4 minutes reading time

If you’d prefer to listen to this week’s Bassanese Bites podcast, click below or subscribe on Apple, Amazon or Spotify:

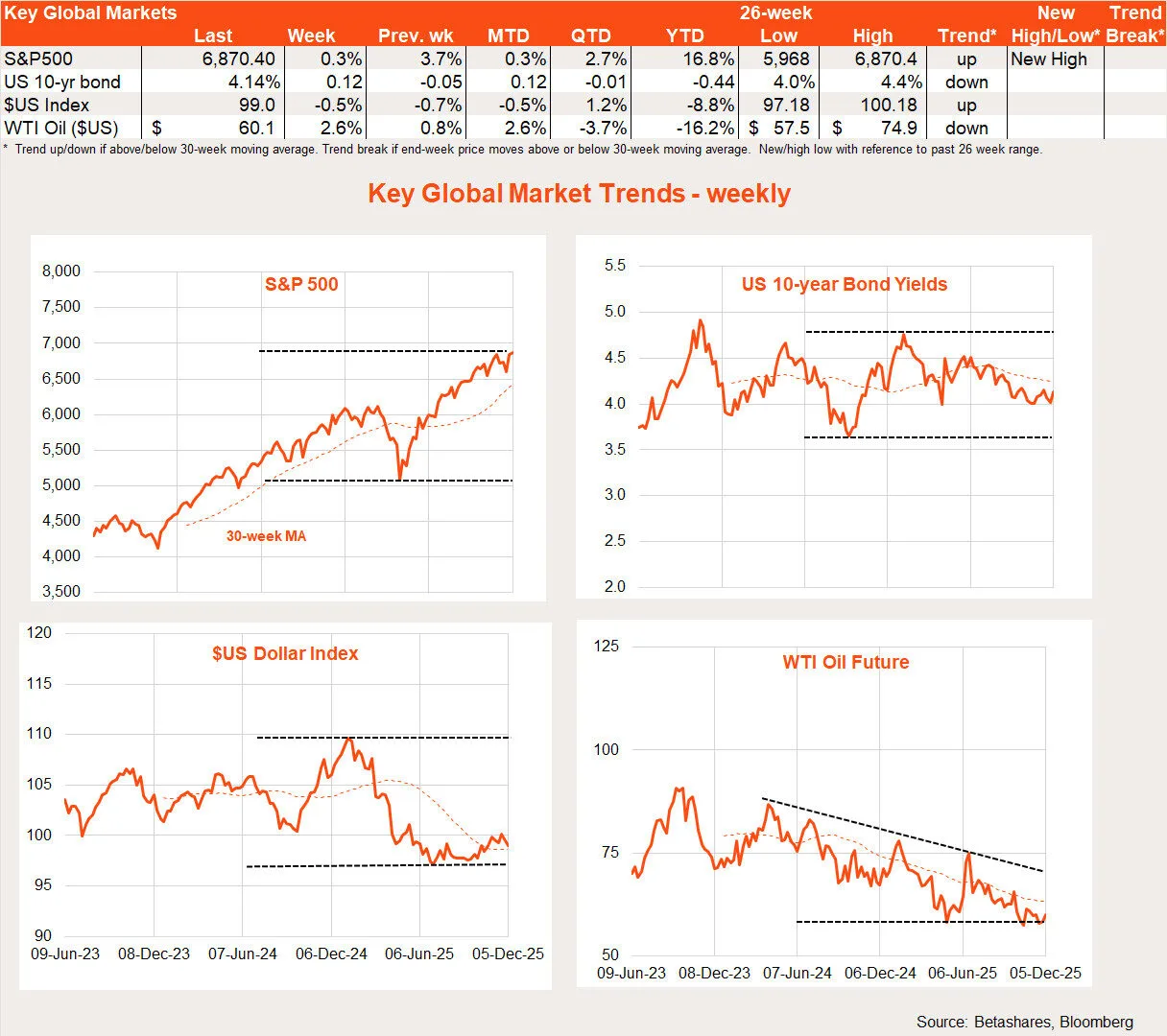

Global stocks consolidated last week after a strong rebound in the previous week, with the prospect of a US interest rate cut continuing to underpin sentiment.

Global week in review: Rate cut hopes

There was little in the way of major US economic data again last week, apart from mixed news on the labour market. The ADP measure of private US employment suggested a decline in jobs during November, although a large decline in weekly jobless claims suggested labour market conditions remained healthy.

Which is right? It’s hard to say, with investors waiting for the delayed November payrolls report on December 16. This report will also include an estimate for October employment, although the unemployment rate in October won’t be calculated because the BLS didn’t undertake a household employment survey during the month due to the US government shutdown.

Unnerving investors a little last week were comments from the Bank of Japan suggesting it will raise official interest rates this month. This has led to a spike in Japanese bond yields, with the 10-year yield reaching 1.95%.

Countering this somewhat were ongoing signs that the Fed will cut interest rates at this week’s policy meeting.

