5 minutes reading time

Note: The Bassanese Bites Podcast will return on 2 February 2026. Latest data in tables below refer to Friday 23 January.

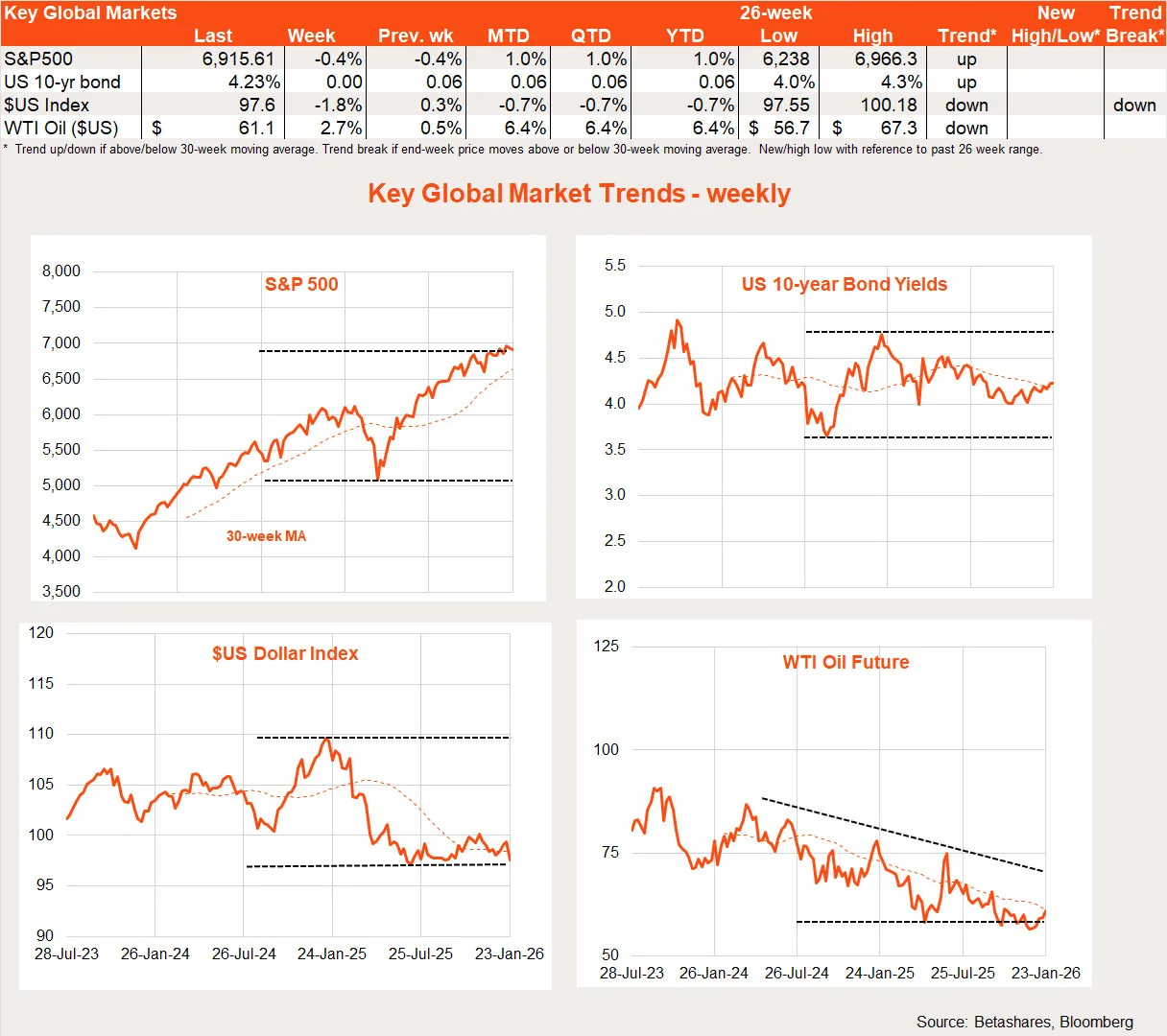

Global stocks have ended the period since Friday 16 January largely flat, reflecting earlier US tariff threats over Europe and tensions with respect to Greenland – which have since eased.

