7 minutes reading time

With Ethereum prices surging and institutional interest booming, it’s an opportune time to understand what Ethereum is and why it matters.

Ethereum is the second largest digital asset behind Bitcoin and is a decentralised blockchain platform designed to support smart contracts and decentralised applications (dApps). It’s more than just a cryptocurrency – it’s a programmable ecosystem.

What are the key differences between Bitcoin and Ethereum?

Digital gold:

- Bitcoin was designed as a decentralised digital currency – a store of value and medium of exchange with very limited scripting capabilities.

Digital infrastructure:

- Ethereum, on the other hand, is a platform for building decentralised applications and executing smart contracts.

- Developers can write complex logic using Ethereum’s native programming language. This enables use cases in gaming, tokenisation, enterprise automation and data sharing. It also has use cases in DeFi (decentralised finance) like lending and trading platforms.

- Ether (ETH) is the native currency used to pay for transactions and services on Ethereum and can be thought of as the “gas” that powers the Ethereum infrastructure.

Energy consumption:

- One of Bitcoin’s main criticisms is the energy-intensive nature of securing transactions on the blockchain. It normally involves complex mathematic puzzles to be solved in a process known as Proof of Work (PoW), where miners compete to be the first to solve the puzzle and validate the transaction. In return, miners receive the block reward.

- Ethereum moved away from PoW in September 2022 in an event known as the ‘Merge’1. It now operates on a consensus mechanism known as proof of stake (PoS), which involves validators staking their ETH and earning a yield in return. A random selection then takes place to decide which validator is chosen to validate the transaction earning the fee; the more a validator stakes the better the chances of selection. The ‘Merge’ reduced energy consumption by over 99.9%, making it one of the most environmentally friendly blockchains2 today.

Issuance:

-

- Bitcoin has a fixed and predictable issuance pattern, halving approximately every four years with a total hard cap supply of 21 million coins.

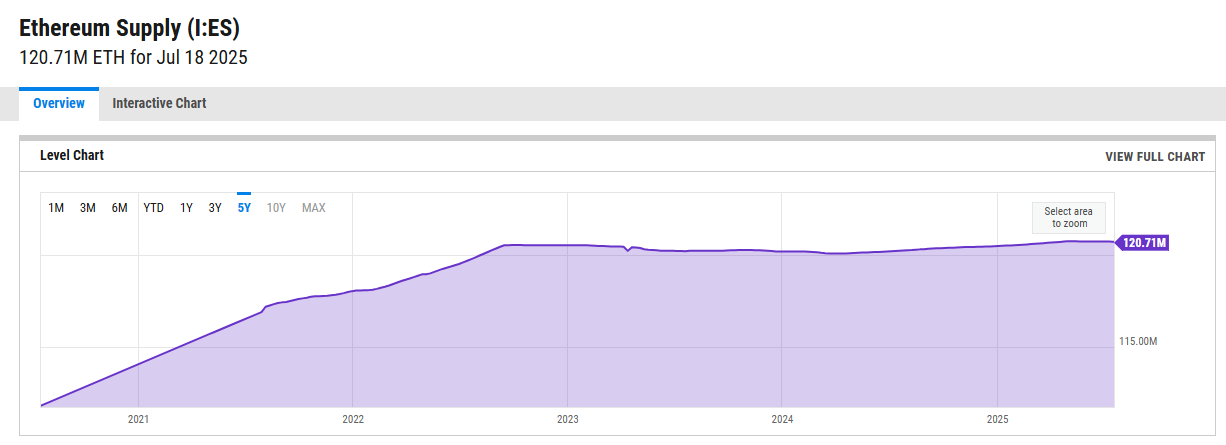

- Ethereum has no fixed supply cap, but its new issuance is offset by fee burning (permanently removing a portion of a cryptocurrency’s supply from circulation by burning or destroying the tokens or coins3). This has significantly reduced the net new supply of coins and, at times, has made ETH deflationary since the Merge (15 Sept 2022)4.

Source: https://ycharts.com/indicators/ethereum_supply

Crypto legislation gains momentum

In a significant step for digital asset regulation, the US House of Representatives advanced three major crypto bills in July 2025, signalling growing bipartisan support for clearer rules in the crypto space.

The three bills at a glance:

1. GENIUS Act

This act focuses on regulating stablecoins, which are cryptocurrencies pegged to assets like the US dollar. The bill has now been signed into law, making it the first crypto-focused law in the US and is seen as a foundational step in legitimising stablecoins as well as providing consumer protections.

2. Anti-CBDC Surveillance State Act

The legislation prohibits the Federal Reserve from issuing a central bank digital currency (CBDC). The bill aims to prevent government overreach and protect individual financial privacy.

3. Digital Asset Market Clarity Act of 2025

The bill seeks to define what constitutes a digital commodity versus a security. It clarifies regulatory responsibilities between the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), reducing ambiguity for crypto businesses and investors.

What is the significance?

These bills aim to provide the legal certainty that institutional investors and developers have long awaited. Emphasis on transparency, auditability and accountability could help to build trust in the crypto ecosystem. Clear rules attract major players and capital inflows, as seen with the success of Bitcoin ETFs and, in more recent times, Ethereum ETFs.

Ethereum’s role in the stablecoin ecosystem

With the GENIUS Act now law, an increase in stablecoin adoption is likely – from fintech apps to payroll systems5. As issuers race to meet compliance standards, consumers may soon see stablecoins integrated into everyday financial services.