Global week ahead: Fed meeting

The major global highlight this week will be the Fed meeting concluding Thursday morning (Australian time). Markets are attaching an 88% chance to a third consecutive rate cut, although the major question now is whether this will be a hawkish cut. Fed chair Powell may use the opportunity to play down the chance of further rate cuts in the new year.

After all, with signs of a serious US labour market deterioration still scant and inflation still comfortably above the Fed’s 2% target, the case for another cut now does not seem especially strong.

We’ll also get more news on the US economy with job openings data and the NFIB small business survey.

Global equity trends

It was a mixed performance across global equity markets last week, with emerging markets and the NASDAQ-100 doing better than Europe, Japan, the S&P 500 and Australia.

All up, it’s still a bit premature to suggest the outperforming bias of US/growth/technology is shifting in favour of non-US and value. However, Japan’s recent period of outperformance may now face a headwind in a potential BOJ rate hike.

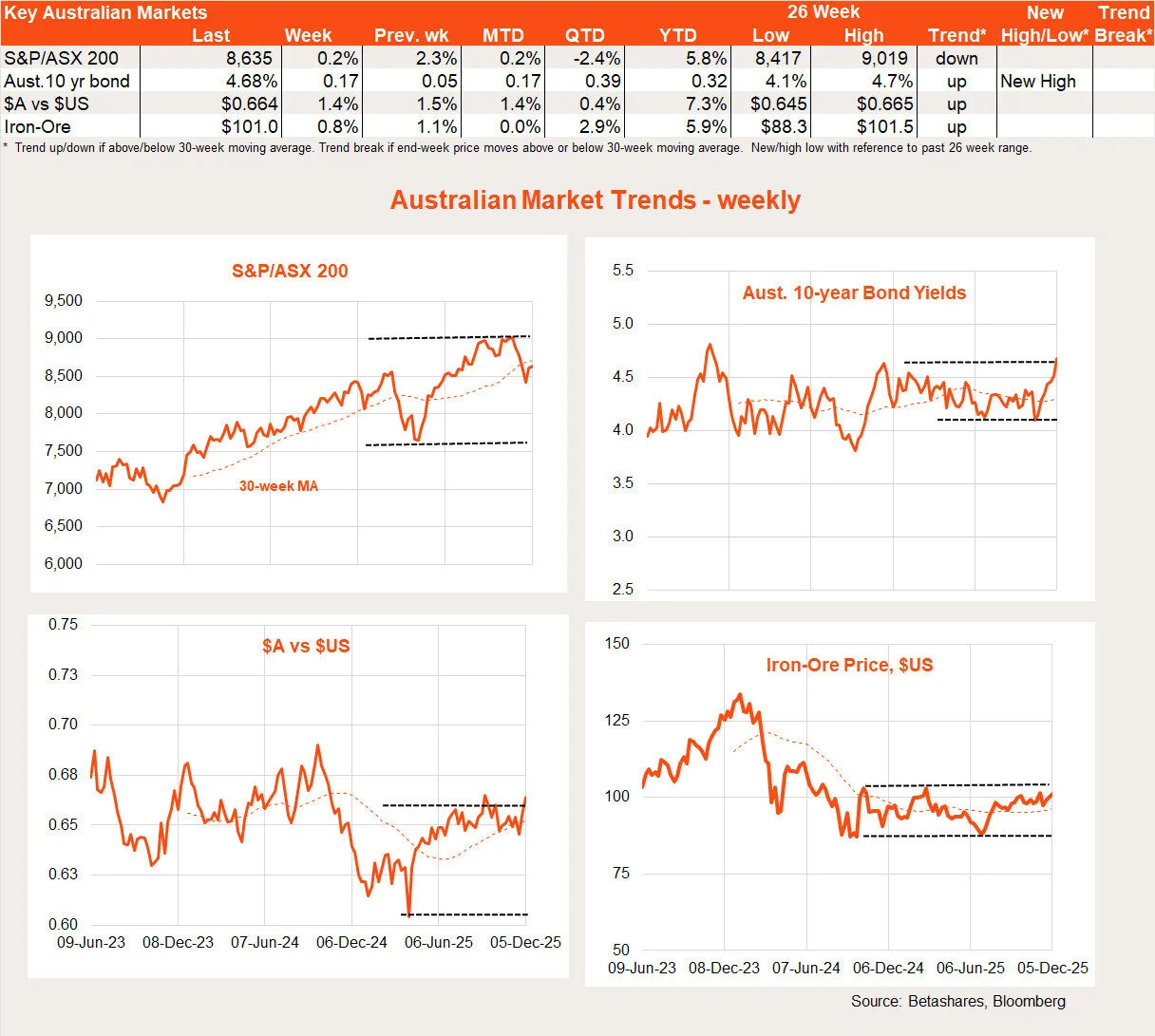

Australian week in review: Solid Q3 demand

Local stocks edged higher along with global markets last week, although a firm underlying GDP report added to concerns that the next move in local interest rates could be up.

