6 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

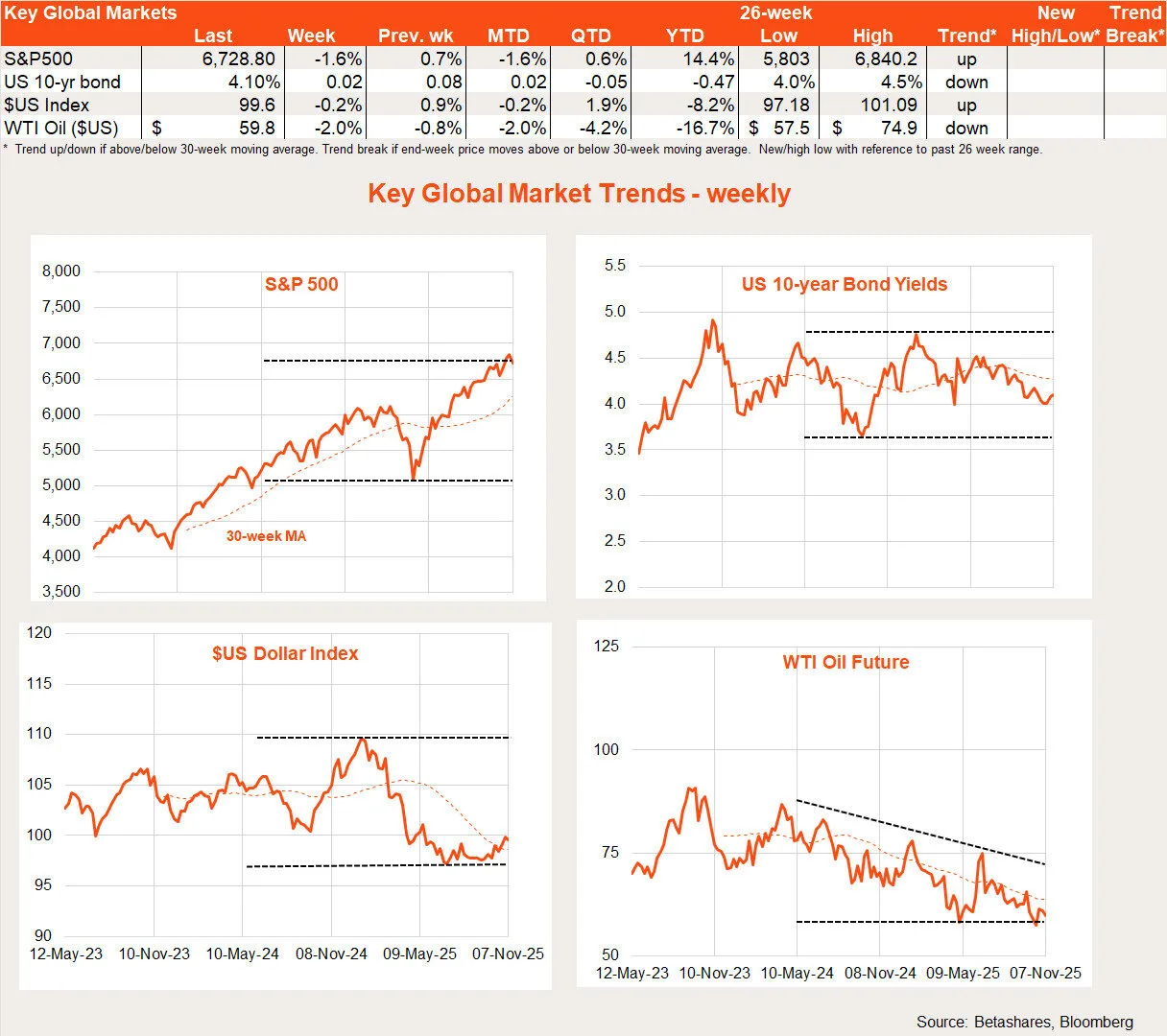

Global equities pulled back last week reflecting tech-related valuation concerns and comments from senior Wall Street bankers pointing to the risk of a correction at some stage in the coming year.