Ethereum is the primary settlement layer for most stablecoins, including USDC, DAI and PYUSD (Paypal). The Act’s passage directly benefits Ethereum by driving higher on-chain activity as well as enhancing Ethereum’s position as the infrastructure for tokenised finance including real-world assets (RWAs).

Ethereum powers the largest share of DeFi (Decentralised Finance) applications. With over $63 billion in Total Value Locked (TVL)6, ETH is the backbone of on-chain finance and regulatory clarity around stablecoins could be expected to attract more developers and capital to the Ethereum-based DeFi platform.

What is tokenisation?

Tokenisation converts traditional assets like stocks, bonds and funds into digital tokens that live on blockchains. This shift promises faster settlement, lower costs and broader access, and could unlock trillions of dollars in value and redefine how financial markets operate.

Robinhood’s crypto push fuels Ethereum demand

Robinhood’s recent launch of tokenised stock trading on Ethereum’s Layer-2 chain, Arbitrum, has positioned ETH as the settlement layer for its next-gen financial products and could attract millions of retail users into the Ethereum ecosystem via Robinhood’s interface7.

Layer-2 chains offer scaling solutions, meaning thousands of transactions are processed off-chain, which is significantly cheaper and faster. It is then batched back to Ethereum which reduces congestion on Ethereum’s mainnet (ETH’s primary and official public blockchain8).

Institutional flows and ETF Momentum

Robinhood’s rally coincides with a broader Wall Street pivot toward Ethereum. Spot Ethereum ETFs saw record flows in July (as at 18 July 2025) of $3.1 billion, with BlackRock’s ETHA leading the charge9.

In total, spot Ethereum ETFs have seen US$9.3 billion of cumulative net inflows since their inception last year10 with spot Ethereum ETF assets under management recently surpassing US$20 billion.11 There has also been a surge in corporate treasury activity, similar to MicroStrategy’s Bitcoin accumulation strategy. ETH treasury companies like BitMine Immersion Technologies, SharpLink Gaming and Bit Digital are accumulating ETH aggressively, with BitMine now holding over 300,000 ETH (worth over US$1 billion)12.

ETH as the next crypto strategic asset: a new narrative?

The crypto bull market has long been defined by institutional flows into Bitcoin. BTC emerged as the institutional grade asset of choice, unlocking massive capital and propelling its market cap to over US$2.3 trillion13. But a new narrative is emerging – one that positions Ethereum as the next institutional-grade crypto strategic asset.

Arguments supporting ETH’s narrative as a strategic asset include:

- Institutional interest in Ethereum is accelerating, with ETFs, staking products and treasury strategies gaining traction

- The staking yields and deflationary supply mechanics are being noticed and appeal to long-term allocators

- Ethereum is seen as the backbone of stablecoins and the platform of choice for tokenisation and real-world assets

- ETH is the gas that may power the next financial era with references to the term “clean” digital oil

- Robinhood’s announcement to enable tokenised stock trading across Europe could attract millions of users into the Ethereum ecosystem

With the recent surge in ETH holdings by corporate treasuries and rising inflows into Ethereum ETFs driving net demand and higher ETH prices, these activities are not using ETH as a utility token for gas or DeFi. Instead, they reflect ETH’s emerging role as a crypto strategic asset – reducing circulating supply and positioning it as a long-term store of value with a native yield.

Investing in crypto assets or companies servicing crypto-asset markets should be considered very high risk. Exposure to crypto assets involves substantially higher risk when compared to traditional investments due to their speculative nature and the very high volatility of crypto-asset markets.

Investing in crypto assets or crypto-focused companies is not suitable for all investors and should only be considered by investors who (i) fully understand their features and risks or after consulting a professional financial adviser, and (ii) who have a very high tolerance for risk and the capacity to absorb a rapid loss of some or all of their investment.

Any investment in crypto assets or crypto- focused companies should only be considered as a very small component of an investor’s overall portfolio.

Sources:

1. https://ethereum.org/en/roadmap/merge/ ↑

2. https://www.newscientist.com/article/2369304-cryptocurrency-ethereum-has-slashed-its-energy-use-by-99-99-per-cent/ . ↑

3. https://news.fuse.io/what-is-fee-burning-in-crypto/ ↑

4. https://cointelegraph.com/news/ethereum-turns-deflationary-for-the-first-time-since-the-merge-eth-price-still-risks-50-drop ↑

5. https://www.reuters.com/legal/government/us-house-sends-genius-act-stablecoin-bill-trump-sign-2025-07-17/ ↑

6. https://www.bitget.com/news/detail/12560604866961 ↑

7. https://www.etfstream.com/articles/robinhood-launches-tokenised-access-to-200-us-etfs-and-stocks-in-europe ↑

8. https://www.bitget.com/wiki/what-is-ethereum-mainnet ↑

9. https://www.ainvest.com/news/ethereum-news-today-ethereum-spot-etf-volume-surges-100-3-1-billion-led-blackrock-2507/ ↑

10. https://thecurrencyanalytics.com/altcoins/ethereum-spot-etfs-see-record-726m-inflow-as-eth-hits-3380-185830 ↑

11. https://www.ainvest.com/news/bitcoin-news-today-spot-bitcoin-ethereum-etfs-attract-20-billion-inflows-april-2507/ ↑

12. https://www.prnewswire.com/news-releases/bitmine-immersion-now-holds-approximately-1-billion-of-ethereum1-to-advance-its-ethereum-treasury-strategy-302507907.html ↑

13. https://coinmarketcap.com/currencies/bitcoin/ (As at 23 July 2025) ↑