7 minutes reading time

- Global shares

Many Australian portfolios are heavily weighted to local assets: Australian shares, property, bank hybrids and domestic ETFs.

While home bias is understandable, it often means overlooking economies that account for most of the world’s population and host some of the fastest-growing companies. And right now, some of the most compelling growth stories are unfolding in markets many Australian investors have never seriously considered.

The comfortable default

According to the ASX Australian Investor Study 2023, 58% of Australian investors hold ASX shares directly, but only 16% hold international stocks.

When Australians do venture overseas, most of that money likely flows into US-focused ETFs that track companies like Nvidia, Microsoft and Apple. This is not to say that doesn’t make sense. These are companies we use every day, and the US market is the largest, most liquid and most covered by financial media.

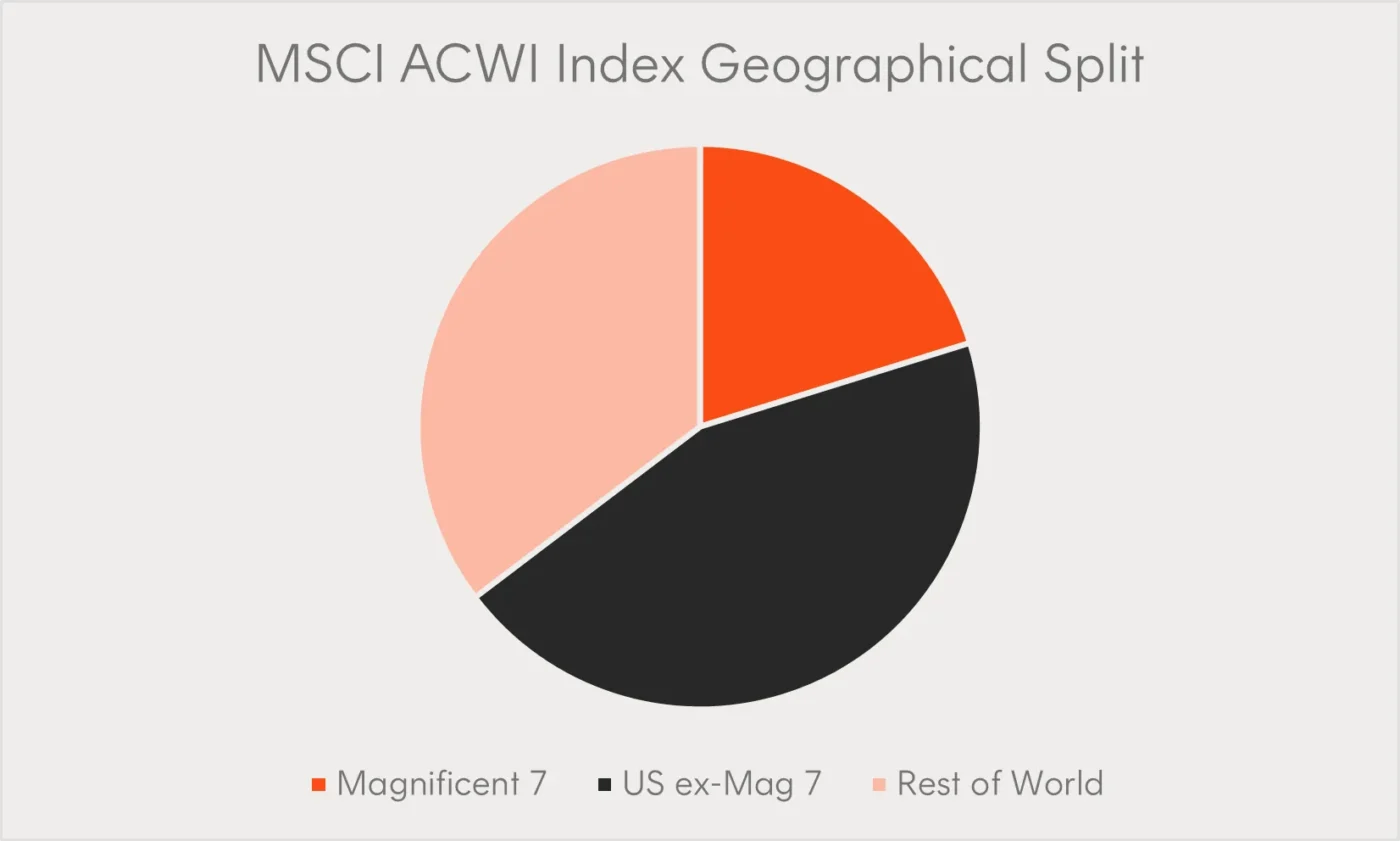

But even portfolios that feel “global” often are not. 72% of the MSCI ACWI Index, the widely quoted benchmark for global equities, is composed of American companies. The Magnificent Seven make up more than 20% of the index.