Global week in review: Valuation concerns re-emerge

In a data-light week, equity markets saw reason to retreat again a little last week, helped by two senior Wall Street bankers – no less than CEOs of Morgan Stanley (Ted Pick) and Goldman Sachs (David Solomon) – acknowledging high valuations and the risk of a correction at some stage. This follows earlier comments from JPMorgan Chase CEO Jamie Dimon about potential “cockroaches” emerging on Wall Street.

Of course, beyond the headlines, this should be a shock to nobody, as corrections happen every year or so and the CEOs would be foolhardy not to acknowledge this obvious fact. Helping support tech sentiment somewhat last week, however, were major deals by Amazon and Microsoft, demonstrating their commitment to investing billions in the AI race.

My take is that AI provides all the classic ingredients for a stock market bubble to develop – and one probably will – although we are likely still reasonably early in the process. NASDAQ valuations remain well below levels seen at the height of the late-1990s dotcom bubble and we’re not yet seeing the flood of AI hopefuls listing on the market at insane valuations. As some have suggested, the persistent talk of a bubble likely suggests we’re still some way away from it – we should worry when most are convinced that high valuations are justified!

What data we did get in the United States last week was fairly mixed, with ADP payrolls and the ISM services survey better than expected, whereas Challenger layoffs and the University of Michigan consumer sentiment index were both weaker than expected. With the US government still shut down, official data is sparse but it does appear the US labour market and consumer sentiment are faltering in the face of tariff uncertainty and simmering price pressures. Whatever its merits, the illegal immigration crackdown is also leading to labour supply pressures in areas such as farms and housing construction – hardly conducive to an easing in food and housing cost pressures.

The last notable development last week was seemingly harsh early questioning by the US Supreme Court over the legitimacy of President Trump’s tariffs. We don’t yet know when the Court will hand down its decision but it remains to be seen whether it ends up striking down Trump’s cavalier use of the tariff weapon. So far at least, the Court has tended to grant Trump all the presidential power he has wanted.

Global week ahead: Private data and the courts

A key focus this week is whether a compromise deal can be reached to re-open the US government, with pressure mounting amid flight cancellations and many families starting to miss out on food relief. A strong showing by the Democrats in last week’s state and municipal elections suggests Republicans are feeling the most heat from the shutdown so far.

Perhaps in reaction, President Trump suggested on the weekend that Republicans have agreed to direct payments to households instead of extending health care insurance subsidies to companies, although it remains to be seen if either side of the aisle will seriously consider it.

In other news, we get an update on small business sentiment with the privately run NFIB survey this week. There’s also a bunch of Fed speakers who will share their opinions on the prospect of a December rate cut.

