3 minutes reading time

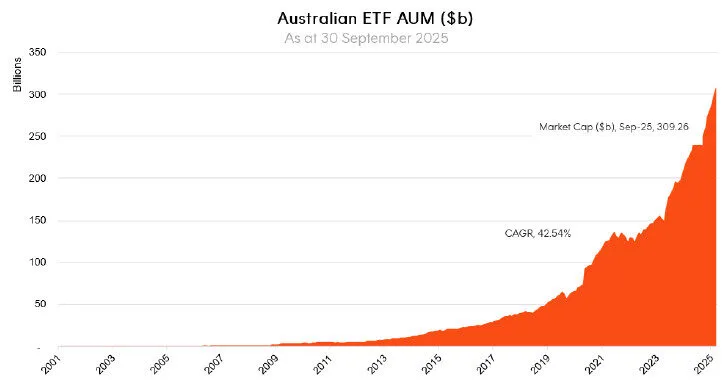

- The Australian ETF industry surged past $300 billion following elevated inflows and positive market performance.

- Another month of inflows above $5 billion, combined with positive market performance, pushed the Australian ETF industry to a new record high of $309.3 billion in funds under management– a rise of $9.9 billion or 3.31%

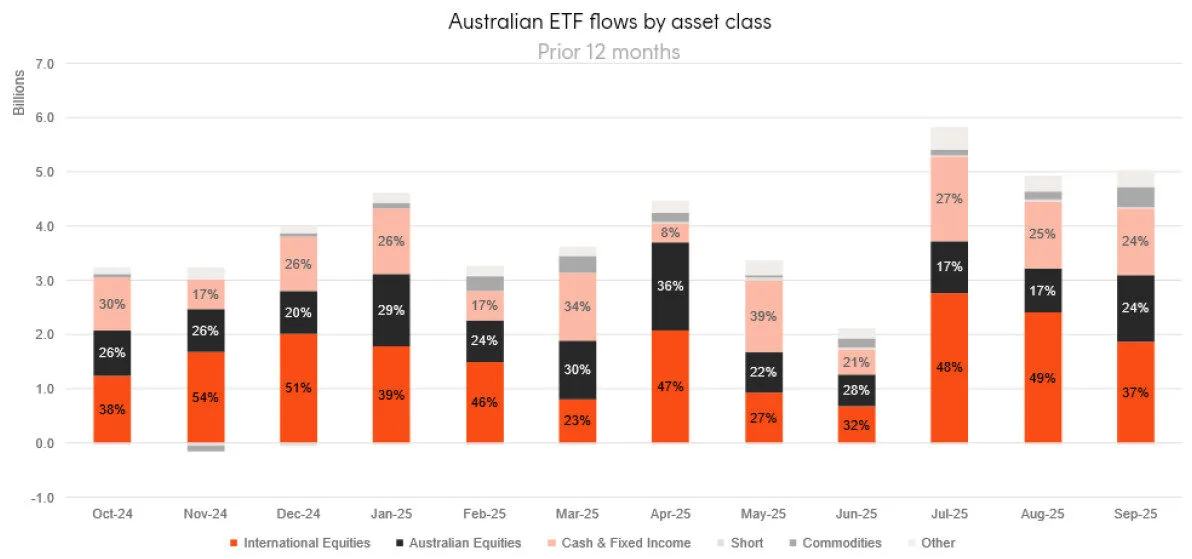

- Industry inflows for the month were an elevated $5 billion – the second time the industry has recorded inflows above $5 billion in a single month.

- ASX trading value was ~$16 billion in September

- Over the last 12 months the Australian ETF industry has grown by 36.3%, or $82.4 billion

- Five new funds, including the Betashares Wealth Builder Global Shares Geared (30-40% LVR) Complex ETF (ASX: GGBL), launched in September.

- The Betashares Global Gold Miners Currency Hedged ETF (ASX: MNRS) was the best performing fund.