Global week in review: TACO 2.0

Markets started last week with understandable jitters as US President Donald Trump threatened to impose tariffs on Europe for resisting his quest to ‘own’ Greenland. That fact he refused to rule out military intervention did not help. The US S&P 500 dropped 2% on Tuesday 20 January.

A few days on and some market wobbles saw Trump quickly walk back his threats. At the G7 meeting, following a meeting with NATO chief Mark Rutte, Trump dropped his tariff and military threats and claimed he had forged a “framework” of a deal with respect to Greenland. Markets once again sighed with relief and clawed back their losses.

Whether Trump really has a deal or not remains to be seen. Absent tariffs or military intervention however, markets don’t really care. It’s just Trump being Trump.

The other notable global development over the past week has been in Japan, with rising bond yields and a weakening yen – reflecting debt concerns amid talk of more fiscal stimulus. There were weekend rumours of possible Yen supportive US/Japanese central bank intervention.

Global week ahead: FOMC & Mag-7 earnings

With Greenland concerns having eased, the global highlights this week will be the Federal Reserve policy meeting and US corporate earnings.

Given solid economic growth (despite a softening labour market) and still firm inflation, the Fed is widely expected to keep rates on hold and issue a fairly neutral policy outlook. Although markets still expect the Fed to cut rates this year, the next move is now seen as some months away – likely after Jerome Powell ends his time as chairman in May.

The next focus is corporate earnings, with four of the Mag-7 US technology stocks reporting this week: Tesla, Microsoft, Meta and Apple. According to FactSet, the S&P 500 US earnings outlook remains solid, with 8% estimated earnings growth in CY’25, lifting to 15% expected growth in CY’26.

Mag-7 companies are still expected to grow earnings much more than the other 493 companies in the S&P 500, although the gap is expected to narrow. In CY’25 and CY’26, Mag-7 companies are expected to grow earnings by 20% and 22.8% respectively, whereas earnings growth for the less magnificent 493 is 4% and 12% over each of these periods.

Beyond the earnings results themselves, investors will be keenly focused on what these companies say about the AI outlook – and especially their capital investment intentions, over which some market nervousness has crept in over recent months.