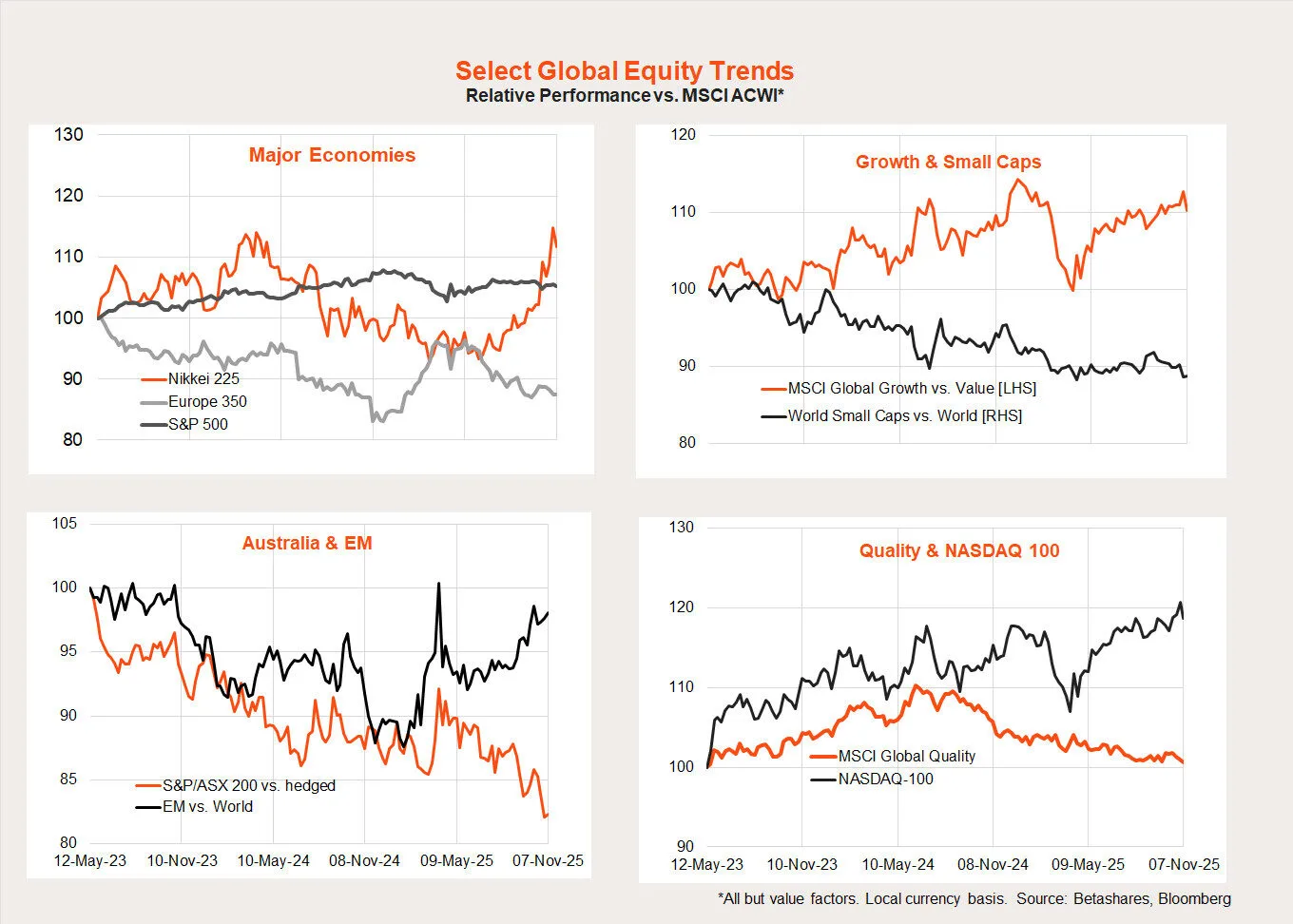

Global equity trends

Last week’s valuation concerns led to stronger declines in the tech and growth space. Indeed, after strong performances in the previous week, current market darlings – Japan’s Nikkei-225 and the NASDAQ-100 – suffered stronger declines. Australian shares and emerging market shares held up best.

That said, it’s still too early to call a shift in underlying trends. The NASDAQ-100 has still performed relatively well of late even though the US market overall is only tracking global market performance. We’ve also seen stronger relative performance in Japan and emerging markets, though not Europe or (sadly) Australia.