The major local highlight last week was the Q3 GDP report. Although output growth was a softer-than-expected 0.4%, this reflected an inventory rundown with overall domestic demand rising by 1.2%.

As outlined here, there was broad based strength in consumer, business and government demand in Q3, which adds to the risk that the Q3 lift in inflation was indeed more demand driven than reflective of one-off temporary factors.

Australian week ahead: RBA and employment

The major local highlight this week will be Tuesday’s RBA meeting, although it’s very likely the Bank will keep rates on hold.

Of interest will be the degree of unanimity behind the rates decision and if one of the options on the table was indeed a rate rise. Given it’s unlikely any Board member would propose a cut, any voting member disagreeing with holding rates would likely have been advocating for a rate hike.

Also out this Thursday is the November employment report, which is expected to show an ongoing glacial slowing in the labour market. A trend-like gain of 20k jobs is expected, along with a small lift in the unemployment rate from 4.3% to 4.4%.

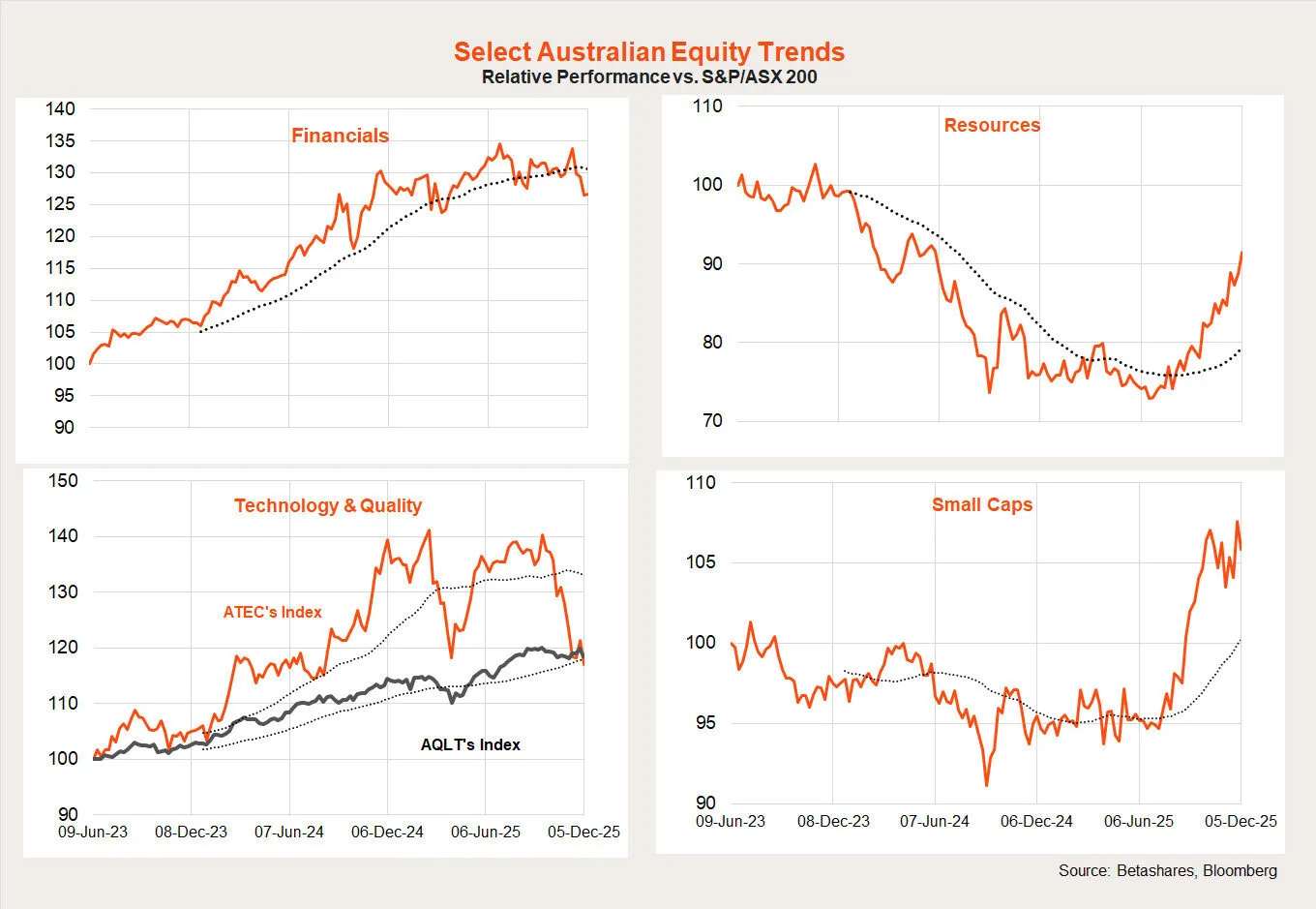

Australian equity trends

Materials and energy continued to perform well last week, while dampened rate cut hopes have generally hurt high-beta local equity themes of late, such as technology and small caps.