- International Equity ETFs continued their streak of receiving the highest level of flows with $1.9 billion, Australian Equities returned to second place with $1.2 billion, while Fixed Income ($1.1 billion) rounded out the top three.

Australian ETF Industry AUM: July 2001 – September 2025

CAGR: Compound Annual Growth Rate. Source: ASX, CBOE

Top 10 Products

By Market Cap

|

Ticker |

Product |

Market Cap |

|

VAS |

Vanguard Australian Shares Index ETF |

$22,463,356,819 |

|

VGS |

Vanguard MSCI Index International Shares ETF |

$13,141,836,321 |

|

IVV |

iShares S&P 500 ETF |

$12,322,187,268 |

|

A200 |

Betashares Australia 200 ETF |

$8,463,575,669 |

|

IOZ |

iShares Core S&P/ASX 200 ETF |

$7,707,946,787 |

|

QUAL |

VanEck MSCI World Ex-Australia Quality ETF |

$7,673,330,146 |

|

NDQ |

Betashares NASDAQ 100 ETF |

$7,321,857,817 |

|

MGOC |

Magellan Global Fund (Open Class) (Managed Fund) |

$6,794,930,890 |

|

DACE |

Dimensional Australian Core Equity Trust (Managed Fund) |

$6,396,004,978 |

|

STW |

SPDR S&P/ASX 200 |

$6,252,247,979 |

Top 10 Inflows (by $) – Month

|

Ticker |

Product |

Market Cap |

|

VGS |

Vanguard MSCI Index International Shares ETF |

$254,363,852 |

|

IVV |

iShares S&P 500 ETF |

$243,371,538 |

|

VHY |

Vanguard Australian Shares High Yield ETF |

$201,836,077 |

|

BGBL |

Betashares Global Shares ETF |

$165,621,509 |

|

A200 |

Betashares Australia 200 ETF |

$164,124,671 |

|

SUBD |

VanEck Australian Subordinated Debt ETF |

$136,027,065 |

|

IOZ |

iShares Core S&P/ASX 200 ETF |

$120,085,308 |

|

NDQ |

Betashares NASDAQ 100 ETF |

$116,140,596 |

|

OZBD |

Betashares Australian Composite Bond ETF |

$112,005,057 |

|

VAS |

Vanguard Australian Shares Index ETF |

$111,899,734 |

Industry Net Flows

Top Category Inflows (by $) – Month

|

Broad Category |

Inflow Value |

|

International Equities |

$1,870,819,537 |

|

Australian Equities |

$1,231,630,226 |

|

Fixed Income |

$1,077,584,093 |

|

Commodities |

$378,137,539 |

|

Multi-Asset |

$209,559,578 |

Top Sub-Category Inflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Australian Bonds |

$886,742,842 |

|

Australian Equities – Broad |

$772,592,286 |

|

International Equities – US |

$618,408,378 |

|

International Equities – Developed World |

$575,394,021 |

|

International Equities – Sector |

$477,981,117 |

Top Category Outflows (by $) – Month

No outflows recorded by broad category

Top Sub-Category Outflows (by $) – Month

|

Sub-Category |

Inflow Value |

|

Fixed Income – E&R – ESG Lite |

-$29,893,724 |

|

International Equities – Europe |

-$12,338,456 |

|

International Equities – Geared |

-$8,813,094 |

|

Australian Equities – Short |

-$7,851,634 |

|

Fixed Income – E&R – Ethical |

-$4,503,862 |

Top Performing Products – Month

|

Ticker |

Product name |

Performance % |

|

MNRS |

Betashares Global Gold Miners Currency Hedged ETF |

22.56 |

|

HGEN |

Global X Hydrogen ETF |

19.59 |

|

GDX |

VanEck Gold Miners ETF |

19.44 |

|

WIRE |

Global X Copper Miners ETF |

19.35 |

|

CRYP |

Betashares Crypto Innovators ETF |

19.00 |