Australian week in review: RBA holds as expected

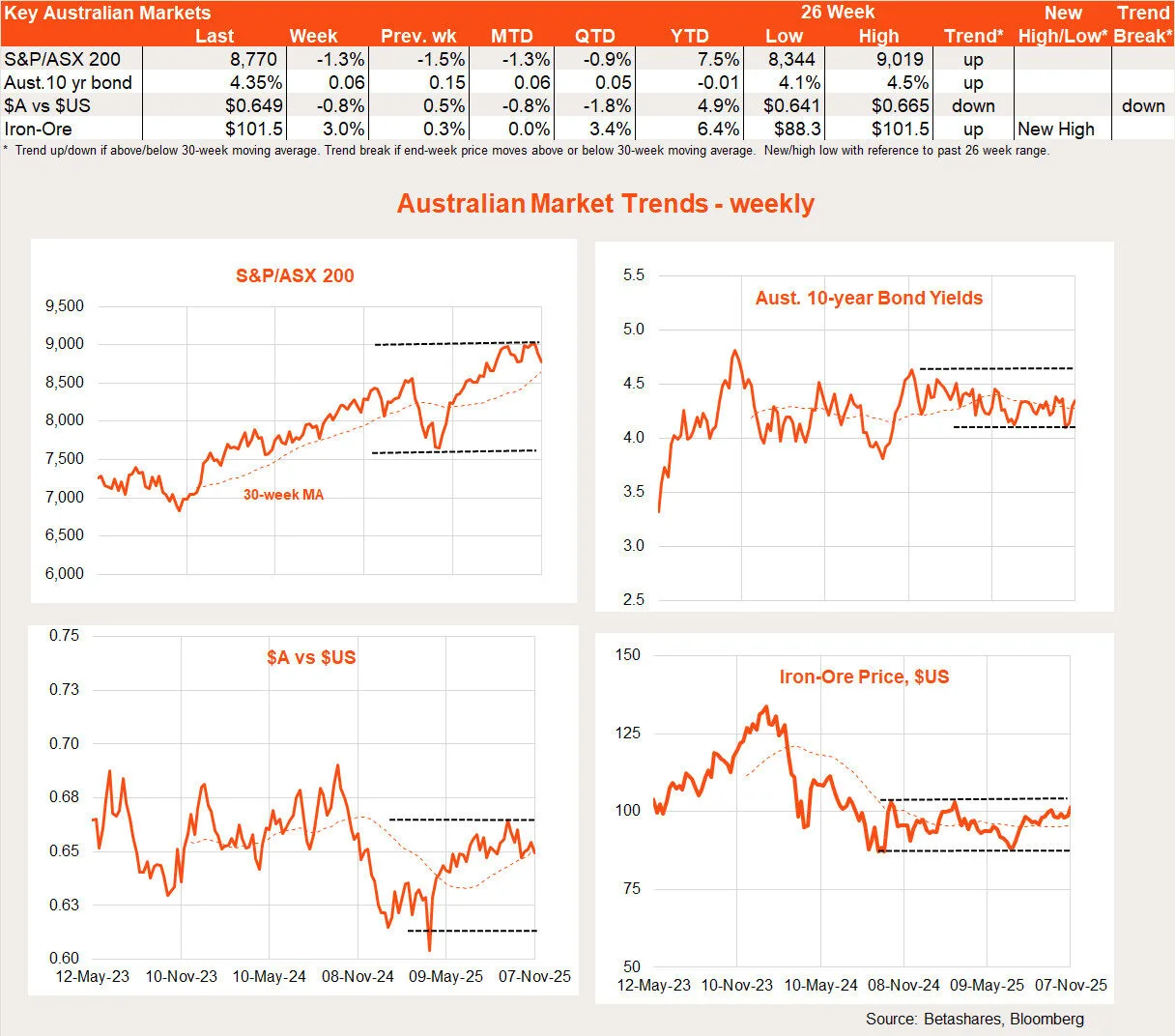

Local stocks eased back further last week with the major highlight being the RBA’s widely expected decision to leave interest rates on hold following the higher-than-expected Q3 CPI report.

That said, the RBA’s accompanying statement, and Governor Bullock’s press conference, were perhaps not as hawkish as feared. The key takeaway is there’s still a chance of one or more rate cuts next year – although not likely before May – if the lift in pricing pressure in Q3 quickly subsides. My take on it all can be found here.

My base case is that the RBA will cut interest rates in May and August 2026, assuming the annualised rate of inflation in the upcoming monthly and quarterly CPI reports shifts down from the 4% pace evident in Q3 to something closer to 2.5%. As it stands, the market now only sees a 50% chance of one rate cut in 2026 – a bit too pessimistic in my view.

Australian week ahead: labour market test

Of course, beyond inflation, the other factor that could goad the RBA into cutting rates would be further serious deterioration in the labour market. We’ll get an update on that with the October labour market report this Thursday, with the market expecting a modest 20k employment gain and a tick back down in the unemployment rate from 4.5% to 4.4%.

A lurch higher in the unemployment rate to 4.6% or 4.7% – which is possible but not probable – would re-intensify market chatter about a potential December or February rate cut.

Also due out this week are housing finance figures and the Westpac and NAB surveys of consumer and business sentiment respectively.