Source: MSCI. As of 28 November 2025. Past performance is not an indicator of future performance. You cannot invest directly in an index.

Meanwhile, 6.9 billion people live in countries that barely register in most portfolios. And some of them are building impressive businesses that could shape the next decade of wealth creation. For years, the scepticism made sense. But the gap between perception and reality is widening.

Today’s emerging economies are home to some of the world’s most impressive growth stories. For investors looking to build wealth over the next decade, these markets – and the companies within them – are becoming important to consider.

Growth stories hiding in plain sight

India is now the world’s fifth-largest economy, with a median age of just 28, ten years younger than Australia’s. That young population is anticipated to create a demographic tailwind that will drive a surge in demand for connectivity. One company catering to that demand is Reliance Jio. Launched in 2016, Jio has since grown to 482 million subscribers and is now the world’s third-largest mobile network operator worth an estimated US$170 billion. Beyond rumours of an IPO, the company is currently developing a 6G network for the subcontinent.

Or consider Brazil, where the digital transformation is reshaping how hundreds of millions of people bank and shop. MercadoLibre, a digital marketplace, operates across 18 Latin American countries and processes 57 purchases and 360 transactions every second. It is now so big that it has been described by business web magazine Quartr as “the digital backbone of Latin America”.

Then there’s Mexico, which is experiencing a structural economic shift that’s easy to miss if you’re only reading Australian financial news. The country attracted US$31 billion in foreign direct investment in just the first half of 2024, driven by ‘nearshoring’. Nearshoring is a phenomenon which sees some Western companies moving their production away from China to places like Mexico in order to build more resilient supply chains closer to US markets. This could provide a boon for local companies like FEMSA, which runs the OXXO convenience store chain.

These three examples barely scratch the surface. Similar transformations are happening across Southeast Asia, Eastern Europe and dozens of other markets that simply don’t receive coverage in Australian media.