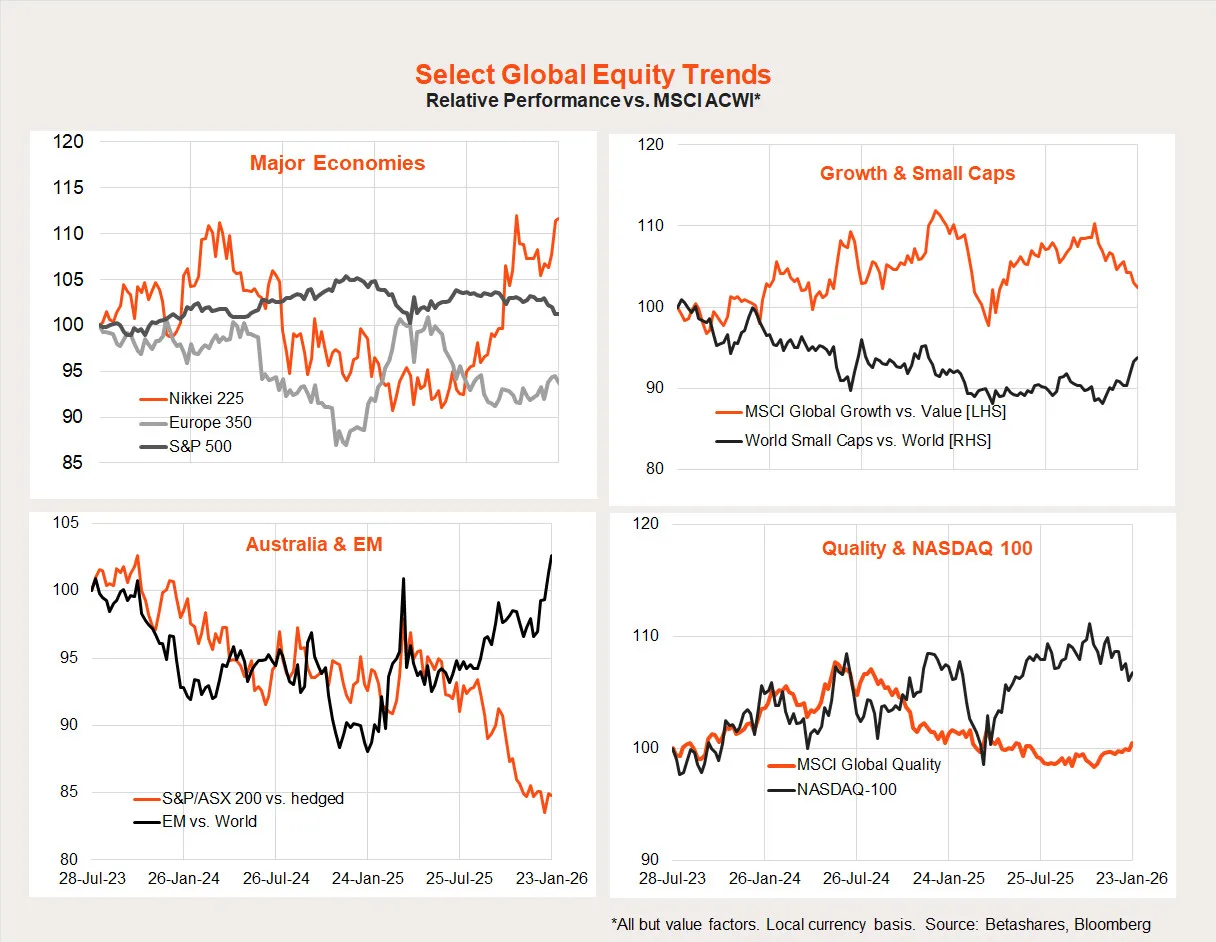

Global equity trends

As evident in the chart set below, there is growing evidence that the ‘great rotation’ is finally underway! Since end-October, a notable trend has been the underperformance of US/growth/technology, replaced by strength in Japan, emerging markets and small caps. Sadly, Australia’s trend of underperformance continues despite renewed optimism in the resources sector.

This rotation reflects not just jitters around the AI boom but also increasing policy risk around the US, given the often erratic policy making of President Trump.

