD-NEA/IAEA, World Nuclear Association

Prices bottomed in December 2016 at around US$17 per pound2 – from a high of over US$112 per pound in 2007. Low prices disincentivised supply, and mine production had fallen by nearly 25% by 20203.

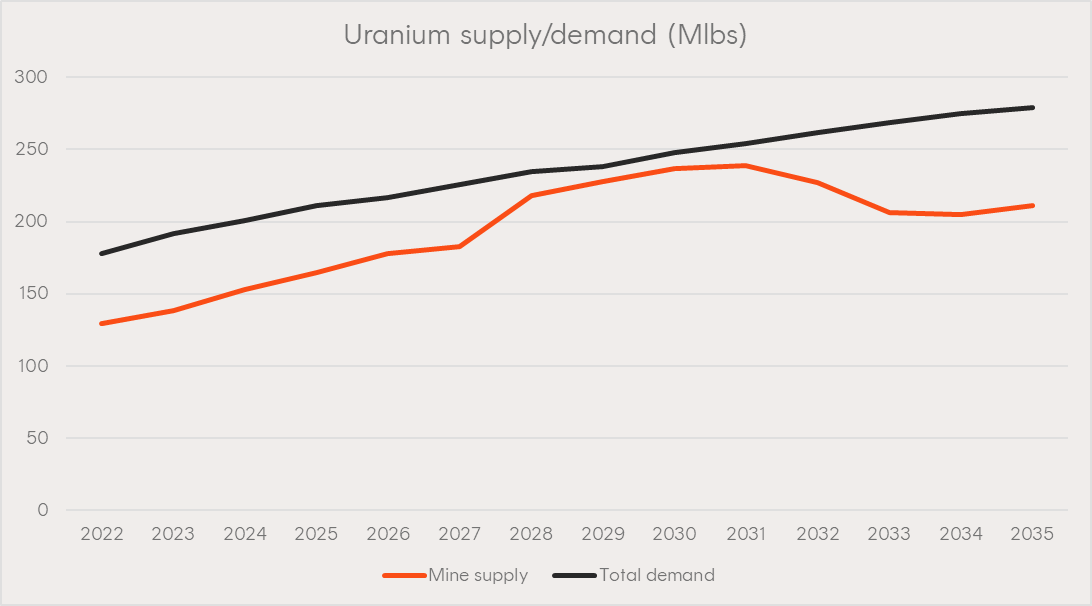

The uranium price slowly improved, until the second half of 2021, when the price increases gathered pace. This is normally the part of the story where we’d start to see new supply come online, incentivised by higher prices.

Source: Canaccord Genuity, TradeTech, uranium.info

One key difference

In uranium mining, bringing on new supply is not easy.

A handful of companies which had existing mines that had been shut down, and were preparing years in advance, are bringing supply to market. But these projects are not enough to bridge the gap.

The largest producers have promised to increase supply yet have repeatedly faced delays and missed targets.

For new projects to come online, the International Atomic Energy Agency estimates a typical 10 to 15 years of lag time4. There is no great surge in production waiting to#post-53964-footnote-4 take advantage of higher prices.