The case for building wealth in emerging markets

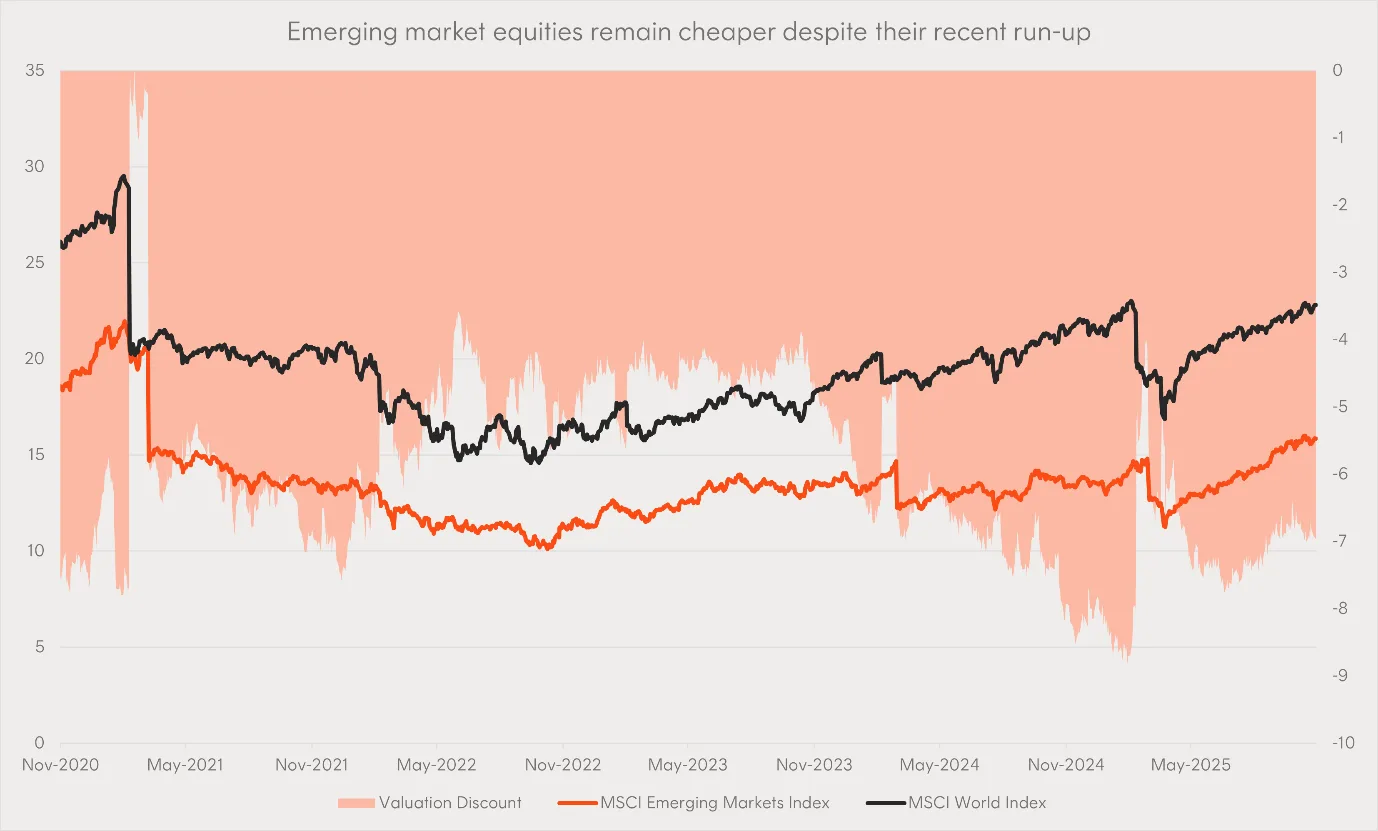

It’s not just the macroeconomic story that makes emerging markets a genuinely compelling investment idea. Emerging market companies are currently trading at significantly lower valuations than their developed market peers on a forward price-to-earnings basis. At the same time, emerging economies are projected to grow at 4% annually versus just 1.5% for developed economies.

Source: Bloomberg. As of 17 November 2025. Valuation discount based on the differential between the MSCI World Index’s 12-month forward price-to-earnings ratio and the MSCI Emerging Markets Index’s 12-month forward price-to-earnings ratio. Past performance is not an indication of future performance. You cannot invest directly in an index.