Australian week in review: Hawkish hold

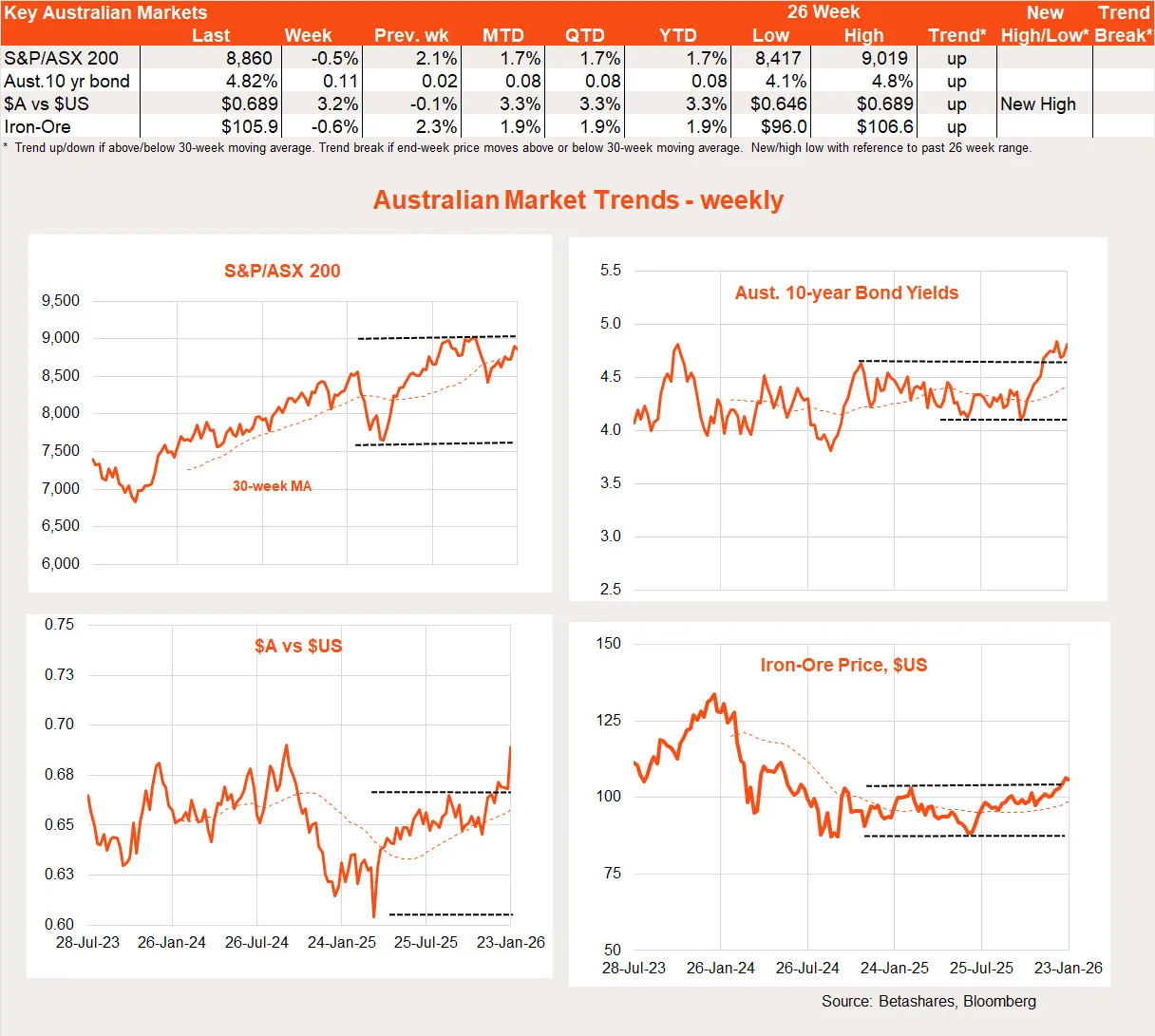

Australian shares eased back over the past week, not helped by nervousness over a possible RBA interest rate hike next month following last week’s solid labour market report.

The major highlight last week was the solid December labour market report. After a surprise 29k slump in November, employment rebounded by 65k in December. Perhaps greater signal came from the unemployment rate, which dropped to 4.1% from 4.3%. The upshot is that reports of a seriously weakening labour market remain greatly exaggerated – at worse the market is softening gradually.

The upshot of this is that tomorrow’s Q4 consumer price index (CPI) report will now be “make or break” with regard to a February RBA rate hike.

Australian week ahead: Q4 CPI

As regards inflation, my base case remains that the quarterly gain in trimmed mean inflation will be 0.8%, which should be enough to keep the RBA sidelined in February (given this result at least implies a deceleration in underlying inflation from the 1% previous quarterly gain).

According to Bloomberg, the median market forecast is 0.9% – so the omens are not good! At this stage, moreover, markets are attaching a near 60% chance to a February rate hike.

While a 0.9% gain would likely seal the deal, it’s still possible the RBA may feel a trimmed mean 0.8% gain is not simply good enough, given that this still annualises to a greater than 3% inflation pace and given other signs of strengthening demand and a tightening labour market. By contrast, a trimmed mean quarterly gain of 0.7% or less would remove the risk of higher rates in February.

Also important to a degree will be the composition of inflation – namely to what extent could any higher or lower result reflect noisy ‘one-off’ factors, and the degree to which demand sensitive areas like housing, market services and consumer durables showed persistent pricing pressure.