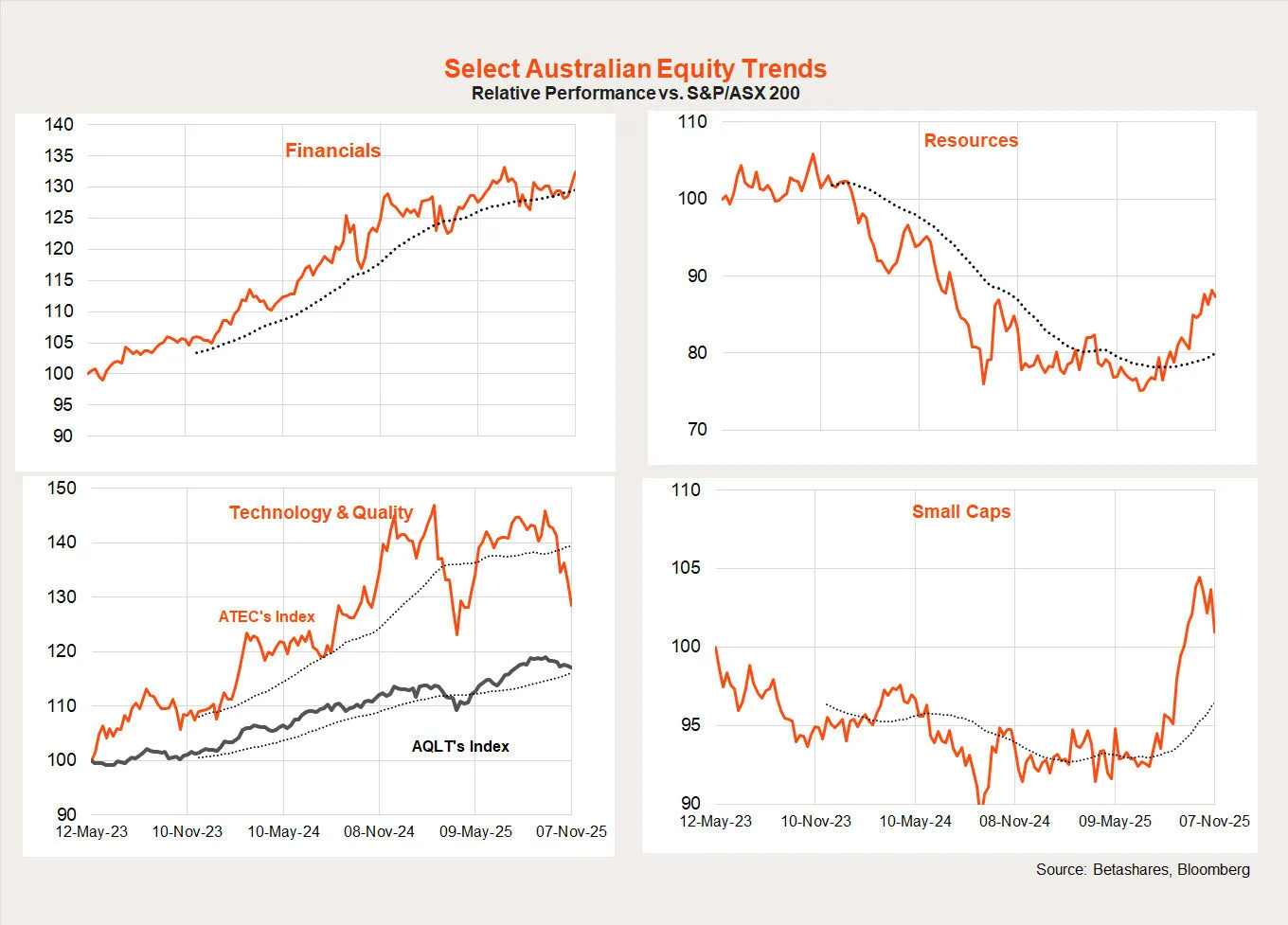

Australian equity trends

The materials and technology sectors suffered the biggest pullbacks last week, while small caps further retraced some of their recent outperformance. The shift from optimism to pessimism around rate cuts appears to have hurt high-beta growth plays on the local market of late.