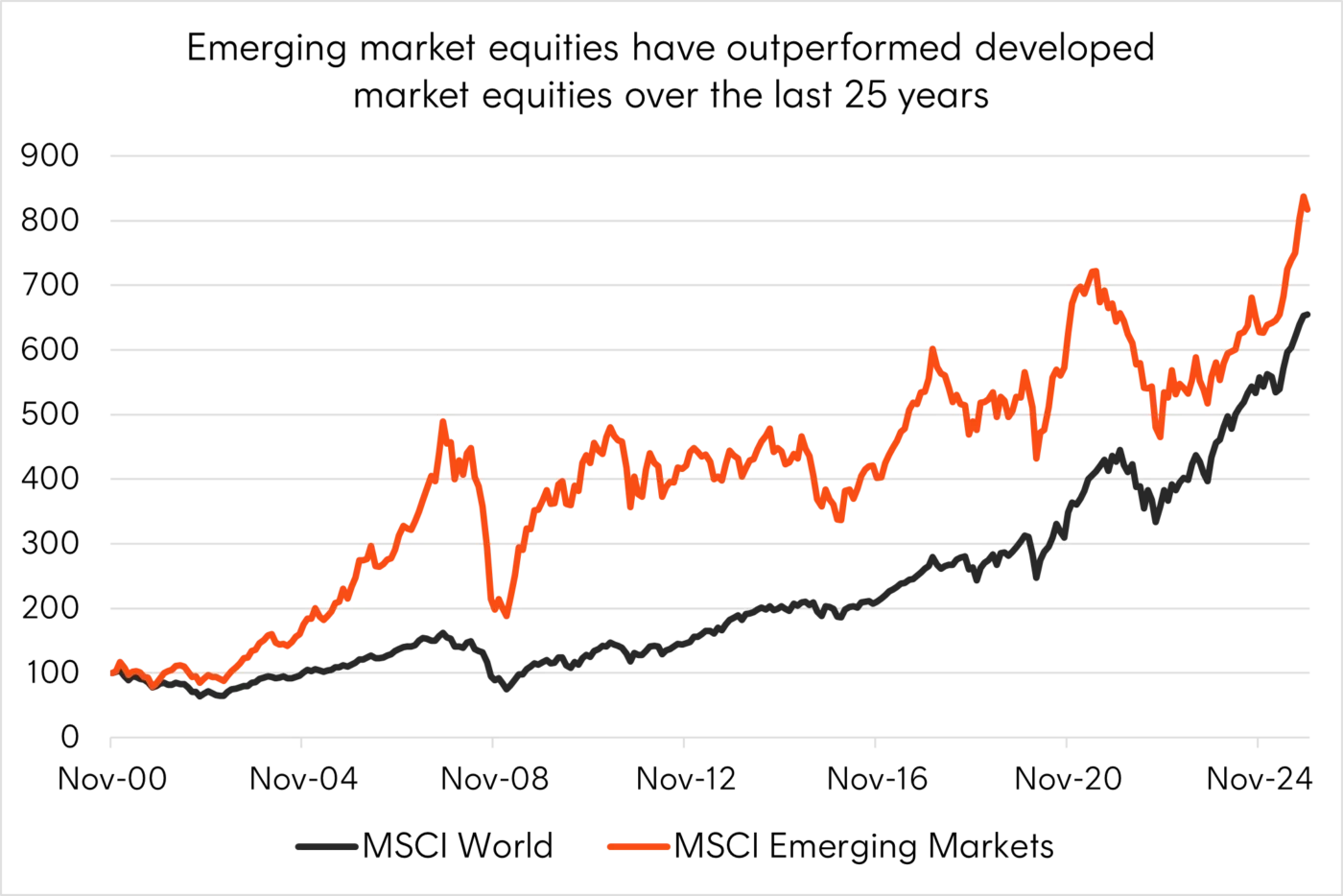

Emerging markets offer faster-growing economies, younger demographics and valuations trading at a discount to developed markets. And contrary to common assumptions among investors, emerging market assets have actually outperformed developed market assets over the past 25 years1. In fact, 2025 has been the best performing year for emerging market assets since 20172.

Source: Bloomberg. As at 9 December 2025. Past performance is not an indicator of future performance. You cannot invest directly in an index.

This is not to suggest genuine risks don’t exist. Currency volatility, political uncertainty and regulatory changes are all important factors to consider. But developed markets face instability too. Every market has risks. The question is whether you’re assessing emerging market risks objectively, or they just feel riskier because they’re less familiar.

Every market has its risks. The question is whether an investor is assessing emerging market risks objectively, or it just feels riskier because these economies are less familiar.

How to access this

The good news is investors do not need to become experts on Indian conglomerates or navigate Brazilian regulatory frameworks. BEMG MSCI Emerging Markets Complex ETF provides exposure to hundreds of companies across 24 countries in a single trade for a low cost.

The fund holds leading companies like Taiwan Semiconductor Manufacturing Company (the world’s largest chip manufacturer), Tencent (China’s social media and gaming giant), Samsung Electronics as well as some of the firms mentioned earlier.3 BEMG is designed as a strategic allocation for investors building diversified, growth-oriented portfolios. For investors who are ready to position their portfolio where tomorrow’s growth may actually be happening, you can explore BEMG’s holdings, strategy and philosophy through Betashares Direct.

The bottom line

Most portfolios weren’t deliberately designed to exclude emerging markets. They evolved based on what was visible and accessible: the ASX, plus some familiar US names.

While this is understandable, the next decade’s wealth won’t be built by ignoring where the world is actually growing. And right now, much of that growth is happening in places that don’t make the evening news.

Sources:

1. Source: Bloomberg. 8 December 2000 to 8 December 2025. MSCI World Index and MSCI Emerging Markets Index used to represent developed and emerging markets. You cannot invest directly in an index. Past performance is not an indicator of future performance. ↑

2. Source: Bloomberg. MSCI World Index and MSCI Emerging Markets Index used to represent developed and emerging markets. You cannot invest directly in an index. Past performance is not an indicator of future performance. ↑

3. There is no guarantee these stocks will remain in BEMG’s portfolio or be profitable investments. Past performance is not an indicator of future performance. ↑