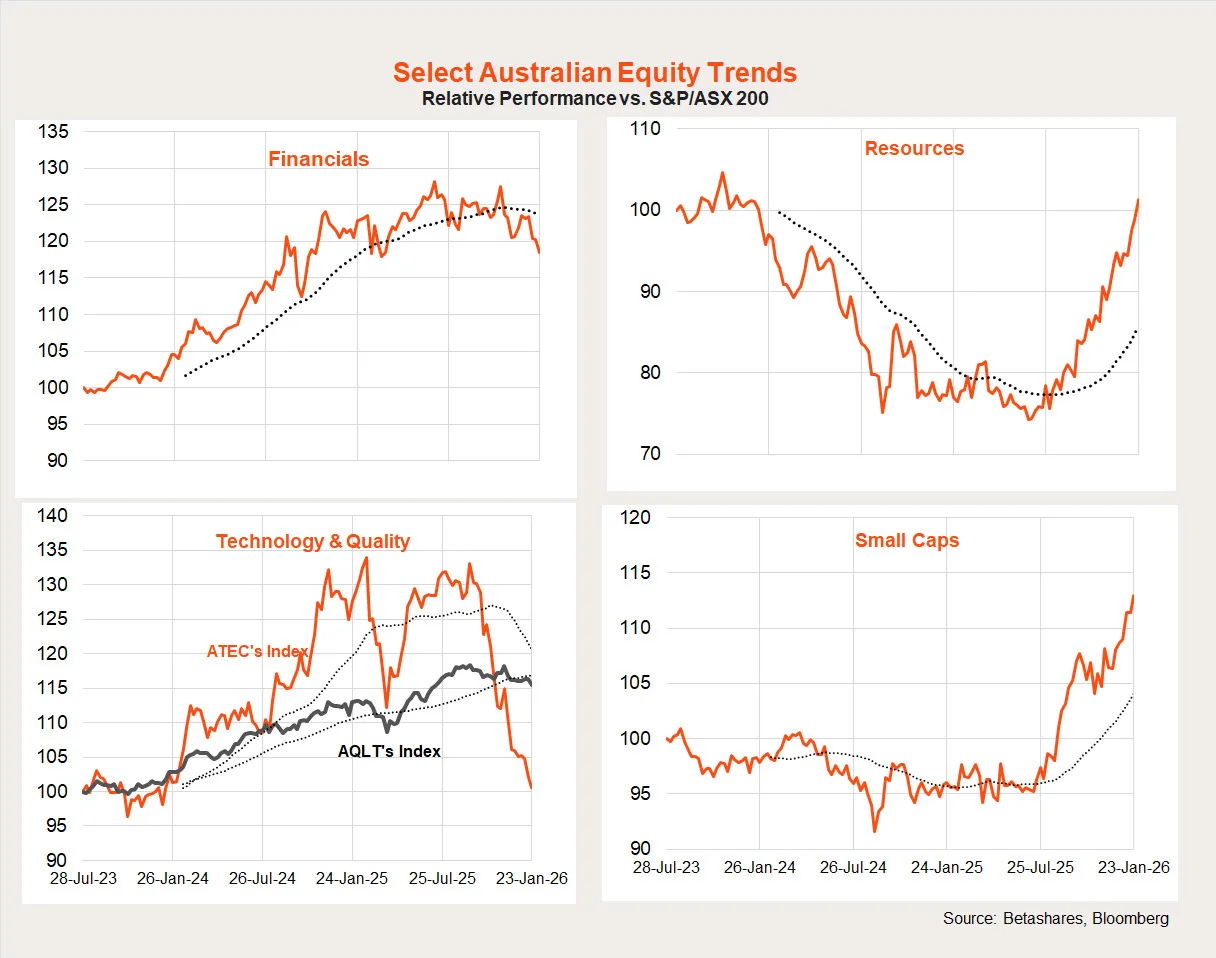

Australian equity trends

A rotation from financials/technology to resources and small caps has been clearly evident in the Australian market over recent months. Upgrades to resource sector earnings and general optimism around commodity prices is supporting both large and small cap resource companies.

2 comments on this

Loved your comment ” the less magnificent 493″

Hi, with the USD depreciating (and likely to continue depreciating), is it time to start rotating to hedged international funds or would that be an overreaction?