The demand side story

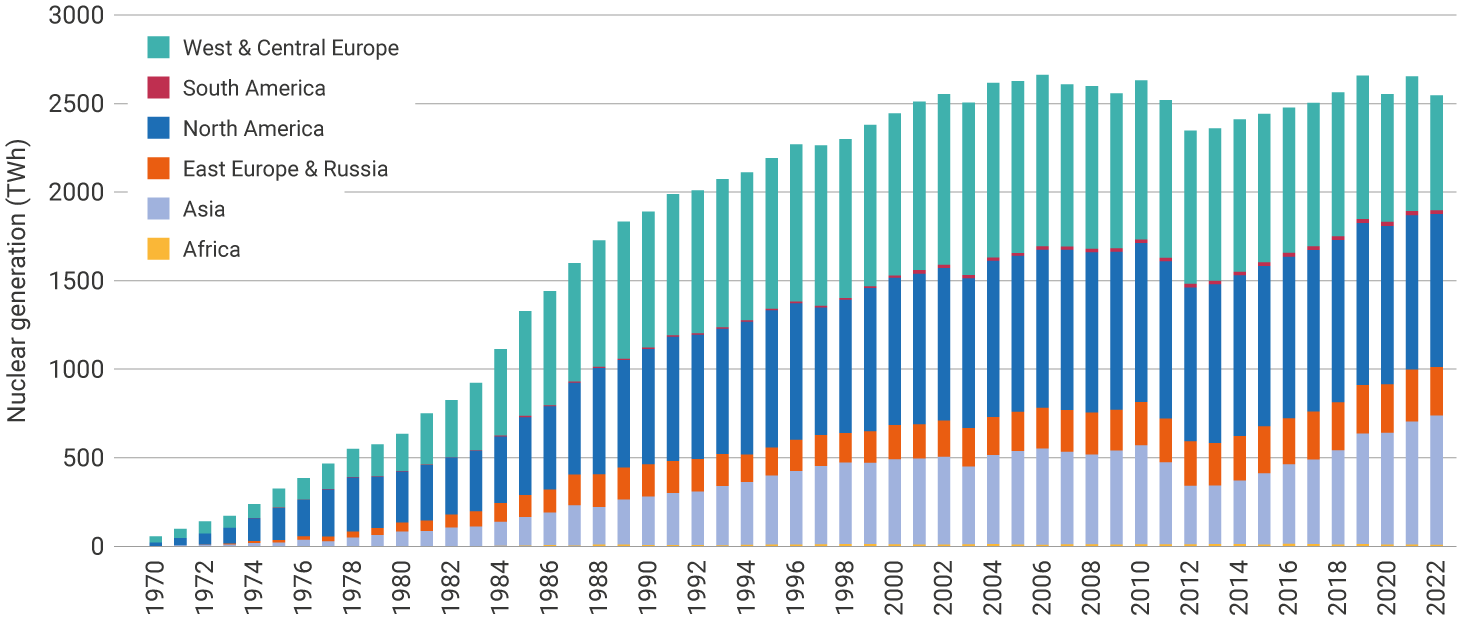

Following the disaster at Fukushima Daiichi Nuclear Power Plant in 2011, Japan suspended operations at most of its nuclear fleet. Parts of Europe and the US also saw opinions turn against nuclear. Some countries, such as Germany, chose to shut down operable reactors. Others chose to allow them to run to their end of their lives, but not repair or replace them.

Despite this, nuclear power generation actually rose globally from 2012 to 2020, as China’s expansion of nuclear more-than offset the loss of capacity elsewhere.

Nuclear electricity production

Source: World Nuclear Association, IAEA PRIS

Another key difference

In most industries, an increase in prices will result in reduced demand. For example, when cobalt prices skyrocketed in 2021, battery manufacturers began to look at alternative battery chemistries that used less cobalt.

This is not the case for nuclear.

For starters, uranium is not even the only input cost for nuclear fuel, let alone the plant’s overall running costs. Uranium needs to go through conversion, enrichment, and fabrication before it can be used as fuel.

In 2021, uranium accounted for around 51% of the total cost of fuel5, which in turn accounted for around 20% of total generation costs6. It should be noted that uranium costs have since risen significantly.

But more importantly, there is no alternative to uranium. Utilities must purchase it to keep running their reactors.

Recent developments

President Trump signed four new executive orders, aimed at rapidly expanding America’s nuclear energy capabilities. The long-term ambition? To quadruple the country’s nuclear capacity by 2050.

According to Flash Update research notes from both Citi Research and Canaccord Genuity7, achieving that goal would require the US’ amount of annual uranium demand to double from current levels8.

The four executive orders are aimed at kick-starting the following initiatives:

- Federal funding and loan guarantees to help construct 10 new large reactors by 2030 and the upgrade of existing nuclear reactors9

- Developing and deploying Small Modular Reactors (SMRs)10

- Removing regulatory barriers, especially the time taken to review an application to build a new nuclear plant11

- Boosting US uranium production and enrichment capabilities as well as expanding the nuclear energy workforce12.

These orders seek to slash red tape and accelerate the approval process for new nuclear reactors and power plants. It also marks a significant shift in how quickly nuclear projects can get off the ground13.

The executive orders follow the passing of Trump’s so-called “Big Beautiful Bill”, which eliminates tax credits for most clean energy projects. Nuclear, however, is the exception, with companies in the sector still eligible for production tax credits on projects that start construction by 2031.

Getting exposure to uranium

URNM Global Uranium ETF invests in leading companies involved in the mining, exploration, development and production of uranium, modern nuclear energy, or that hold physical uranium or uranium royalties.

Quick facts about URNM:

- Holdings include: Cameco Corp, Kazatomprom, CGN Mining, Uranium Energy Corp*

- FUM: $174M

- Index: Indxx North Shore Uranium Mining Index

- Management Costs: 0.69% p.a.**

- Inception date: 8 Jun 2022

- Investment risks: Market risk, sector concentration risk, international investment risk and regulatory risk.

Investment value can go up and down. An investment in URNM should only be considered as part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of the Fund, please see the Product Disclosure Statement and Target Market Determination, both available on www.betashares.com.au.

- World Uranium Mining Production

- IAEA – The Economics of Uranium Mining

- NEI – Nuclear Costs in Context (2021), p. 4

- U.S. DOE – COP28 Nuclear Energy Declaration

- World Nuclear Association – New Reactor Plans

- Boss Energy – Honeymoon Project

- Kazatomprom – 2024 Production Adjustment

- Citi Research, 26 May 2025

- Canaccord Genuity Research, 25 May 2025

- Executive Order: Reinvigorating the Nuclear Industrial Base

- Executive Order: Reforming Nuclear Reactor Testing

- Executive Order: NRC Reform

- Executive Order: Deploying Advanced Nuclear Tech

- Reuters – Nuclear Stocks Surge on Trump Orders

1 comment on this

I ate a spoonful of Uranium 44 years ago and I’m not glowing yet lol